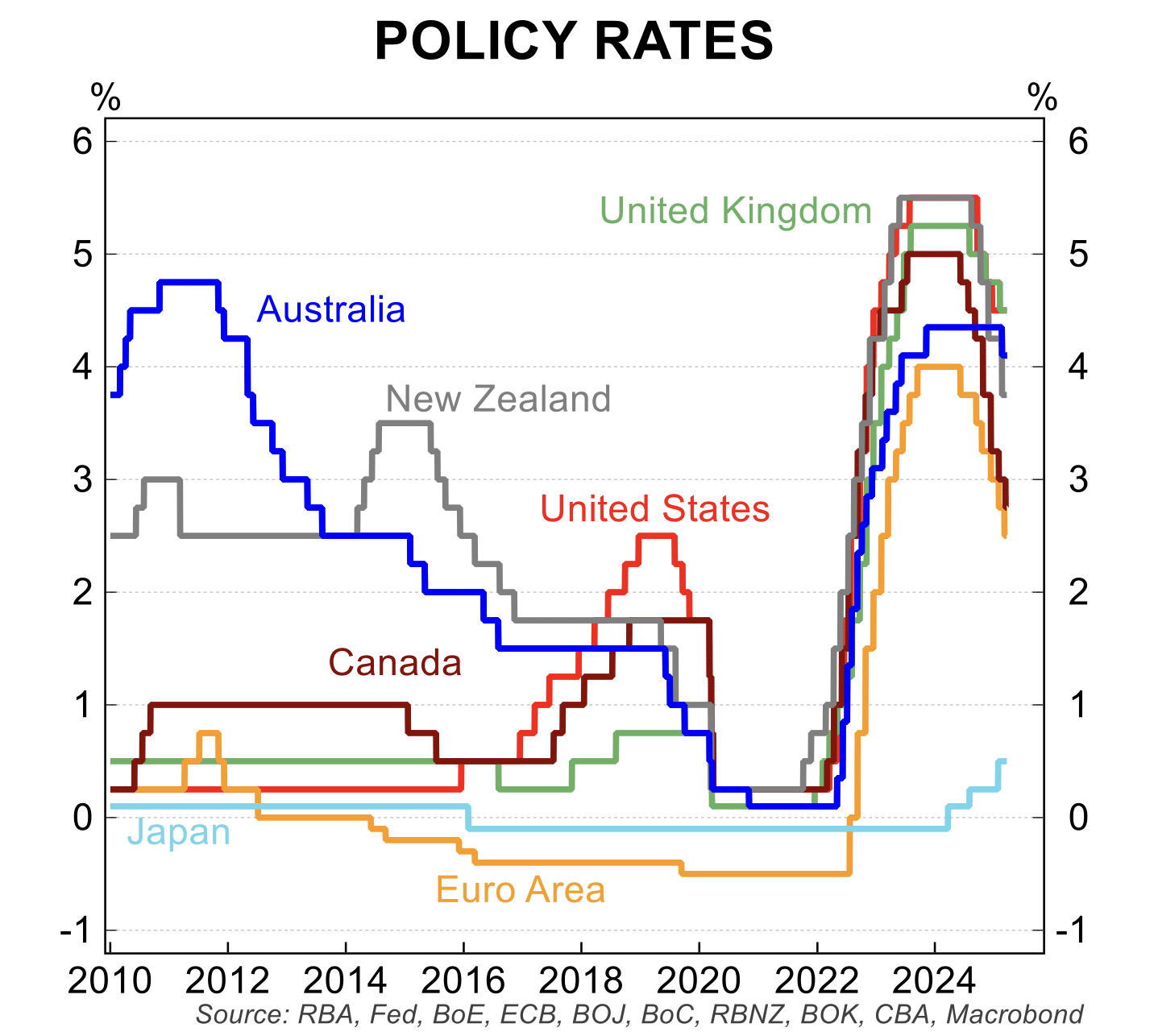

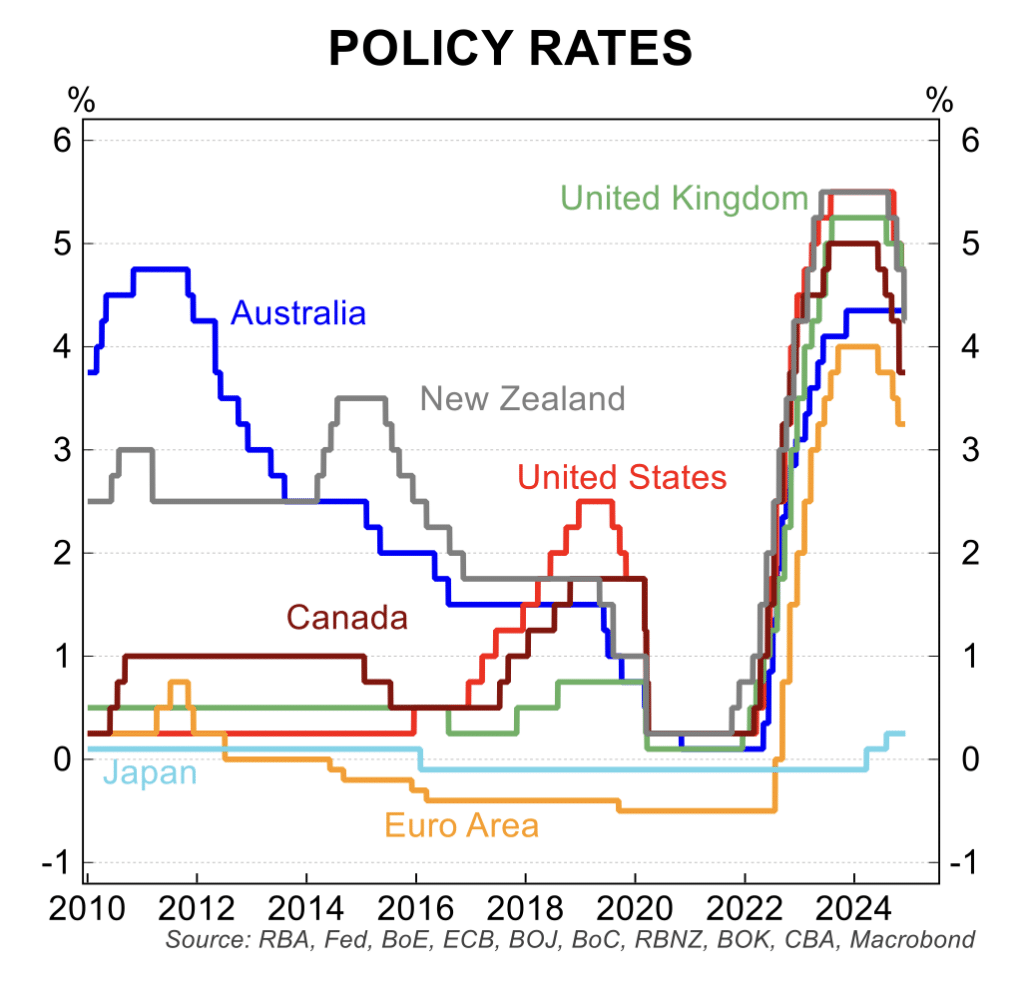

A busy 2024 ended with the RBA holding official interest rates where they started the year – at 4.35 per cent.

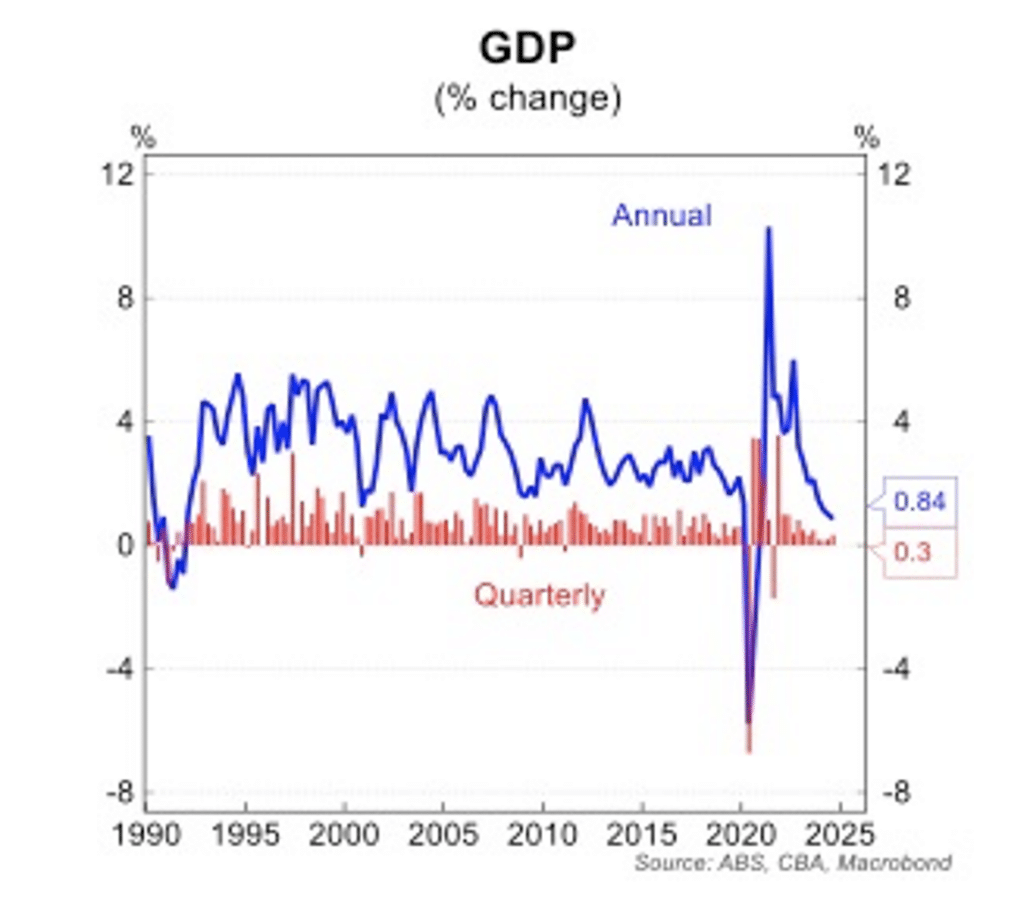

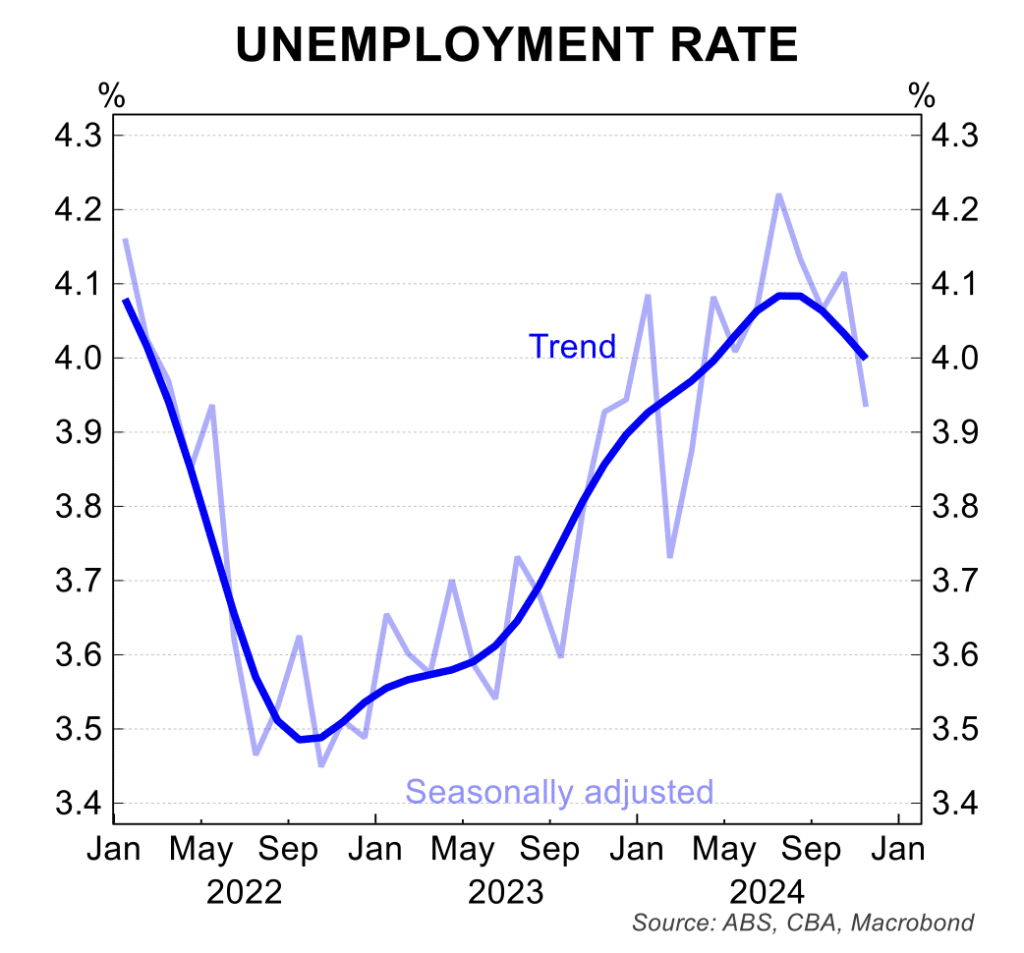

Through the course of 2024, the economy slowed appreciably to register one of the weakest growth rates since the early 1990s; inflation fell sharply and in headline terms dropped back to the RBA target band of 2 to 3 per cent; while unexpectedly, the unemployment remained just above a 50 year low at around 4 per cent, little changed from where it started the year.

The other key themes were:

- a record high in the Australian stock market,

- a generally weaker Australian dollar,

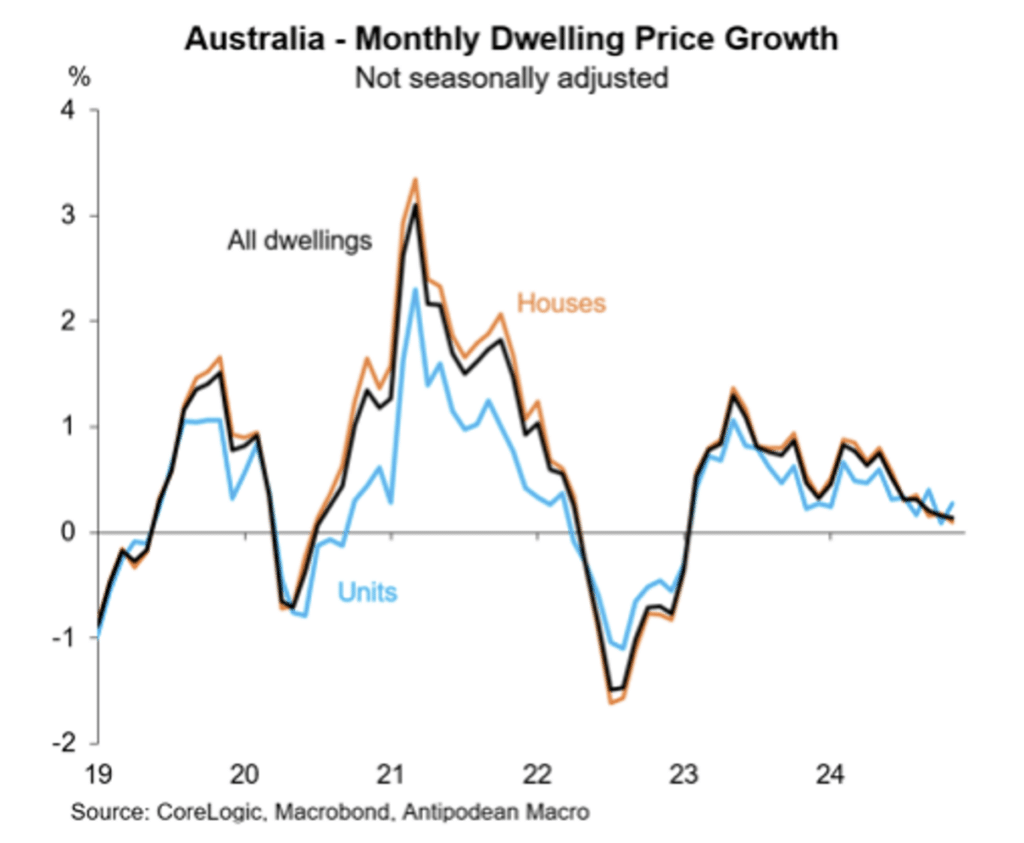

- a cooling in house prices – with falls in some cities –

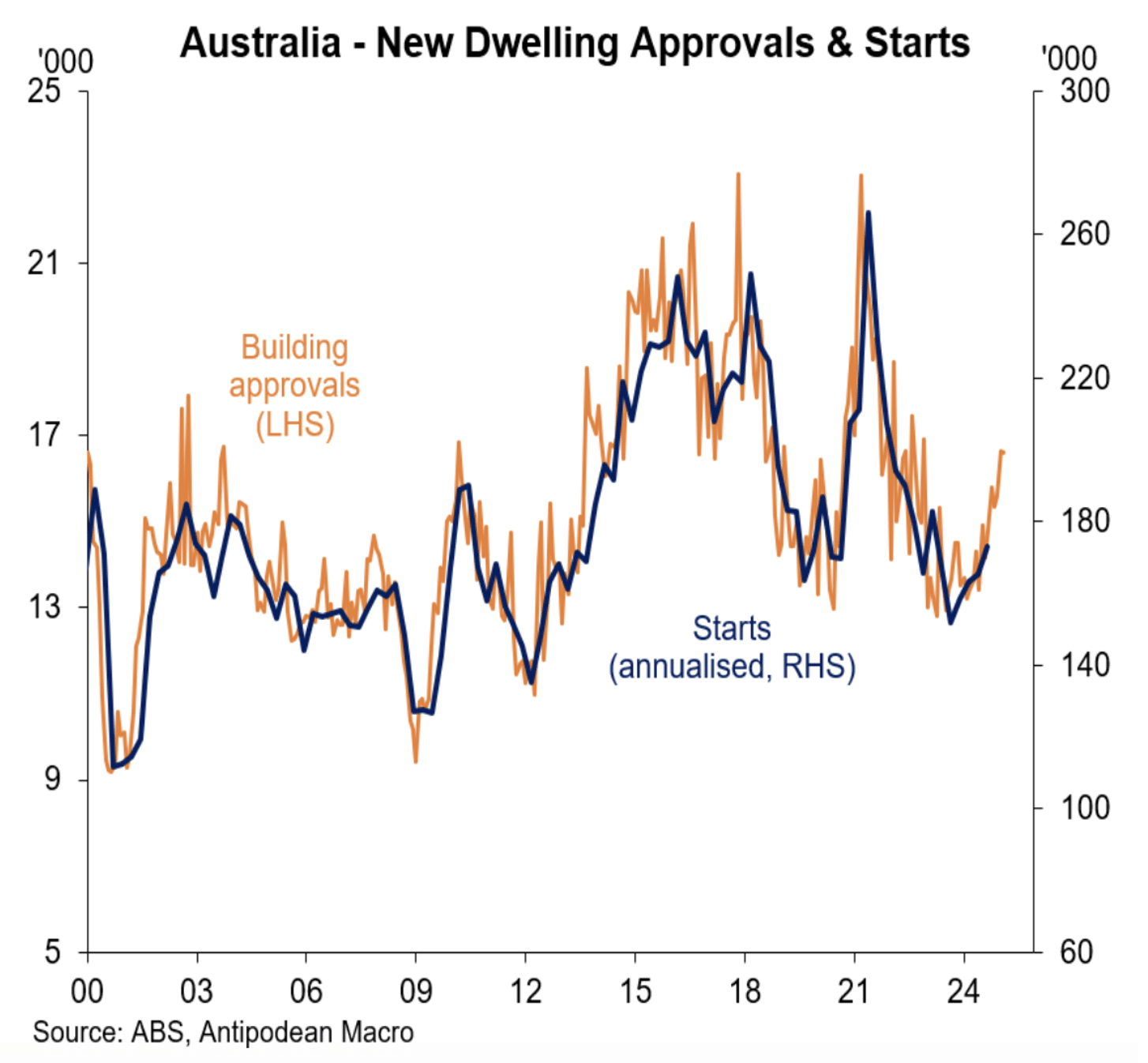

- and early signs of an upturn in dwelling construction.

In holding interest rates steady at its December 2024 meeting, the RBA noted that both GDP and wages growth were below their expectations. Taken together, the market interpreted it as a move towards lower interest rates in 2025 and priced in a roughly even chance of a 25 basis point interest rate cut at the next RBA Board meeting on 18 February 2025 and a full cut at the 1 April meeting.

The economic news in the past month has generally been weak.

- GDP grew by 0.3 per cent in the September quarter to be just 0.8 per cent higher than a year ago. Public demand accounted for all of the increase in GDP while private sector demand was flat. Household consumption was negative over the past two quarters, a surprise for the RBA which was expecting resilient consumer spending.

- There was positive news in the dwelling construction market with new building approvals rising a further 4 per cent in October to be at the highest level in nearly two years. In trend terms, the number of dwelling approvals has now risen for 8 consecutive months to be 20 per cent above the February 2024 low. This is an important development which will provide a much needed lift in dwelling supply.

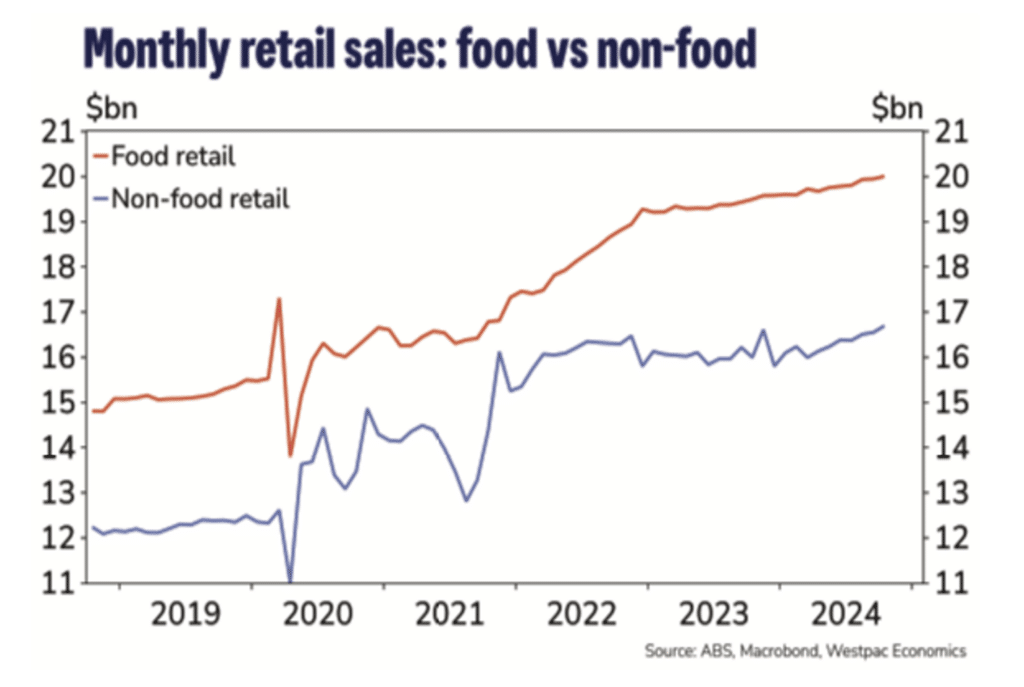

- Retail spending rose 0.6 per cent in October after a rise of 0.1 per cent in September. The lift in spending was, in part, linked to early ‘Black Friday’ sales which may unwind with the next monthly data. Also aiding the slight improvement in retailing was falling inflation, expectations for interest rate cuts and the effect of the 1 July 2024 income tax cuts and cost of living relief policies.

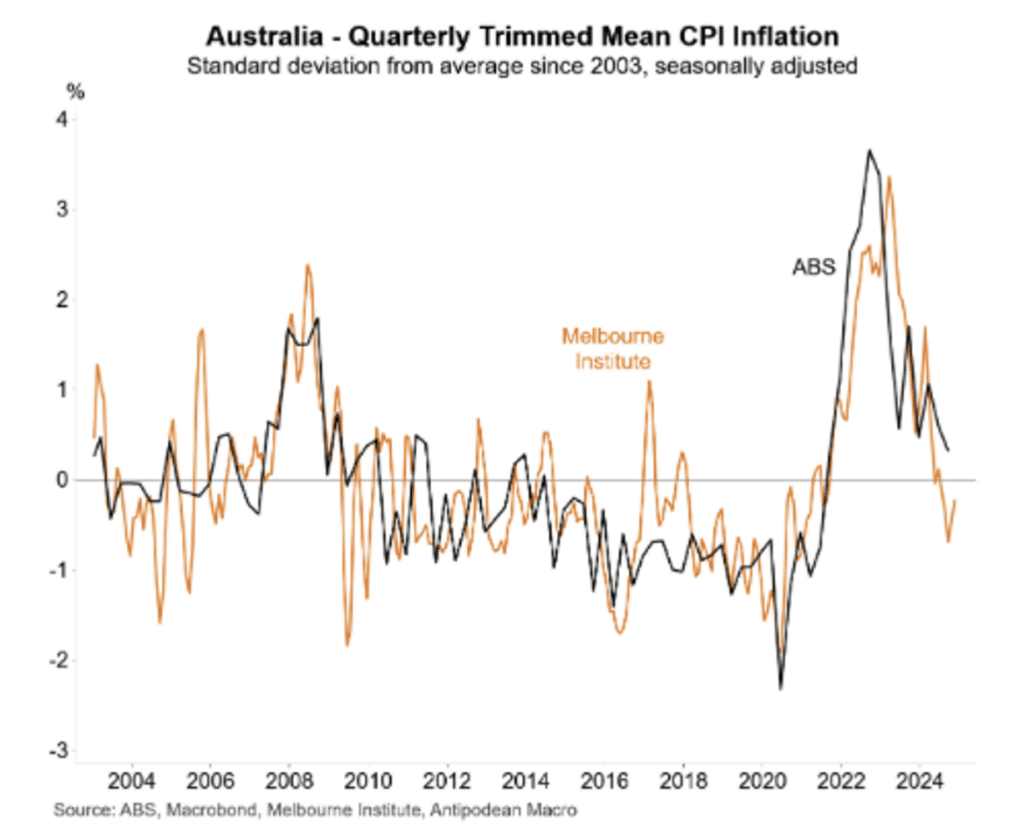

- The monthly inflation indicator saw annual inflation rate hold steady at 2.1 per cent, the third consecutive month that inflation has been in the RBA 2 to 3 per cent target range. The deflationary impact of a range of government cost of living measures – electricity and rent subsidies in particular – and falling petrol prices account for part of the lower inflation rate in recent months. The trimmed mean annual inflation rate edged up in the month to 3.5 per cent but remains on track to hit the RBA target band.

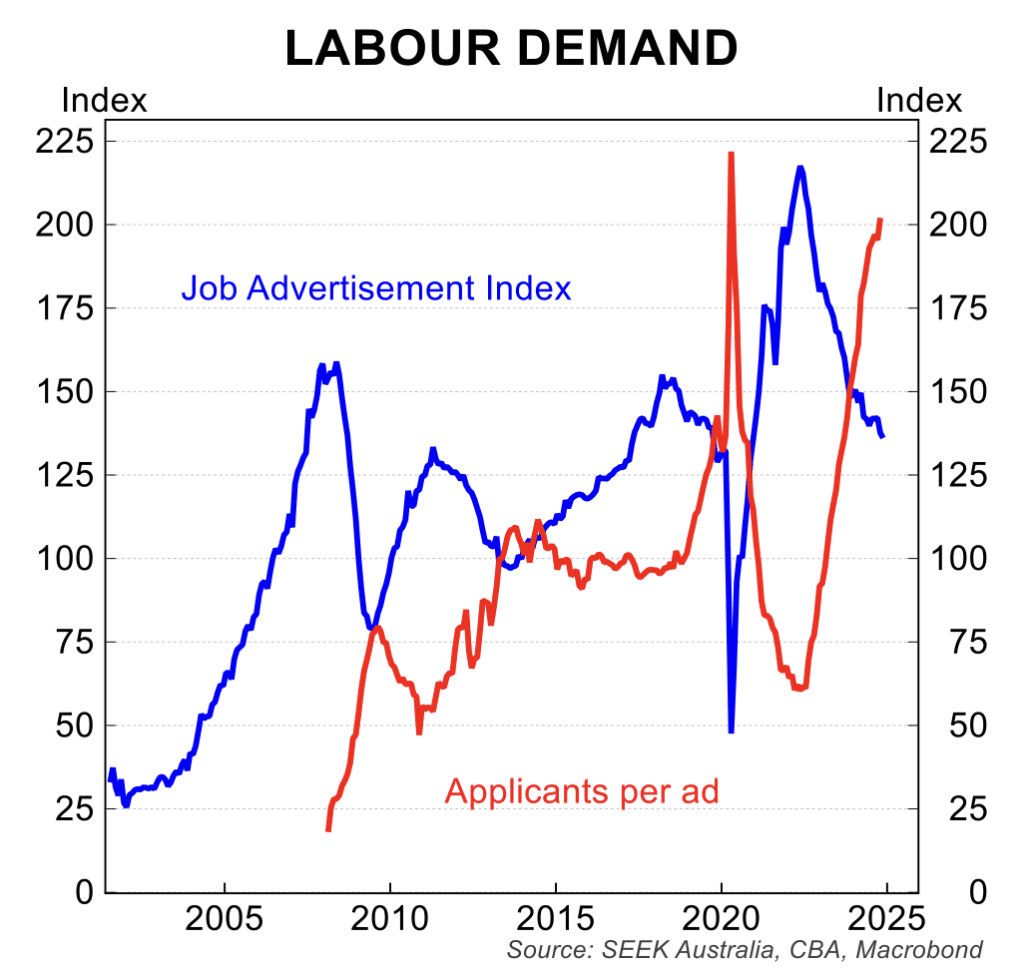

- The labour market has been surprisingly resilient in recent months, with the main surprise being the step lower in the unemployment rate in November. Since the start of 2024, the unemployment rate has hovered around 4 per cent. That said, job ads are still weak and the consensus is for higher unemployment in the months ahead.

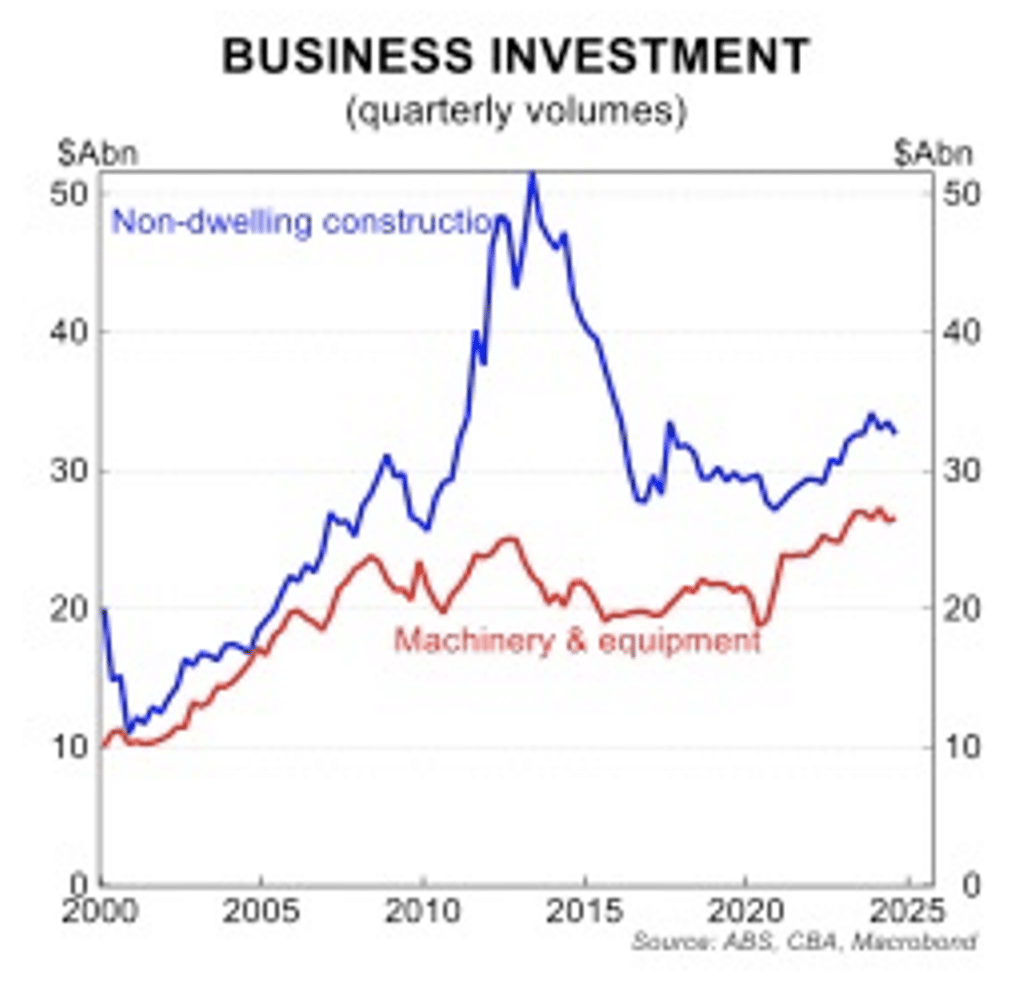

- Private business capital expenditure fell 0.6 per cent in the September quarter with a sharp fall in non-dwelling construction and engineering only partly offset by rising machinery and equipment and computer software. The broad trend for business investment is soft after a solid rise from 2021 to early 2024.

- Interest rate cuts continued to be delivered around much of the world as other central banks react to lower inflation and weaker growth in their economies.

House prices

House prices are falling in around three-quarters of Australia with a slowdown in price increases in the other parts of the country.

Nationwide house prices rose just 0.1 per cent in November marking the weakest result in almost two years. The preliminary data for December is suggesting a fall in prices into year end. House prices fell in Sydney for a second consecutive month, while prices were again flat to down in Melbourne, Hobart, Canberra and Darwin.

In four capital cities, house prices fell in the three months to November:

- Darwin -0.7 per cent.

- Canberra -0.3 per cent;

- Melbourne -1.0 per cent; and

- Sydney -0.5 per cent; and

- Hobart prices fell 0.1 per cent in November and were down 1.0 per cent compared to a year ago.

The three cities that remained strong where prices rose solidly in the three months to November were:

- Perth +3.0 per cent;

- Adelaide +2.8 per cent; and

- Brisbane +1.8 per cent.

House prices are poised for a period of softness impacted by lower demand with immigration returning to normal, a lift in supply linked to a rise in new listings and a gradual upturn in construction and a weaker labour market.

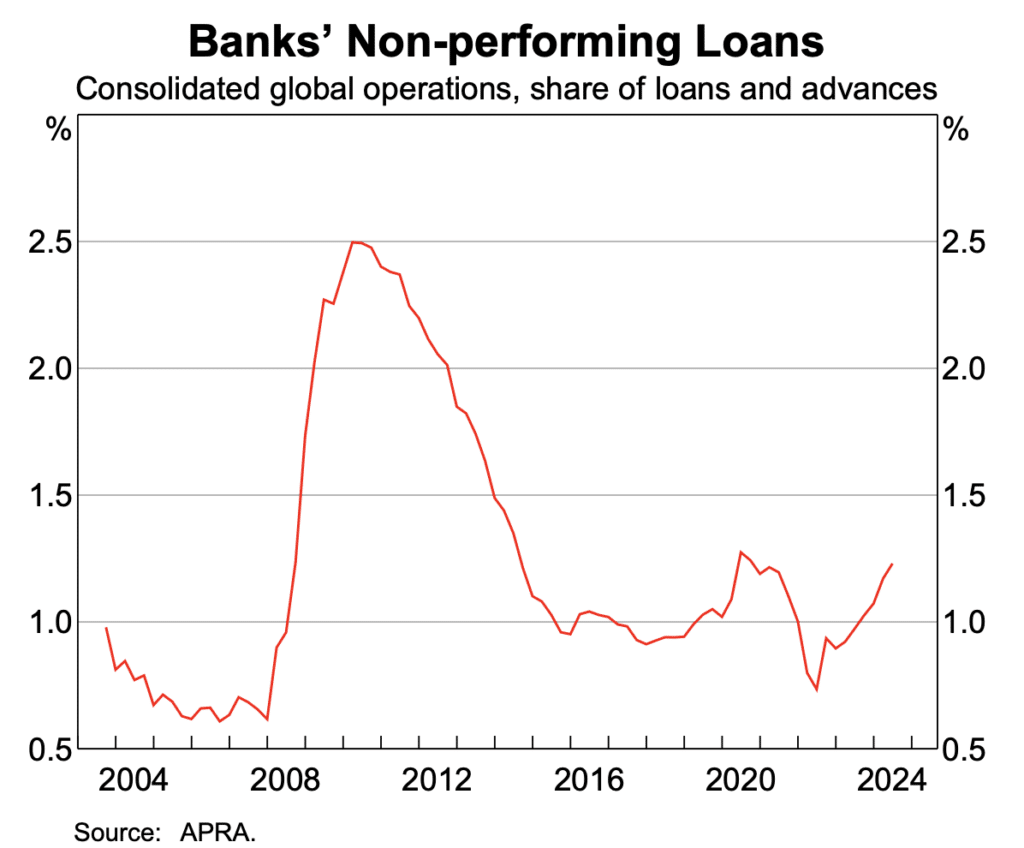

At this stage there is nothing to suggest a troubling decline in house prices even though there has been an upturn in mortgage loan arrears and bad debts. If monetary policy is kept tight for too long and / or there is a sharper than expected rise in unemployment, the risks of more severe house price weakness will intensify.

The broader cooling of house prices is showing up in dwelling rents where growth has stalled in monthly terms and is slowing in annual terms. Like with house prices, there is a wide divergence from city to city but the broad trend to slower growth in rents in clear. This, with a lag, will be an important factor reducing the inflation rate given the importance of rents in the consumer price index basket.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.