The last month has seen what might be called “green shoots” of an economic recovery in Australia, aided by an easing in cost of living pressures as inflation has retreated towards the RBA target band.

It is important to note that these encouraging signs are from a weak starting point – it is too early to be confident of a meaningful economic recovery, but it is encouraging to see some better news.

Signs of economic resilience in the US economy, which has been clouded by the antics of the Presidential election campaign, has seen investors scale back the extent of the interest rate cutting cycle. Importantly, there is still a further 150 basis points of rate cuts priced in in the US over the next 18 months.

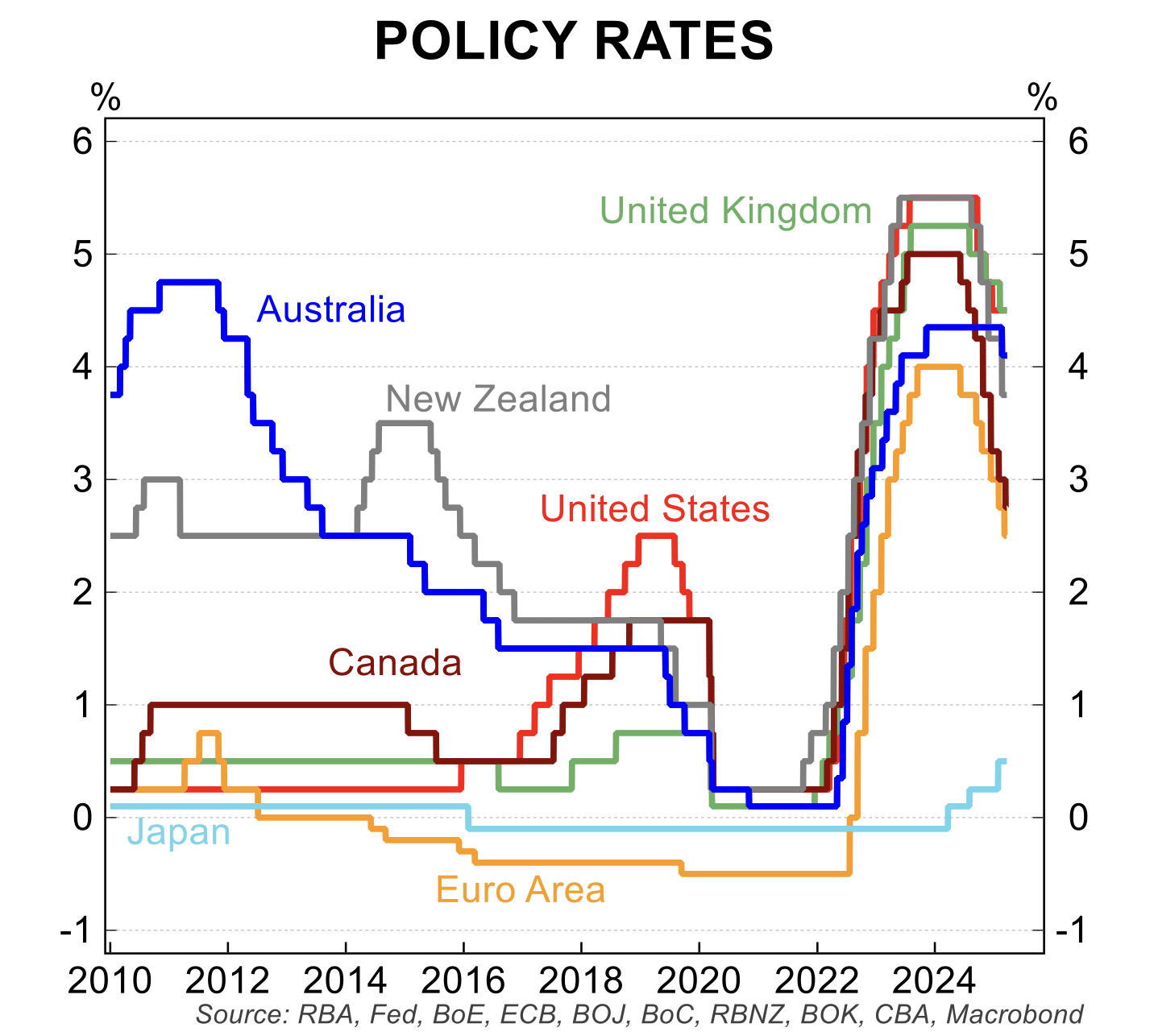

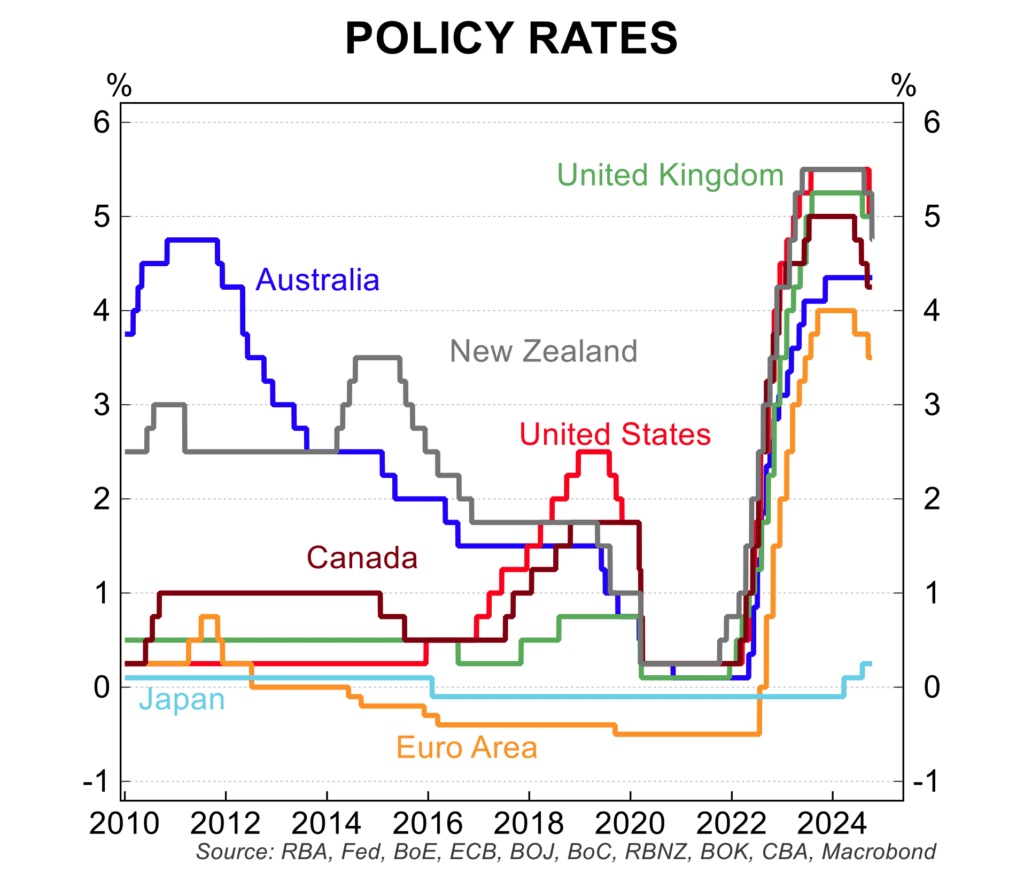

The US market moves has impacted Australia with timing and extent of interest rate cuts scaled back to 75 to 100 basis points by early 2026.

That said, interest rates are being cut in most major countries with more easings expected in the near term in those markets. Interest rates have been cut in the US, UK, Canada, China, Sweden, Switzerland, South Korea, New Zealand, Denmark, among others.

In terms of the local economy, the are some tentative but encouraging signs that growth is consolidating, albeit at a weak level.

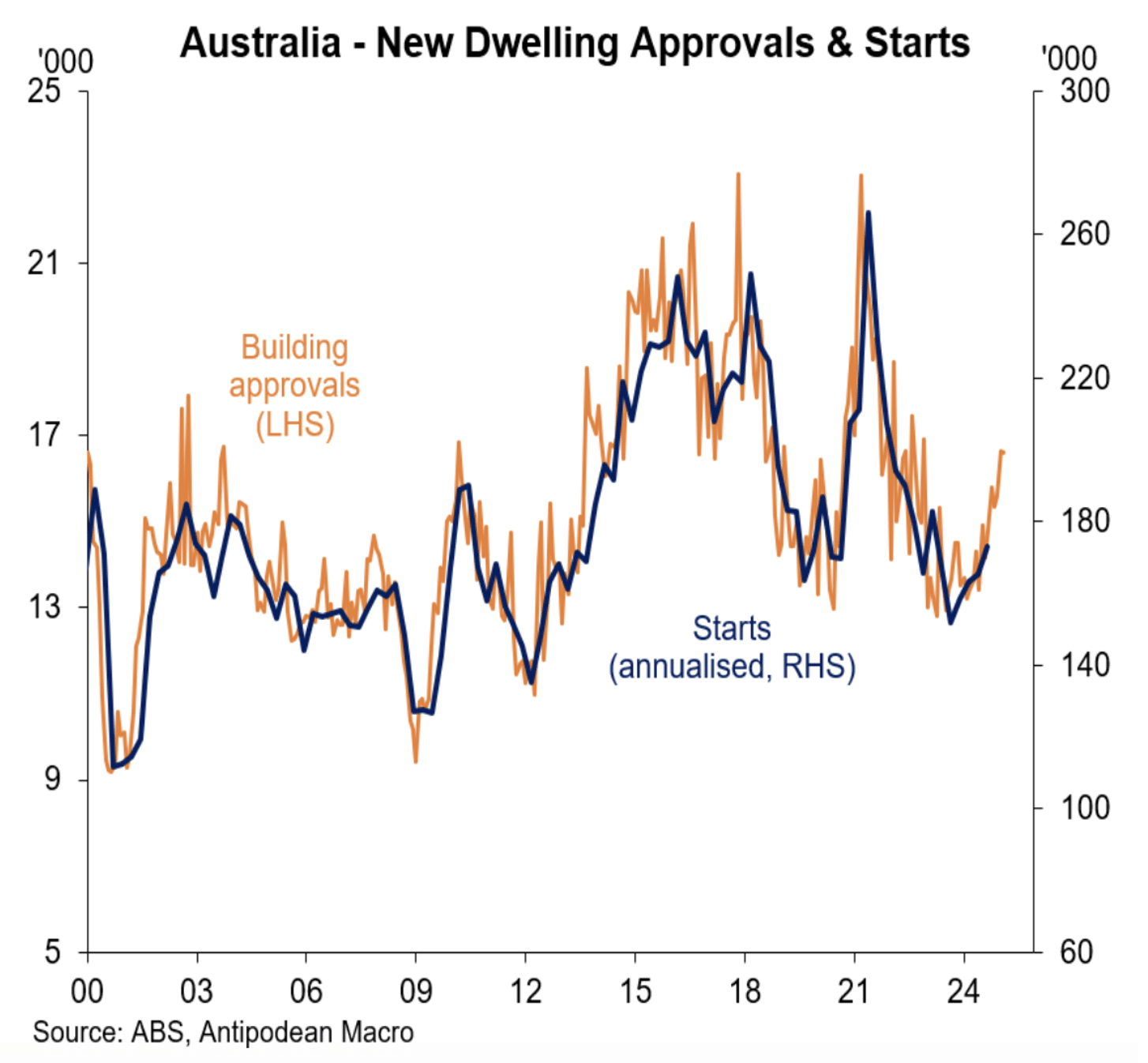

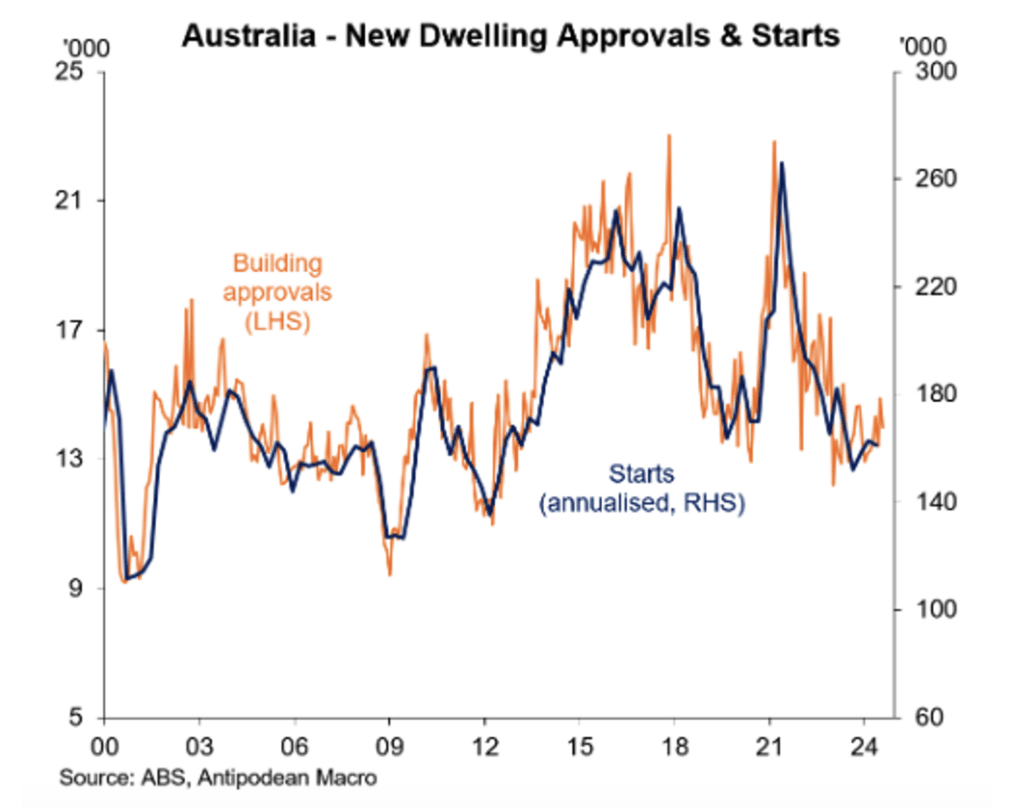

- New building approvals for dwellings are up for 6 straight months in trend terms to be almost 10 per cent above from the low point in February 2024.

- Retail spending rose 0.7 per cent in August to register the 5th straight month of increase. Income tax cuts, rising wages and falling inflation are likely to have boosted consumer spending.

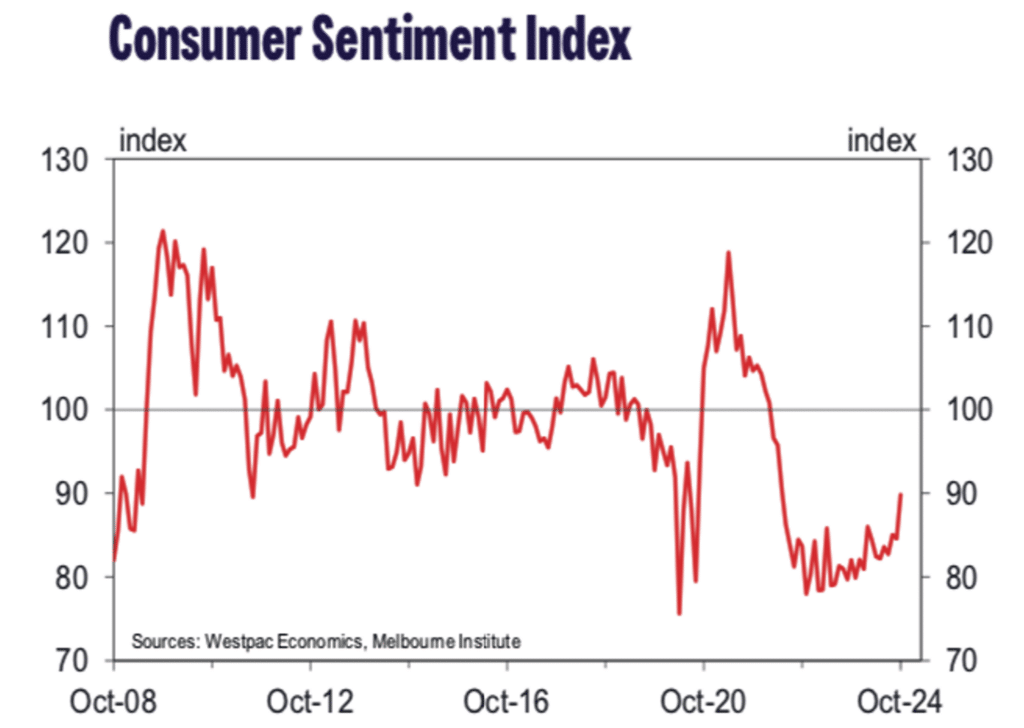

- Consumer sentiment rose 6.2 per cent in October to be at its highest level in two and half years. Sentiment is up 10 per cent from the low point. Steady interest rates and expectations for interest rate cuts were cited as a reason for the improvement.

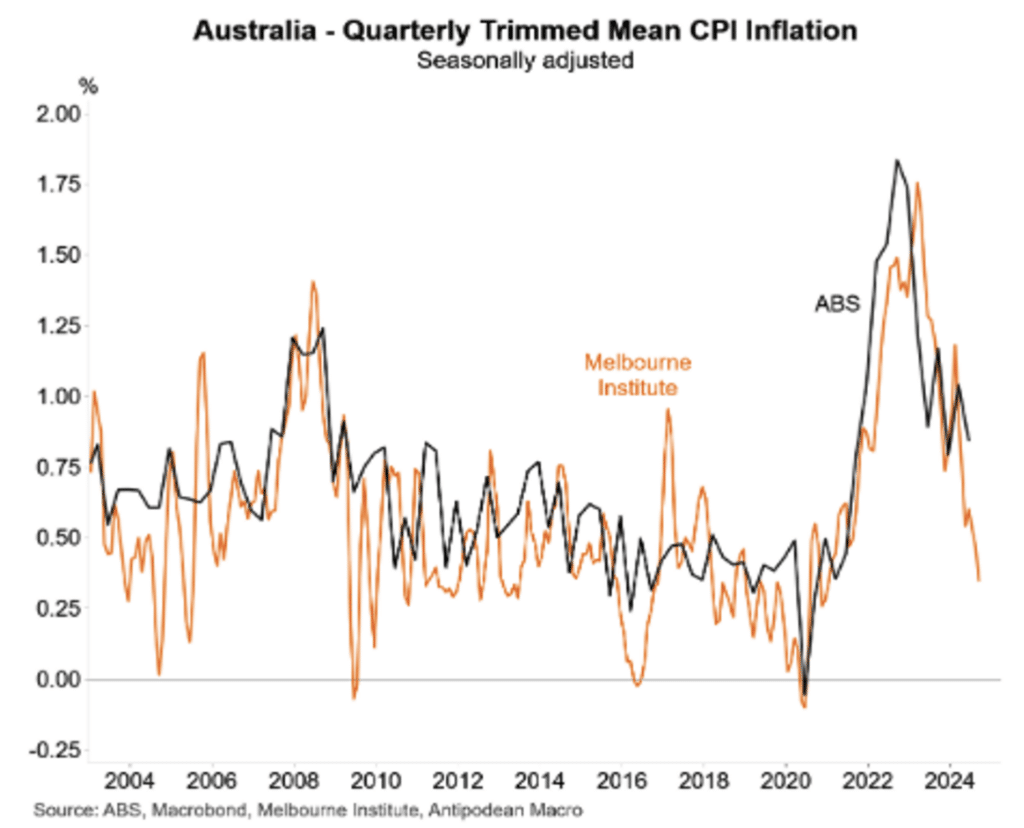

- Inflation has fallen from 8.4 per cent at the end of 2022 to 2.7 per cent in August 2024, returning inflation to the RBA’s target. The impact of government subsidies on electricity costs and rents are having a significant impact on the inflation result. The trimmed mean inflation rate is also easing in line with the slowing economy and global conditions.

- In terms of a number of other partial and tentative indicators, monthly job ads, business confidence and commodity prices, have all ticked up which is encouraging for the economy.

Some economic concerns remain

There are still a number of negative factors which remain as a drag and a reality check on the positive signs.

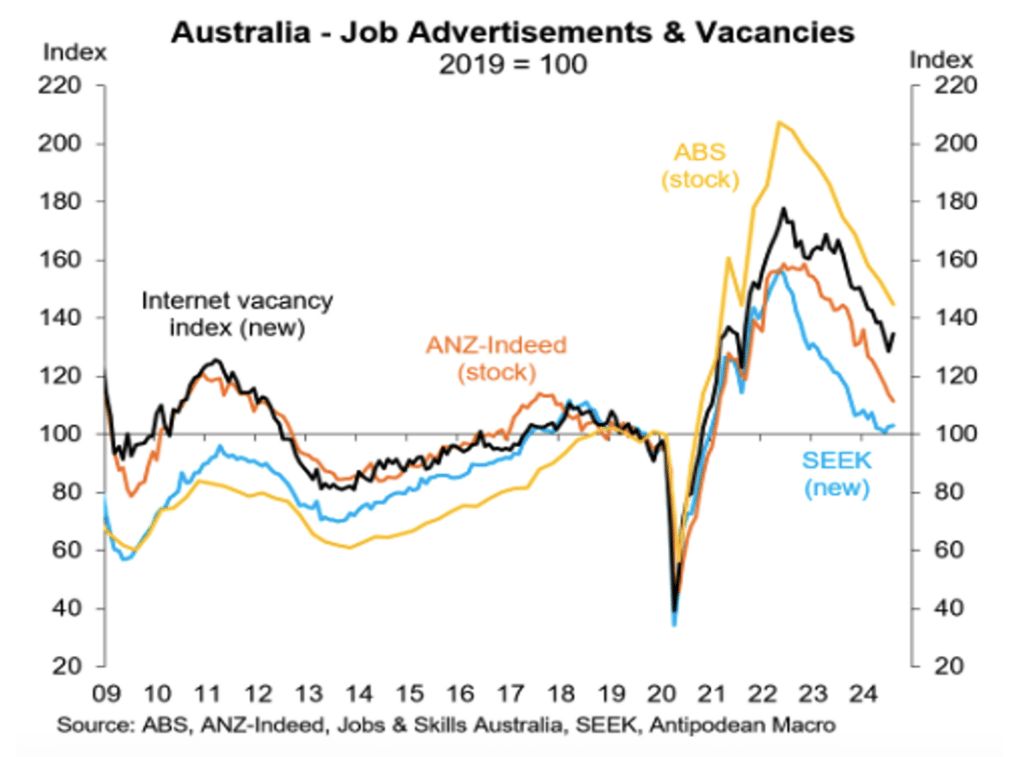

- Demand for labour is weakening with job vacancies and advertisements 30 per cent off their peak.

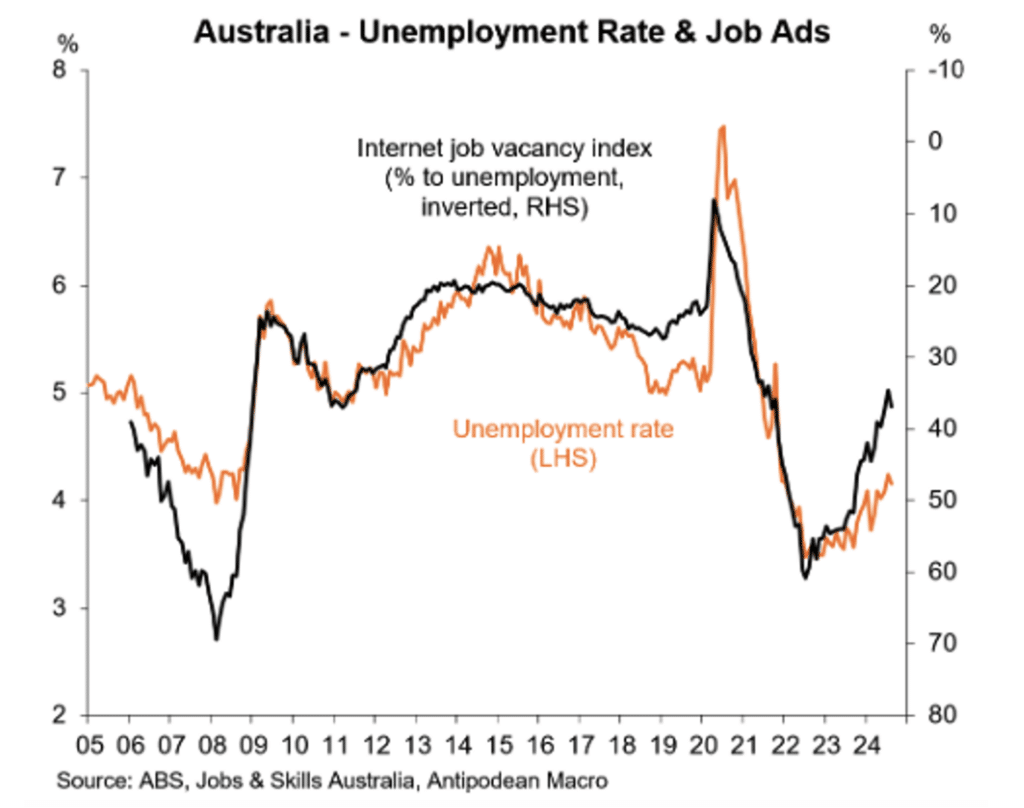

- The labour market has been resilient in the wake of the broader economic slowdown, but the unemployment rate has risen from what was a 48 year low of 3.5 per cent in 2023 to hit 4.1 per cent in September 2024. It has been stable just over 4 per cent in the last few months. Based on trends in job advertisements the unemployment rate is on track to hit 4.75 to 5 per cent in the next 12 months.

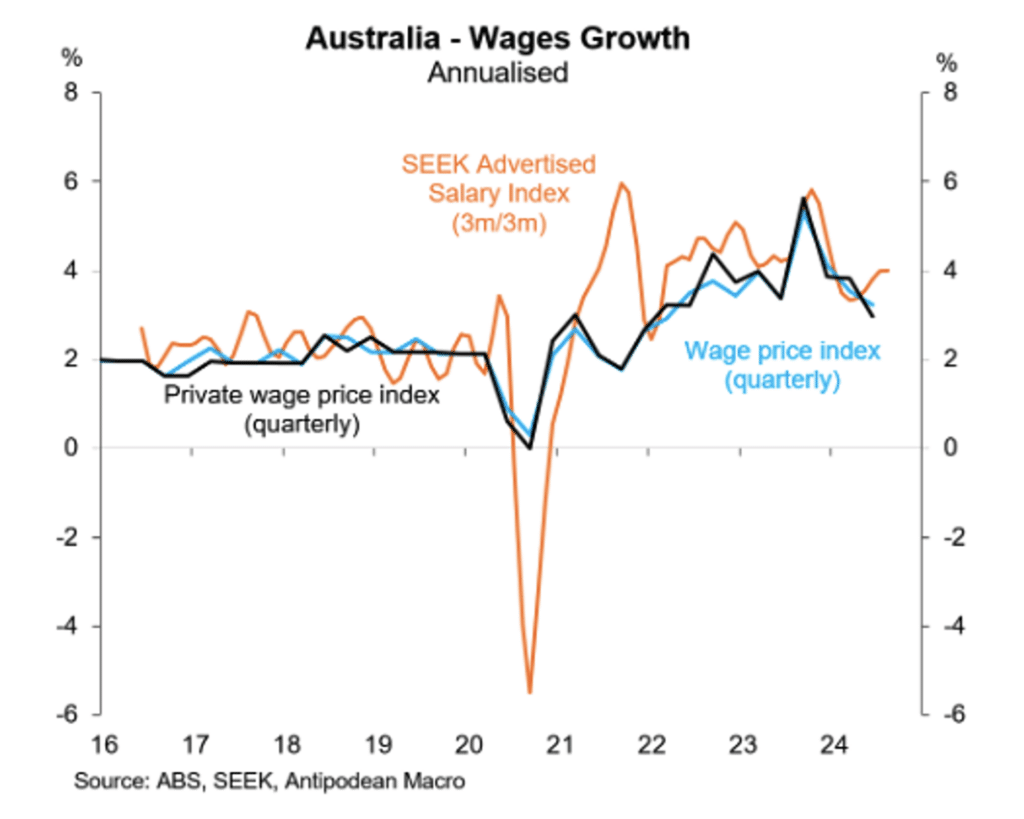

- Wages growth is slowing in line with the softening in the labour market. The last three quarterly increases in the wage price index have been 1.2 per cent, 1.0 per cent and 0.8 per cent, respectively. The Seek advertised salary index has turned lower from the peak in late 2023.

House prices

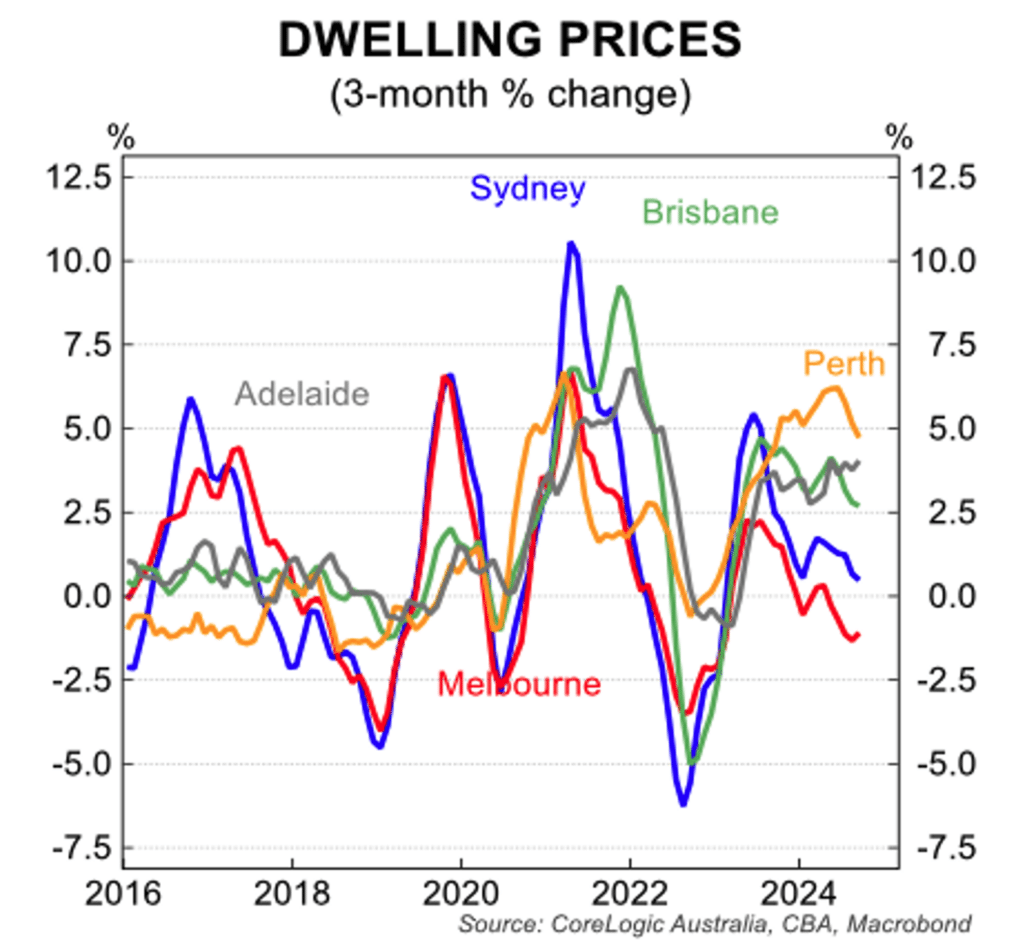

At the national level, there is a clear slowing in house price growth even though there are areas where price growth remains strong.

Corelogic data shows that house prices rose by just 0.4 per cent in September after rising by just 0.3 per cent in each of the previous two months. In the September quarter, house prices rose by 1.0 per cent, the weakest quarterly increase in two years.

That said, the divergence in price momentum between cities remains extreme.

In four capital cities, house prices fell in the September quarter:

- Melbourne -1.1 per cent;

- Canberra -0.9 per cent;

- Hobart -0.8 per cent; and

- Darwin -0.7 per cent.

Sydney prices are close to stalling with a quarterly rise of just 0.5 per cent.

The three cities that remained strong were:

- Perth +4.7 per cent;

- Adelaide +4.0 per cent; and

- Brisbane +2.7 per cent.

It is noteworthy that even in these ‘strong cities’, the pace of price increases are slowing.

Preliminary data for the first part of October points to a further cooling in price growth and auction clearance rates in Sydney and Melbourne are tracking lower.

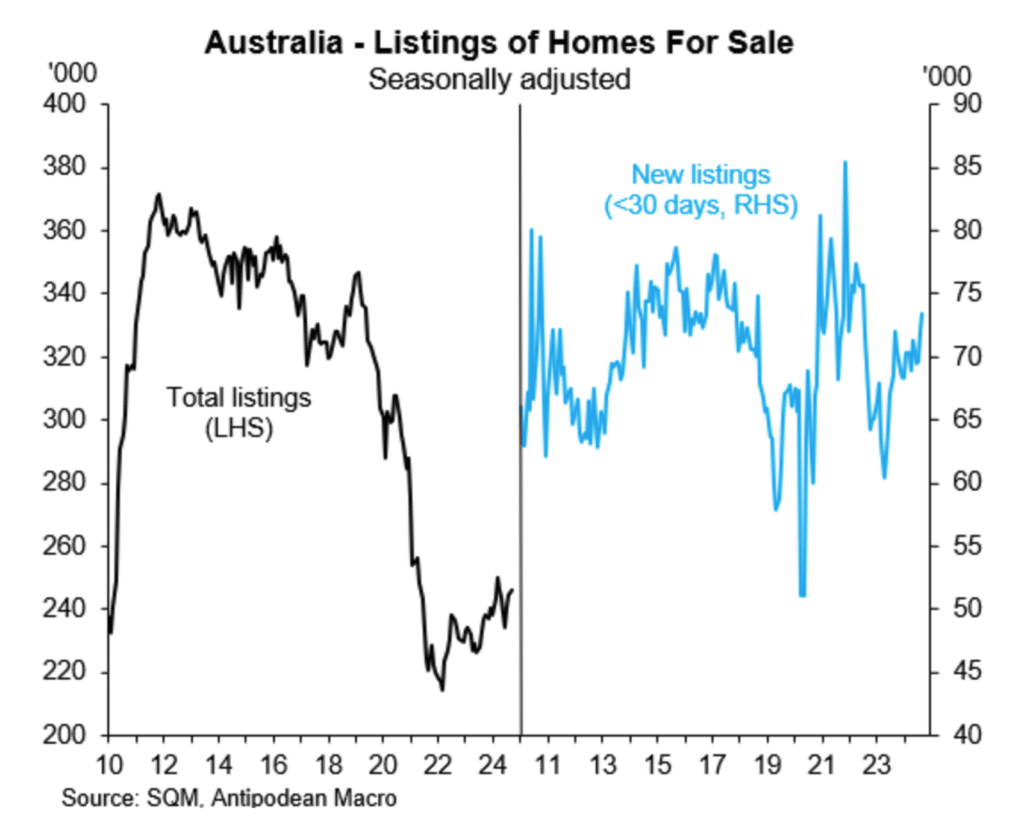

The slowing in house price growth is being driven by an increase in new listings albeit from a low base, which is adding to supply for potential buyers, while the pace of population growth is normalising after the post-COVID lockdown jump. At the same time, broader cost of living pressures is crimping the borrowing power of potential home buyers.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.