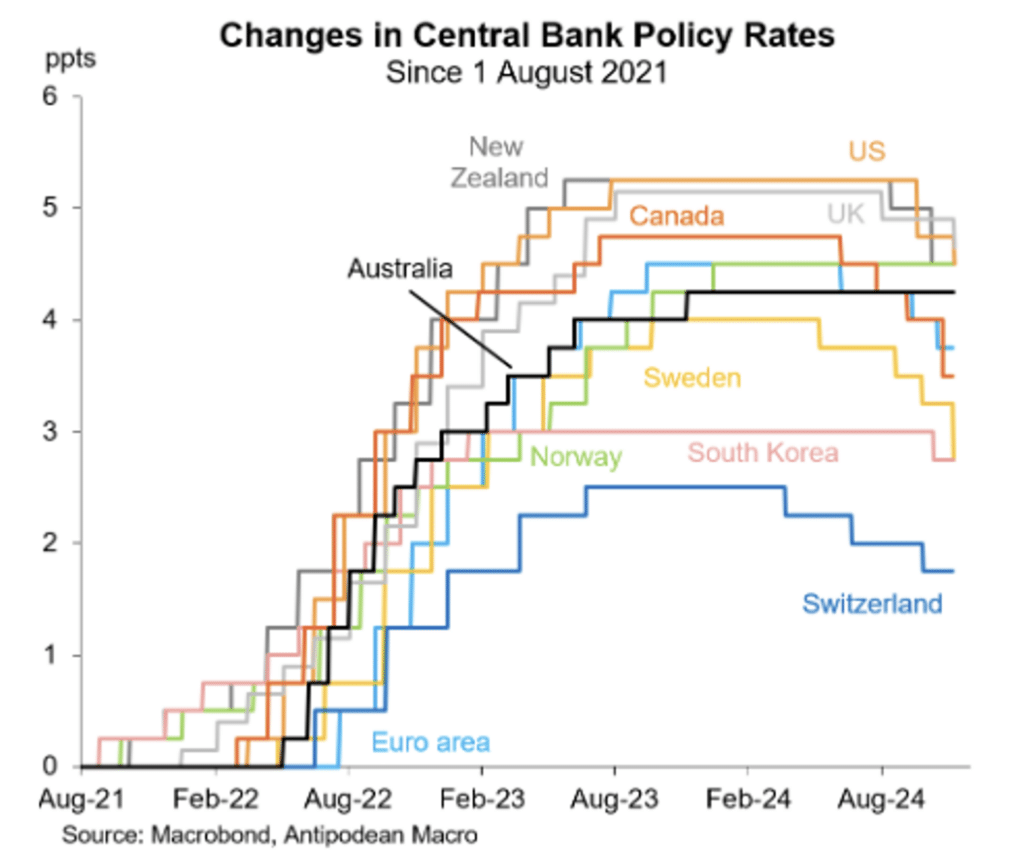

The RBA has now held official interest rates steady for more than a year despite the substantial fall in inflation, the weak economy, the slowing in wages growth and the flood of interest rate cuts around the world.

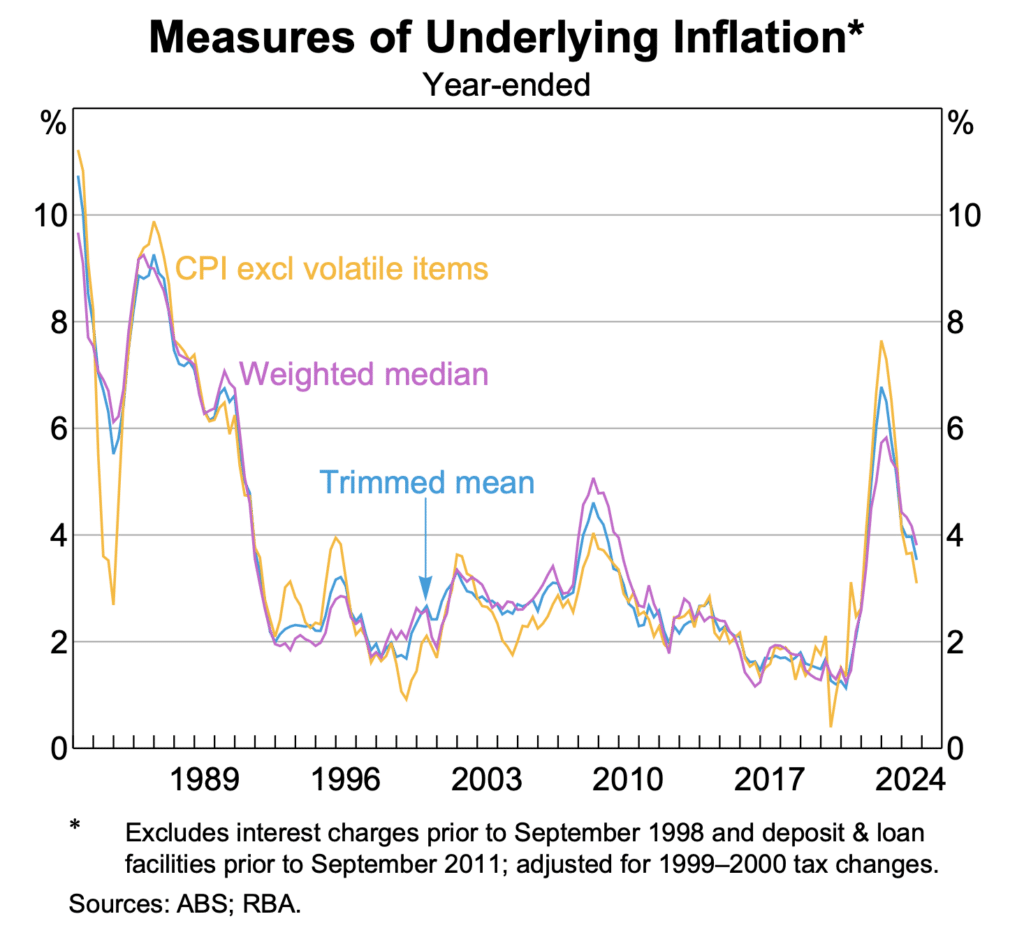

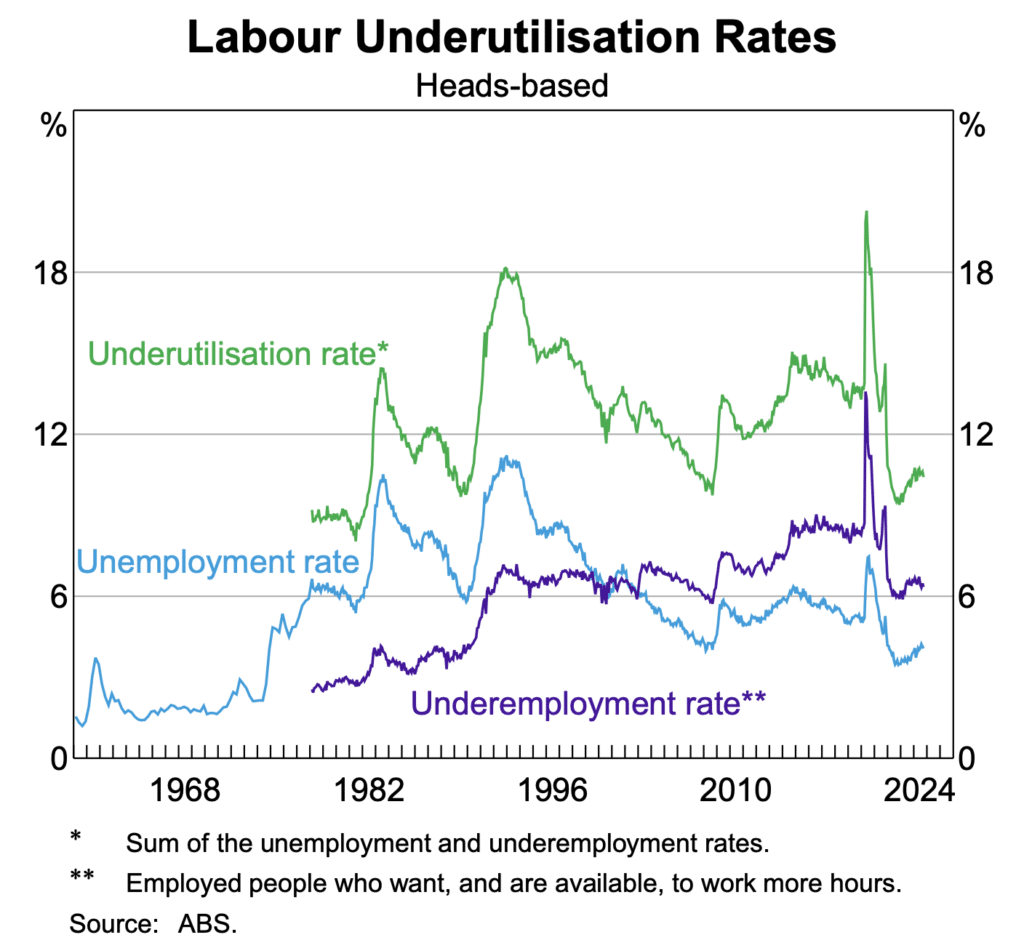

The RBA is concerned that the ‘trimmed mean’ or underlying inflation rate is above the 2 to 3 per cent target and that it needs to see more evidence that this has fallen further before cutting interest rates. It also judges the labour market to be ‘tight’ despite the rise in unemployment and moderation in wages growth.

Internationally, the election of Donald Trump as US President has had an impact on financial markets, most notably a sharp jump in bond yields and share prices. The policy suite of a new Trump administration that underpinned these moves relate to upside inflation risks from the imposition of tariffs and substantial stimulus from proposed tax cuts.

Many major central banks continued to cut interest rates. Several economies have cut official interest rates on multiple occasions and despite the market ructions from the US election, further interest rate cuts are priced in over the medium term.

In Australia, annual inflation fell to 2.8 per cent in the September quarter, aided by the general economic softness and government decisions to lower householder’s electricity bills as part of a cost of living relief package. The trimmed mean measure of inflation which the RBA refers to as a target, eased to 3.5 per cent.

The other news on the Australian economy is mixed.

Economic growth remains subdued although it may be a little stronger in the September quarter than during the first half of 2024.

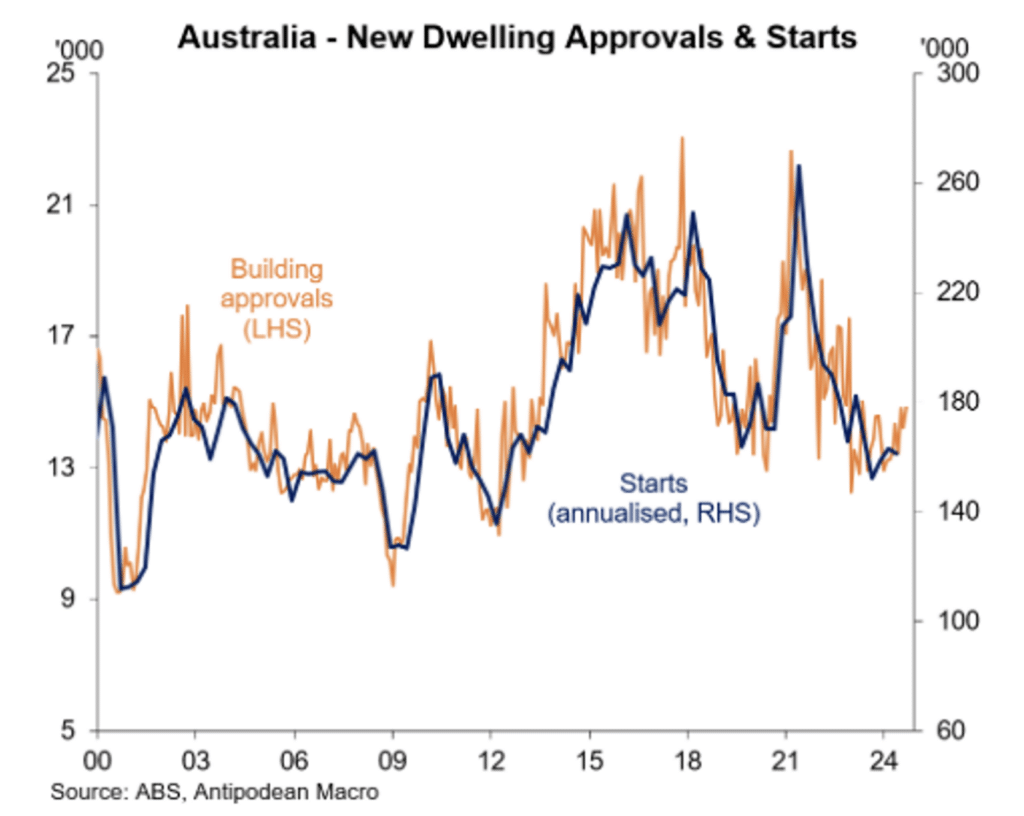

- New dwelling building approvals rose 4.4 per cent in September to be at the highest level since May 2023. In trend terms, the number of dwelling approvals has risen for 7 consecutive months to be 14 per cent above the trough in February 2024.

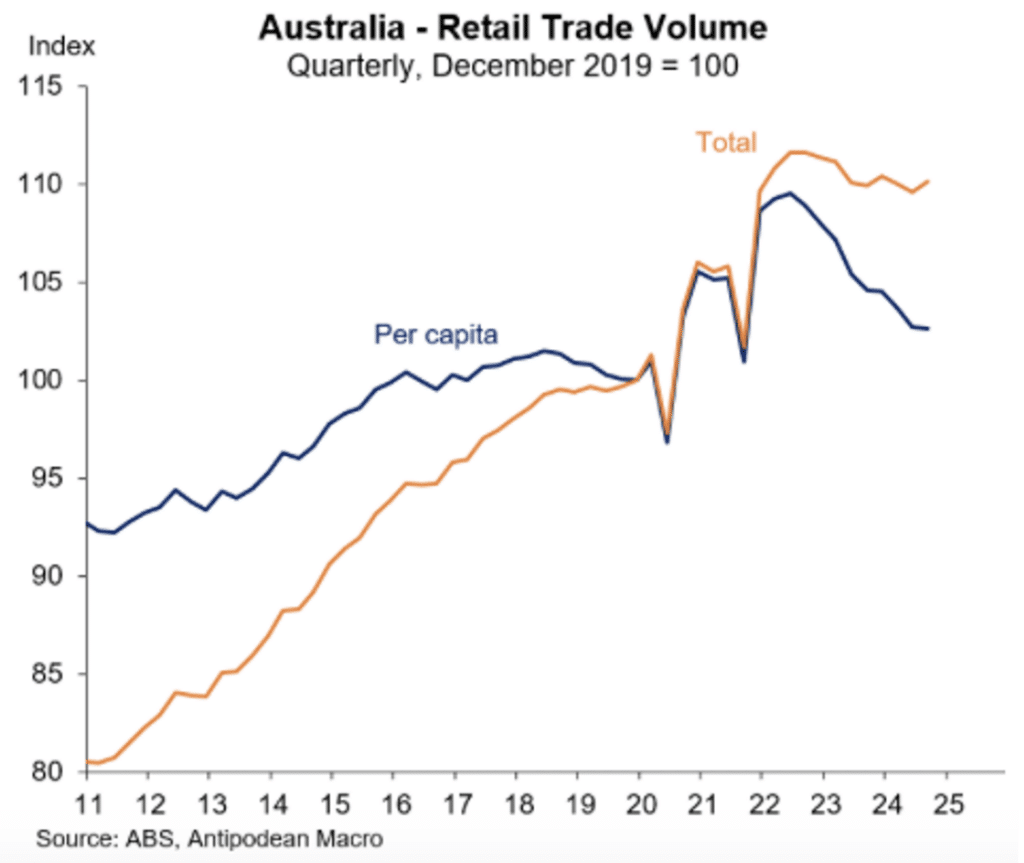

- Retail spending rose just 0.1 per cent in September, down from the solid lift of 0.7 per cent in August. In real, inflation adjusted, terms retail sales rose 0.5 per cent in the September quarter to record only the second quarterly rise since 2022. Income tax cuts and rising real wages have aided consumer spending albeit, from a low base.

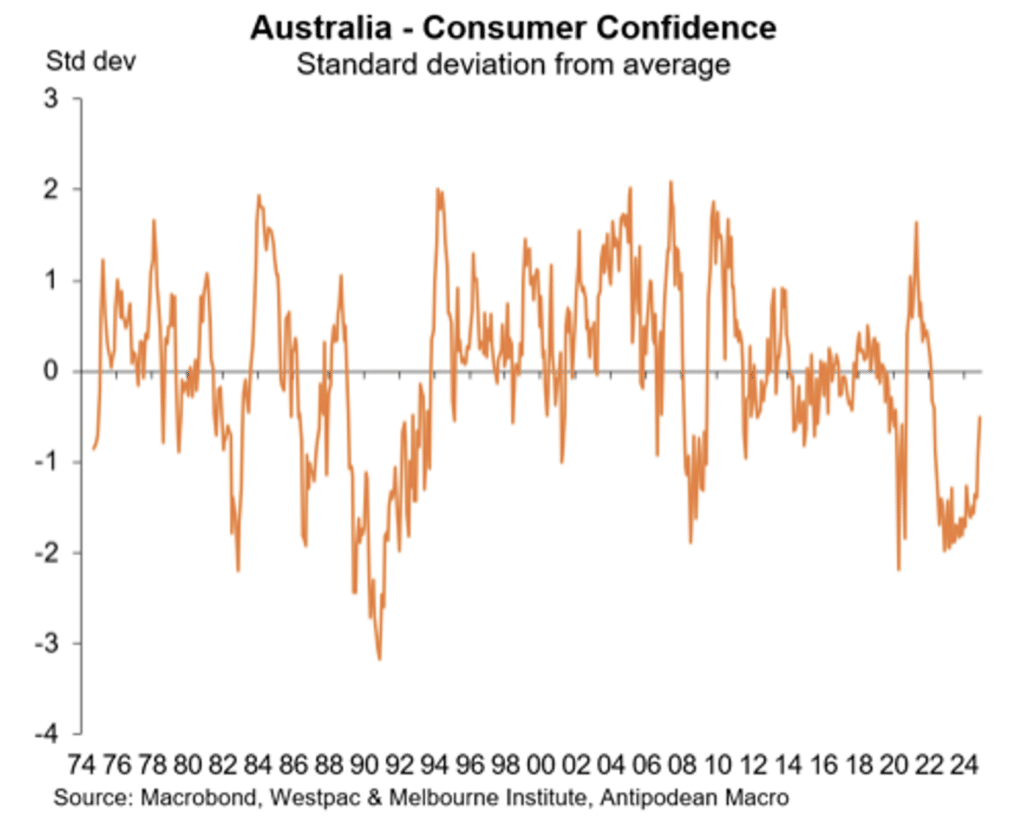

- Consumer sentiment has moved higher with rising real wages and rising wealth helping. That said, the level of sentiment remains where there are more pessimists than optimists which suggests consumer spending will remain subdued.

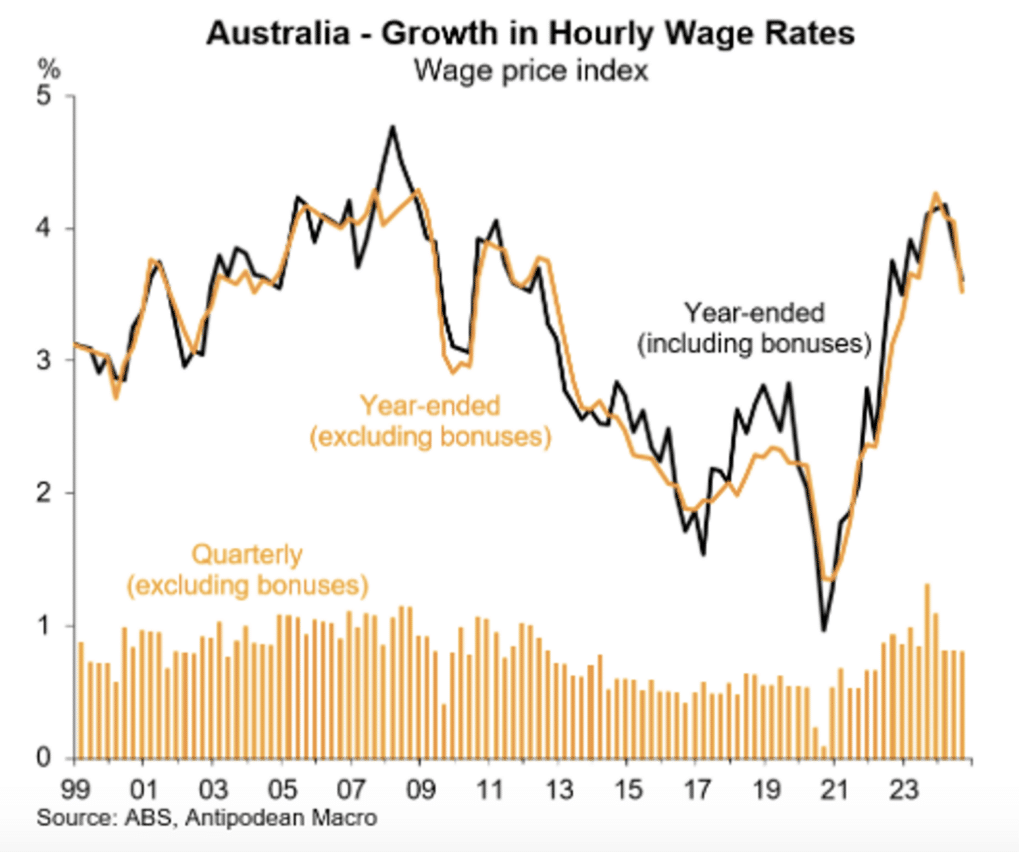

- Wages growth continues to slow with annual increases easing to 3.5 per cent in the September quarter from a peak of 4.3 per cent a year ago. The Seek advertised salary index has turned lower and points to further moderation in wages into 2025.

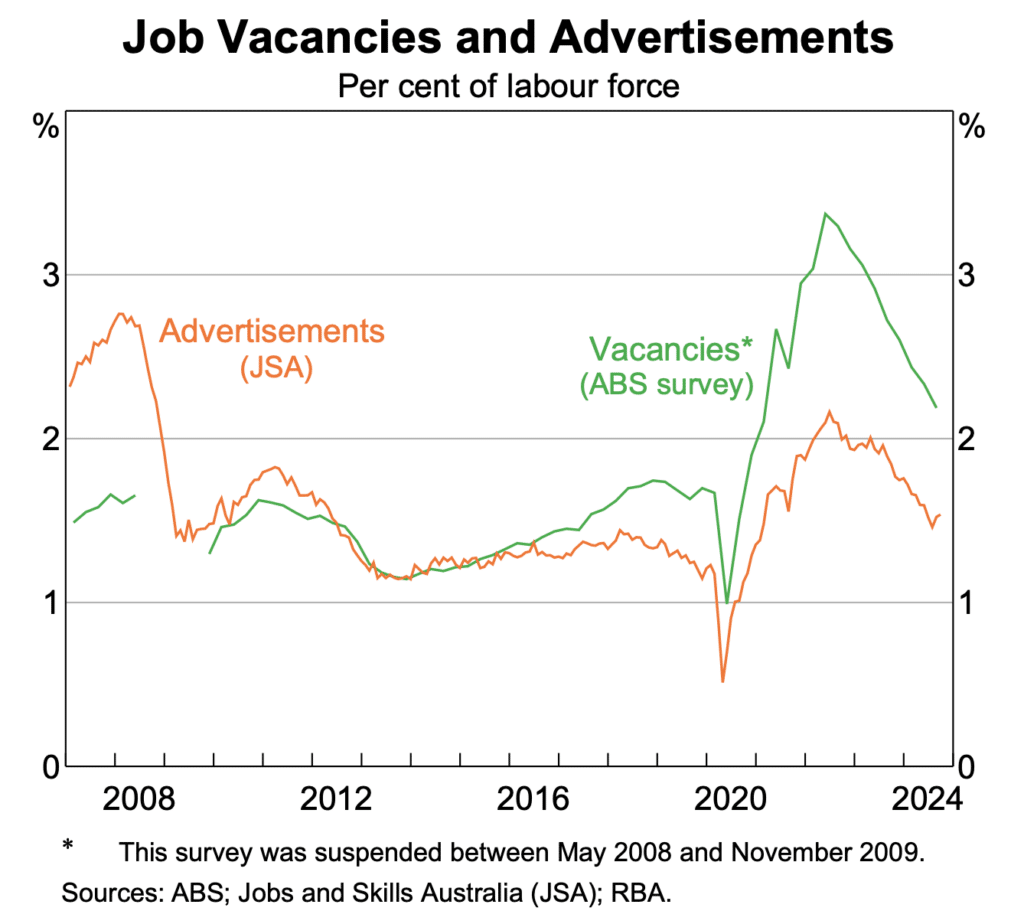

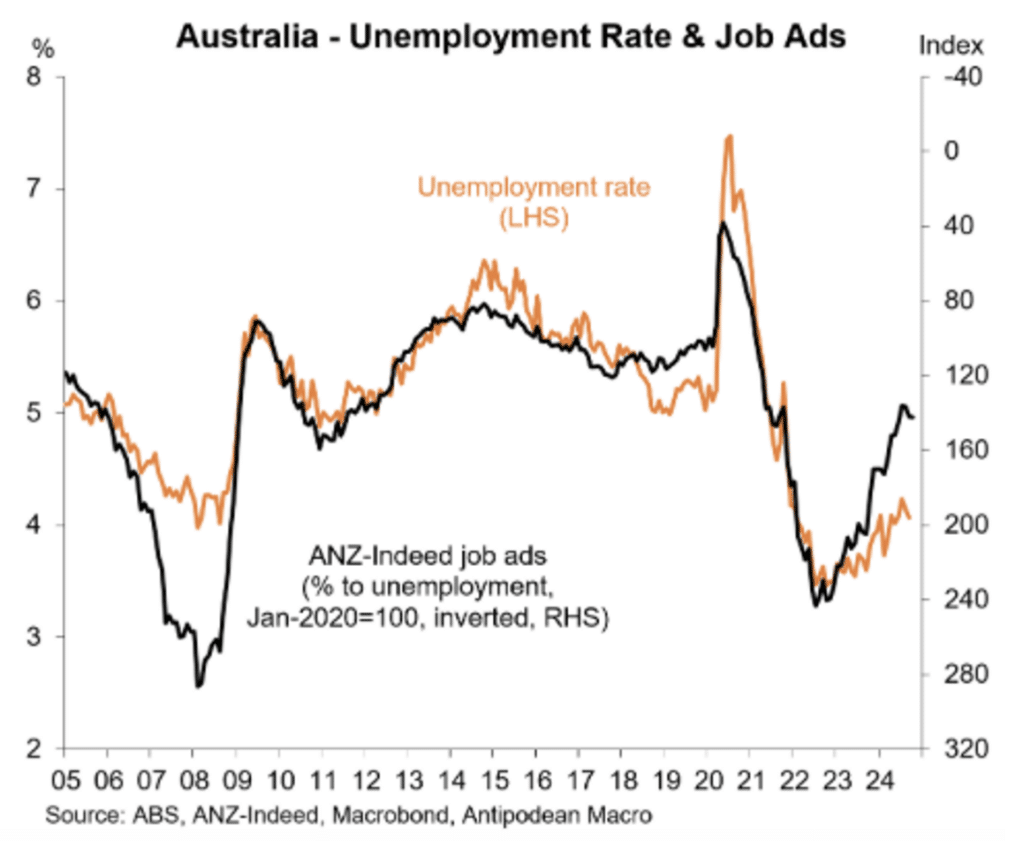

- The number of job advertisements has stabilised in recent months after sharp falls over the prior two years. Job vacancies continue to track lower. The change in job ads is consistent with further increases in unemployment over the near term.

- The unemployment rate was steady at 4.1 per cent in October, held lower by solid gains in employment despite the softer pace of bottom line GDP growth. The Statement of Monetary Policy from the RBA is forecasting the unemployment rate to rise to 4.5 per cent in 2025 and 2026.

House prices

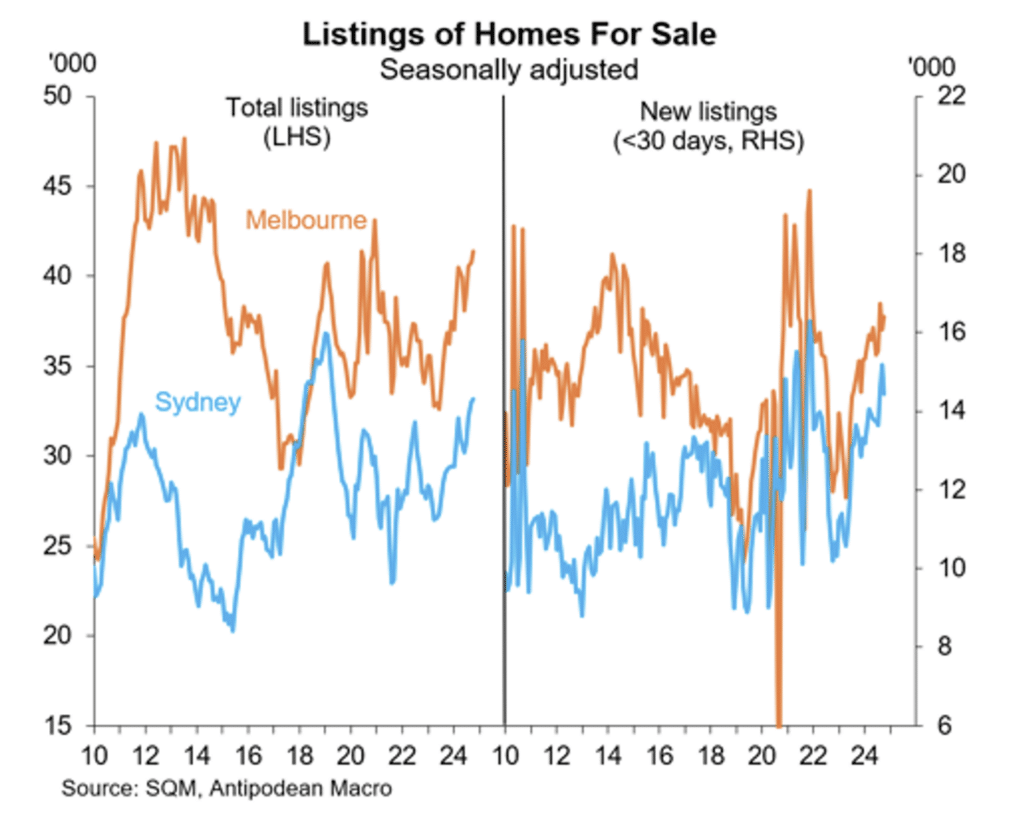

Nationwide house price growth continues to slow. In the last four months, the average monthly increase has eased to 0.3 per cent, down on the 0.75 per cent growth evident in late 2023 and early 2024. Prices will be close to dead flat in November.

For the first time in nearly two years, house prices fell slightly in Sydney while prices were flat to down in Melbourne, Hobart, Canberra and Darwin. While price growth was still strong in Perth, Adelaide and Brisbane, the rate of price increase is cooling in these cities.

In four capital cities, house prices fell in the three months to October:

- Darwin -1.3 per cent.

- Canberra -0.9 per cent;

- Melbourne -0.8 per cent; and

- Hobart -0.1 per cent; and

Sydney prices fell 0.1 per cent in the month of October and were up just 0.1 per cent in the three months.

The three cities that remained strong where prices rose solidly in the three months to October were:

- Perth +4.1 per cent;

- Adelaide +3.7 per cent; and

- Brisbane +2.4 per cent.

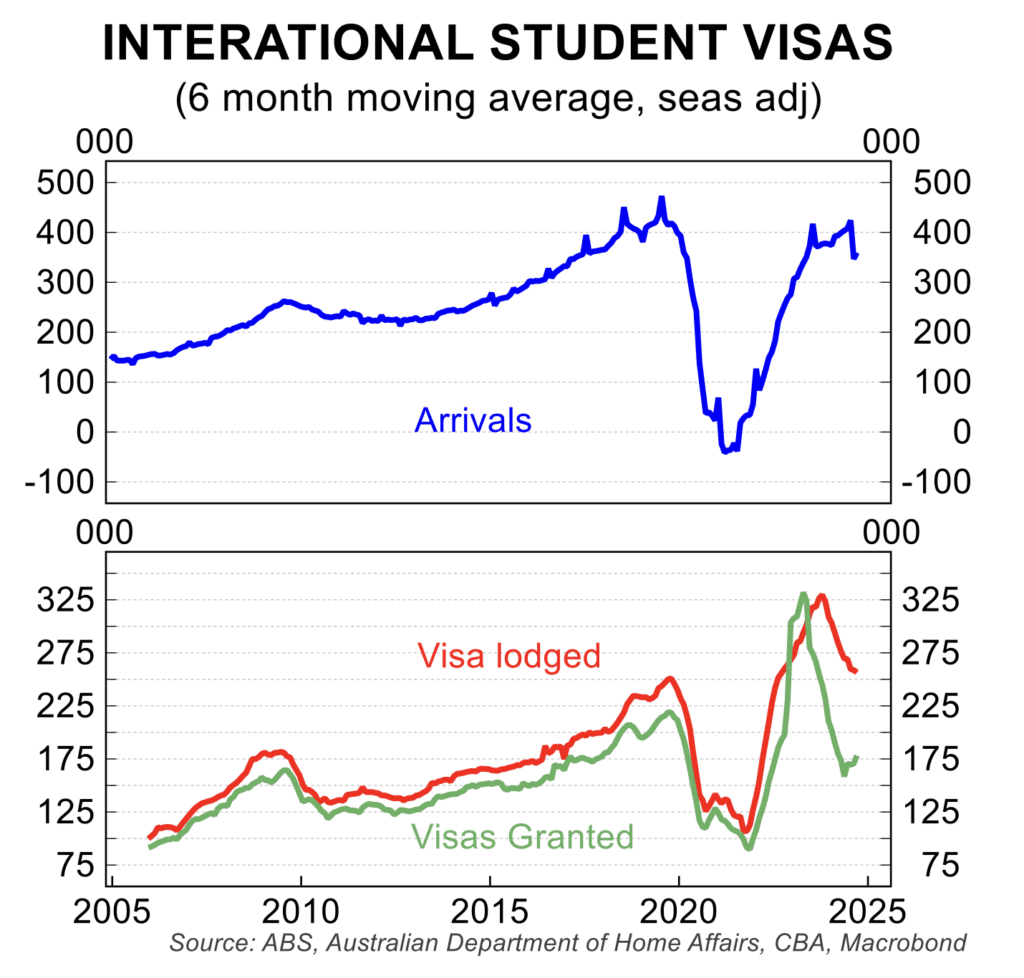

In very simple terms, the gap between demand and supply for housing is closing. As the chart to the right shows – the green line – the number of student visas granted, one of the key factors impacting housing demand, has fallen back to the levels prevailing prior to the pandemic.

Market pricing for interest rates has been further scaled back with a sharp lift in bond yields. The RBA Governor has dampened expectations for interest rate reductions by highlighting the trimmed mean, rather than headline, inflation rate. The resilience in the labour market has also impacted monetary policy expectations.

The markets are pricing in no change in interest rates before the June quarter of 2025 and has just two 25 basis points of cuts priced in by early 2026. This is in sharp contrast to the five 25 basis points of interest rate cuts that were priced in to the Australian market earlier in 2024.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.