We are pleased to report that all Funds across the Zagga portfolio have performed very well for the period ended 31 December 2024 – a year that was characterised by robust macroeconomic and market conditions across different assets in the real estate sector.

The headwinds in the post-Covid cycle, which included 13 interest rate rises, supply chain disruptions, labour shortages and new government processes, have largely dissipated, and we have seen velocity in the book through a number of successful exits.

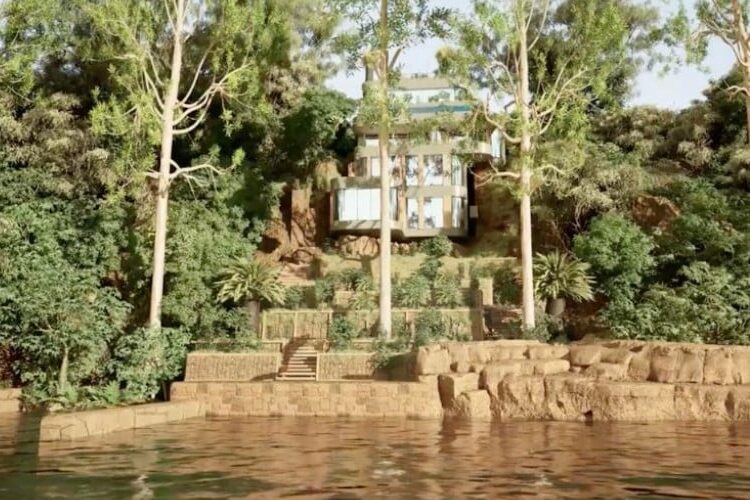

In the last calendar year, Zagga focussed on originating opportunities across multiple property sectors in blue-chip locations with strong counterparties, as the non-bank sector continues to capture market share from the major banks. We remain acutely aware of continuing external challenges in the market, so our key focus on preserving capital remains paramount. Accordingly, we have sought out numerous deals in Sydney’s Eastern Suburbs, Lower North Shore and Northern Beaches, as well as other metro Sydney and Melbourne locations, for proven and capable counterparties, strong assets, and market depth.

Our loan book overall is performing exceptionally well.

It is inevitable, in any lending activity, to have loans which do not run exactly as expected, which require careful management or might take longer than expected to discharge. We have had a couple of instances where we have had to put in additional enforcement measures which represent less than 10% of the Funds investments. We are managing these specific instances carefully, however, do not believe that the Funds’ performance will be materially impacted. We also expect a large number of our older-dated loans to discharge over the next three to six months, giving rise to an opportunity to add new transactions to the book and for our investors to re-cycle into newer opportunities.

We have certainly seen an increase in competition for deals of this calibre because of increased liquidity, driven by the growing attraction of private credit as an investable alternative asset class. As our funds under management continue to grow, our growth strategy does not necessarily indicate an increase in number of transactions, rather a shift towards larger transactions, within the same credit parameters, within the mid-market, and strongly preferencing quality over quantity.

No doubt this year will bring with it its own challenges as interest rates look to remain stagnant for at least the first half of 2025. Relying on the experience of our team, our proven investment strategy, and ever-growing presence, we consider ourselves to be well-placed to meet both the challenges and opportunities that come our way.

We look forward to a successful 2025.