Press Release

Source: Foresight Analytics

Date: 08 January 2025

Foresight Analytics & Ratings has recently completed an initial rating assessment of the Zagga CRED Fund.

The fund has been assigned a VERY STRONG rating indicating a very strong level of confidence that the manager can deliver a risk-adjusted return in line with its investment objectives.

The Zagga CRED Fund (ZCF) is a pooled mortgage trust established in January 2024 managed by Zagga Investments Pty Ltd (‘the Manager’). The underlying investments are loans secured by registered first mortgages on property development, land development and refinancing of completed stock. The Fund is effectively a floating interest rate investment strategy.

Foresight Analytics & Ratings Designation as a COMPLEX product indicates that the underlying assets require specialist investment skills to acquire, manage and monitor. In addition, a large proportion of the Trust’s assets are illiquid, and investors should have a good understanding of the investment time horizon as well as the distribution characteristics of this type of fund.

Zagga was co-founded by Alan Greenstein (CEO) and Marcus Morrison (Executive Director) in 2017 (together with 3 other investor shareholders), both having significant experience in banking and finance. Zagga funded its first loan of $7.2M in June 2017 funded by 32 investors. Since then, it has originated more than $2.1Bn through approximately 300 ACRED loans. Zagga currently has approximately $900M in FUM through 4 ACRED funds and an investor base of approximately 500 investors spanning wholesale, SMSFs, HNW, family office, and ‘junior’ institutional investors. To date, lending growth has almost entirely been via word-of-mouth referrals, both from the investor and borrower side. This reflects well on investor experience / manager performance. In relation to the latter, to date, all investors have received contracted principal repayments and interest distributions without loss.

While ZCF is relatively new and with a current total FUM of circa $13.8M, portfolio diversification has been achieved by way of making ‘fractionalised’ loans into larger credit risk parameter appropriate loans originated by the Zagga group. The latter typically in the $2-$50M range. This interaction with other Zagga funds is also but one of what is a liquidity waterfall to assist in ensuring liquidity (invariably a focus point for any new, low FUM fund).

Zagga’s head office is located in Sydney, with representations now also in Melbourne, Singapore and Hong Kong, as well as staff in Manila and Auckland. The total number of employees has now grown to approximately 28 (at end November 2024). The Manager is well-placed from a resources perspective to achieve its growth ambitions. It is also very well placed from a system, processes, structural perspective to do so – Zagga is an institutional grade manager.

Zagga’s growth strategy is, just like its lending, inherently conservative – just the way Foresight likes it in private debt. It is characterised by high expertise in target markets, organic growth driven by word-of-mouth referral for investors and borrowers alike, and geographic expansion driven by following existing borrowers in which the Manager has long-term relationships with (rather than geographic expansion for the sake of it). Borrower focus is very much on reputation, experience, financial capacity, in addition to loan specific aspects such as projected profitability (heavily stress-tested) of the assets lent on (be it development, residual stock, or land development).

The investment strategy for the Fund is designed to meet the target performance of annualised returns at least equal to the benchmark plus 4% with minimal risk of capital loss. In endeavouring to achieve this goal, the Fund is a senior loan only mandate with capped maximum LVRs ranging from 70-75%, subject to each particular ACRED sub-segment. In practice, LVRs almost invariably do not exceed 65%. Loans are short duration ‘bridging’ loans, with the entirety of the loan book currently comprising loans of 12-24 months duration (up to 36 months in the case of land development loans). As such, economic and property cycle risks are mitigated.

Property lent on is what Foresight deems as inherently lower risk in the ACRED property type spectrum. Specifically, it is typically 4-12 more upper market residential developments in more upper market in inner urban ring suburbs. The Manager is currently targeting loans of between $2M and $50M. The targeted mix of the portfolio by sub-segment is approximately 65% property development with the rest, less a 5% liquidity cash holding, split between residual stock and land development.

About Foresight Analytics’ Investment Due Diligence Rating (IDD Rating)

The objective of Foresight Analytics’ Investment Due Diligence Rating (IDD Rating) is to identify the best funds and opportunities for future investment. We assess the fund’s historical risk-adjusted performance – compared to its peers – to form a holistic view of the manager’s ability to deliver future returns. The IDD rating indicates the quality of the investment option within the context of a diversified portfolio and full investment cycle.

Foresight’s analysts use a 5-point scale to determine how the fund will perform against a range of risk factors.

- SUPERIOR indicates the highest level of confidence that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is highly suitable for inclusion on APLs.

- VERY STRONG indicates a very strong conviction that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is suitable for inclusion on most APLs.

- STRONG indicates a strong likelihood that the fund can deliver a risk-adjusted return in line with its investment objectives and that it is suitable for inclusion on most APLs.

- COMPETENT indicates the fund may deliver a risk-adjusted return in line with its relevant benchmark and that it may be suitable for APLs.

- WEAK indicates the fund is unlikely to deliver a risk-adjusted return in line with its investment objective and that it is not suitable for most APLs.

A ‘Hold’ designation is applied to a fund’s rating if a material change impacts the fund manager, and we need to review the rating. A ‘Sell’ designation indicates the Foresight Investment Ratings Committee considers risk factors to be elevated enough that maintaining an investment in the fund as part of their diversified portfolio is questionable.

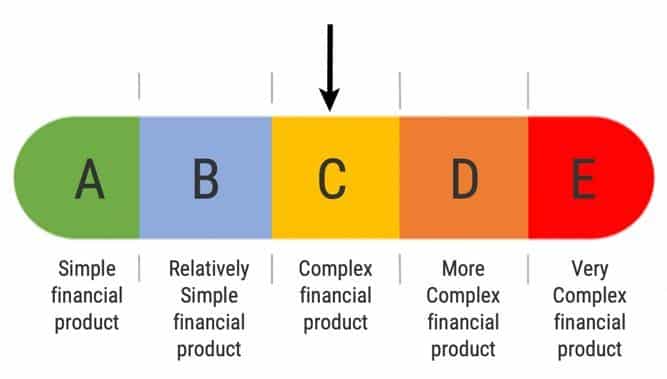

Foresight Complexity Indicator

A Foresight Complexity Indicator (FCI) highlights the complexity of an investment product based on a range of indicators. These typically include its terms and conditions, performance-based fees, liquidity structure, financial leverage, use of derivatives, rare and niche asset class/opportunity set, currency exposure and the level of transparency offered for investors. Foresight believes these factors can disproportionately affect risk-adjusted return outcomes for investors even if a manager is very skilled. Investors can use FCI as a guide to portfolio position sizing within a diversified portfolio context.