The important news in the first month of 2025 centred on a further sharp deceleration in inflation, the full pricing in of a series of interest rates cuts from the RBA and the start of the Trump Presidency in the US.

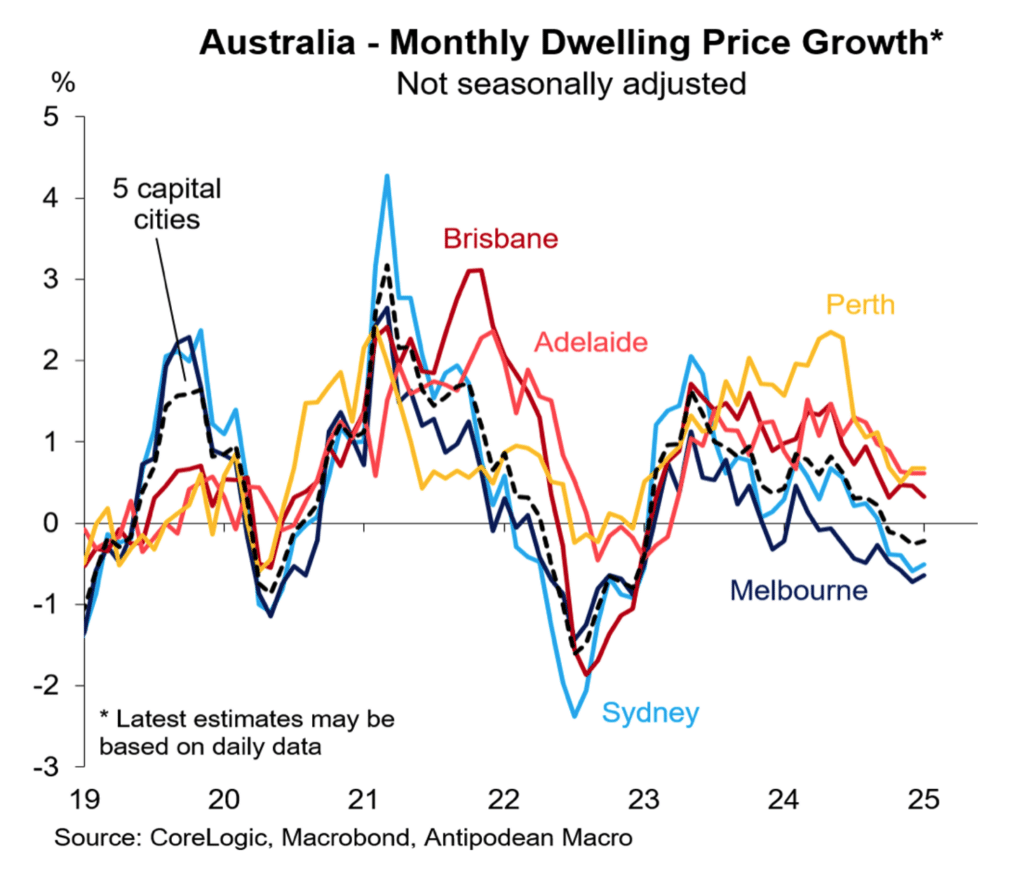

The other major issue to unfold in Australia is falling house prices at a national level, but it remains the case that market conditions are uneven from city-to-city.

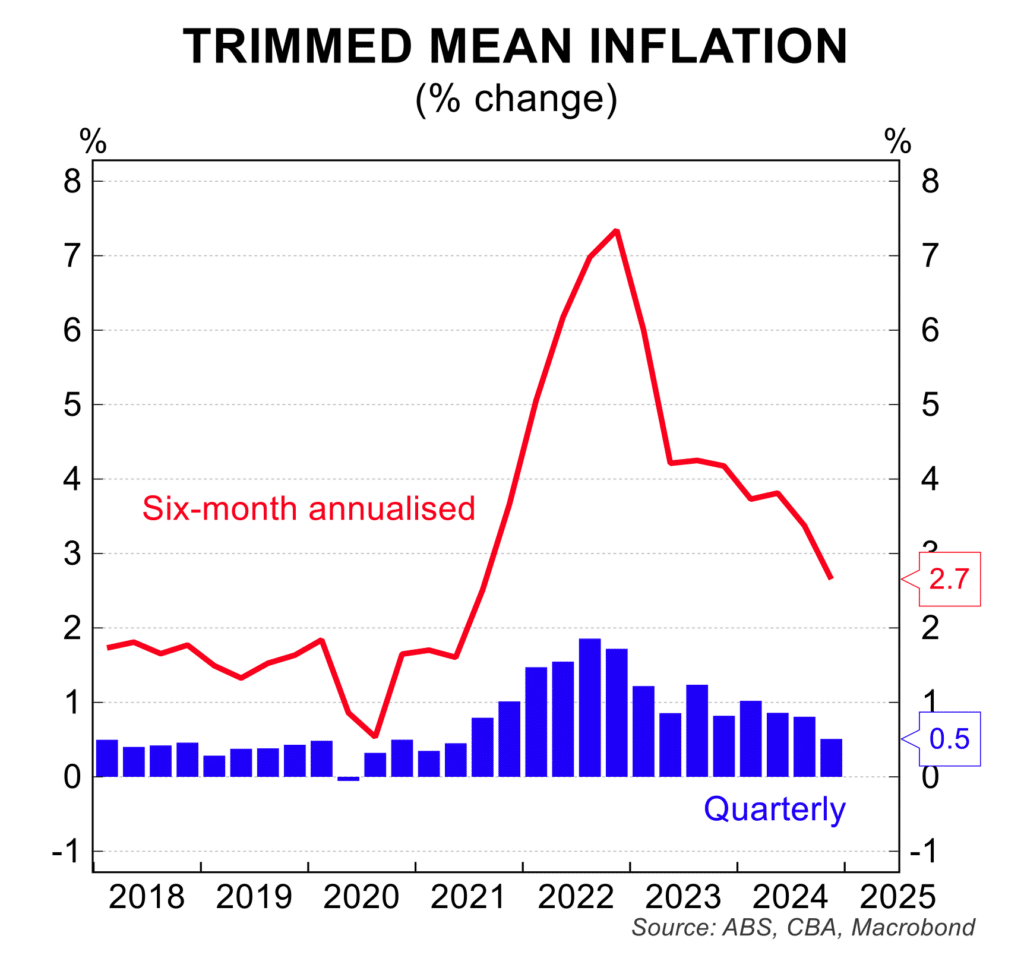

Expectations for interest rate cuts were reinforced by the December quarter inflation data which showed annual inflation at 2.4 per cent, in the middle of the RBA target band and down from the peak of 7.8 per cent at the end of 2022. Even the trimmed mean or underlying inflation measure was encouraging rising by just 0.5 per cent in the quarter, the smallest rise in nearly four years.

At the time of writing, markets were expecting an approximately 95 per cent chance of a 25 basis point cut from the RBA on 18 February and a 40 per cent chance of a further 25 point cut at the following meeting on 1 April. Around 100 basis points of rate cuts are priced in by the first half of 2026. Note market pricing is volatile and can change rapidly with global events and local data on the labour market and inflation highly influential.

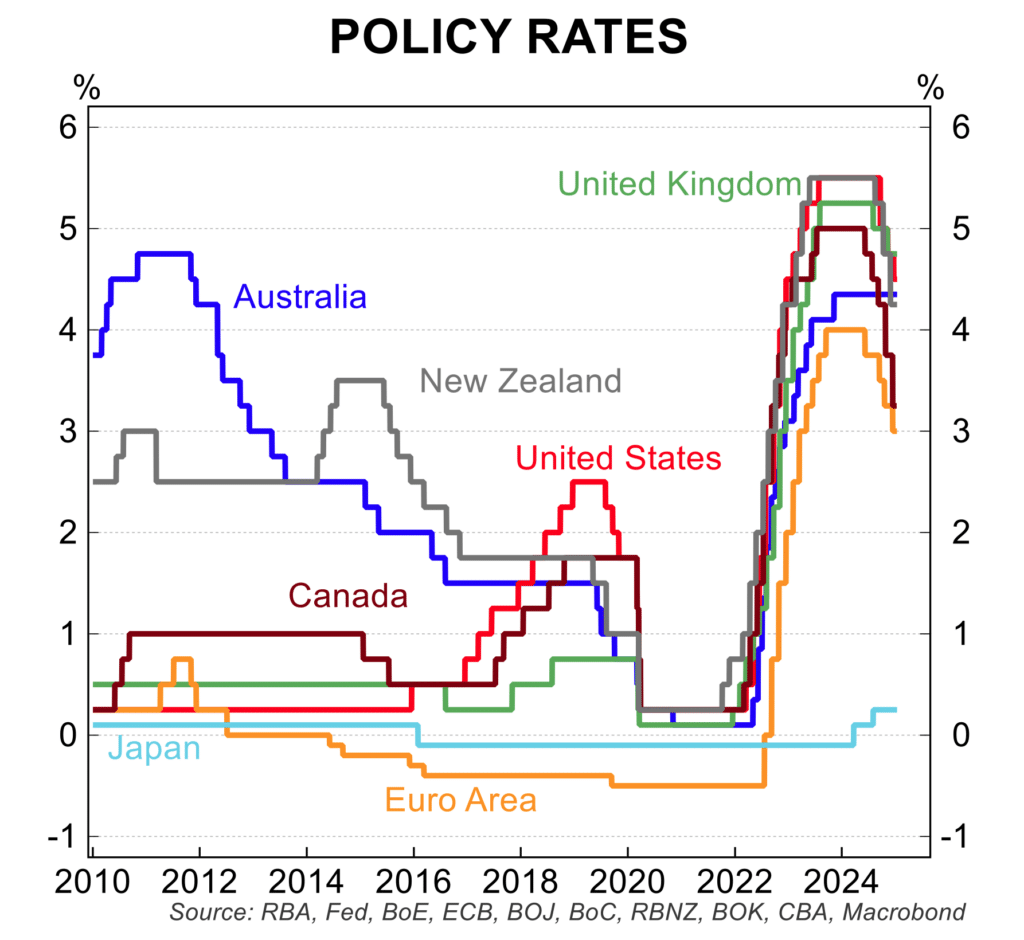

Despite the recent volatility resulting from US political developments, global interest rates remain on a clear downtrend.

The early policy announcements of President Trump have added to market volatility and there is heightened uncertainty from many economists about the outlook for US growth and inflation. It is too early to be sure of the longer run influences from the new administration, suffice to say higher tariffs and tax cuts are seen to be inflationary and disruptive for global trade flows.

Key data

Below is an update of key recent trends in the economy:

- Inflation rose 0.2 per cent in the December quarter for an annual increase of 2.4 per cent. Inflation has been with in the RBA 2 to 3 per cent target band for two quarters and is set to remain on target over the longer term. The trimmed mean inflation rate, which is given importance by the RBA, eased 3.2 per cent in annual terms and is firmly on track to fall below 3 per cent through 2025. Using monthly CPI data, the annual change in trimmed mean inflation was just 2.7 per cent.

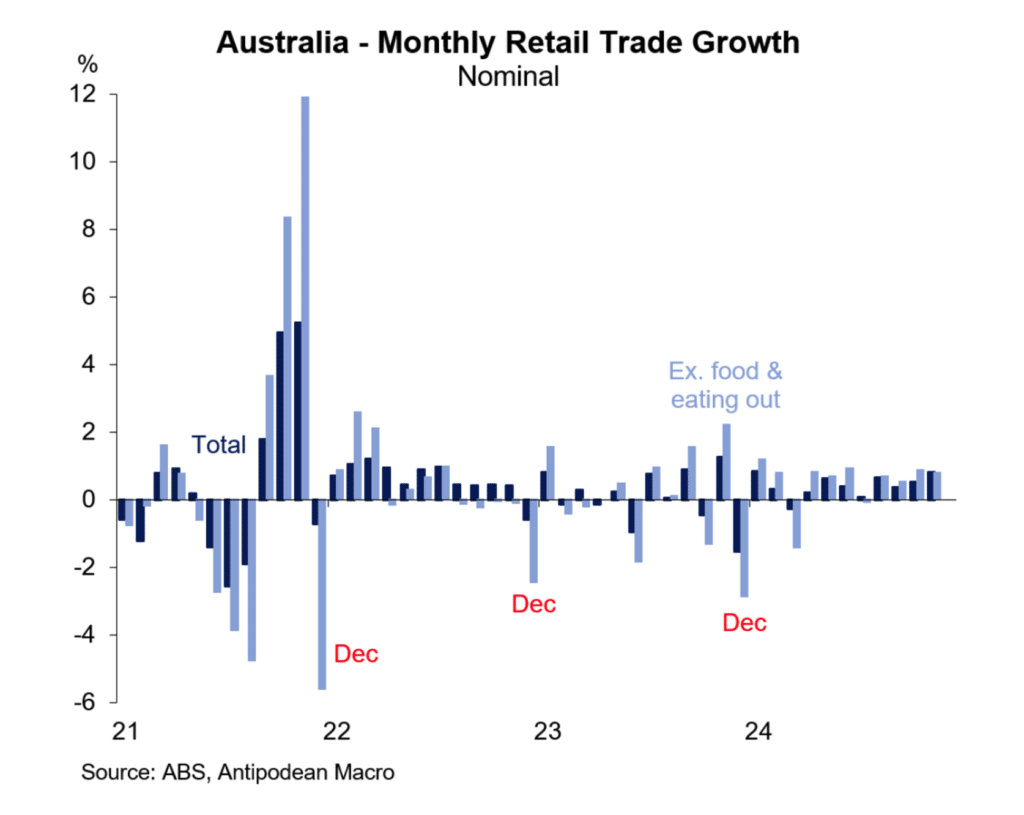

- Retail spending rose what was a superficially solid 0.8 per cent in November, boosted by spending in the Black Friday sales period. As has been the case in recent years, a solid November increase in spending has been followed by a fall in December. Growth in household spending is a key element is expectations for an economic recovery in 2025.

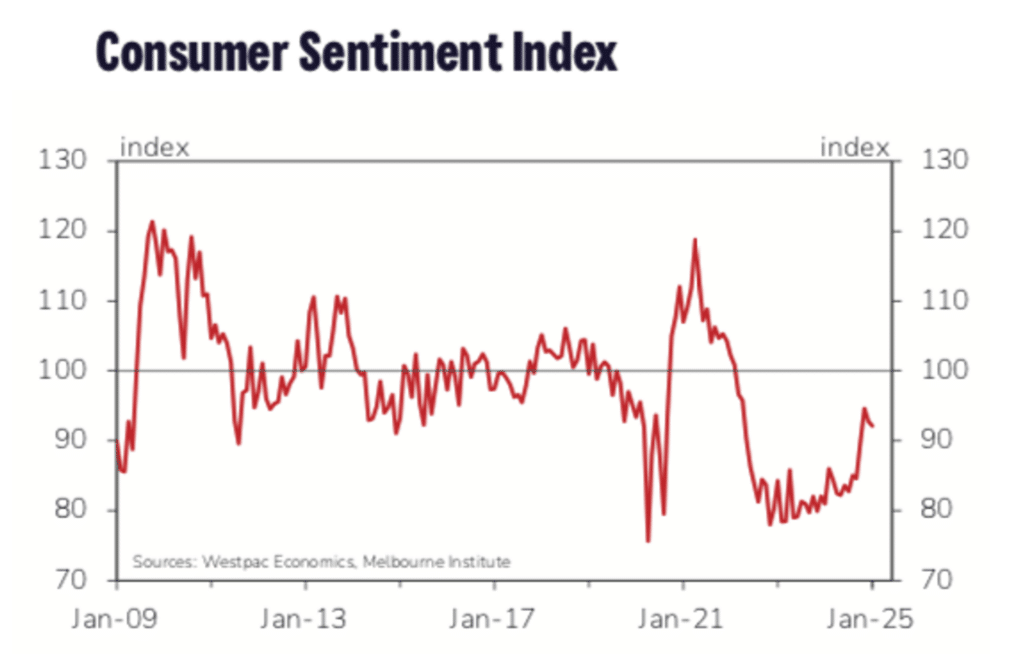

- Consumer confidence edged lower in January after a small fall in December. This consolidation in sentiment followed a solid uptrend from the middle of 2024. The impact of income tax cuts from 1 July 2024, rising wages, falling inflation, expectations for interest rate cuts and a solid labour market were likely drivers of the improved confidence levels. That said, consumer confidence remains below neutral – there remains more pessimists than optimists.

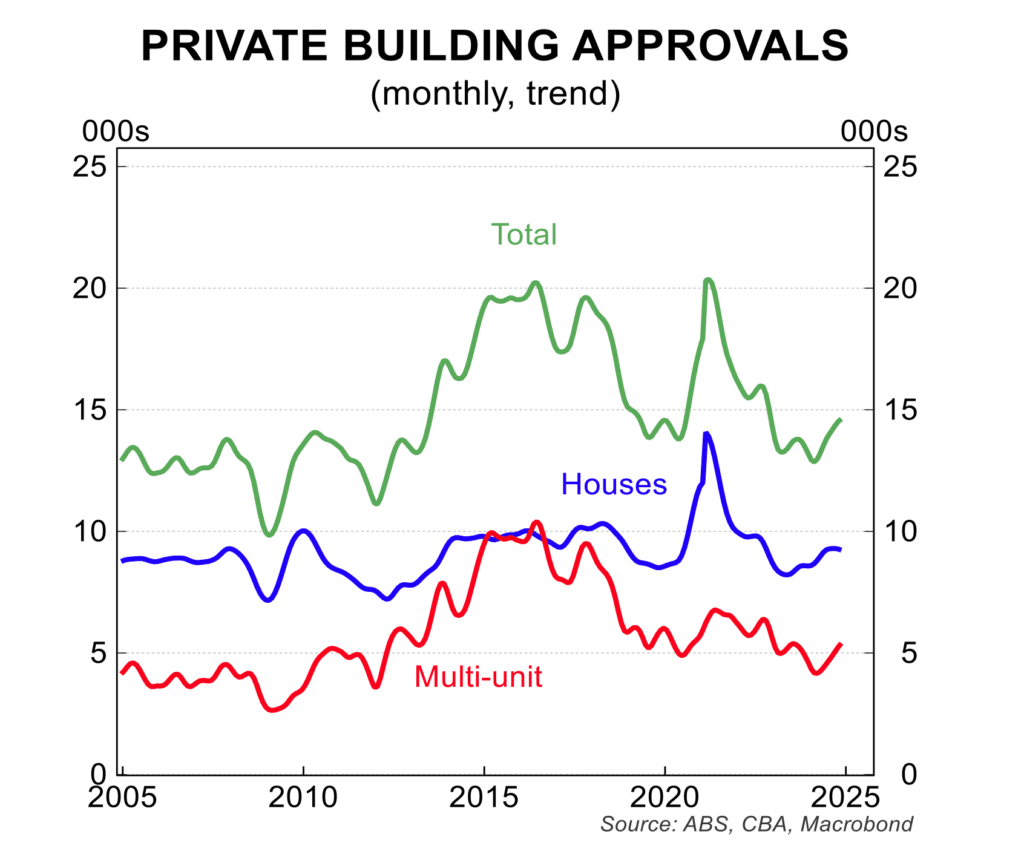

- While the number of new dwelling building approvals edged 3.6 per cent lower in November, the trend has actually increased 18 per cent from the early 2024 trough. New dwelling construction is set to have a positive year in 2025. As interest rates are cut through 2025, expect a solid rise in dwelling construction over the medium term.

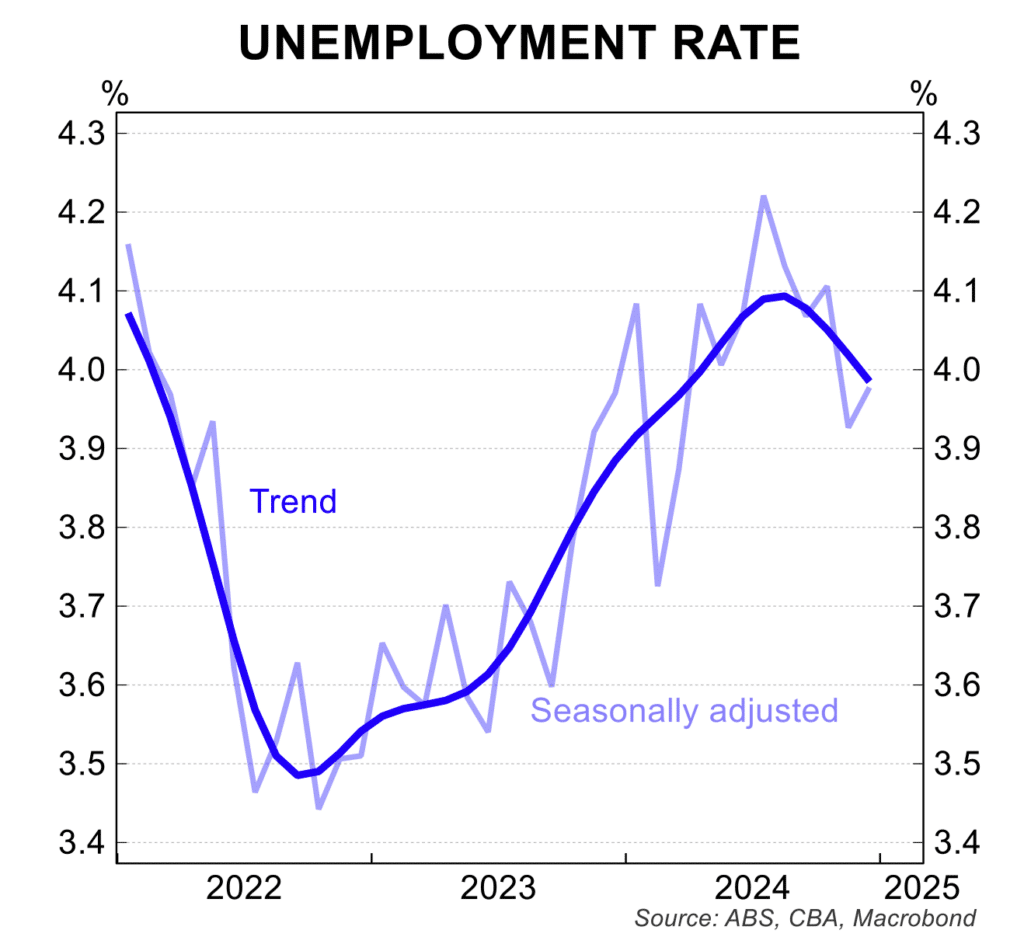

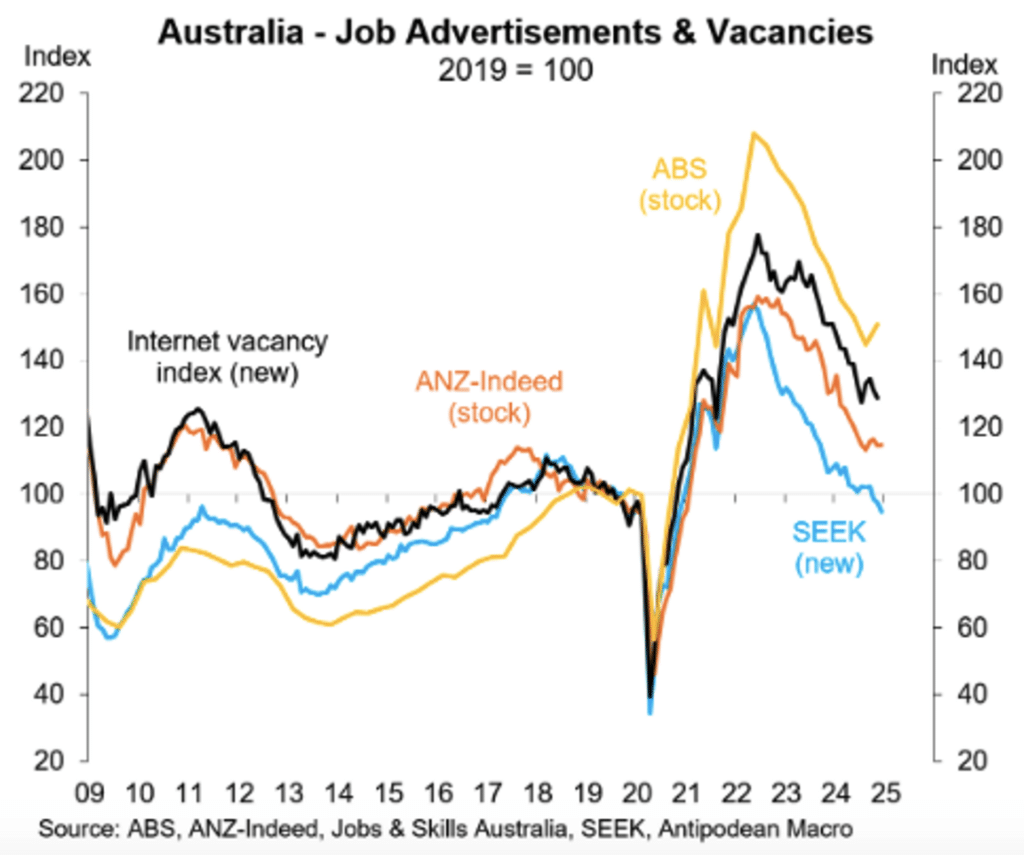

- The labour market continues to surprise with its resilience, even as signs of a softening in macroeconomic conditions remain in place. Employment rose 56,000 in December, with fall-time employment dropping 24,000 which was more than offset by an 80,000 increase in part-time jobs. The unemployment rate rose to 4.0 per cent but remains just 0.5 percentage points above a 50 year low. The various indicators of labour demand point to weaker labour market conditions in the months ahead.

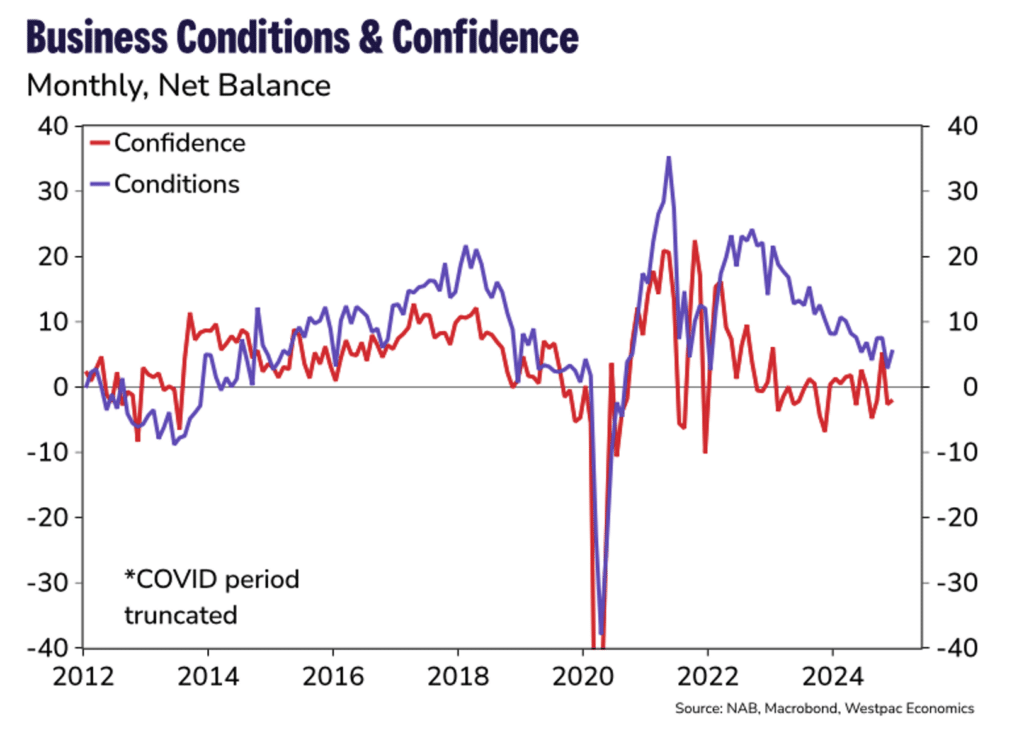

- The NAB survey of business remained subdued in December. The index of business conditions has been volatile month to month but is below the long run average. This is consistent with sub-trend private sector growth. Business confidence remains negative with businesses cautious about the economic outlook.

House prices

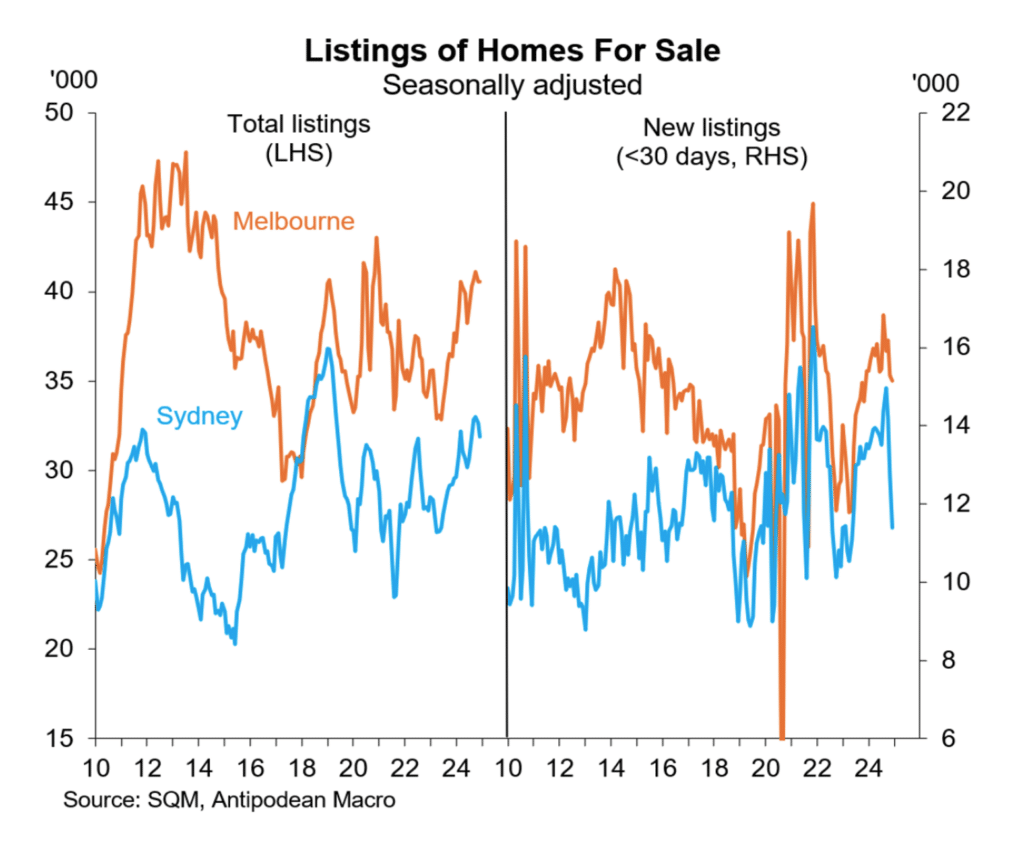

The slowing in house prices through 2024 culminated with prices actually falling in December. A cooling in demand via net immigration returning to ‘normal’ levels and additional supply in the form of a rise in new listings for sale have been key factors behind recent price trends. The preliminary Corelogic data is pointing to further weakness in January particularly in Melbourne and Sydney.

In the three months to December 2024, prices were weakest in:

- Melbourne -1.8 per cent;

- Sydney -1.4 per cent;

- Canberra -0.3 per cent; and

- Hobart no change.

The four cities with more resilient house prices in the three months to December were:

- Adelaide +2.1 per cent;

- Perth +1.9 per cent;

- Brisbane +1.3 per cent; and

- Darwin +0.6 per cent.

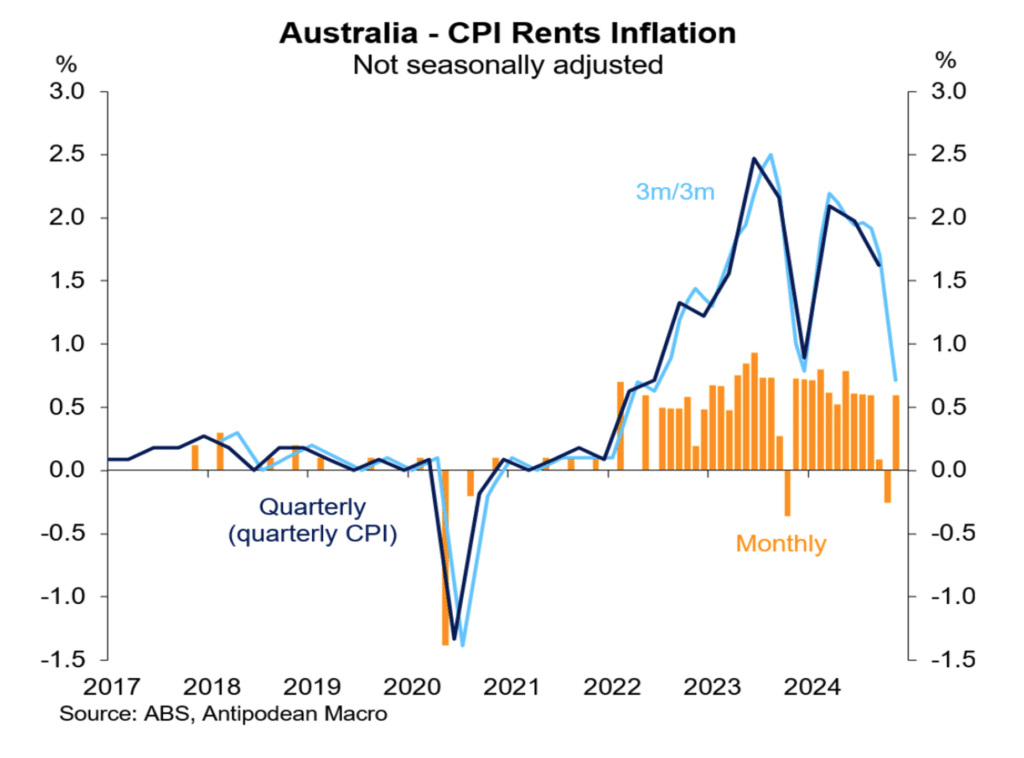

Of significance for cost of living and its weighting in the consumer price index, growth in dwelling rents has slowed.

According to Corelogic, rents rose 0.4 per cent in the December quarter, the smallest December quarter rise in six years. The annual increase, of 4.8 per cent, was the lowest since March 2021. A higher rental vacancy rate, linked to lower demand, is filtering into lower asking rents, a trend which should be more evident during 2025.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.