Global investors and policy makers continue to assess the extent of the negative impact of US President Trump’s tariff policies. It is likely to remain a moving feast in the months ahead with some retaliation and adjustments to the tariff plans seemingly inevitable.

One thing where there is unanimity is the effect of the tariffs – negative for international trade and global economic growth. The major uncertainty is the extent of the fallout. In the past month, stock markets have fallen sharply, while yields on government bonds have gyrated in huge trading ranges on expectation of a US recession and US budget problems.

In Australia, the Federal election campaign is underway with the incumbent Labor Party slightly ahead in recent polling. The election is on 3 May. Economic data in Australia confirmed on-going low inflation, a moderate pace of economic growth, signs of a softening in labour market conditions and a slight rise in house prices.

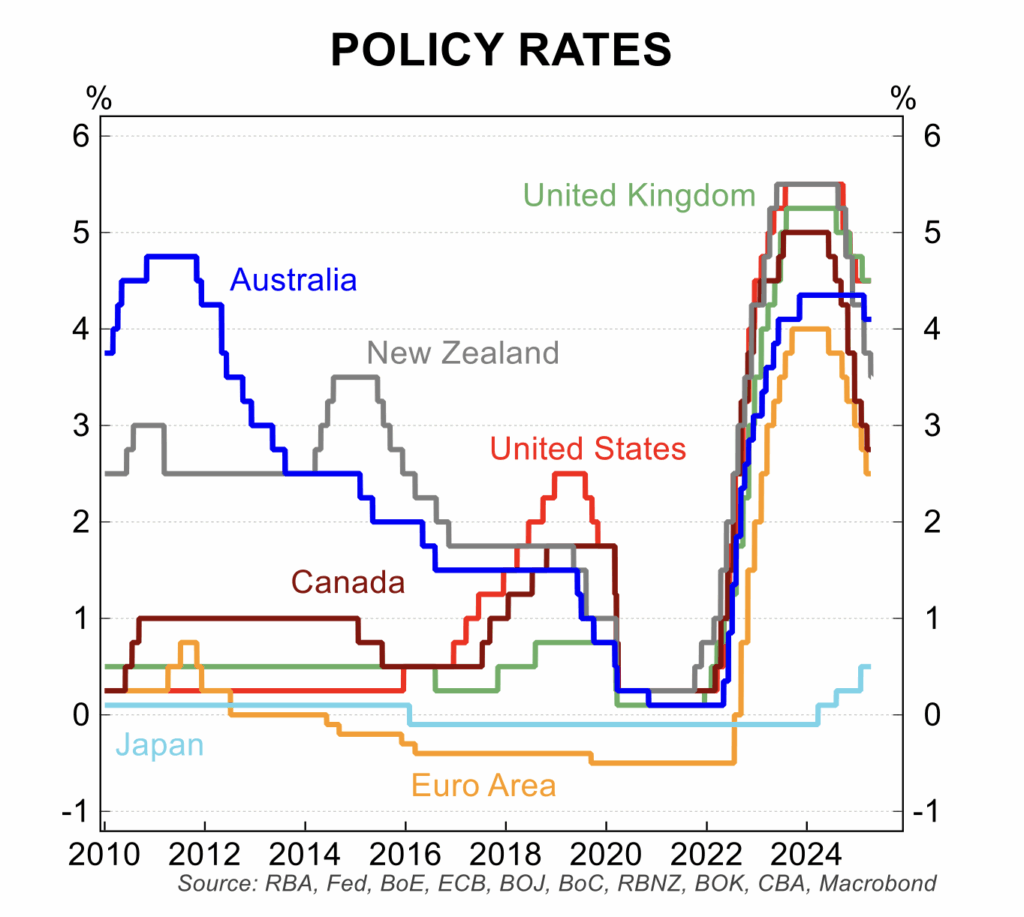

Expectations for RBA interest rate cuts has intensified with futures pricing in a cash rate around 2.80 per cent in early 2026, down from the current 4.10 per cent. Note this pricing is volatile and subject to sharp changes in a short time frame. The next scheduled meeting of the RBA Monetary Policy Board is 20 May with a 25 basis point rate cut fully priced in.

Key data

Following is an update of key recent trends in the economy:

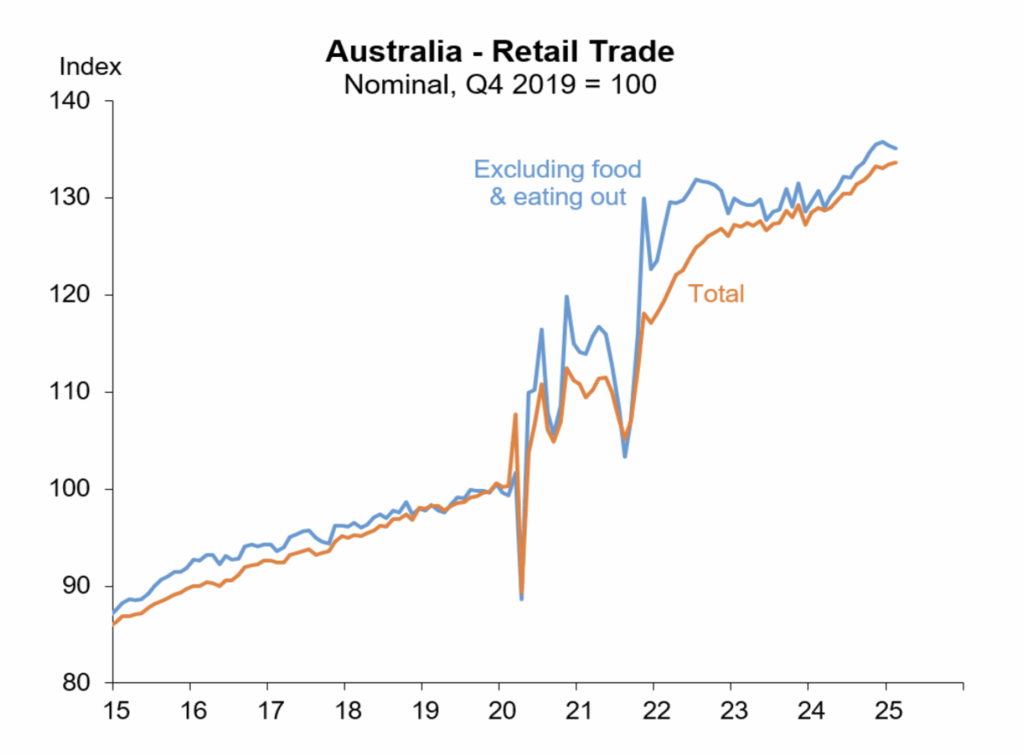

- Retail spending rose 0.2 per cent in February, continuing to register tepid growth. It has been helped by falling inflation and rising wages, but dampened by softer labour market conditions and broader economic uncertainty.

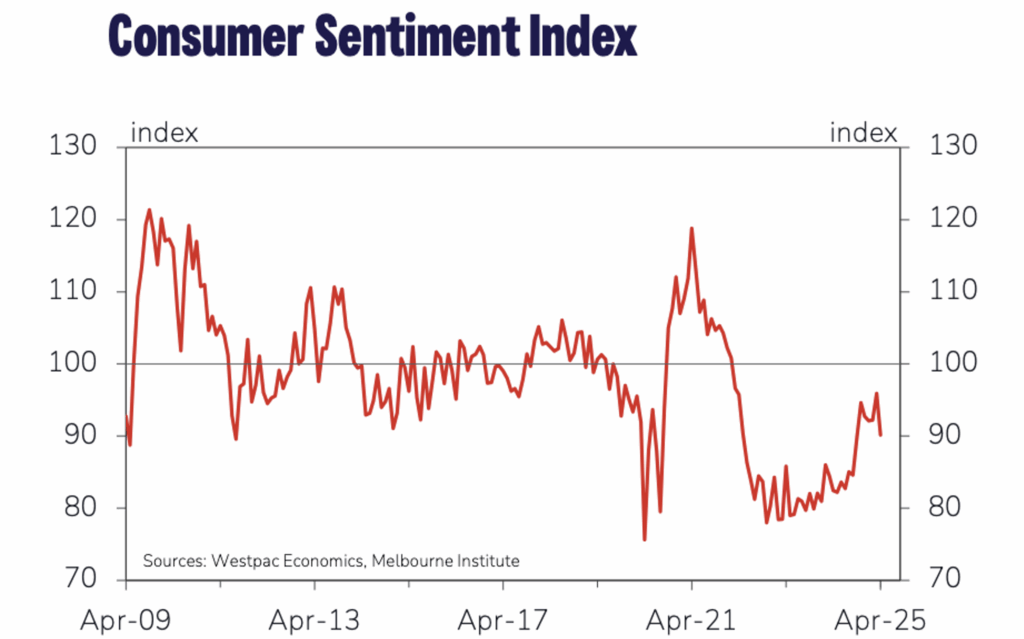

- Consumer sentiment fell sharply in April, reversing some of the more optimistic readings from the middle of 2024. The dive in sentiment was linked to the US tariff escalation and news the RBA paused its interest rate cutting cycle. The pull-back in sentiment suggests downside risks to household spending growth in the next few months.

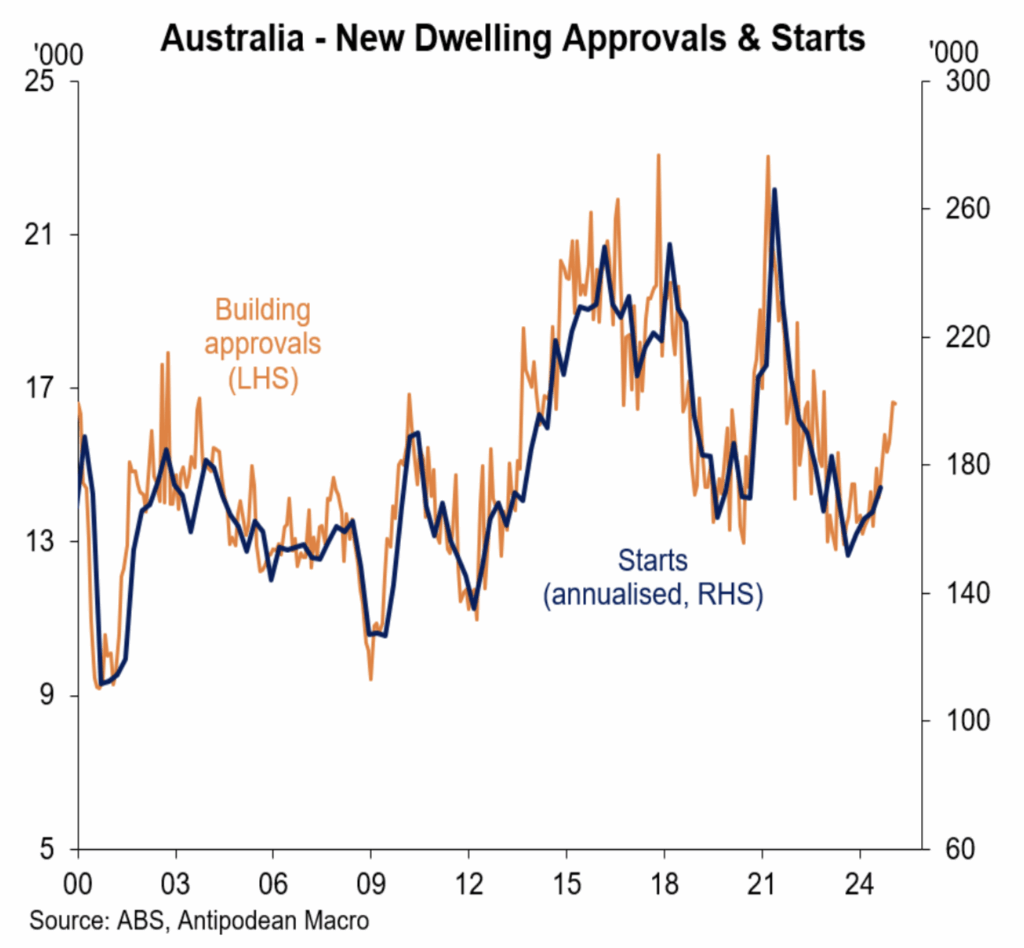

- While building approvals fell 0.3 per cent in February, they are 26 per cent higher than a year ago, which was the low point in the residential construction cycle. The current annualised number of dwelling approvals is approximately 200,000, up from 150,000 a year ago and moving towards the 240,000 dwellings per annum needed to meet the government’s plan for 1.2 million new dwellings over 5 years.

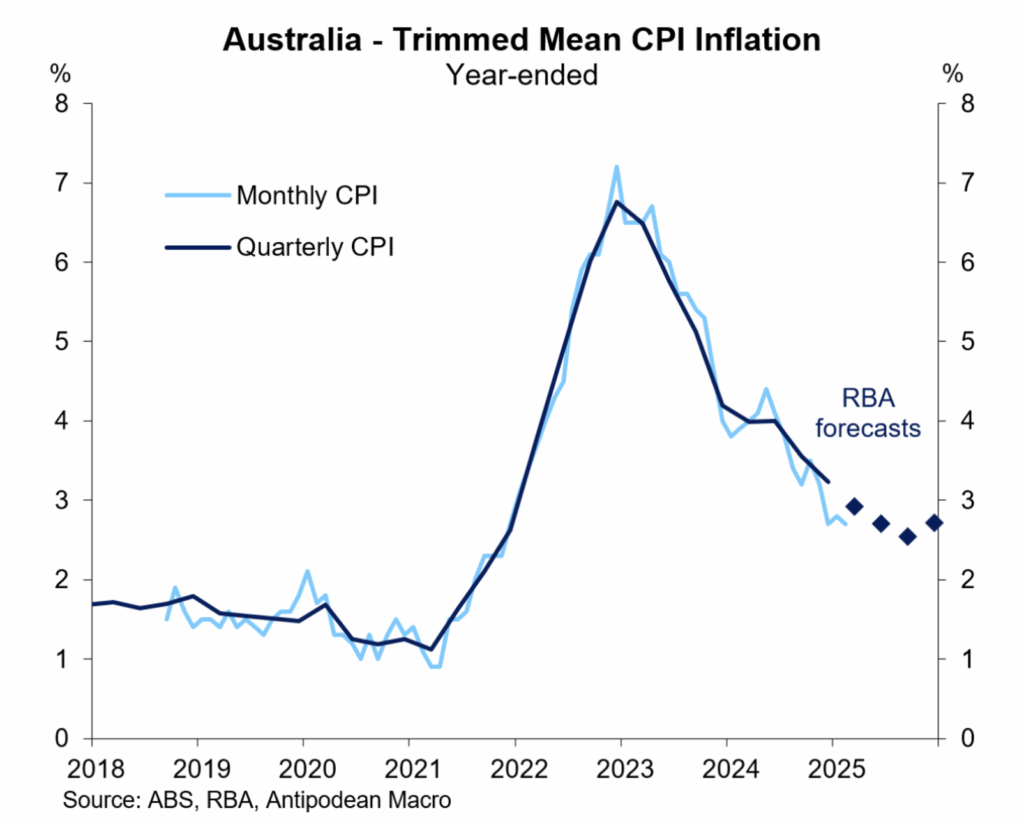

- The monthly data confirmed inflation holding around the mid-point of the RBA target band. In annual terms, inflation was 2.4 per cent in February, locking in seven straight months in the 2 to 3 per cent band. Trimmed mean inflation eased to 2.7 per cent, making it three consecutive months within the target. The March quarter CPI is released on 30 April.

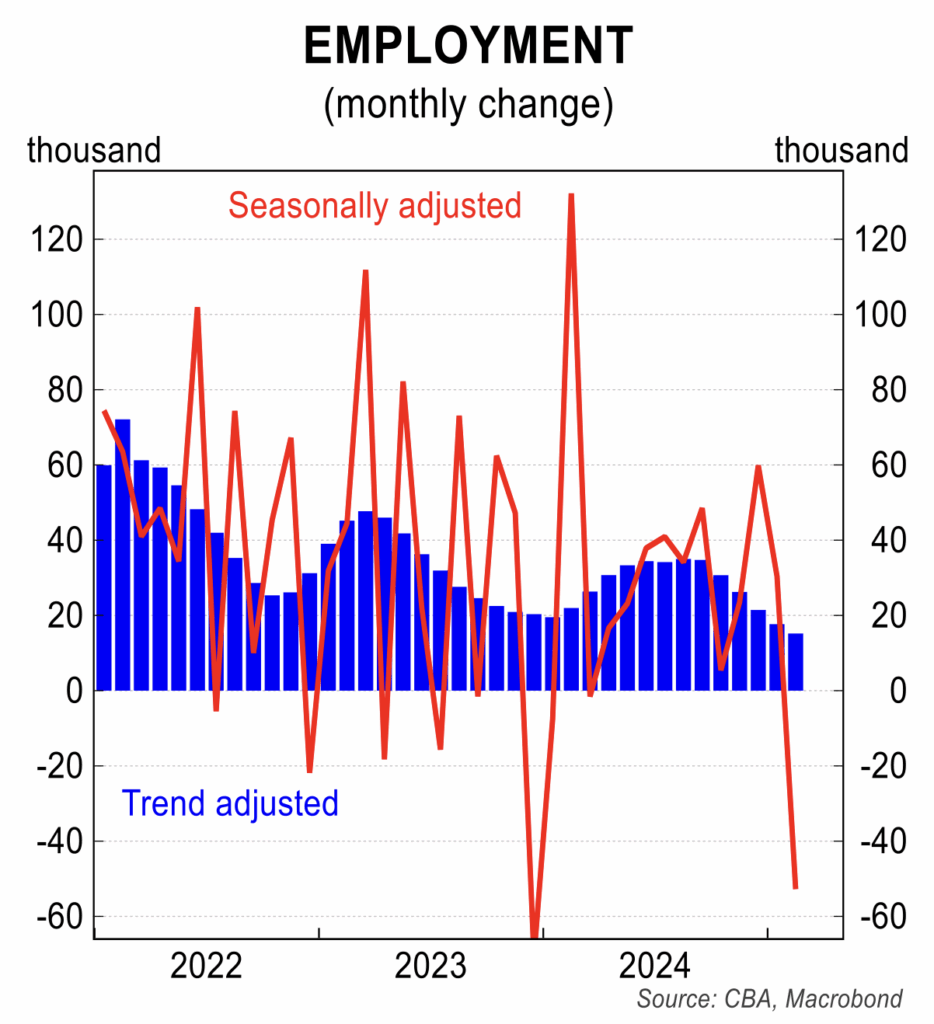

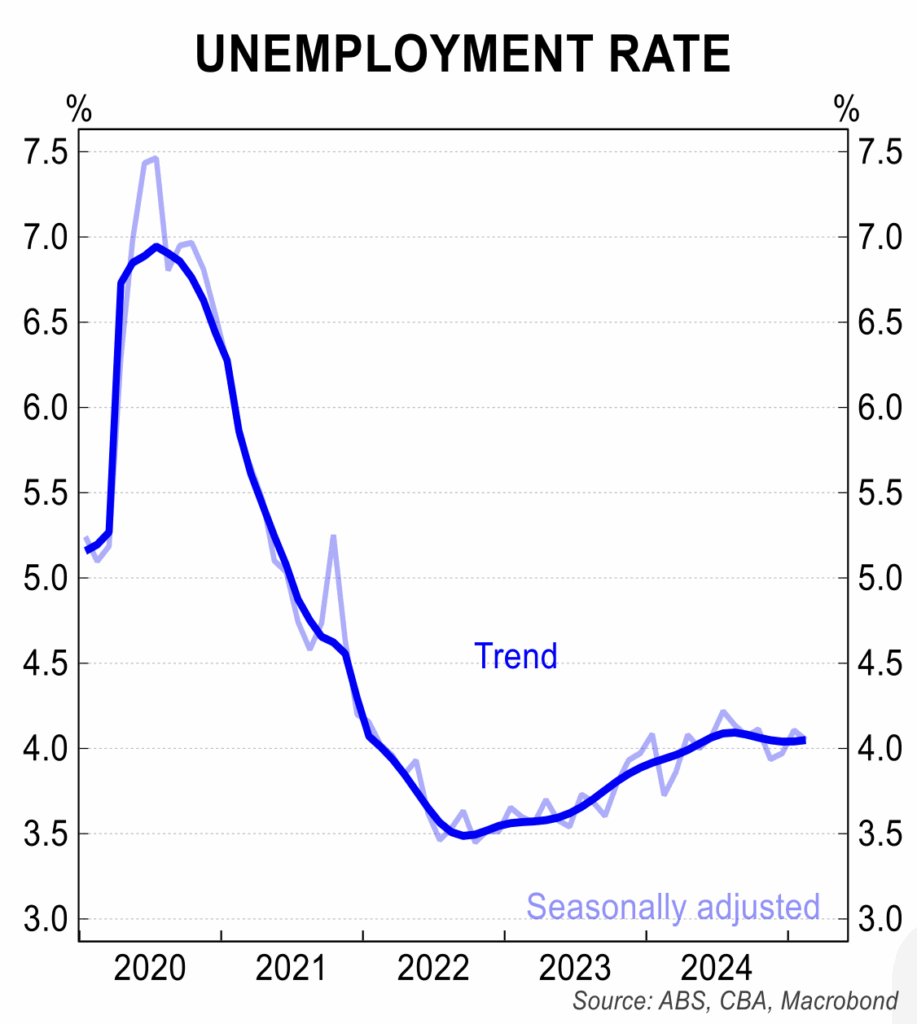

- There was a surprisingly sharp fall of 53,000 in employment in February, which was accompanied by a steady unemployment rate at 4.1 per cent. The decline in employment was the sharpest in a year and meant that the trend in job creation is slowing (see blue bars in the left hand chart below). Employment is now more into line with the subdued economic growth.

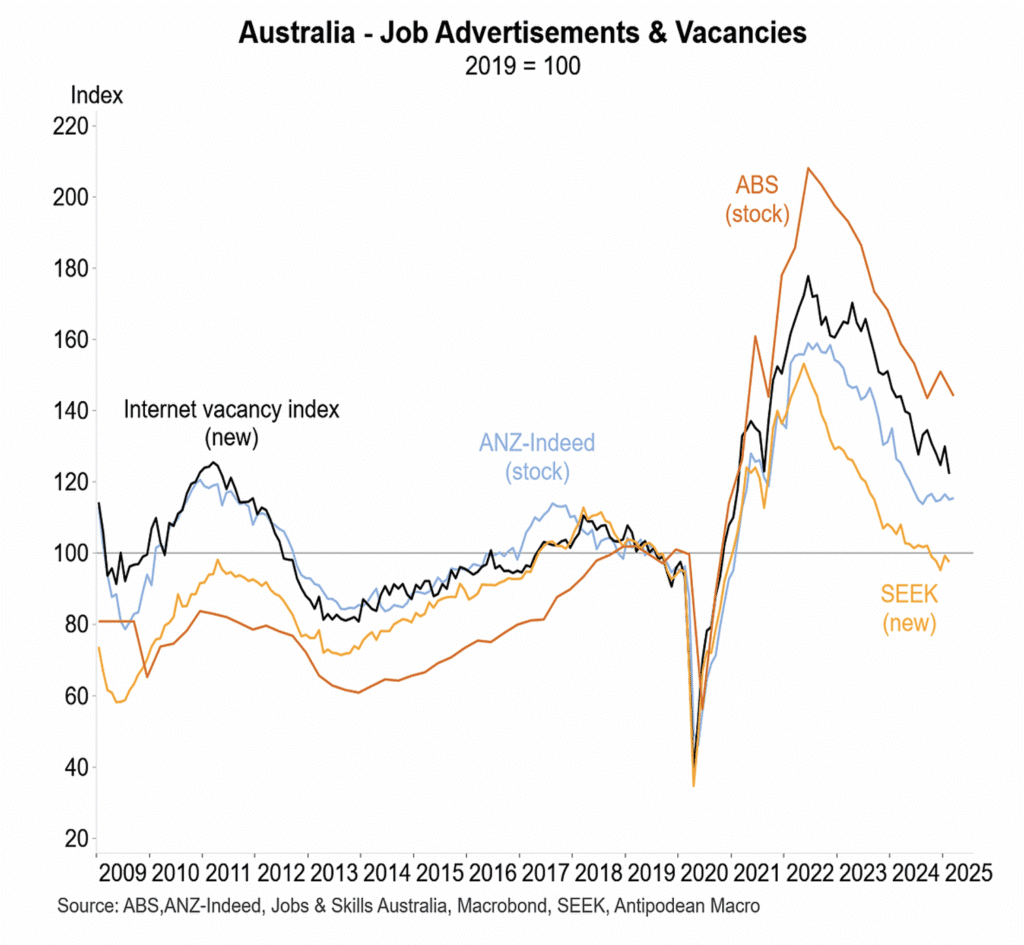

- The number of job vacancies fell 4.5 per cent in February and are 30 per cent below the peak level in 2023. The other job advertisements series are showing a similar downward trend. The decline in demand for labour points weaker job creation and a likely rise in unemployment in coming months.

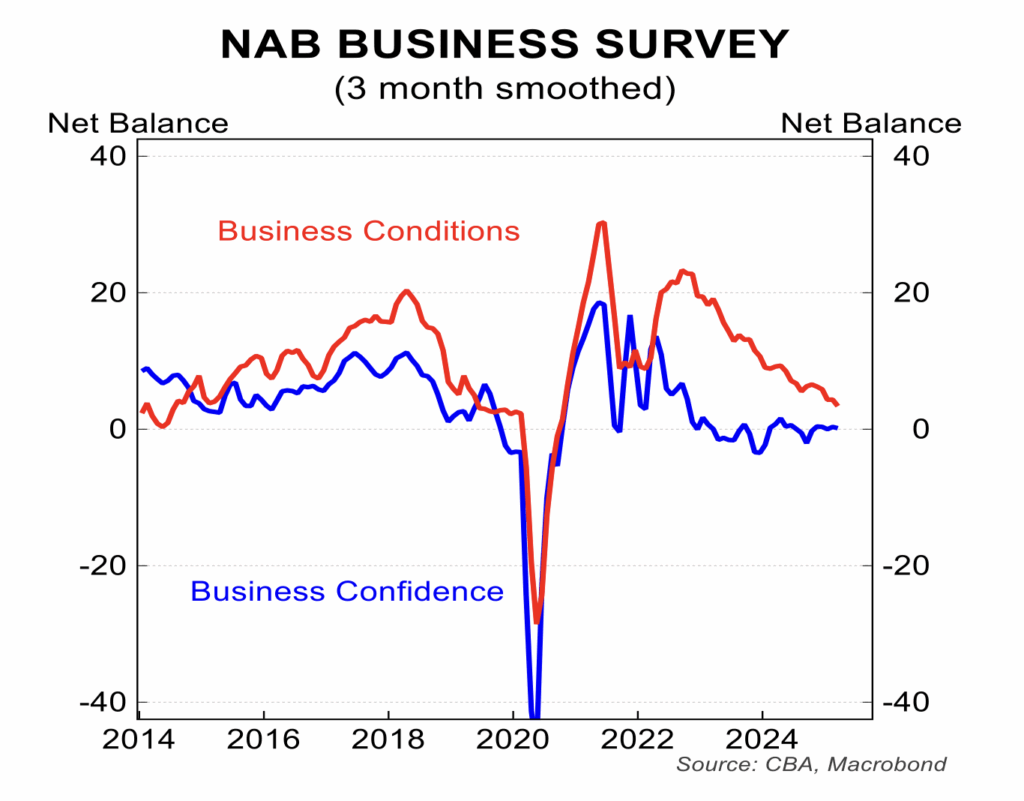

- The NAB business conditions and confidence survey, which was undertaken before the tariff blow up, showed broadly steady business confidence, albeit below the long run average, while business conditions eased further. Both measures are consistent with a subdued outlook for the business sector.

RBA monetary policy and current pricing

The RBA held rates steady at its 1 April meeting. Governor Bullock noted that a further interest rate cut was not discussed. The Governor was not yet convinced that inflation has been locked into the mid-point of the target band and that there were upside risks to wages from a tight labour market. She reinforced this view in a subsequent speech.

Markets dismissed this and are pricing in a series of interest rate cuts. At the time of writing, markets were effectively pricing a 25 basis point cut on 20 May and a total of 130 basis points of cuts by early 2026. This implies a cash rate of 2.80 per cent. The market pricing has been volatile, reacting to unfolding tariff and economic news.

House prices

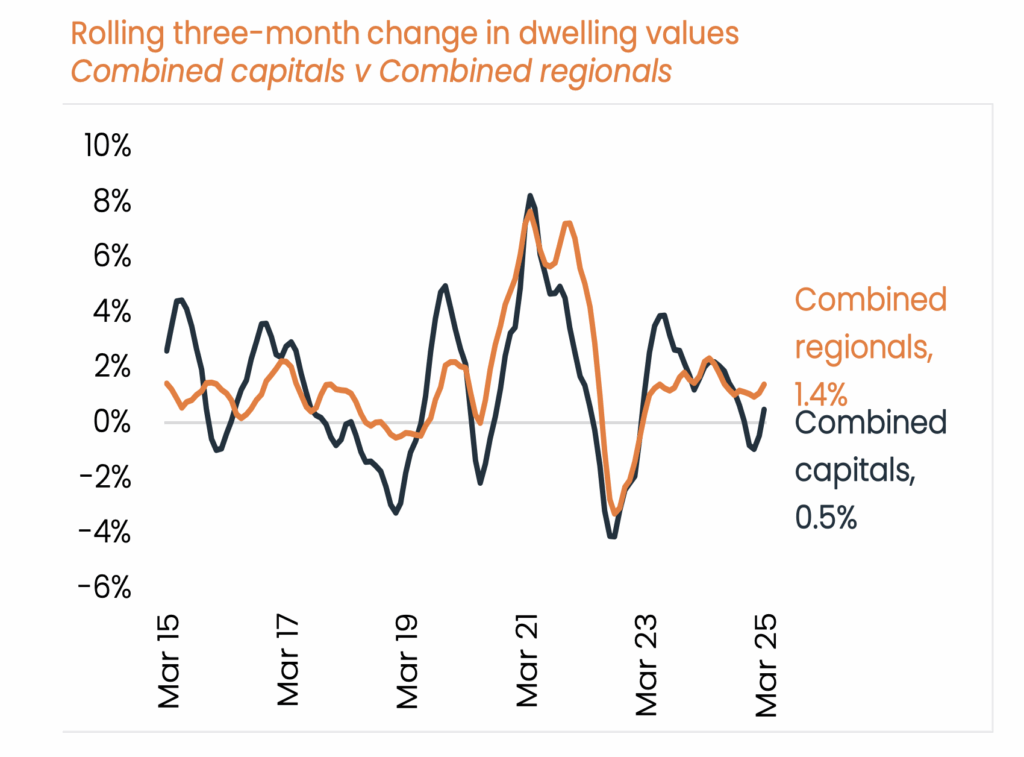

After a moderate pull-back in late 2024, house prices edged higher in February and March in line with an improvement in auction clearance rates. House prices rose 0.4 per cent in March to be 3.4 per cent higher than a year ago, although prices are flat over the past six months. Expectations that interest rate cuts will underpin a pick up in house prices needs to be offset by the negative effects of a weaker economy and rising unemployment.

There also remain the fundamental issues for house prices of a moderation in demand as immigration inflows slow and as new supply builds with some additional listings from those exiting the market. Preliminary data from Corelogic for April is pointing to a small rise in house prices in the five largest capital cities.

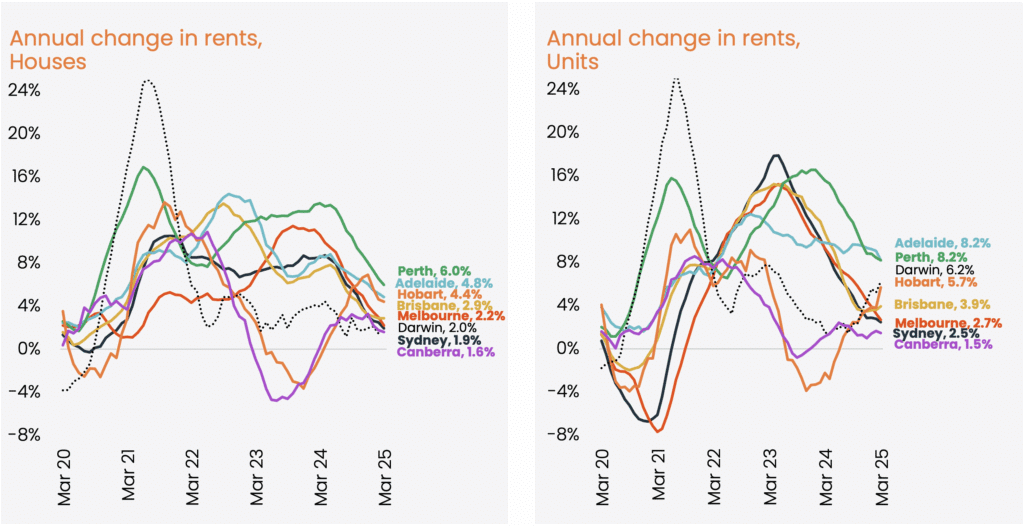

While rental vacancy rates remain relatively low, they have increased from the shortage that was evident during 2024. The upshot is a slowing in rental growth rates in the major cities which is helping to ease some of the rental affordability problems.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.