Media release – 28 April, 2023

The Zagga Investments Lending Trust rated 4-star, SUPERIOR rating for third year running

Key factors are deep levels of investment experience, strength of company tenure and cross-functional expertise of the team

Zagga, a fully licensed boutique, non-bank lender and investment manager, has confirmed that independent research house, SQM Research (SQM) has awarded a 4-star ‘Superior’ (Investment Grade) rating for the Zagga Investments Lending Trust (ZILT), for the third year running.

Zagga has originated over $1.2 billion in private credit transactions since inception in June 2017. Zagga’s objective is to generate high-yielding, alternative investment opportunities through facilitating the funding of high-quality loan transactions, ranging from $3 million to $50 million, primarily in the Commercial Real Estate Debt (“CRED”) sector.

Zagga deploys a fractional investment structure and proprietary technology platform to originate and fund transactions. The underlying assets are short and medium-term (up to 24 months), first-mortgage secured, senior loans to approved borrowers. Zagga has experienced significant growth over the past 24 months, with new business increasing by more than 50%, off the back of increased funding and larger deal sizes.

Credit quality is strong and investors have incurred no losses to date.

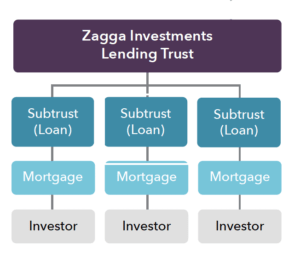

Zagga’s transaction structure is centred on ZILT, a non-unitised fixed trust where each investment is fractional and each investor secured for their fractional interest in the underlying security via a dedicated investment lending sub-trust.

SQM considers ZILT to be of a high investment grade, with an appreciable potential to outperform over the medium-to-long term and suitable for inclusion on most approved product lists.

The SQM rating recognises and reaffirms the deep experience and cross-functional expertise across the team based in Sydney. Additionally, the practice of constant communication and the broad-based inclusion of team members in decision-making has been cited as a vital ingredient to the success of Zagga’s credit decisioning and investment management process.

When assessing the Zagga Investments Lending Trust, SQM said:

“The Lending Trust targets net returns in excess of those typically achieved from traditional commingled fixed interest, term deposits, enhanced cash or credit managed funds.”

This is notably the case over the past two years during which the COVID-19 pandemic wrought havoc across markets and caused huge disruption, during which the Zagga team not only grew the book, but put in place additional, robust measures and practices to maintain credit quality.

Alan Greenstein, CEO and Founder of Zagga, said:

“We are delighted to again receive this ‘superior’ rating by SQM Research. To receive it three years running is a testament to the dedication, knowledge and expertise of our team.

To have the rating confirmed across a period of tremendous upheaval caused by COVID and related issues says much about our team’s ability to select, assess, fund and manage loan investment opportunities and to deliver value for our investors, borrowers and stakeholders.”

He added that Zagga’s “experience, transparency, integrity, reliability and loan assessment are the foundation stones” of its business and a key differentiator between Zagga the many players in Australia’s CRED space.

*** END ***

Financial Advisers and individuals who satisfy the criteria of a wholesale client as defined under the Corporations Act (2001) (Cth) may request a copy of the full report.

Please note that research reports are intended for financial advisers and wholesale clients only.

The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.