In the realm of investment strategies, private debt investing has emerged as a compelling option for savvy, income-focused investors seeking diversified and stable returns.

This blog explains what you need to know about private debt investing, the associated risks and benefits, and how this alternative asset class can help add that middle ground to create a well-diversified portfolio, providing regular predictable income without a commensurate increase in risk.

What is private debt investing?

Defined as the allocation of capital into non-public or private debt securities, private debt investing involves investors providing loans directly to companies or individuals, bypassing traditional financial institutions like banks. The investors are often private individuals, institutions, family offices and/or self-managed superfunds (SMSFs). Private debt investing presents a unique opportunity for investors to diversify their portfolios and generate attractive risk-adjusted returns.

Why consider an investment in private debt?

Private debt investing offers several appealing aspects that make it a sound and viable investment strategy. First and foremost is the potential for higher yields compared to other more traditional asset classes like term deposits, high-interest savings accounts and fixed-income securities. By lending directly to quality borrowers and loan transactions, investors can achieve higher interest rates and regular cash-flow, potentially yielding greater returns than publicly traded bonds or equities.

Moreover, this investment avenue typically exhibits lower volatility compared to public markets. Private debt investments are less susceptible to market fluctuations, offering a more stable, predictable income stream. Additionally, private debt investments often come with collateral or specific asset-backed securities, providing an added layer of security in case of borrower default.

In Commercial Real Estate Debt transactions, the lending transaction is always secured by a registered mortgage over property providing the investors with a tangible and enforceable claim on the underlying property asset. This collateralisation significantly reduces the risk associated with borrower default, as the investors hold a priority position in recouping their investment capital through the foreclosure and sale of the property if the borrower fails to meet their repayment obligations.

Speak with one of our team today

Why private debt investment is on the rise

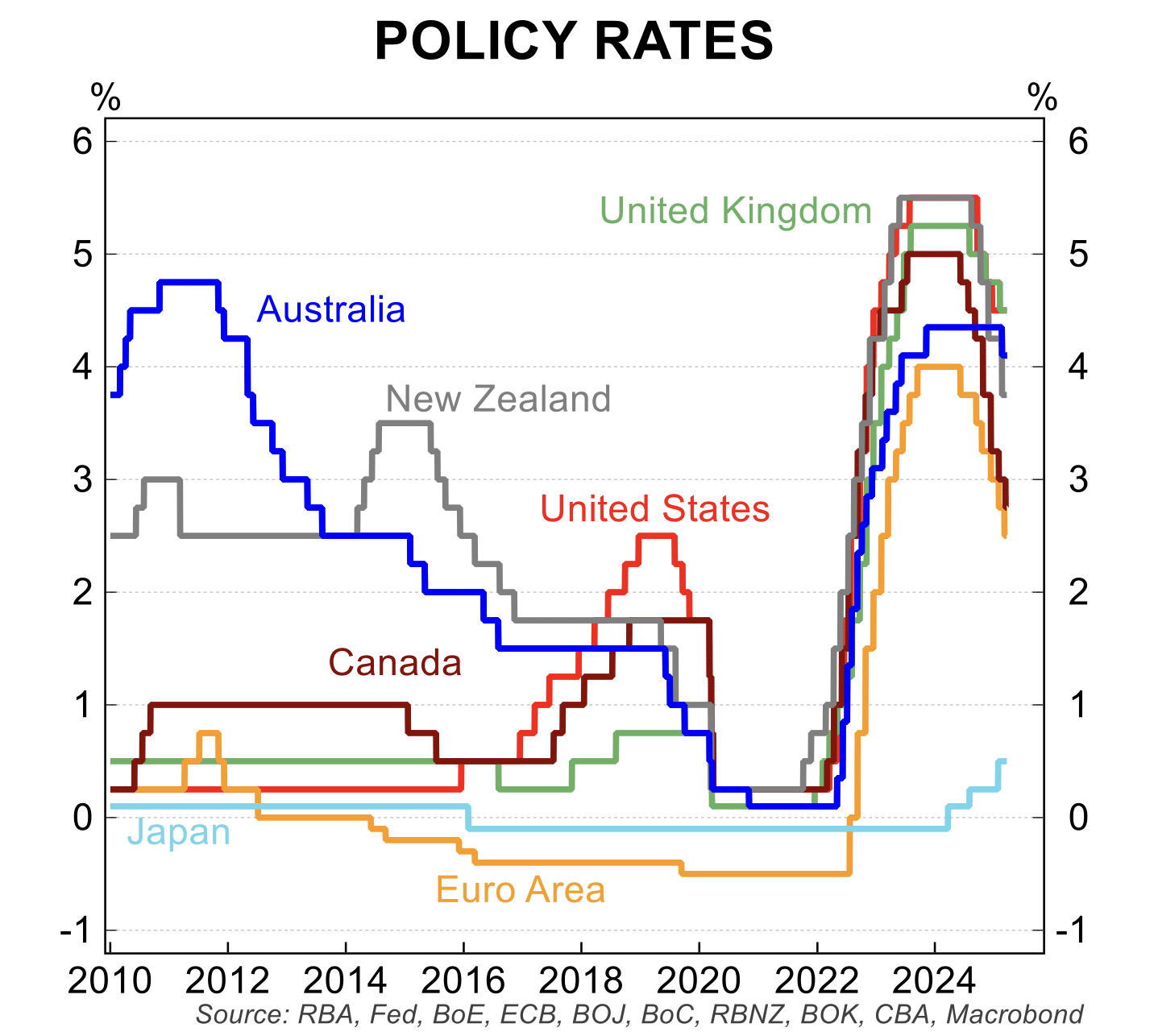

Private debt investing has been gaining a steady ascent to the forefront of investment strategies for some time now. In recent years, private debt investing has gained considerable traction and desirability among investors. One primary reason for its increasing popularity is the prolonged low-interest-rate environment. As traditional investment options like term deposits, cash and near cash assets and fixed-income securities struggle to offer acceptable yields, investors turned to alternative investment options like private debt as a way to enhance their portfolio returns and provide regular, predictable income without a commensurate increase in risk.

Furthermore, the regulatory environment and banking constraints post-2008 financial crisis have prompted companies to seek alternative sources of funding.

This has created a fertile ground for private debt investors, as businesses look beyond traditional banks for financing, offering a plethora of opportunities for private debt investments.

What are the benefits of private debt investing?

Private debt investments – specifically commercial real estate debt – presents a compelling option for income-focussed investors given its unique characteristics. Its equities-like returns, coupled with debt-security can offer diversification benefits and compelling relative value. It can provide investors with a reliable income stream adjusted for inflation.

Comparative to other alternative asset classes, private debt is regarded by industry leaders as a low-risk investment vehicle, making it a solid alternative for income-focussed investors.

Private debt can offer investors many benefits:

1. Portfolio diversification due to low correlation to public markets

Private debt and the public markets are affected by different market forces, and as such they have low correlation. A low correlation means that fluctuations in one asset class will have limited effect on the other, which gives investors a more balanced overall return.

2. Attractive, risk-adjusted returns

Typically, private debt investments have the potential for a higher returns than compared with fixed-income securities and traditional assets like term deposits and high-interest savings accounts.

3. Predictable returns based on interest rate charged

The floating rate of the underlying loans offers protection in a rising rate environment effectively hedging against inflation, whilst offering a lower risk investment compared to other alternative strategies, including private equity.

4. Lower portfolio volatility

Private debt relies less on broad market trends and more on the strength of the individual investments made. This can allow for a reduction in risk within your portfolio investment, while also adding an income-like return.

5. Good alternative to fixed income investments

Private debt investments in most cases offer a monthly income stream in the form of interest repayments, which are paid to investors through the form of monthly distributions.

What are the risks of private debt investing?

As with any investment, there is a level of risk. Investors must determine their risk appetite. Striking a balance between risk and return, and income and capital preservation is crucial. High-yield investments may promise attractive income, but they could also expose you to higher risks. Generally, higher risk is associated with the potential for higher returns but also with a greater risk of capital loss, while lower risk typically corresponds to lower returns. Each investor should conduct their own risk-return analysis to decide which investment option, whether traditional or alternative, best suits their specific needs.

Below is a look at the typical risks associated with private debt investments such as Commercial Real Estate Debt (CRED):

1. Credit Risk

The risk of loss arising from the failure of a borrower to repay some or all of the money they owe.

2. Borrower Defaults

If a borrower defaults, there may be shortfalls where the sale proceeds of the security property are not sufficient to recover in full, the invested funds and costs incurred by the lender in enforcing or recovering the repayment of principal and interest under the relevant loan. There is a risk that an investor may not receive all of their monthly payments, could lose a portion or all of the principal amount they have invested to fund that particular loan and/or could potentially be required to contribute towards any shortfall.

3. Term of Investment and Liquidity Risk

Once you have agreed to invest funds in respect of a particular loan, you are committed to the investment for the full duration of the loan term, which can range from three months to two years, or more. Therefore, once exposed to a loan, your investment is essentially illiquid in nature. You may be unable to convert to cash, the portion of the principal component of a loan you agreed to fund. You must take this into consideration when deciding on what loan types will be suitable for you in light of your overall investment portfolio and needs.

We acknowledge the risks of investing to fund loans and have put in place many checks and controls to mitigate your exposure to risk. Thorough due diligence, expert guidance, and a comprehensive understanding of the investment are essential for managing these risks effectively. Read further here.

When should you consider private debt investing?

Private debt investing presents an attractive opportunity for investors seeking higher yields and portfolio diversification. It is imperative for investors to understand the risks involved, and diversify their investments to mitigate potential downsides.

The key for investors is to undertake their due diligence to ensure they select competent investment managers, with the knowledge and skills to navigate through the intensive asset management process required in this environment.

With its potential for stable returns and a growing landscape of opportunities, private debt investing continues to carve its niche as a compelling investment avenue in today’s financial landscape.