Debt forms a crucial layer in the commercial real estate capital stack. Discover the intricacies of the various layers of debt and equity to grasp the pivotal role of debt within the capital stack.

In the world of commercial real estate (CRE) financing and investing, grasping the concept of the capital stack is essential. The capital stack serves as the foundation upon which real estate projects are funded and structured. The capital stack essentially represents the different sources of funding that contribute to a real estate investment. Let’s delve into what comprises the capital stack, its layers, significance, and why it’s essential for all stakeholders in the CRE sector.

What is the Capital Stack?

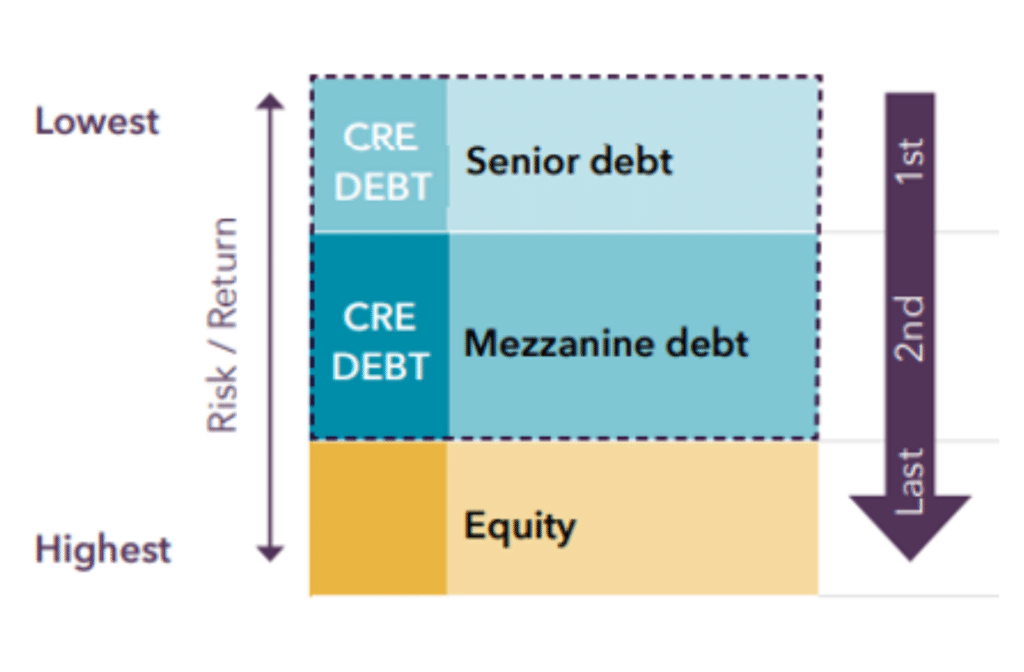

The capital stack is a hierarchical structure that delineates the various types of financing used to fund a real estate project. It comprises different layers or tranches of capital, each with its own risk and return characteristics. These layers typically include debt, mezzanine financing, preferred equity, and common equity.

Layers of the Capital Stack?

Senior debt

At the foundation of the capital stack sits senior debt, which is considered the lowest risk of financing and real estate investing. It takes precedence and repayment priority over other forms of capital and layers in the capital stack in the event of default. For this reason, it typically offers the lowest interest rates. Historically, senior debt was primarily provided by major banks or institutional lenders. However, in the last decade, there has been a notable trend: an increasing number of real estate developers are turning to non-bank and private lenders for senior debt funding. This shift is driven by the desire for faster processing, greater transparency, and enhanced flexibility in financing arrangements.

Mezzanine debt

Mezzanine debt occupies a unique position within the capital stack, positioned between senior debt and equity financing. Unlike senior debt, which holds a priority position in repayment – the highest, mezzanine debt ranks lower in repayment priority. This means that in the event of default or liquidation, senior debt holders are entitled to be repaid before mezzanine debt holders receive any proceeds. Due to this increased risk, mezzanine debt typically attracts a higher interest rate compared to senior debt. Lenders and private credit investors providing mezzanine financing accept a greater level of risk, as their investment stands to be repaid only after senior debt obligations have been met. Therefore, to compensate for this heightened risk, mezzanine debt attracts higher interest rates, reflecting the increased potential for loss in the event of default. Despite its higher cost, mezzanine debt remains an attractive option for real estate developers seeking additional capital beyond what senior debt can provide when financing real estate projects.

Preferred equity

Preferred equity represents a distinct layer within the capital stack, offering investors a hybrid form of financing that combines elements of both debt and equity. Preferred equity investors hold a position senior to common equity but subordinate to – or after – debt. Unlike common equity, preferred equity holders typically receive fixed dividends or priority distributions from the project’s cash flows. This preferential treatment entitles them to receive returns before common equity holders but after senior debt obligations have been met. However, preferred equity investors generally do not have full participation in the project’s upside potential. Despite this, preferred equity presents a lower risk compared to common equity, as investors’ returns are more predictable and stable. Nevertheless, this stability comes at the cost of potentially lower overall returns compared to common equity. Investors in preferred equity must weigh the trade-off between lower risk and potentially lower returns, making it essential to carefully evaluate the risk-return profile of preferred equity investments within the broader context of the capital stack.

Common equity

Common equity represents the ownership stake in the project. Equity investors bear the highest risk but also stand to gain the highest returns if the project succeeds. They have voting rights and share in the project’s profits, but their returns are not guaranteed and are subject to the real estate development project’s performance.

Significance of each layer of the capital stack

Each layer of the capital stack serves a distinct purpose and caters to different investor preferences and risk tolerances. Senior debt provides stability and security, mezzanine financing bridges the gap in funding, preferred equity offers fixed returns, and common equity provides potential upside through profit-sharing.

Debt layers in the capital stack, such as senior debt and mezzanine financing, are characterized by lower risk but also lower potential returns compared to equity layers. Equity investors assume higher risk but have the potential for greater rewards if the project performs well.

Importance of the capital stack to commercial real estate investors

Understanding the capital stack is crucial for all stakeholders in the commercial real estate sector, from developers to private credit investors. It enables investors to assess the risk-return profile of a project, structure financing in a way that optimises returns, and mitigate risks associated with different layers of capital.

Read our blog “Understanding the capital stack: A comprehensive guide for all commercial real estate investors” to find out more.

Conclusion

The capital stack serves as the fundamental framework for commercial real estate financing, incorporating diverse and unique layers of debt and equity. Its significance lies in shaping the risk and return dynamics of real estate investments, providing investors with essential guidance in navigating the intricacies of the commercial real estate sector. Understanding the composition and interplay of the capital stack is crucial for investors aiming to make informed decisions and a considered approach when it comes to private credit real estate investments.