Alan Greenstein, Zagga CEO & Co-Founder, spoke with Michael Downing from Ethium Wealth and answered three questions

Q1. What was your high conviction view of the macro economic environment 12 months ago?

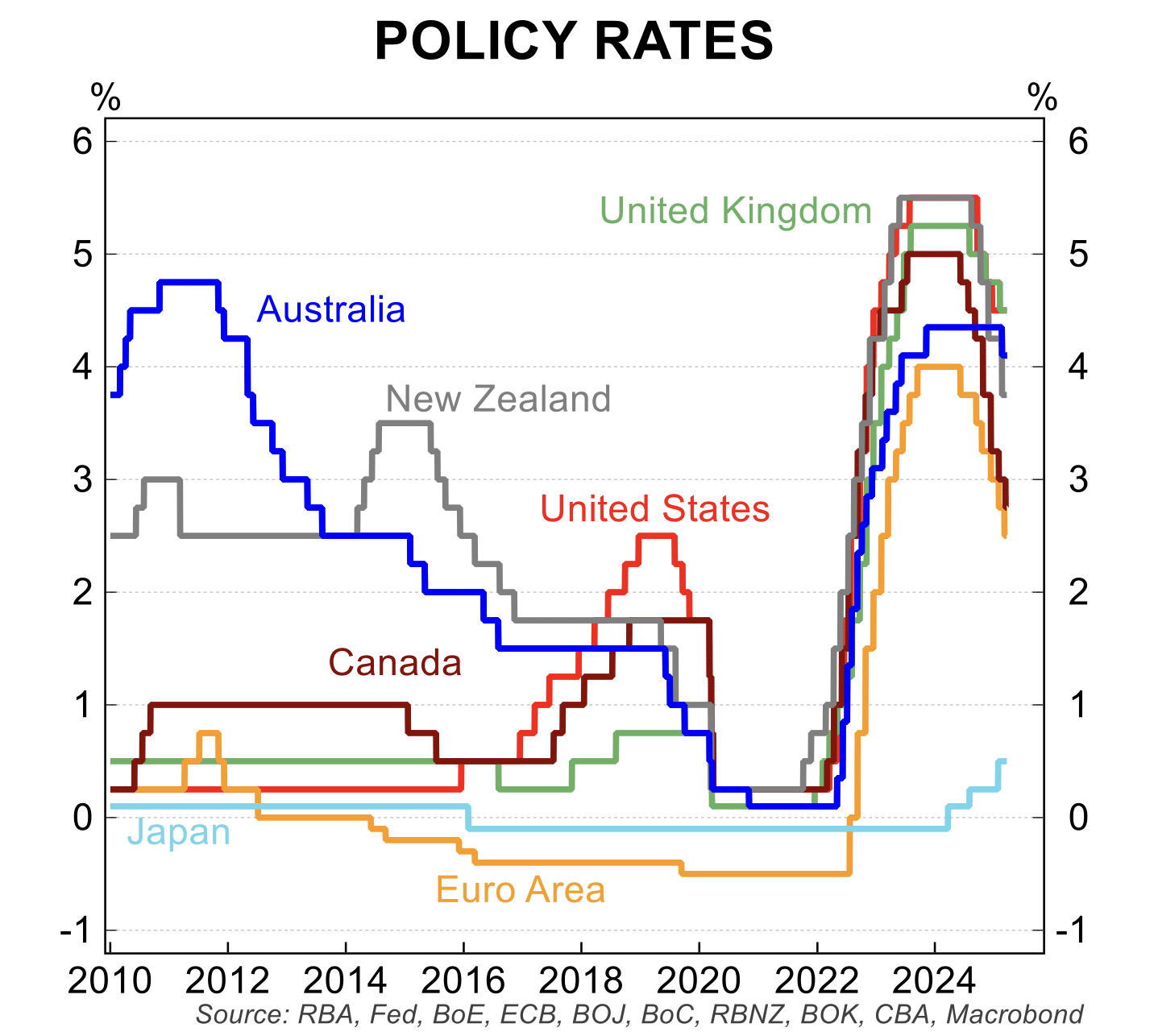

On January 1, 2022 we were of the view that the low interest rate environment had at least another 12 to 18 months to run, followed by gradual increases, most of this based on the message given by the RBA. Against that, we knew that supply side inflation would bite increasingly harder given COVID-, weather-, supply-chain- and related issues, coupled with zero migration and huge labour and skills shortages.

We considered the Australian macro-economic environment to be resilient and to have the wherewithal to withstand shocks, which we expected but thought would be moderate. With the benefit of hindsight, we missed the bullseye on that prediction!

Q2. What is your current high conviction view of the macro economic environment?

We always knew that the cost of printing money to combat COVID would have to be paid at some stage. 2023 appears to be the year when this will happen. Australia will face serious headwinds for the next 12 to 18 months as we battle rampant inflation, a steep rise in interest rates with possibly one or two more to follow, and the economic hardship which that will result in for sections of the economy.

Whilst it is pleasing that migration is being fast-tracked and skilled migrant quotas increased, these will take time to filter through. Against that, business failures will increase, consumer demand will soften, and expansionist mindsets will become more introspective until green shoots appear. We think cash will be king during a period of disruption and uncertainty, however, there will be opportunities for businesses such as ours, given the counter-inflationary nature of CRED investments.

As always, we will assess investment with an ultra-cautious and conservative eye.

Q3. What is your future less high-conviction view of the macro economic environment?

Much the same as above. Times will be tough for the next 18 to 24 months. The eruption of a huge (fourth) wave of COVID in China is cause for concern given the disruption caused by the first two. We think the US will be much more severely impacted by inflationary issues than Australia, but we will all catch some of the cold from the US sneezing.

Macro-economically, we see the next 12 to 24 months as an uneasy resetting of benchmarks, a possibly disruptive period of adjustment to changed macro- and micro-economic circumstances, and an uncomfortable adaption to the new-normal (whatever that will mean). With that in mind, we know that cream always rises to the top, and believe that safe harbour investments such as CRED offer an opportunity to earn meaningful returns without commensurate risk. On that basis we see strong demand for our Zagga offering going forward.

* Please note that responses to the questions above, are the opinion of Alan and is not investment advice and should not be relied on as such.