Australians will go to the polls on 3 May to vote at the Federal election. Current polling suggests it will be a closely run race.

As part of the pre-election campaigning, Treasurer Jim Chalmers delivered a steady budget which outlined forecasts for an economic recovery, ongoing low inflation and a moderate uptick in the unemployment rate.

The budget balance slipped back into deficit after two years of surpluses, in part due to lower growth in revenue but also due to a range of policies relating to cost of living relief for households including modest tax cuts. Deficits are projected for the next decade. The impact of the budget on macroeconomic conditions is broadly neutral, which was confirmed with the muted reaction in financial markets to the budget.

The run of economic data in the past month confirmed low inflation, only moderate economic growth and the early stages of a weaker labour market.

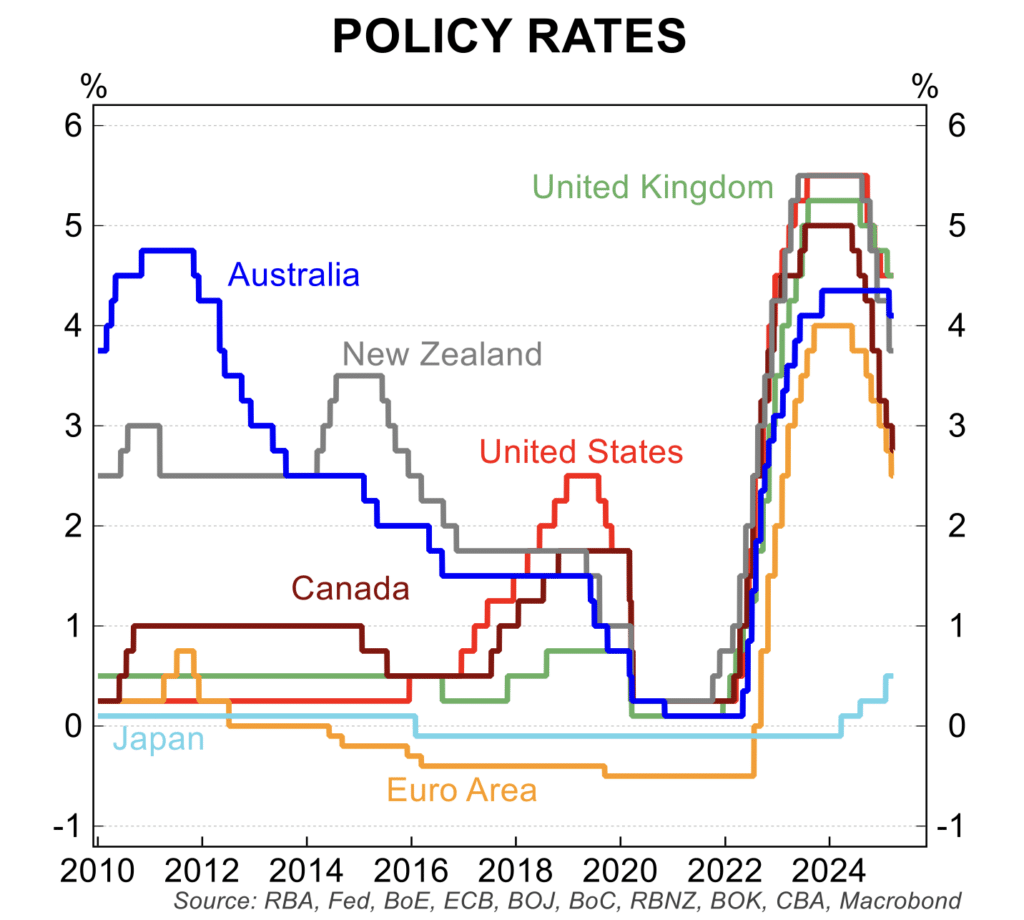

The pre-conditions are in place for the RBA to deliver further interest rate cuts but the timing of the next rate reduction is, at this stage, open.

Key data

Below is an update of key recent trends in the economy:

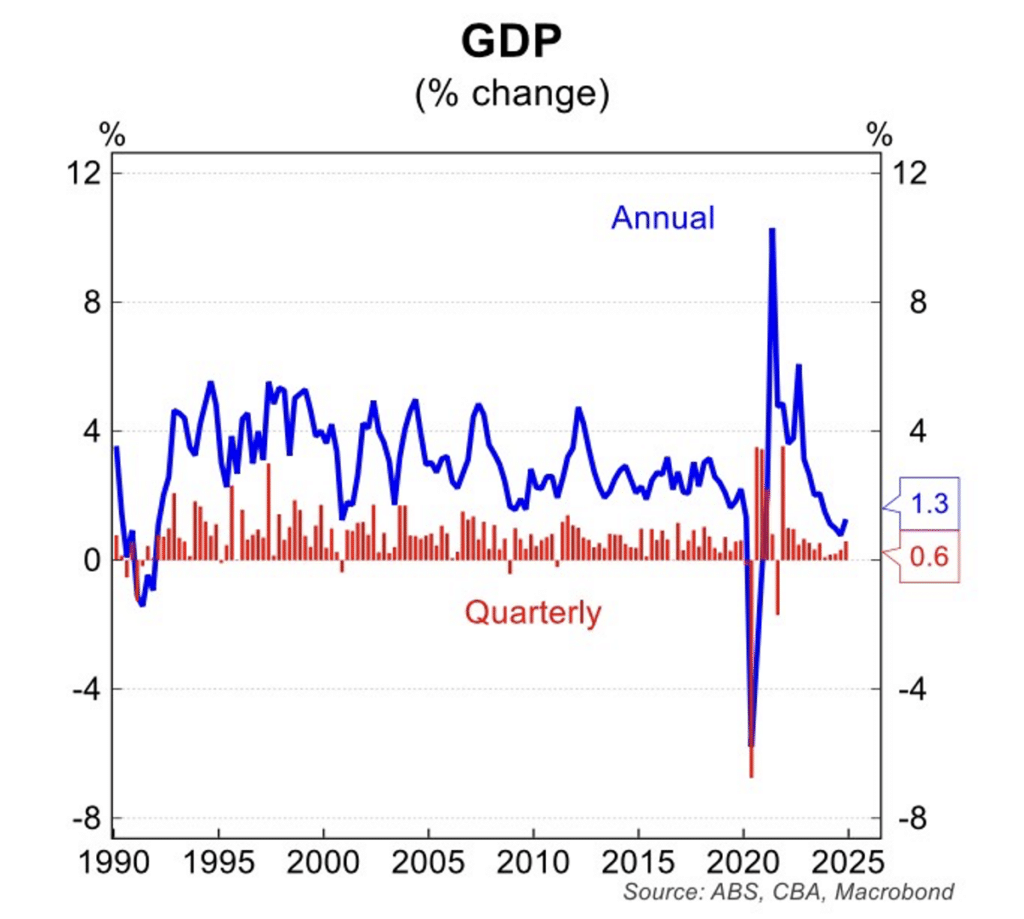

- GDP grew by 0.6 per cent in the December quarter to be 1.3 per cent above the level of a year earlier. This represents a moderate upturn in activity with the quarterly growth rate at a two year high. Private sector demand registered a recovery, particularly in household spending, while public demand remained a solid contributor to bottom line growth. Private sector business investment fell in the quarter.

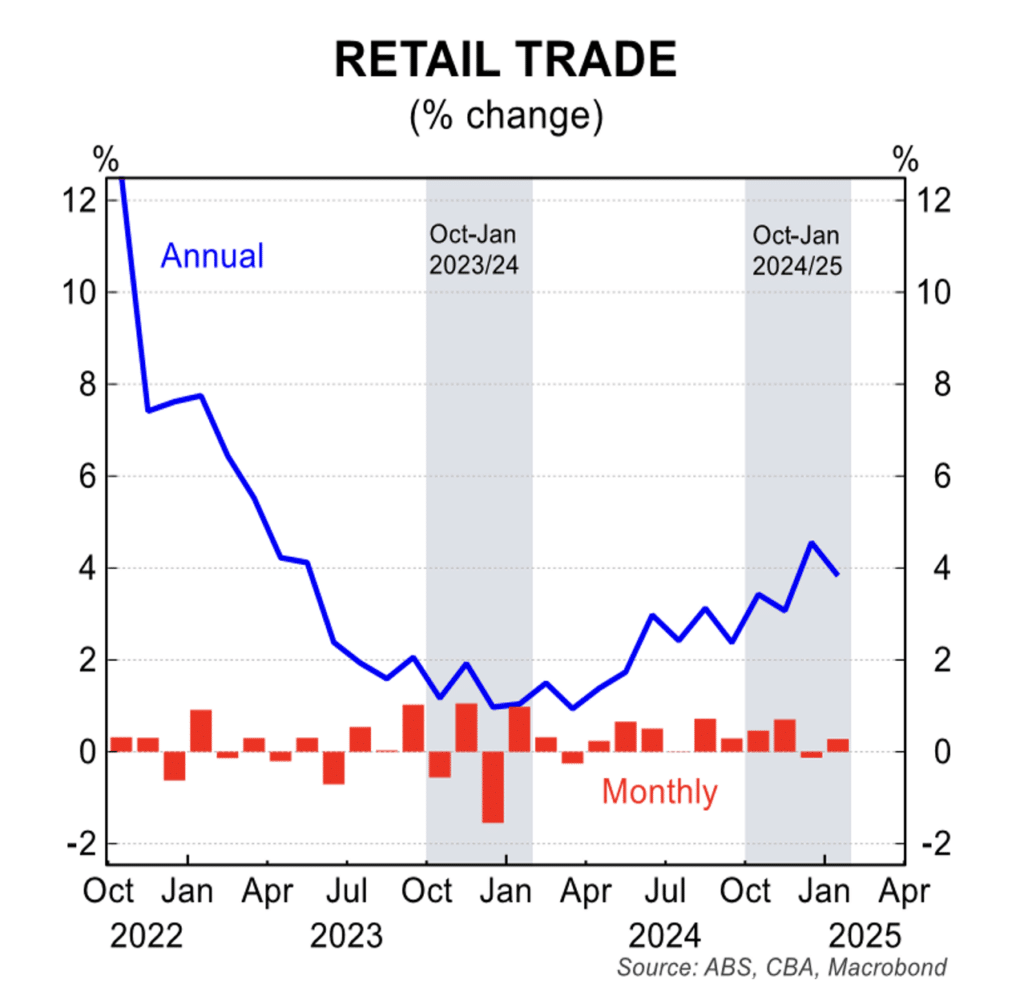

- Retail spending rose 0.3 per cent in January after falling 0.1 per cent in December in what was a below par result. It appears that the lift in spending in October/November, based on income tax cuts and changed spending patterns around the Black Friday sales, was temporary.

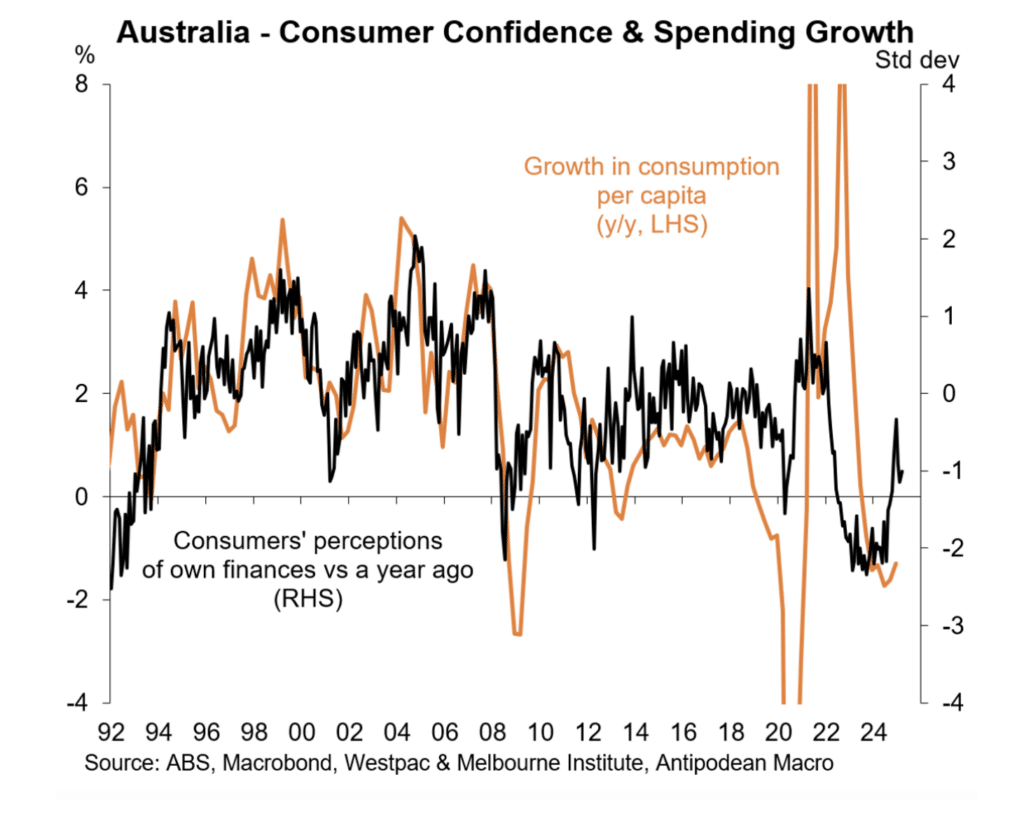

- The February interest rate cut sparked a rise in consumer sentiment which was partly reversed in subsequent weeks. That said, sentiment has been trending higher from the low point in the middle of 2024, but it remains below the long run average. Further interest rate cuts, when delivered, will be positive for sentiment and spending.

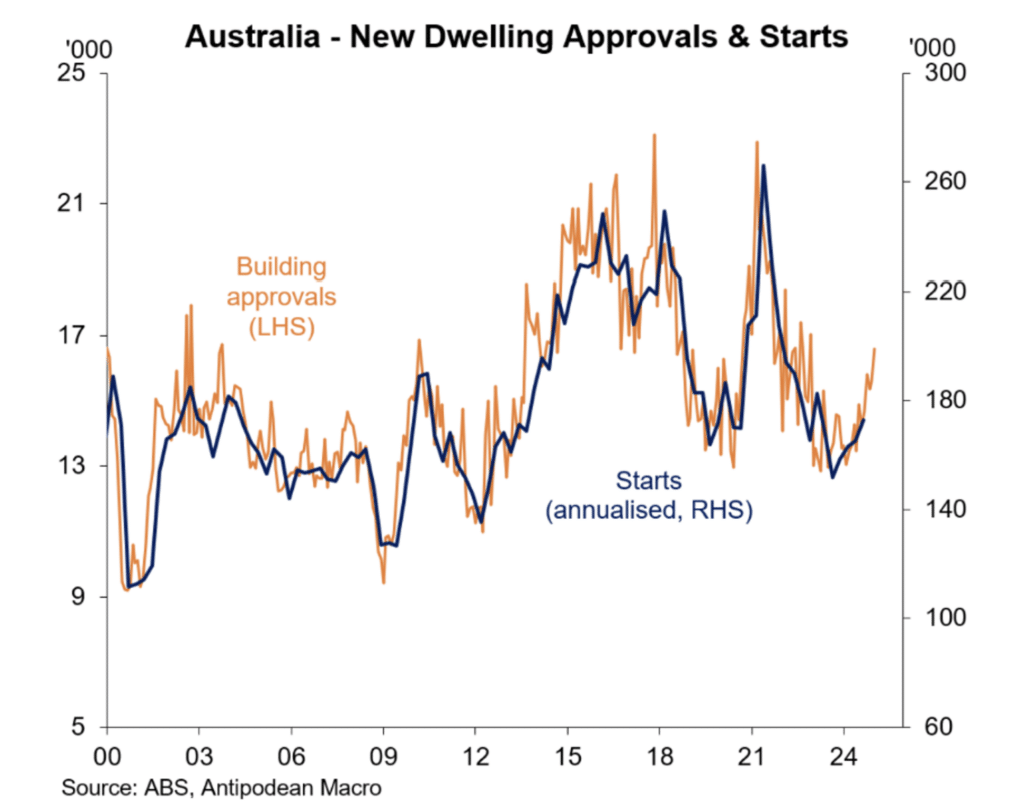

- There is a clear and welcome recovery in dwelling construction. The number of new dwelling building approvals rose 6.3 per cent in February to be a strong 27 per cent above the cyclical low point in February 2024. This is a supply side response to the housing shortage and is a trend that is likely to gain further traction once the effect of easier monetary policy fully kicks in.

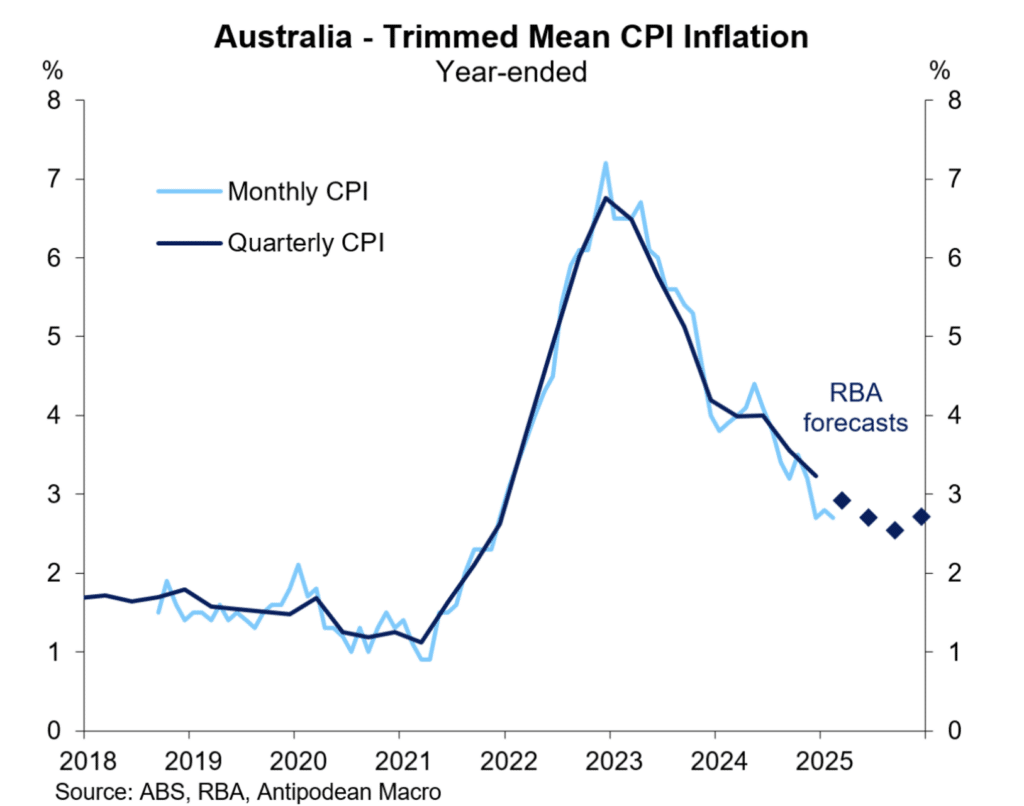

- The monthly data confirmed annual headline inflation easing to 2.4 per cent in February to be squarely anchored near the middle of the RBA target band. Inflation has been below 3 per cent for seven consecutive months. The trimmed mean inflation rate edged down to 2.7 per cent in February from 2.8 per cent in January and has been below 3 per cent for three straight months.

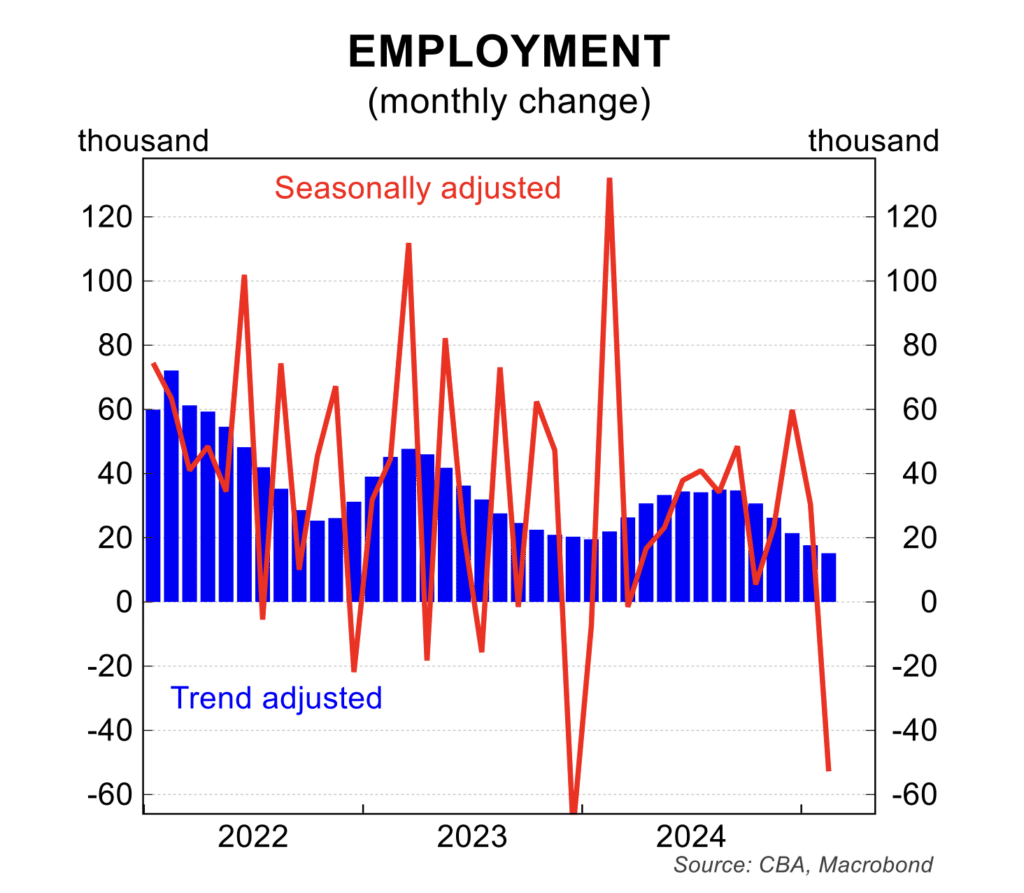

- The labour market recorded one of its weakest results in over a year, with employment falling 53,000 in February. While the monthly data can be volatile, it feed into a weak trend, moving employment in line with weaker job advertisements. The unemployment rate was steady at 4.1 per cent in February but is above the 3.9 per cent recorded in November.

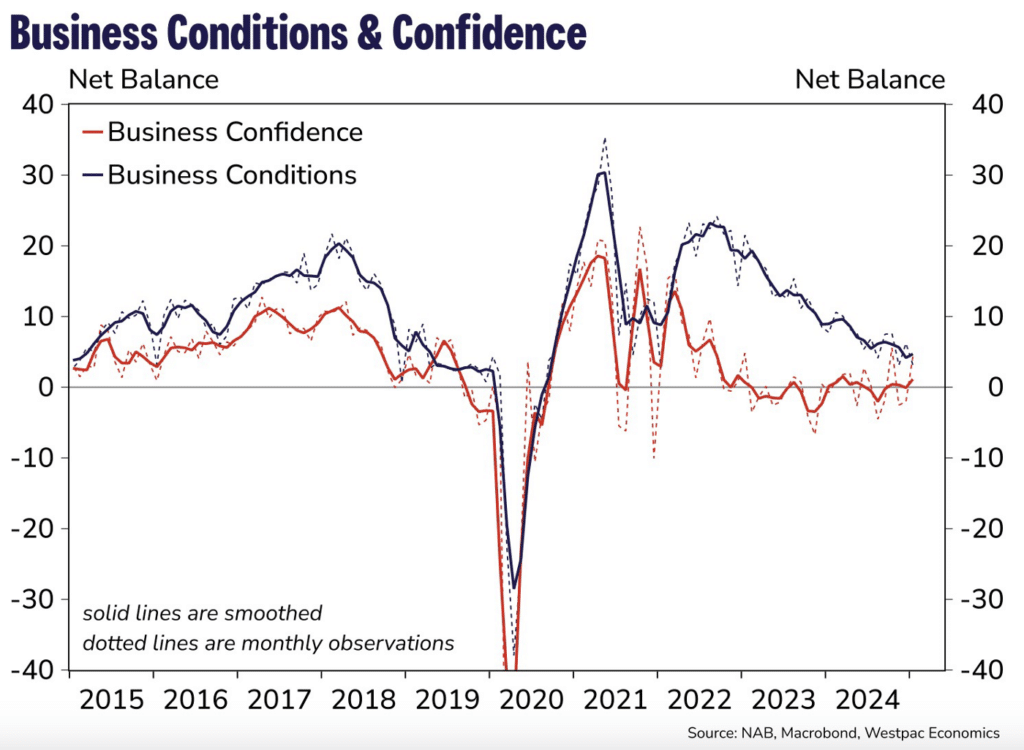

- Business conditions and business confidence were little changed in February but remained at levels consistent with only moderate growth. While the start of the interest rate cutting cycle will support the business sector, global developments – including the escalation of the tariff disputes and geopolitical uncertainties – are a headwind to greater business optimism.

RBA monetary policy and current pricing

Following the 18 February interest rate cut from the RBA which saw the cash rate reduced to 4.10 per cent, futures markets have been volatile. Guidance from the RBA has warned against expectations for near term rate cuts but this has been somewhat offset by a run of softer data including from the US where the resumption of the interest rate cutting cycle is expected in the months ahead.

At the time of writing (28 March 2025) a cash rate around 3.40 to 3.50 per cent has been priced in to the first half of 2026. This is a fair assessment.

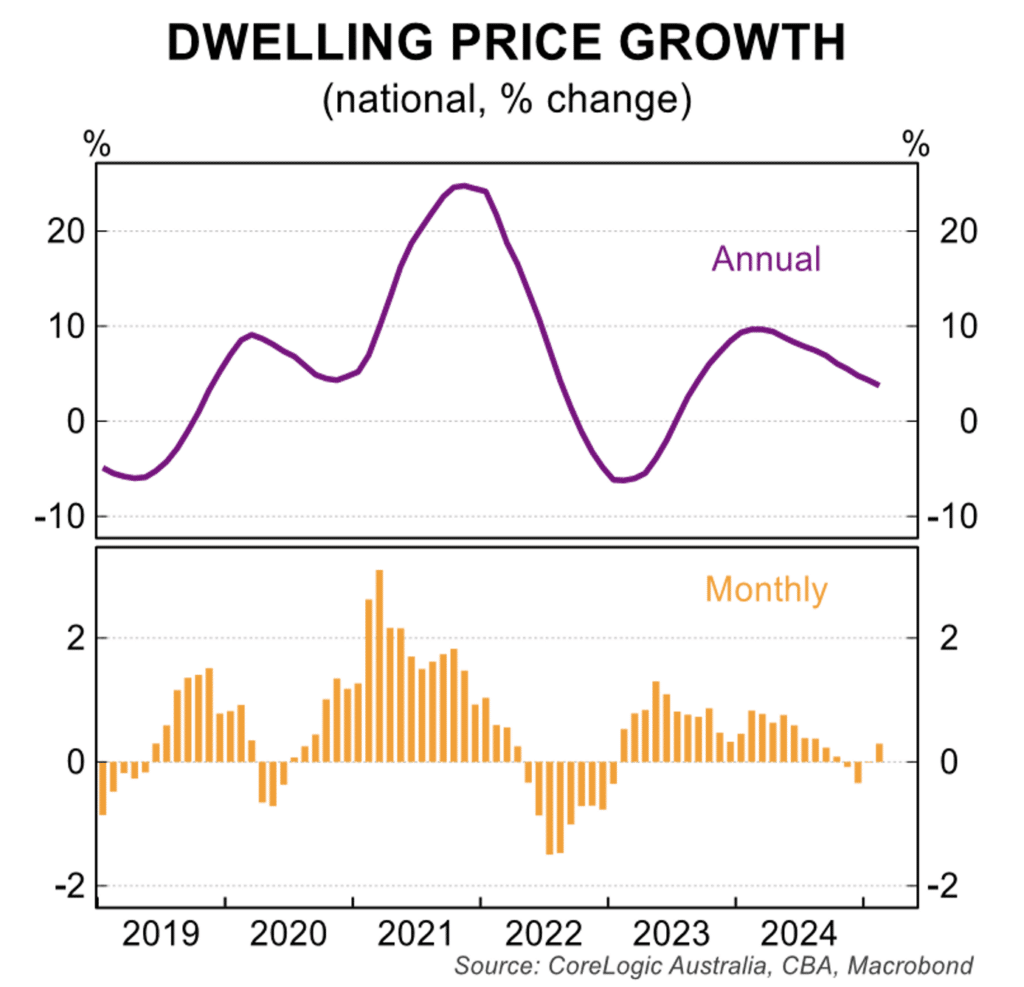

House prices

There was a surprising 0.3 per cent rise in house prices in February, with all capital cities other than Darwin registering a small increase. The rise followed three months, between November 2024 and January 2025, where prices fell by a total of 0.4 per cent.

The preliminary data from Corelogic for March points to a further small rise in prices in the five main capital cities for which data are available.

In the three months to February 2025, prices were weakest in:

- Melbourne -1.1 per cent.

- Sydney -0.9 per cent;

- Canberra -0.8 per cent; and

- Hobart -0.1 per cent.

The four cities with more resilient house prices in the three months to March 2025 but where price growth is generally slowing were:

- Adelaide +1.2 per cent;

- Brisbane +0.9 per cent;

- Darwin +0.7%; and

- Perth +0.3 per cent.

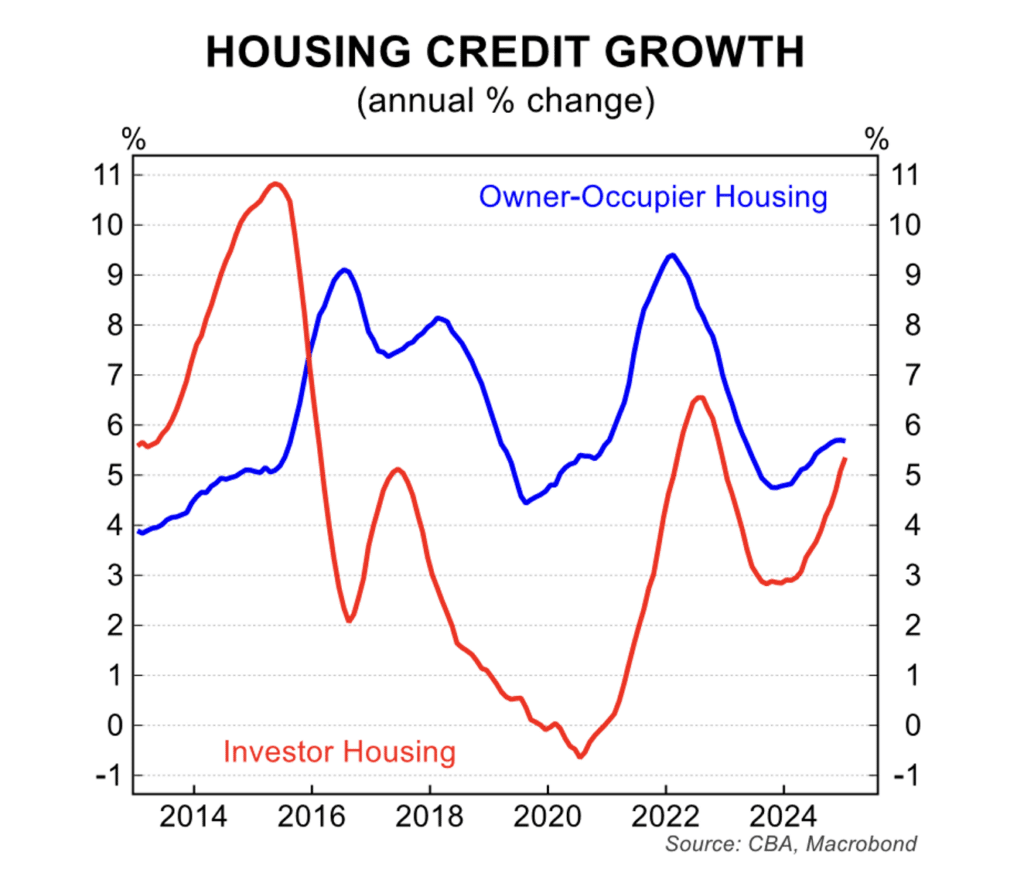

The turning point in housing has been driven by a lift in investor activity where growth in lending has picked up to almost match lending for owner-occupiers. Solid rental returns, what were low vacancy rates and little prospect of tax policy changes relating to the investor market are underpinning the rise in investor activity.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.