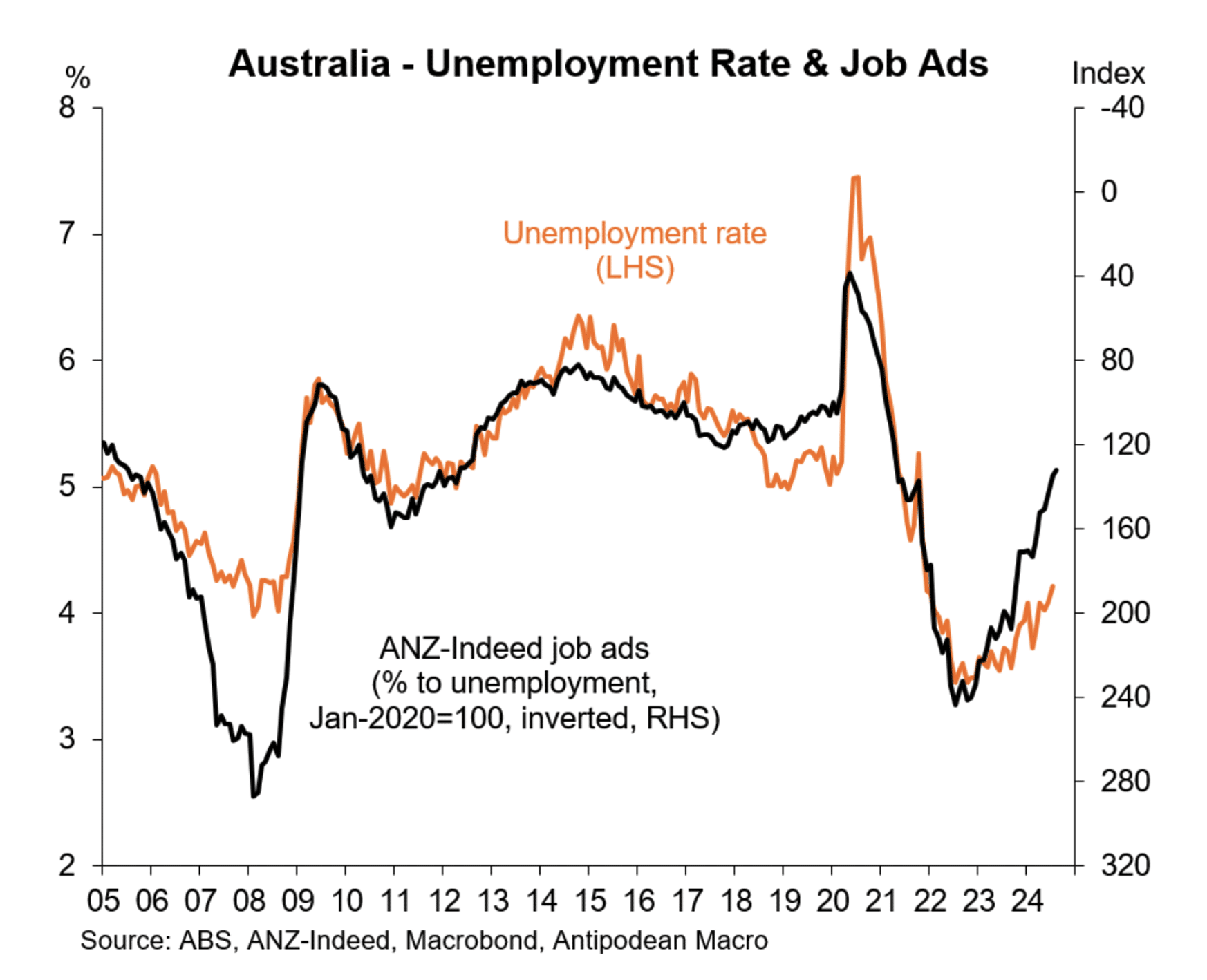

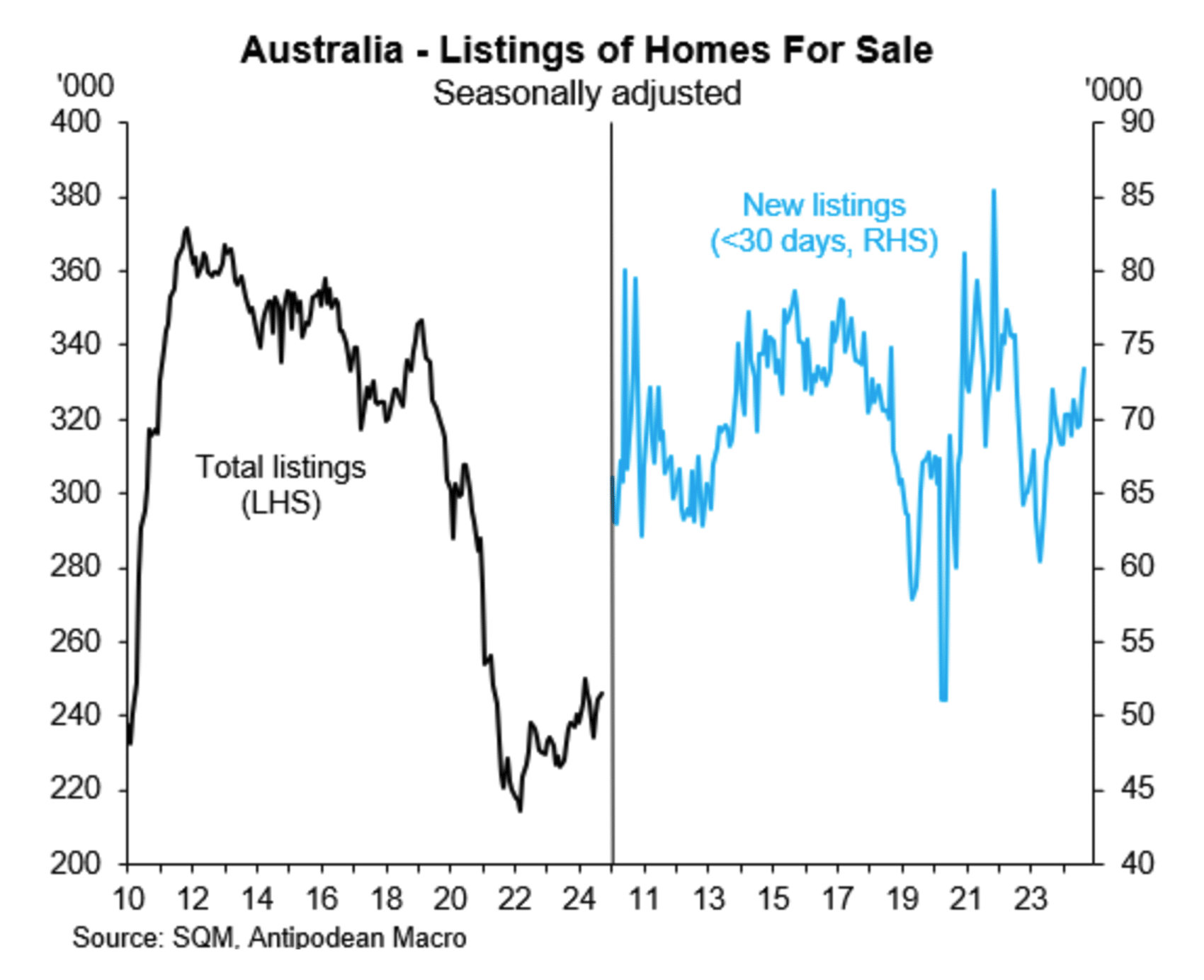

Some tentative signs of a recovery as inflation continues to ease

The last month has seen what might be called “green shoots” of an economic recovery in Australia, aided by an easing in cost of living pressures as inflation has retreated towards the RBA target band.

It is important to note that these encouraging signs are from a weak starting point – it is too early to be confident of a meaningful economic recovery, but it is encouraging to see some better news.