Interest rates pressured by inflation as the economy slows

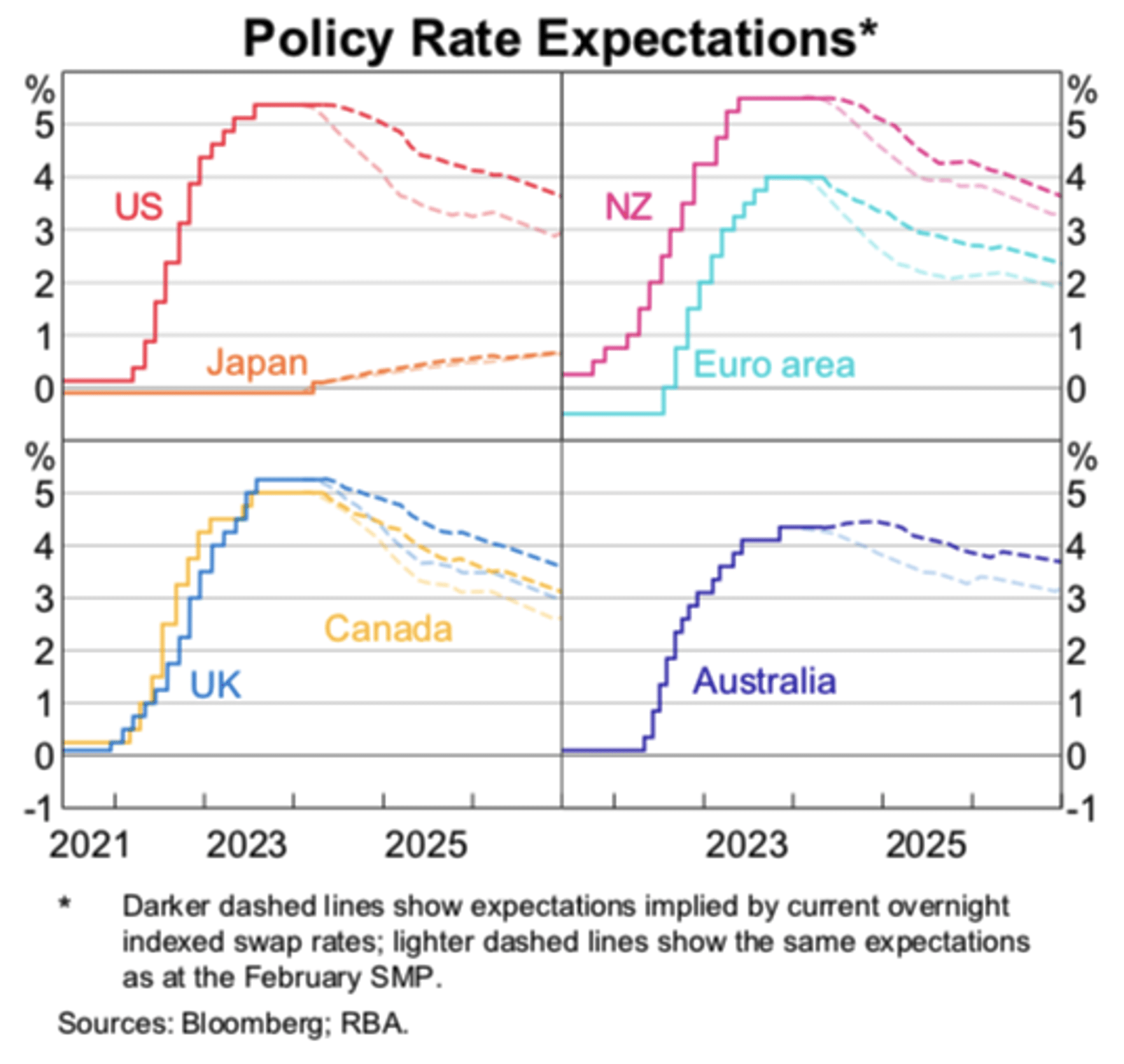

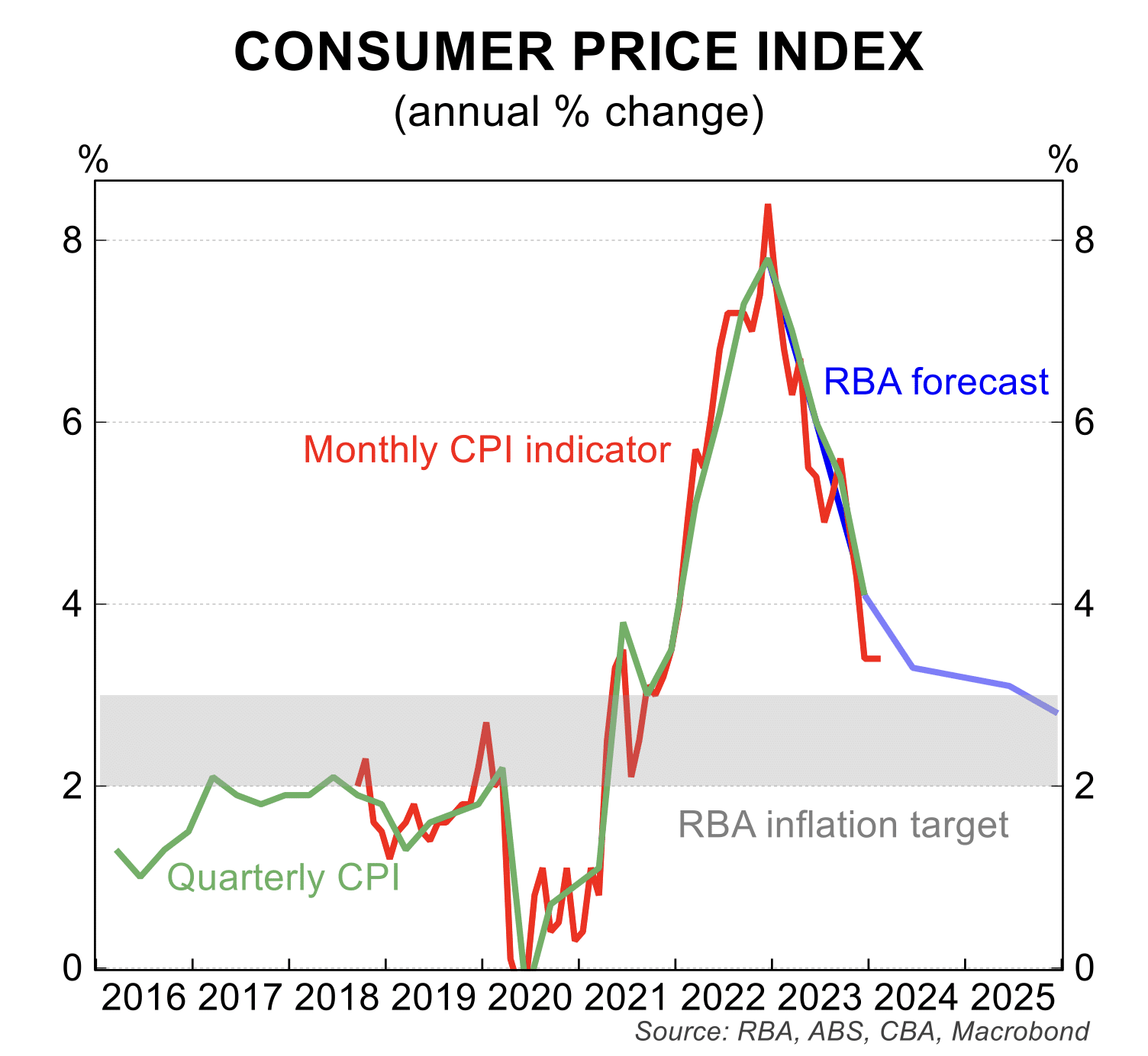

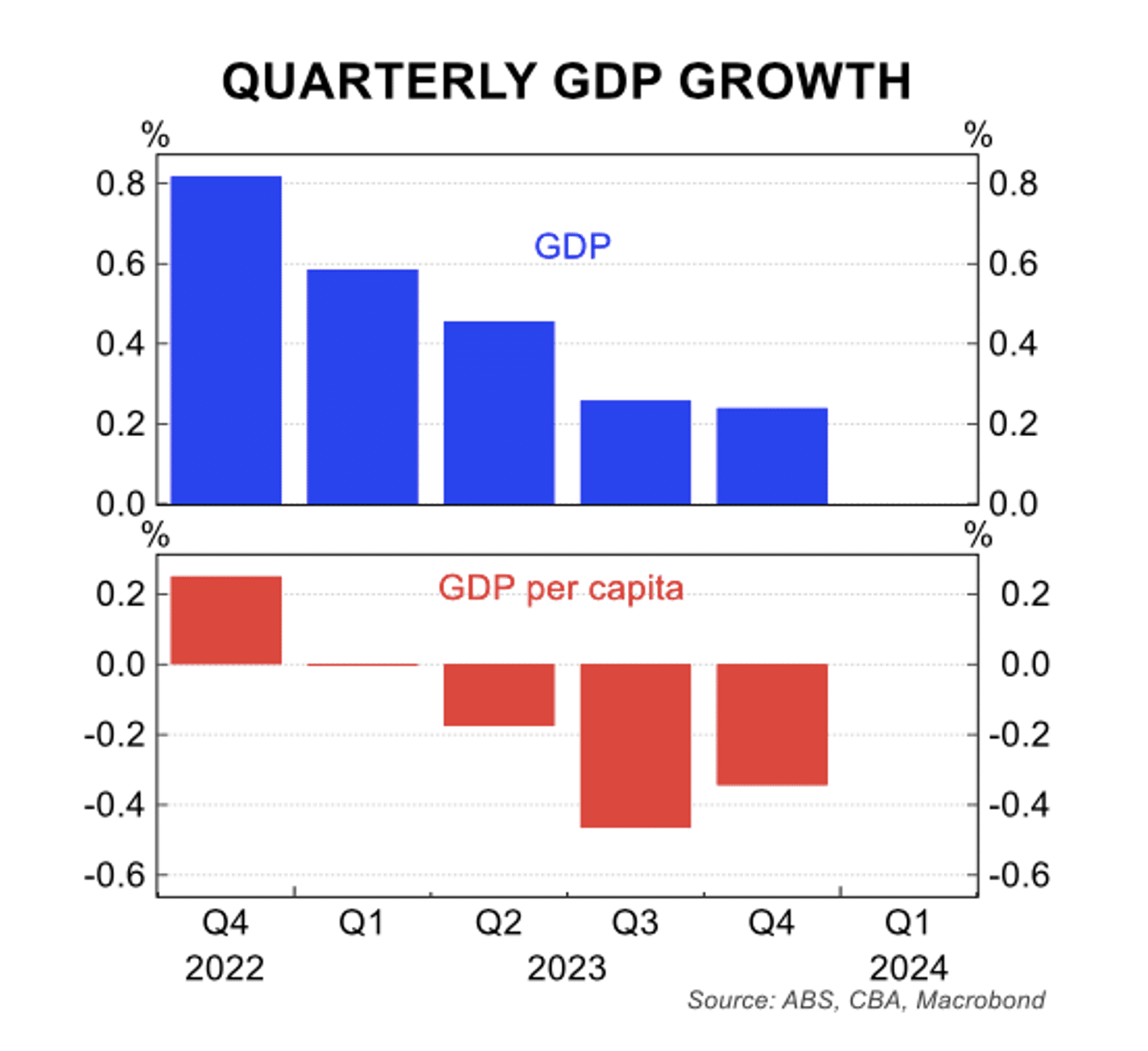

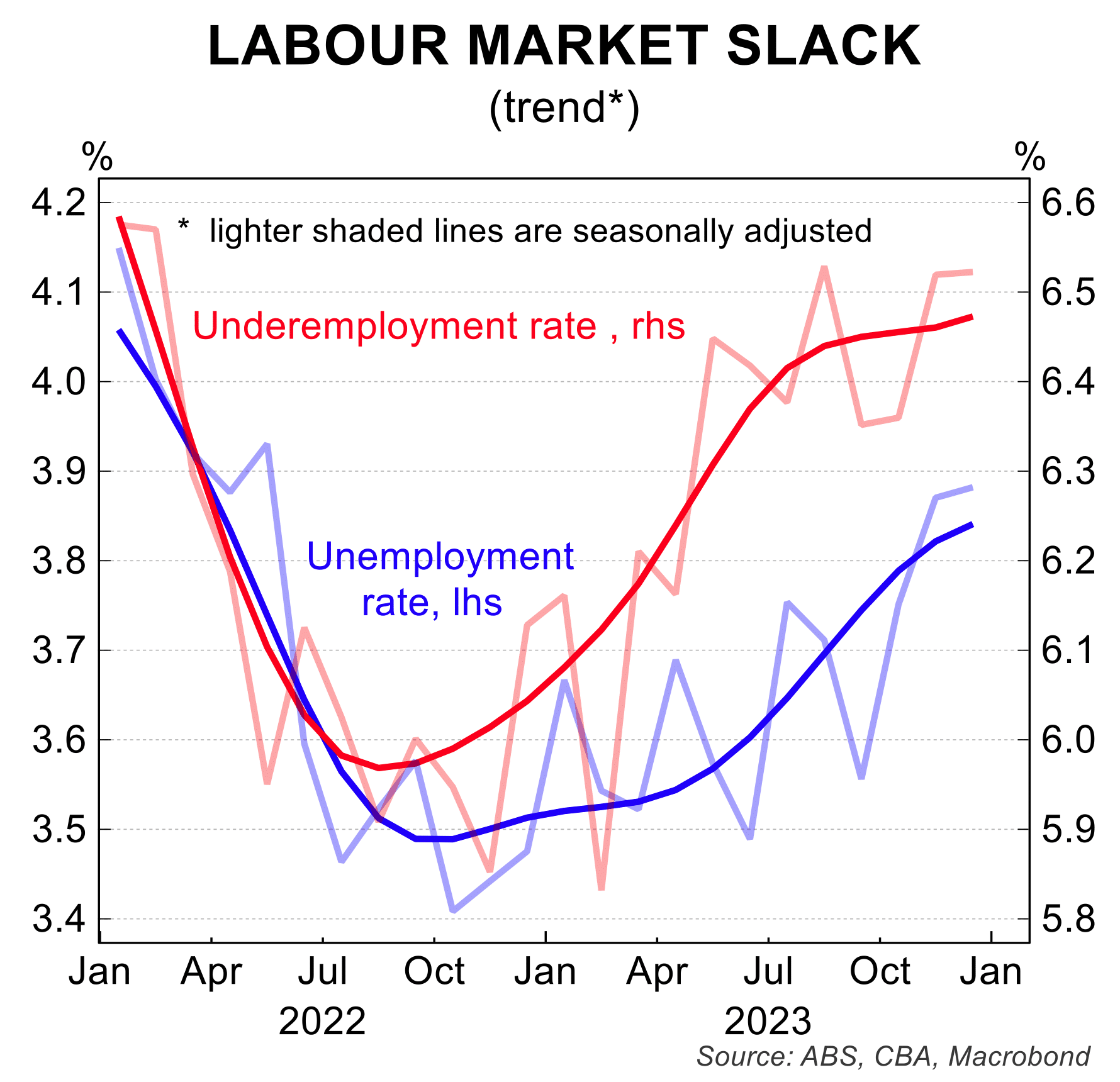

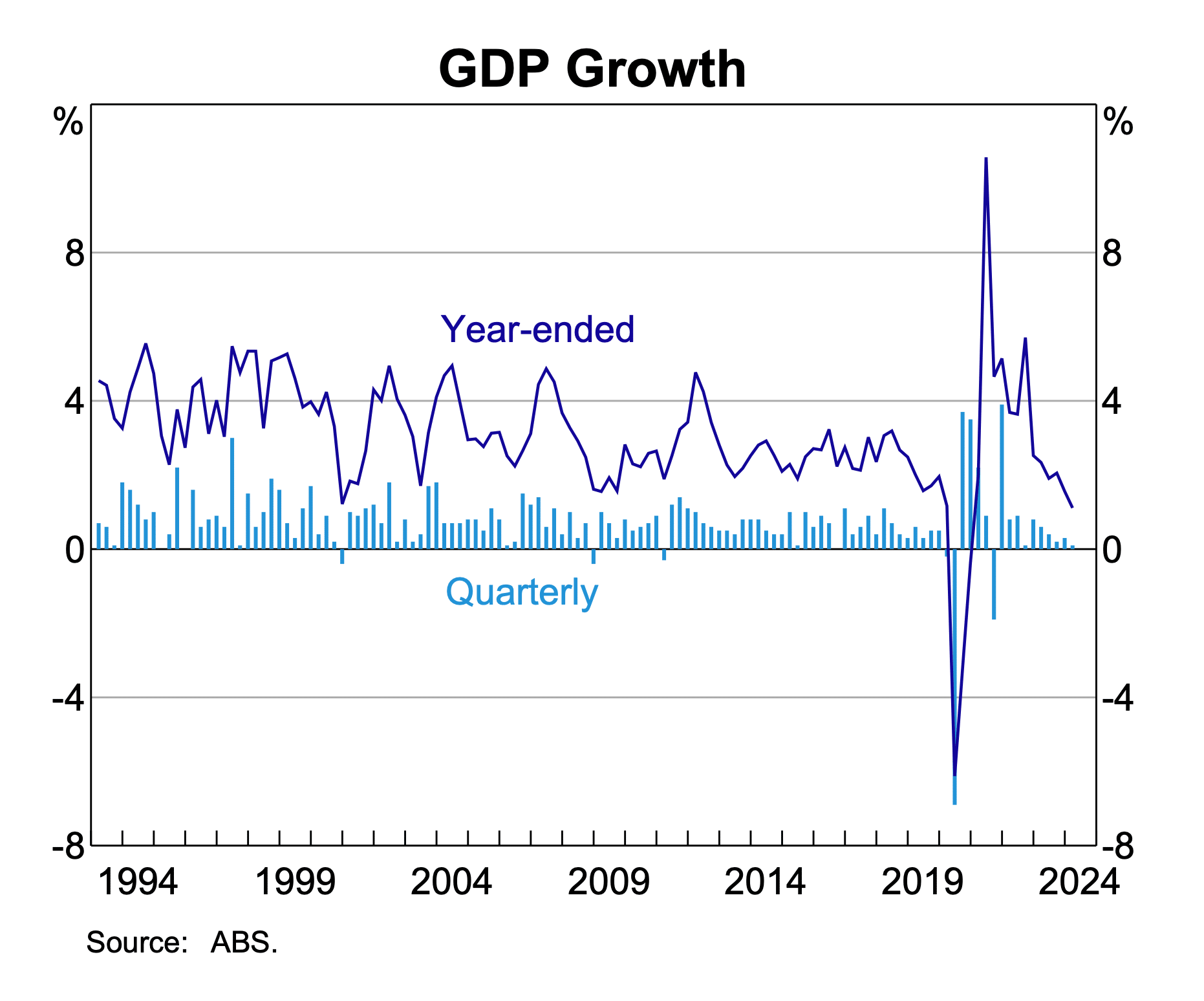

The past month was dominated by news of weaker economic growth, a still fragile labour market and an upward blip in inflation. There was no surprise when RBA left interest rates steady at 4.35 per cent after its June meeting, meaning there has been no policy change since the last rate hike in November 2023.