The Australian property market continues to deliver stable results in most jurisdictions despite the higher cost of living currently being experienced by many Australians.

Auction clearance rates in Sydney, Adelaide and Canberra are close to 70% with Melbourne and Brisbane hovering at around 50% (as at 8/6/2024).

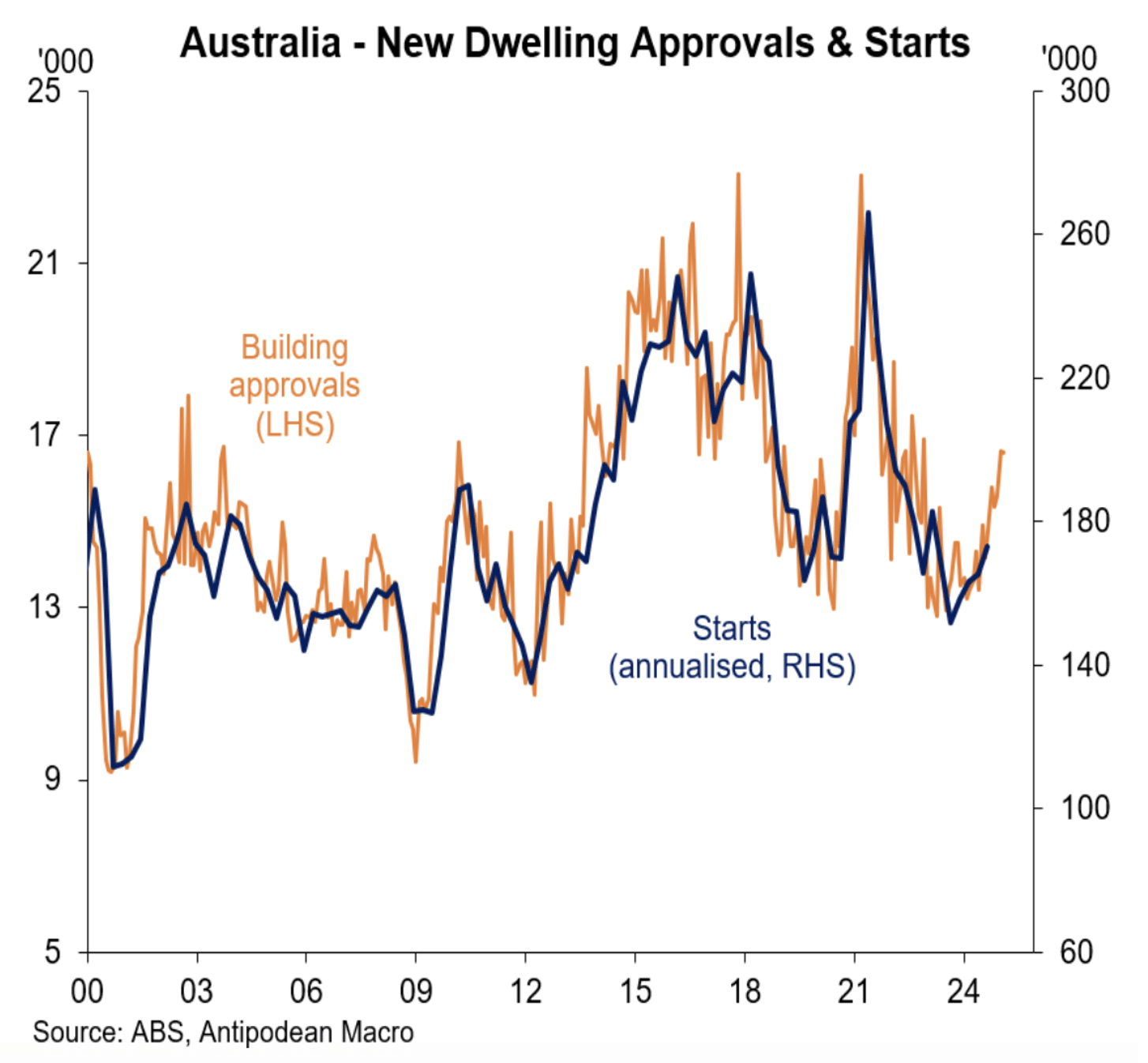

There is a huge housing shortage in most parts of the country which is providing an obvious cushion to property prices due to the supply / demand imbalance.

The demand for housing, from immigrants and locals alike, continues to be the main driver, which is also proving to be a challenge for governments looking to ease the pressure on those looking to rent or buy real estate. Economic forecasts project a substantial increase in the population over the next five years, further exacerbating the current housing issue.

Most state governments have implemented a form of incentive such as first home owner schemes, however NSW has taken further steps in recent times to attempt to boost housing supply numbers.

The State Government is reforming policies which include allowing higher density developments in and around locations in metro and greater Sydney.

The government has earmarked a strategy focussed on transit oriented development (“TOD”) which effectively aims to provide planning controls that are conducive to creating additional housing in 37 locations across Sydney, that are currently being serviced and are in close proximity to metro, railway and commercial amenities.

Outside of the property sector

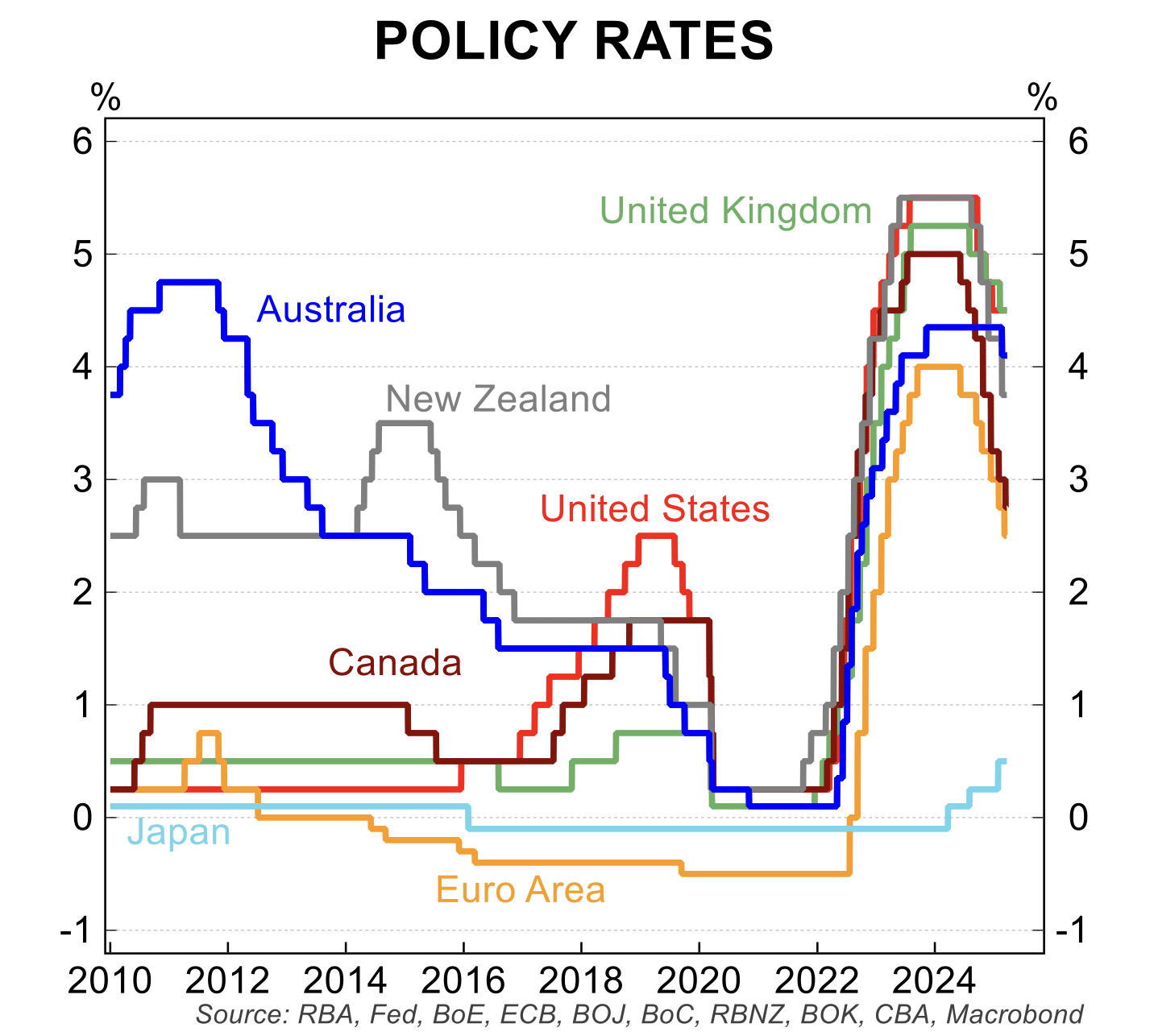

We are witnessing a huge influx of global capital from Asia, US, UK and Middle East from those investors seeking predictable, alternative opportunities that differ from the traditional bank deposits, bonds and listed shares.

A growing pool of fund managers in the real estate private credit sector are offering fixed interest returns, which are becoming the preferred destination for capital. This preference is driven by the fact that the deployment of invested funds is primarily underpinned by real estate mortgage security, considered a stable asset.

The construction sector remains tight with pressure on supply-chains relating to materials and labour evident, however we are seeing trends suggesting we are at, or very close to, the top of the price-hiking cycle.

At Zagga, we remain vigilant in managing all construction loans within our portfolio by closely monitoring project cash flows, time and cost budgets, builders, and trades on sites to ensure smooth operations.

Zagga’s Director – Property & Risk, Frank Hageali, who recently attended a building industry conference, reports that the NSW Building Commissioner maintains an optimistic outlook on the construction sector. This is an important sentiment which will help boost the sector’s confidence in the wake of the implementation of the NSW Government’s TOD planning reforms.

Now, more than ever, experienced teams and deep industry networks matter in this space.

The key for investors is to undertake their due diligence to ensure they select competent investment managers with the knowledge and skills to navigate the intensive asset management process required in this environment.

The protection of our investors' capital remains paramount.

Please do not hesitate to reach out should you have any questions or require further clarification.