The broad economic themes that kicked off 2024 remain in place, with economic weakness, unemployment moving higher and inflation set to fall to the RBA’s 2 to 3 per cent target.

There are no material signs of a recovery in the economy and for the moment, the Reserve Bank of Australia is not inclined to reduced interest rates to support the economy and limit the extent of the rise in unemployment.

There are some factors that are helping to limit the weakness rather than promoting a recovery, but the overall effect of these is highly uncertain. Income tax cuts were paid from 1 July 2024 and electricity subsidies will have a small impact on cost of living pressures, but these are only a partial offset to the effect of high interest rates.

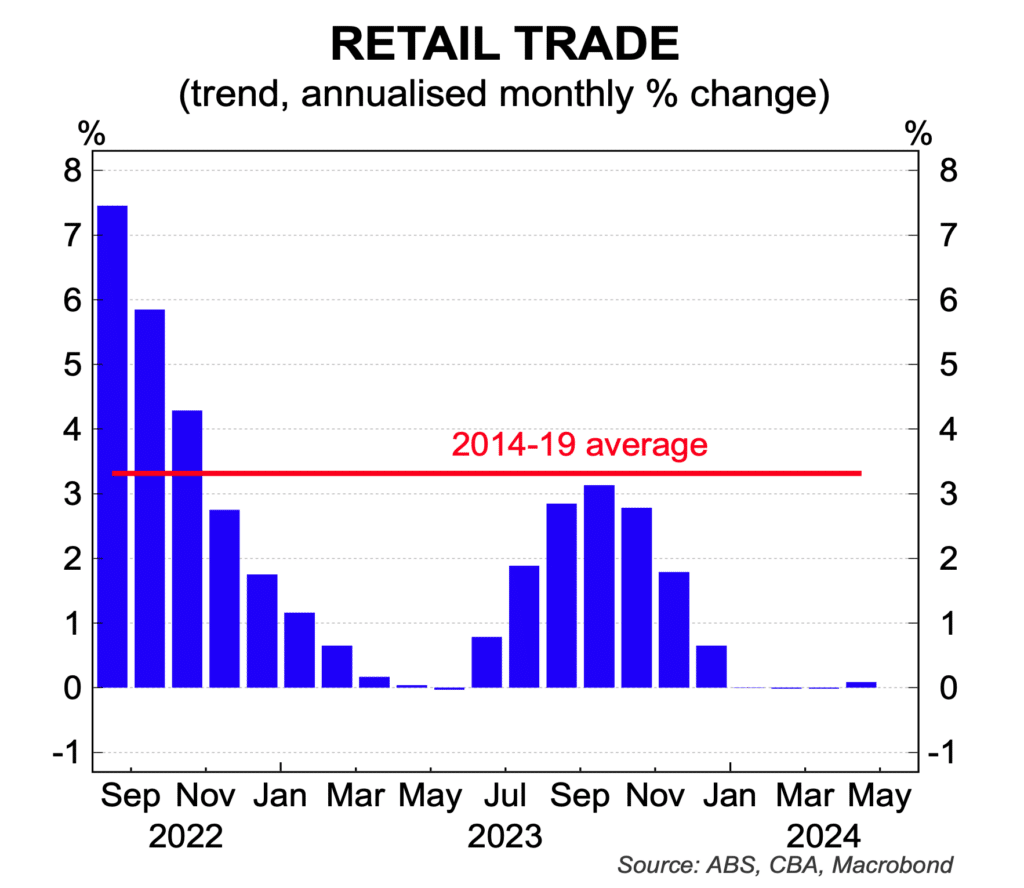

In terms of the recent data, retail sales rose 0.6 per cent in May which follows several months of weakness. The level of retail spending is still lower now than in November 2023. In trend terms, retail spending is flat and it is falling in real terms.

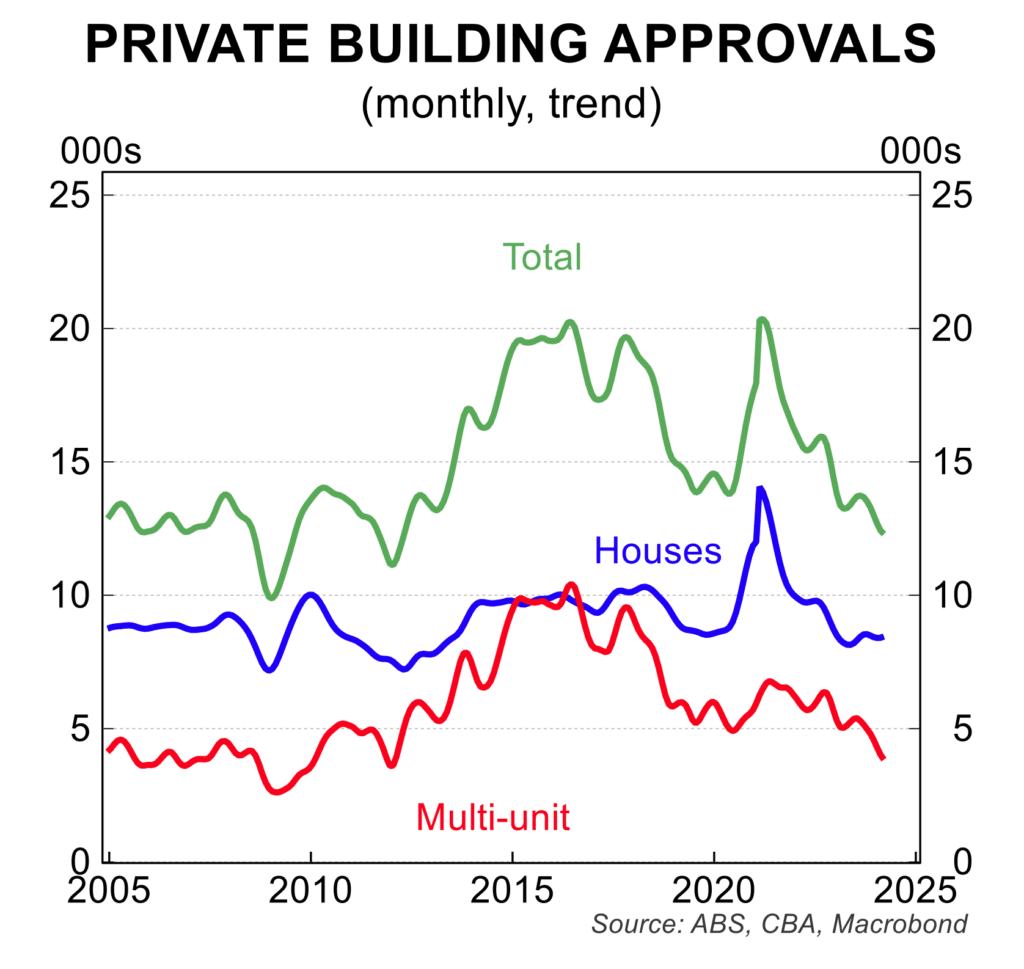

Similarly, the number of residential building approvals edged up in May but were only marginally above an 11 year low.

Residential construction activity remains significantly below the level required to meet housing demand from strong population growth.

Inflation rose, in annual terms, to 4.0 per cent in May from 3.6 per cent in April. The uptick was driven by price increases in tobacco, insurance, petrol, holiday travel and rents. Inflation is still well below the December quarter 2022 peak of 7.8 per cent and from the second half of 2024 is forecast to return to the 2 to 3 per cent target range.

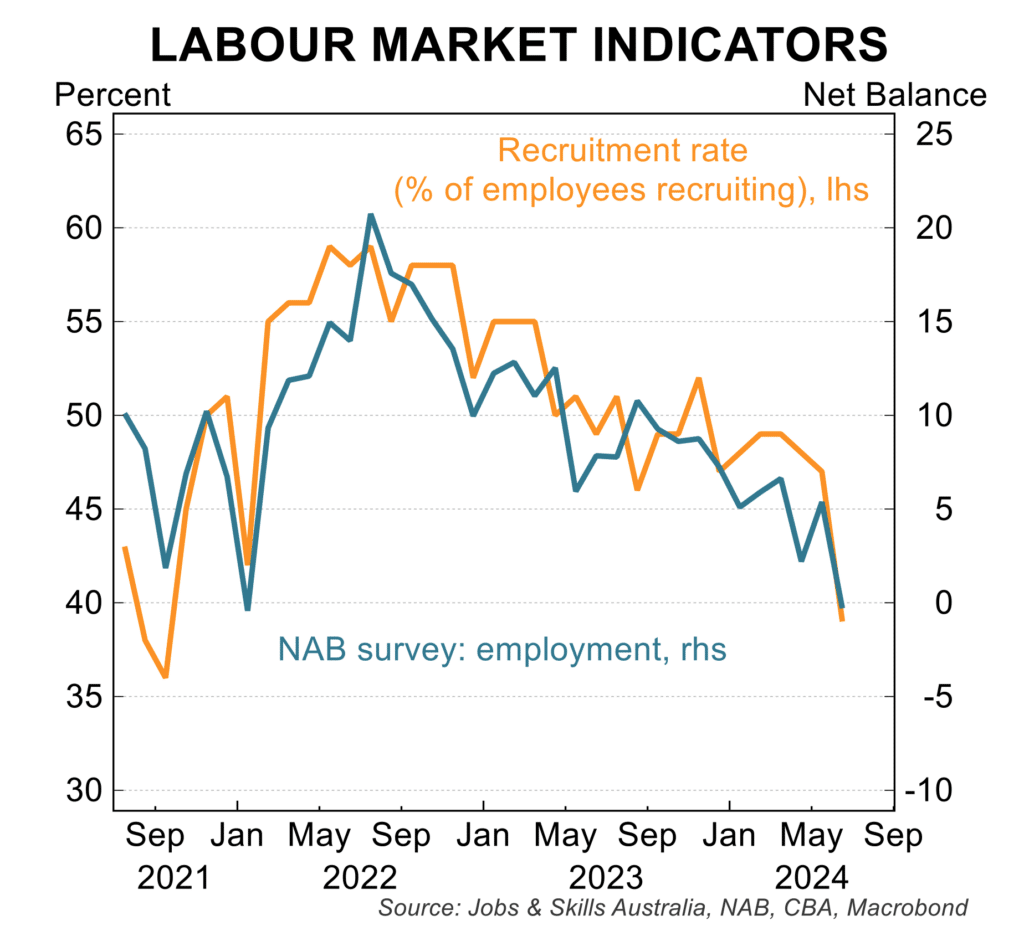

Labour market conditions are showing signs of distress. In trend terms, employment growth is now below the rate of population growth which means the unemployment rate has risen from a low of 3.5 per cent in 2023 to 4.1 per cent in June. Worryingly, the number of job vacancies has fallen for eight consecutive quarters to be down 26 per cent from the peak and surveys of employment expectations are falling. These trends are pointing to further significant increases in the unemployment rate in the year ahead.

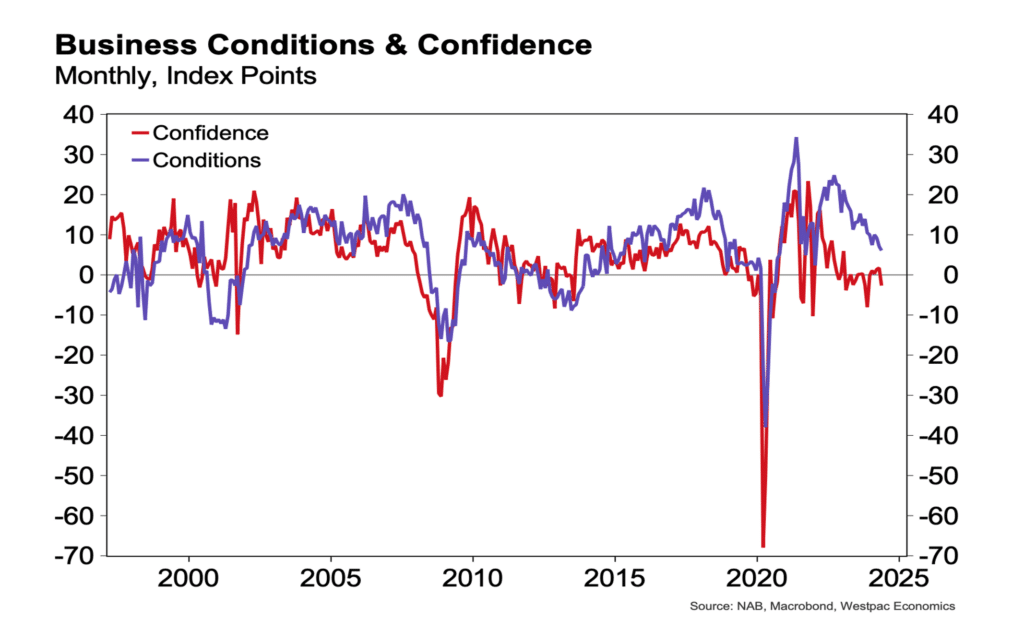

Business confidence, which was resilient through to the middle of 2023, is now trending lower which is concerning for the medium term outlook. Firms are reporting a softening in profits, sales, forward orders and labour hiring intentions.

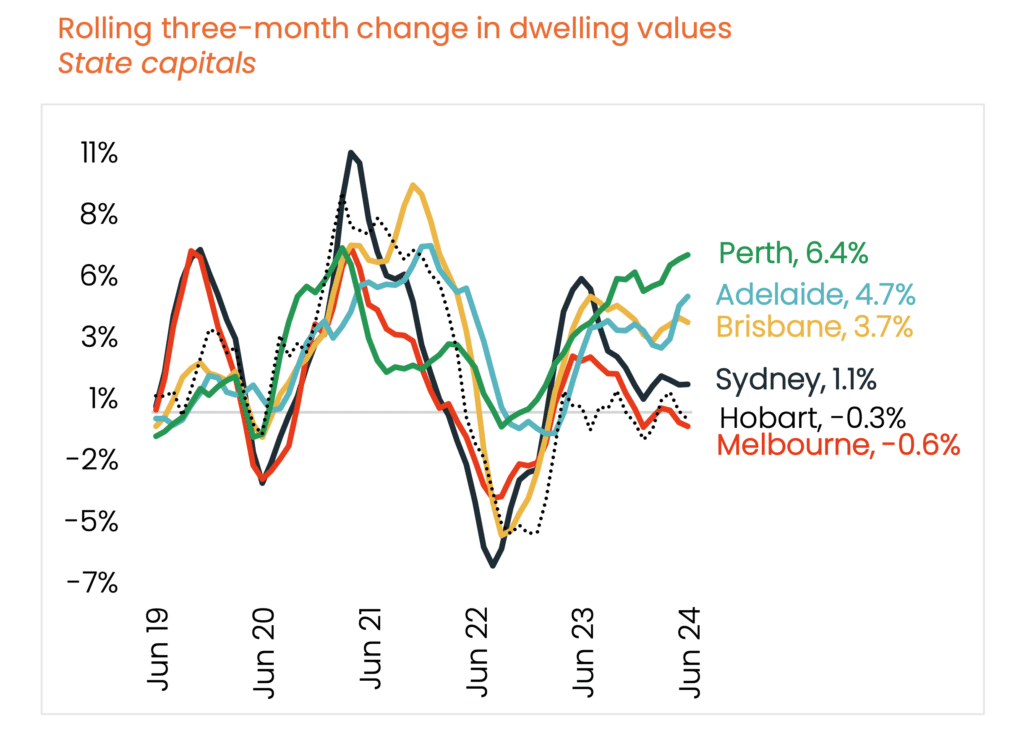

The pace of house price appreciation has been broadly steady for the last year, with month on month increases in a tight 0.5 to 0.8 per cent range since January 2024. Annual growth in house prices has eased from 10 per cent in late 2023 to around 8 per cent. The rise in prices remains inexorably linked to limited supply from low levels of new construction and buoyant demand from a surge in population growth that accompanied the reopening of the international borders after the pandemic related shut-down.

Over the year to June 2024, Perth dwelling prices are up 23.6 per cent, they are up 15.8 per cent in Brisbane,15.4 per cent in Adelaide and 6.3 in Sydney. In contrast, prices in annual terms are up just 2.4 per cent in Darwin, 2.2 per cent in Canberra and 1.3 per while prices are down 0.1 per cent in Hobart.

Financial markets continue to price in a faint possibility of an interest rate increase in the next few months, but at the same time continue to embrace a series of interest rate cuts through 2025. Upcoming news on inflation and unemployment will determine the interest rate outlook.

It is noteworthy that interest rates cuts have been delivered or are priced in in all major markets including the US, the Eurozone, China, Canada, the UK and New Zealand. The main issue for debate is the timing and magnitude of future interest rate cuts.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.