As the investment landscape continues to evolve, astute investors are increasingly exploring alternative avenues for diversification, capital preservation and potentially higher, non-correlated returns. Among the various options available, alternative real estate investments have gained significant traction. In this blog, we delve into the realm of alternative real estate investments – specifically commercial real estate debt – , shedding light on their benefits, associated risks, and the rising popularity of this alternative investment in Australia.

The rising popularity of alternative real estate investments:

In the past, investors seeking exposure to Australian real estate investments were mostly only able to do so through direct or indirect equity investments. Direct real estate investment is especially popular among retail ‘mum and dad’ investors: data from the Australian Taxation Office (ATO) shows that over 20% of Australia’s 11.4 million taxpayers owned an investment property in 2019-20, and collectively they own 3.25 million investment properties1.

However, approximately 70% of those owners own just one property, meaning they have significant concentration risk: with a large amount of wealth tied up in one asset, it is heavily dependent on asset selection – in other words, putting all their eggs in one basket. In addition, there can be significant and often unpredictable maintenance costs, plus sensitivity to rising interest rate costs.

Another way to ‘own’ real estate is through Real Estate Investment Trusts (REITs), but these are particularly sensitive to valuation fluctuations. For example, the S&P/ASX 300 A-REIT, which tracks Australian REIT performance, is yet to recover from the significant drop it experienced at the start of the pandemic2.

Against this background, debt-based, alternative real estate investments have grown in popularity and availability in recent years. Just as corporate bonds provide an alternative to buying shares in companies, alternative real estate investments, such as commercial real estate debt (CRED) provides exposure to the property market without needing to own the assets. Such alternative real estate investments encompass a range of unique benefits beyond traditional ownership of residential or commercial real estate.

Benefits of alternative real estate investments:

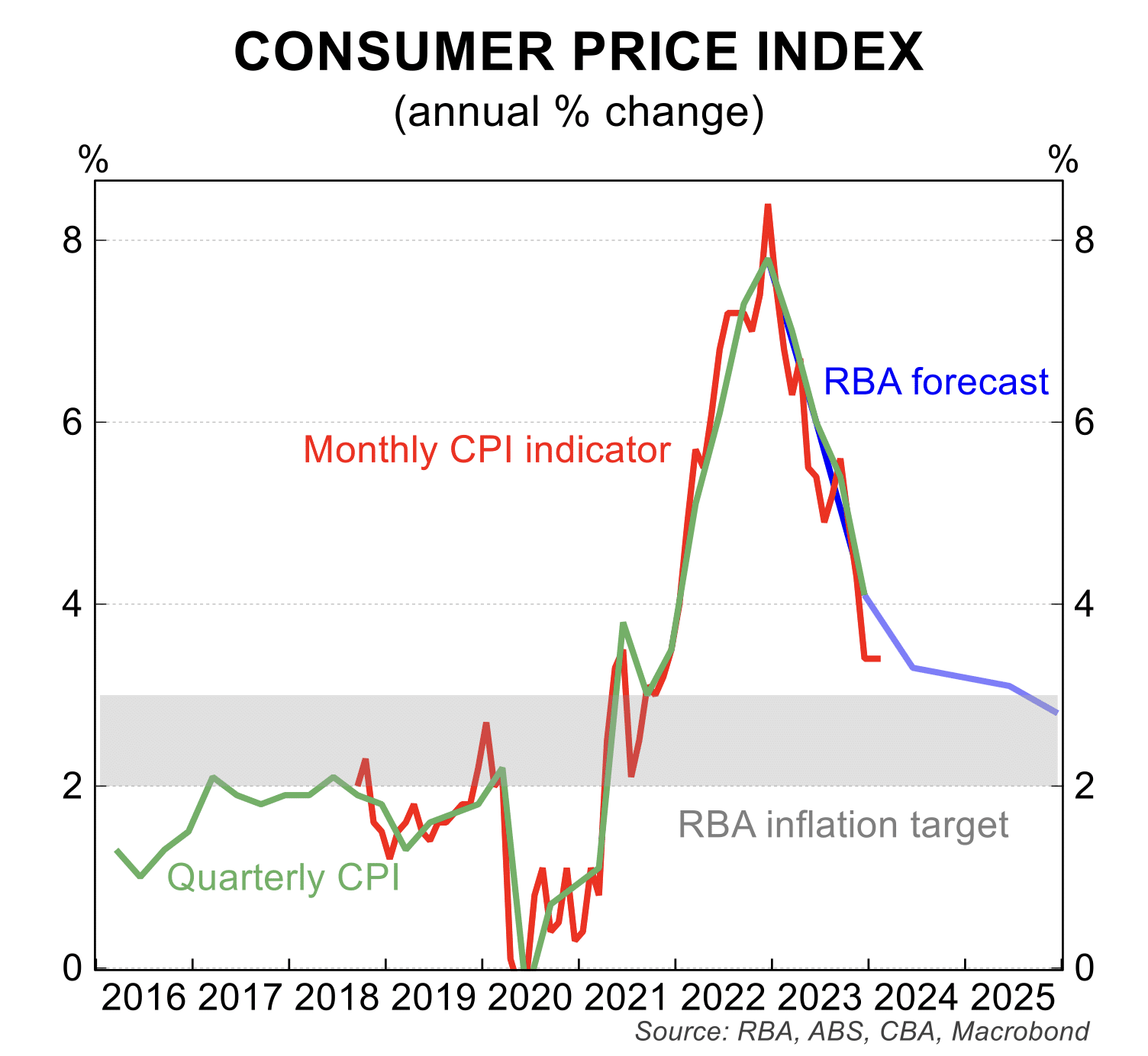

In a period of rising inflation and interest rates, alternative real estate investments, such as commercial real estate debt, has a number of attributes that may make it attractive to investors.

1. Commercial real estate debt (CRED) can benefit from rising interest rates

As CRED investments are secured by real property loans, they are one investment option that can actually benefit from rising rates. Most loans incorporate a variable rate pricing mechanism. This means that as official interest rates rise, so too the rates of the loans within the CRED portfolio. These increased returns are then passed onto the investors as monthly distributions.

equity-based property investments.

2. Commercial real estate debt (CRED) enables real estate investment without equity risk

The other benefit of commercial real estate debt (CRED) over commercial real estate equity is security. In a CRED transaction, all underlying loans are secured by real property asset (e.g. the development site, commercial building or apartment block or warehouse). This helps to manage risk.

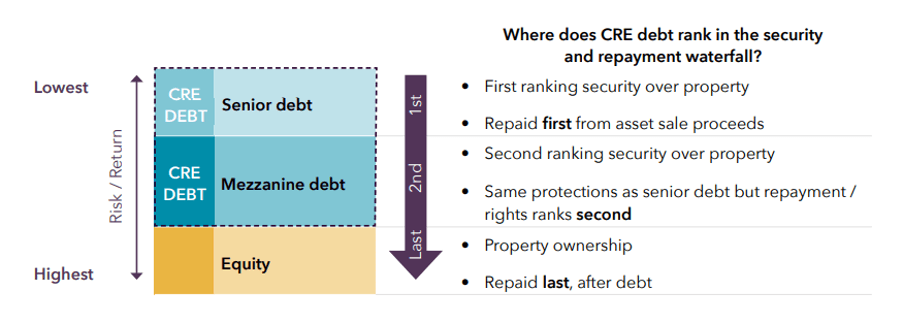

Compared to commercial real estate equity (eg. Australian Real Estate Investment Trusts (A-REITs), CRED ranks higher in the capital structure and is secured by the real property mortgage security. As the illustration below shows, debt investments sit lower on the risk-return scale than compared to equities. This is because debt investors take priority over equity investors in the event of the loan defaulting.

First-mortgage secured debt has first security ranking over property, meaning it gets repaid first from the sale of the asset. However equity – meaning property ownership and the most traditional form of real estate investing – is repaid last after all debt investments.

3. Commercial real estate debt (CRED) can offer regular, predictable income for the term of the investment

Commercial real estate debt (CRED) offers a source of regular and predictable income, particularly during times of market volatility. Unlike traditional equity investments, such as stocks and shares where the dividends are discretionary and dependent on the company’s cashflows, CRED provides investors with a consistent stream of income in the form of interest payments. This stability stems from the fact that debt investments are secured by tangible assets, such as office buildings, retail spaces, or industrial warehouses. The interest payments made by borrowers through the life of the loan are passed on to the CRED investors in the form of monthly distributions, offering a steady cash flow for the investors. This income predictability can make CRED an attractive fixed-income style, alternative real estate investment option for investors seeking capital preservation and a hedge against inflation.

Risks to consider:

While alternative property investments offer enticing prospects, it is crucial to acknowledge associated risks. Market fluctuations, liquidity concerns, regulatory changes, and specific risks related to each investment type should be carefully evaluated. Thorough due diligence, expert guidance, and a comprehensive understanding of the investment are essential for managing these risks effectively.

Zagga does not provide you with personal advice that any investment you make will be suitable for your personal circumstances or that the investment will meet your investment objectives. Check out our further information in our FAQs.

Rising popularity in Australia

Alternative real estate investments have experienced a surge in popularity in Australia. This alternative asset class provide access to an alternative form of real estate investment without the costs and risks of direct ownership and not only has it proven its ability to ride out periods of rising interest rates but could actually benefit, making it increasingly popular to a growing range of investors.

There aren’t many opportunities for investors to achieve stable, risk-adjusted returns with debt security, but alternative real estate investment managers offer exactly that.

For investors who are attracted to commercial property and the returns it can deliver, but dislike the risk of rising rates and how they might affect it, professionally managed commercial real estate debt may be an appealing alternative.

In a rising interest rate environment, alternative real estate investments like CRED has the potential to offer attractive yields but with greater capital preservation whilst still maintaining exposure to property. It’s an income-focused investment with a proven ability to ride out periods of rising rates.

With various investment options available, it is crucial to conduct thorough research, seek professional advice, and understand the associated risks.

Get in touch with one of our Investment Directors today to find out more about the alternative real estate investments we offer at Zagga.