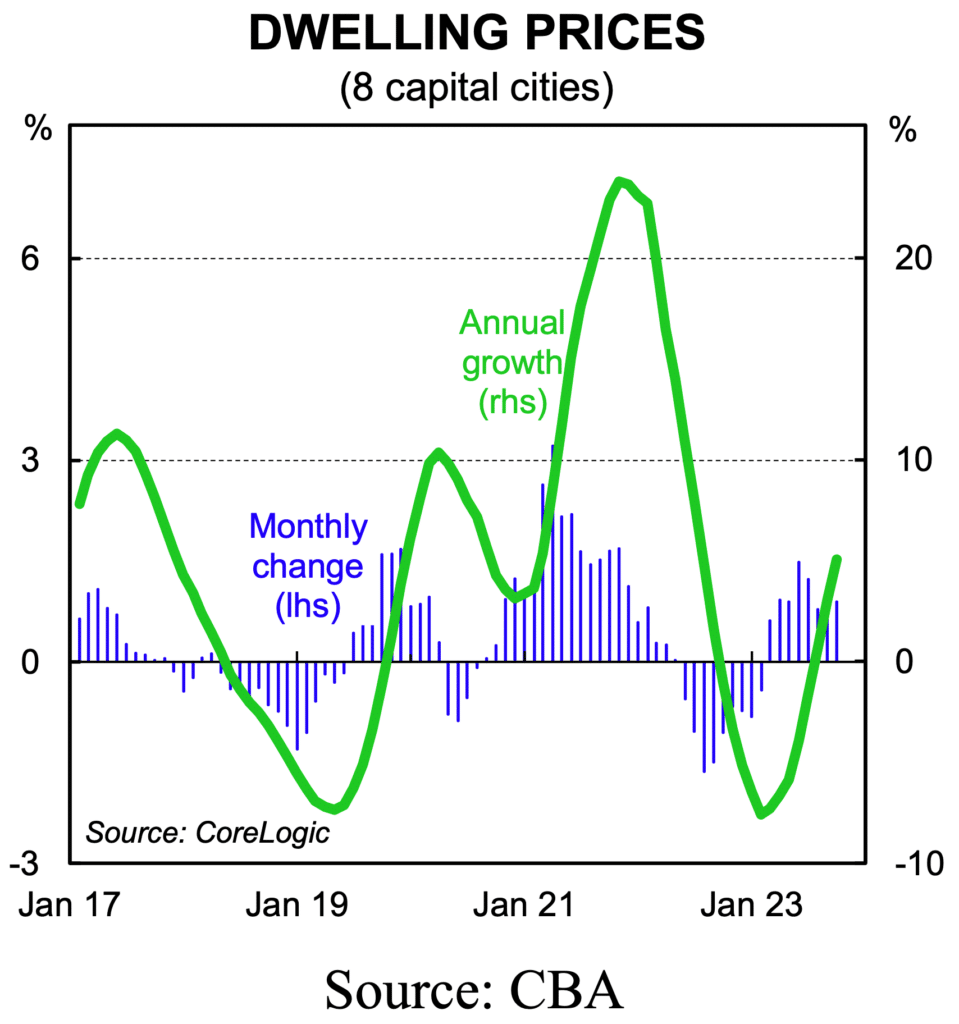

One of the key issues for the Australian economy in 2023 has been the strength in house prices.

2023 began with many forecasters looking for 20 to 25 per cent house price declines with those forecasts based squarely on the effects on borrowers from the interest rate hiking cycle from the Reserve Bank. What was commonly overlooked was the surge in housing demand from population growth as the international borders reopened after the pandemic lock downs and the shortage of housing supply driven by the downturn in new construction and sellers being reluctant to list their properties for sale.

The end point from the Corelogic data is that house prices are set to rise by 10 per cent in 2023, not fall 20 per cent, as the demand and supply dynamics underpin prices across all capital cities and in many regional areas. From an economic perspective, this is good news.

The shortage of dwellings has also been evident in the surge in the cost of dwelling rent and record low vacancy rates. This rental squeeze has, in turn, underpinned house prices as investors take advantage of favourable conditions and renters move to purchase dwellings for financial reasons linked to the rising cost of rent.

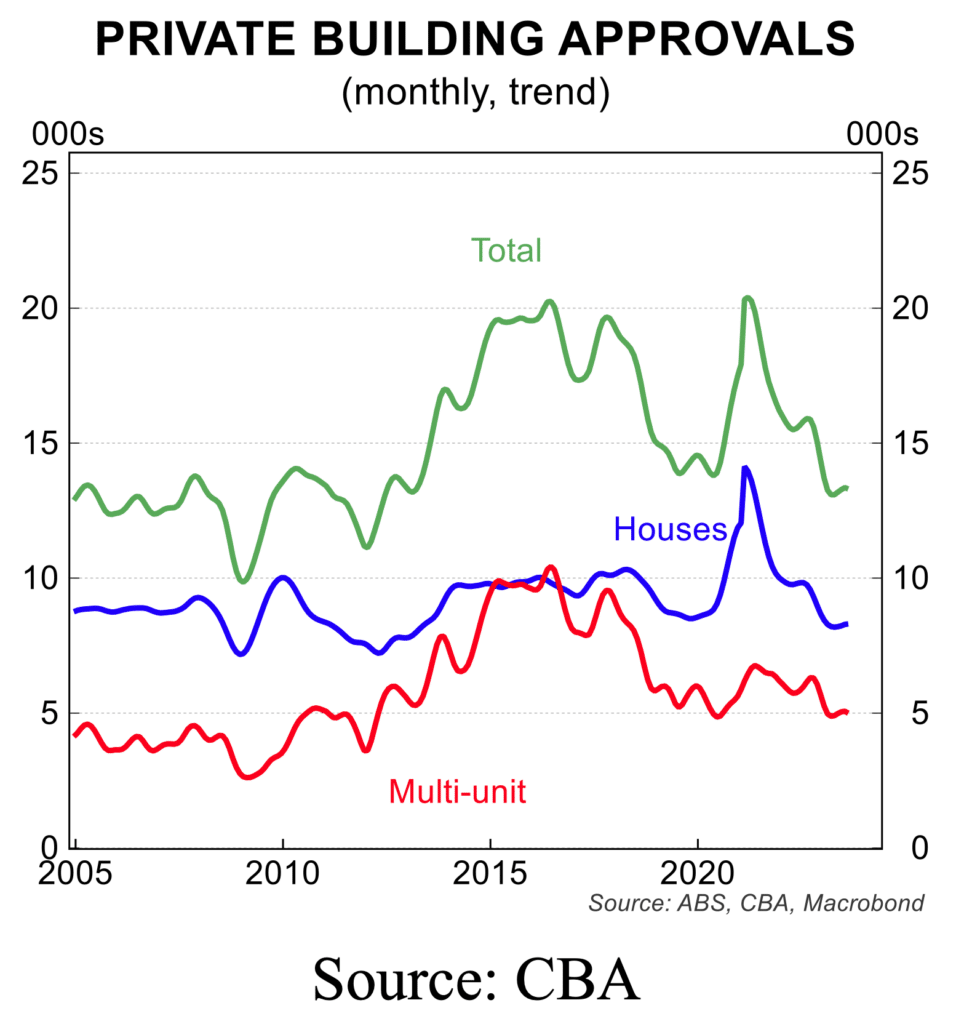

The outlook for dwelling construction is starting to turn mildly positive having negotiated a period of weakness in 2023 where the number of new dwelling approvals sank to its lowest level in a decade. Recent dwelling building approvals data point to a bottoming out in activity despite the cost pressures and ongoing effects of high interest rates and tighter lending.

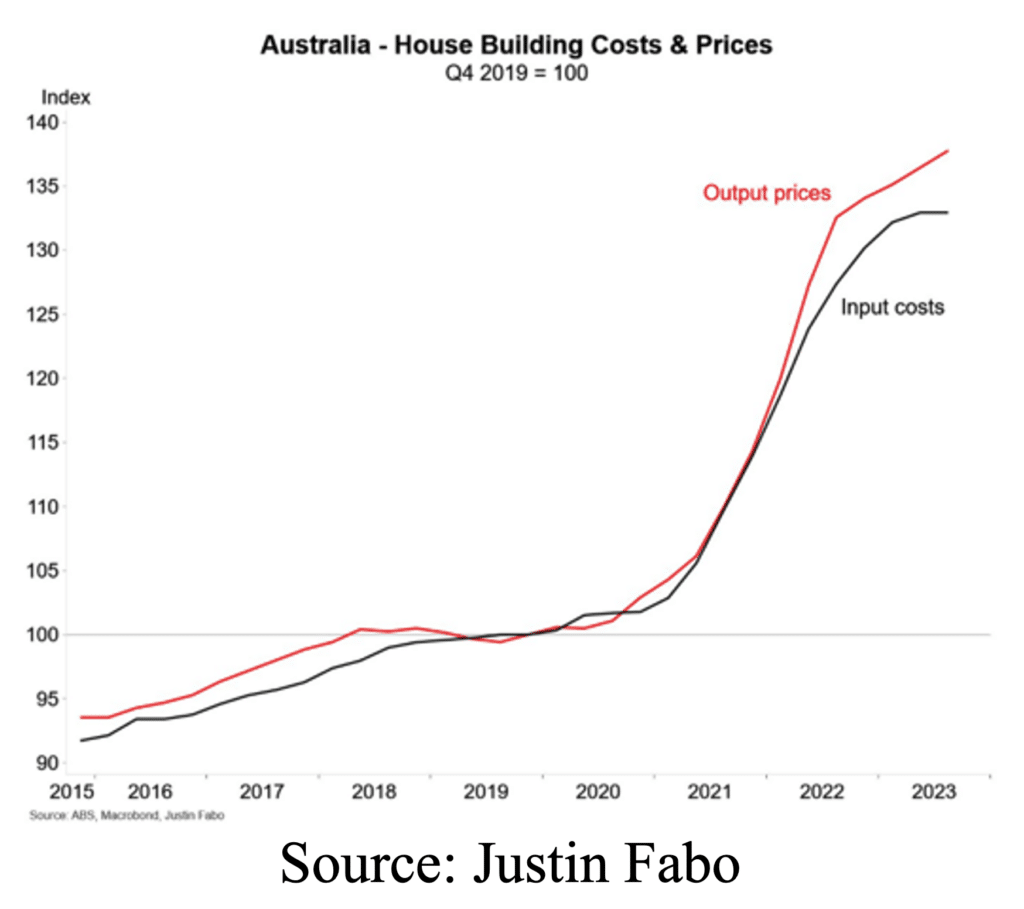

Helping the situation for future construction is an easing in house building input costs after the sharp lift in 2021 and 2022. This is in line with the broader deceleration in inflation and the dip in many commodity prices since early 2023 as the global economy slows and supply chain problems abate.

This will be a positive factor in what is increasingly likely to be a recovery in dwelling investment and construction in 2024 and 2025. Rising selling prices relative to moderating input costs is a formula that property developers need to see to ramp up construction.

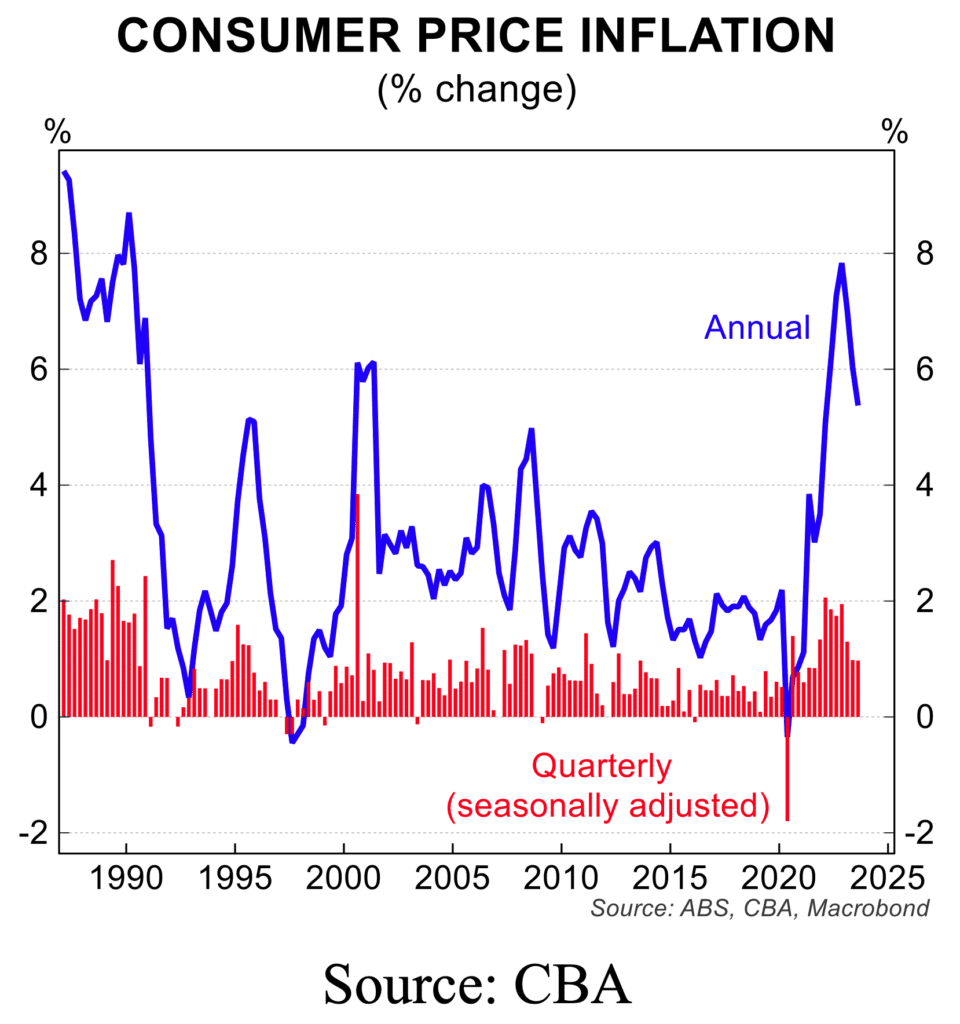

The other critical issue for the economy and policy makers has been, and still is, the inflation problem that was unleashed after the massive global policy stimulus measures during the COVID pandemic.

The good news is that inflation is continuing to fall on the back of the broader economic slowdown which has been driven by the interest rate hiking cycle.

The question dominating policy makers and market participants is whether the deceleration of inflation is fast enough to ensure it returns to the target range in a timely manner. In Australia, the annual September quarter inflation rate eased to 5.4 per cent, down significantly from the peak of 7.8 per cent in the December quarter 2022.

It was, however, a fraction higher than expectations and as a result raised doubts about the speed at which inflation will return to target, which the RBA currently expects to be in mid to late 2025.

This debate is likely to linger and while it does, speculation will remain elevated as to whether further interest rate increases are needed to ‘lock in’ the path to a lower inflation rate.

For the RBA, the inflation data presents a dilemma.

It is clearly on the view that monetary policy and interest rate settings are restrictive and it points to the broad economic slowdown and the turning point lower in the labour market as evidence for this.

The market is expecting interest rates to remain near current levels for longer than it was a month ago, with the 3 year government bond yield, which is a good proxy for medium term cash rate expectations, yielding around 4.25 per cent compared with the current cash rate of 4.1 per cent. The yield on the 3 year bond is up around 25 basis points from a month ago and reflects the slight change in market expectations for official interest rates.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.