In a world where financial uncertainty and fluctuating markets have become the new normal, a strategically created investment portfolio combining both income-generating assets as well as capital appreciating assets can help investors achieve a much wider range of financial goals. Many investors focus on building long-term wealth but equally important is creating an investment portfolio that can also be used to generate an ongoing stream of supplemental, passive income.

This article explores the pros and cons of income investing, shedding light on various types of income-generating investments, the necessity of risk assessment, and the importance of selecting highly-experienced investment managers. Whatever your stage and experience in investing, and whatever your financial goals and objectives, finding out more on the different options to income investing will help you make more informed and considered choices.

What is income investing?

Income investing is a strategic approach to building wealth by putting your money into assets that generate regular income. Unlike capital appreciation investments that focus on the potential for growth in asset value, income investments prioritise the consistent receipt of income payments, providing investors with an added source of income and passive cash flow.

This strategy may be particularly important to income-focussed investors who aim to supplement their existing, or create a reliable source of alternative, income.

Types of income-generating investments

Traditional assets

Traditional investment assets refer to conventional and widely recognised financial instruments or securities that are commonly used by investors to build and manage their investment portfolios. These assets are typically associated with more established and regulated financial markets and have a history of providing returns through capital appreciation and income. Traditional investment assets include:

1. Dividend

Dividend stocks are shares of public companies that distribute a portion of their profits to shareholders in the form of dividends. These distributions can offer a steady income stream, with the potential for capital appreciation over time.

2. Bonds and fixed-income securities

Bonds and fixed-income securities are debt instruments that investors can buy as a way to lend money to a government or corporation. When you invest in bonds, you’re in exchange for periodic interest payments and the return of your principal at a specified maturity date. Bonds and fixed-income securities are considered a more conservative investment compared to equities, as they offer a predictable stream of income and are generally less volatile.

3. Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate properties such as commercial buildings, shopping centres, and industrial facilities. REITs are a common investment vehicle for investors to gain exposure to the real estate sector, without needing to own the physical property, and generate regular income in the form of distributions.

4. Term deposits and high-interest savings accounts

Traditional bank savings and term deposit accounts with deposit-taking institutions can offer a secure way to invest money and earn interest income. While the returns are typically low, they are highly liquid and low risk.

5. Direct property ownership

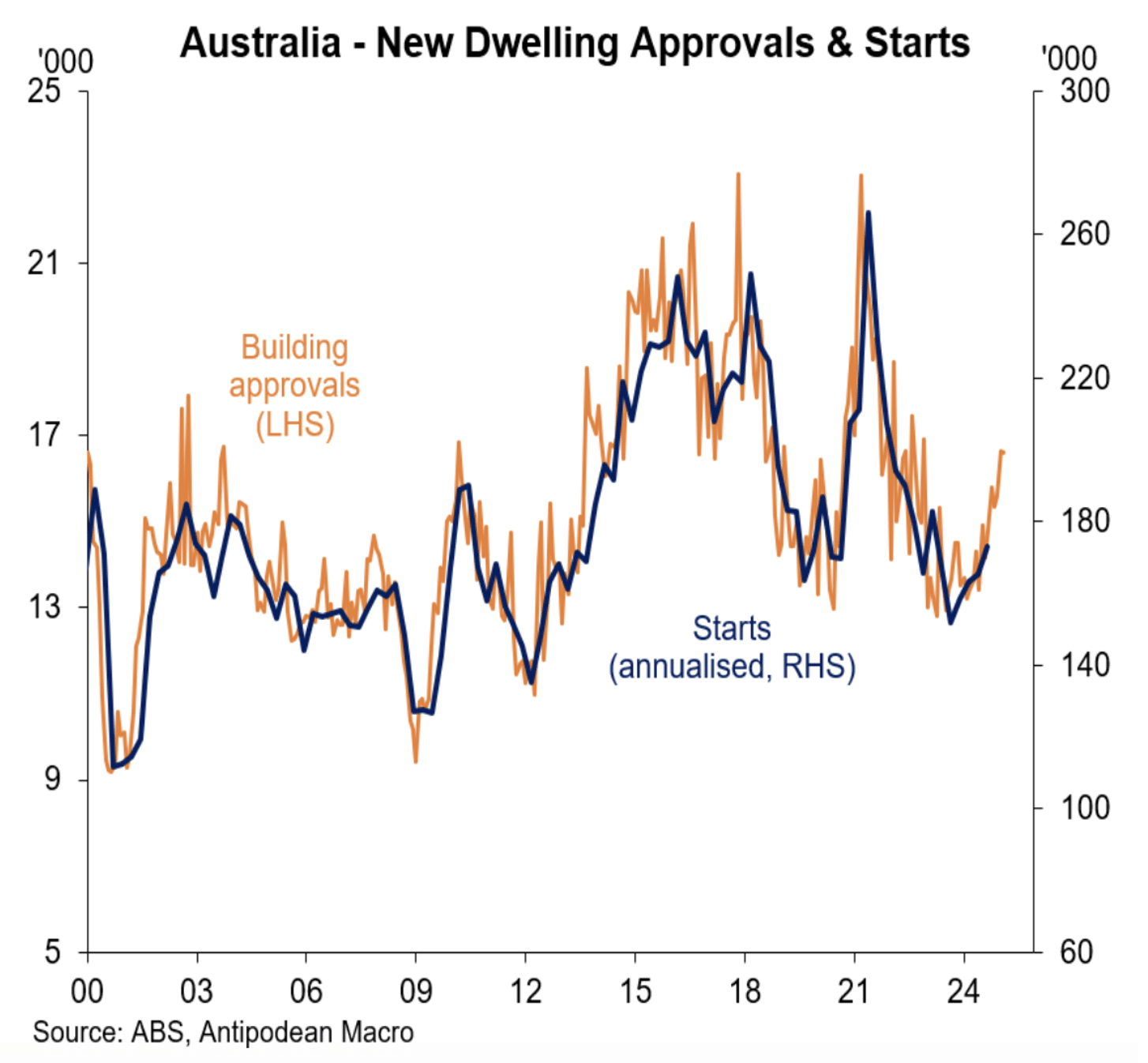

In the past, investors seeking exposure to Australian real estate investments were mostly only able to do so through direct investments. Direct property investment is especially popular among retail ‘mum and dad’ investors: data from the Australian Taxation Office (ATO) shows that over 20% of Australia’s 11.4 million taxpayers owned an investment property in 2019-20, and collectively they own 3.25 million investment properties*. Real estate investments can generate income through rent and capital appreciation.

*https://data.gov.au/data/dataset/taxation-statistics-2019-20

Traditional investment assets are often an integral part of investors’ portfolios because they offer a range of risk and return profiles. The mix of these assets within a portfolio can be adjusted to align with an investor’s goals, risk tolerance, and investment timeframe.

Alongside traditional assets, many savvy investors will also incorporate alternative investments into their investment portfolios as part of their investment strategy as diversifying across various asset classes can help better manage risk whilst achieving a balance between income generation and capital appreciation.

Traditional assets like equities and bonds are valuable components of a well-diversified portfolio, but they often move in tandem with broader market trends. By introducing alternative assets, such as private equity, private debt (of which commercial real estate debt is a subset) investors can potentially reduce correlation with traditional assets and enhance their risk-adjusted returns. Furthermore, alternative investments may offer unique risk-return profiles and have the potential to perform well in different economic environments, serving as a hedge against market volatility. Diversifying with alternative assets not only helps spread risk but also taps into opportunities that may be less affected by traditional market cycles, contributing to more balanced and resilient portfolios.

Speak to one of our team today

Alternative investments

Alternative assets is the collective name for investment types that are not traditional. Income-generating alternative investments are therefore non-traditional assets that can provide investors with regular income streams and these investments can offer higher yields compared to traditional assets.

So if ‘traditional’ means equities, cash and bonds, and direct property, then ‘alternate’ means anything that is not those so the list can be quite extensive.

For the purpose of this article, we have taken two of the more commonly-known alternative real estate investments options – private equity and private debt.

1. Private real estate equity investments

Private equity real estate investments generally involve raising capital from institutional investors, high-net-worth individuals, or private equity firms to acquire, develop, manage, or reposition real estate assets within a private equity fund. These assets can include residential properties, commercial buildings, office spaces, retail shopping centres and industrial facilities. Income to investors are in the form of rental, or other, income from the real estate assets. When the fund realises gains from property sales or refinances, the profits are also distributed to investors.

Whilst a private equity real estate fund appears similar to a real estate investment trust (REIT), the liquidity aspect is one of the key differences that set these two investment vehicles apart. REIT investments are highly liquid because they are publicly traded on major stock exchanges. Private equity real estate funds on the other hand have a much longer investment horizon, often requiring the contributions to be held for several years.

2. Private real estate debt investments

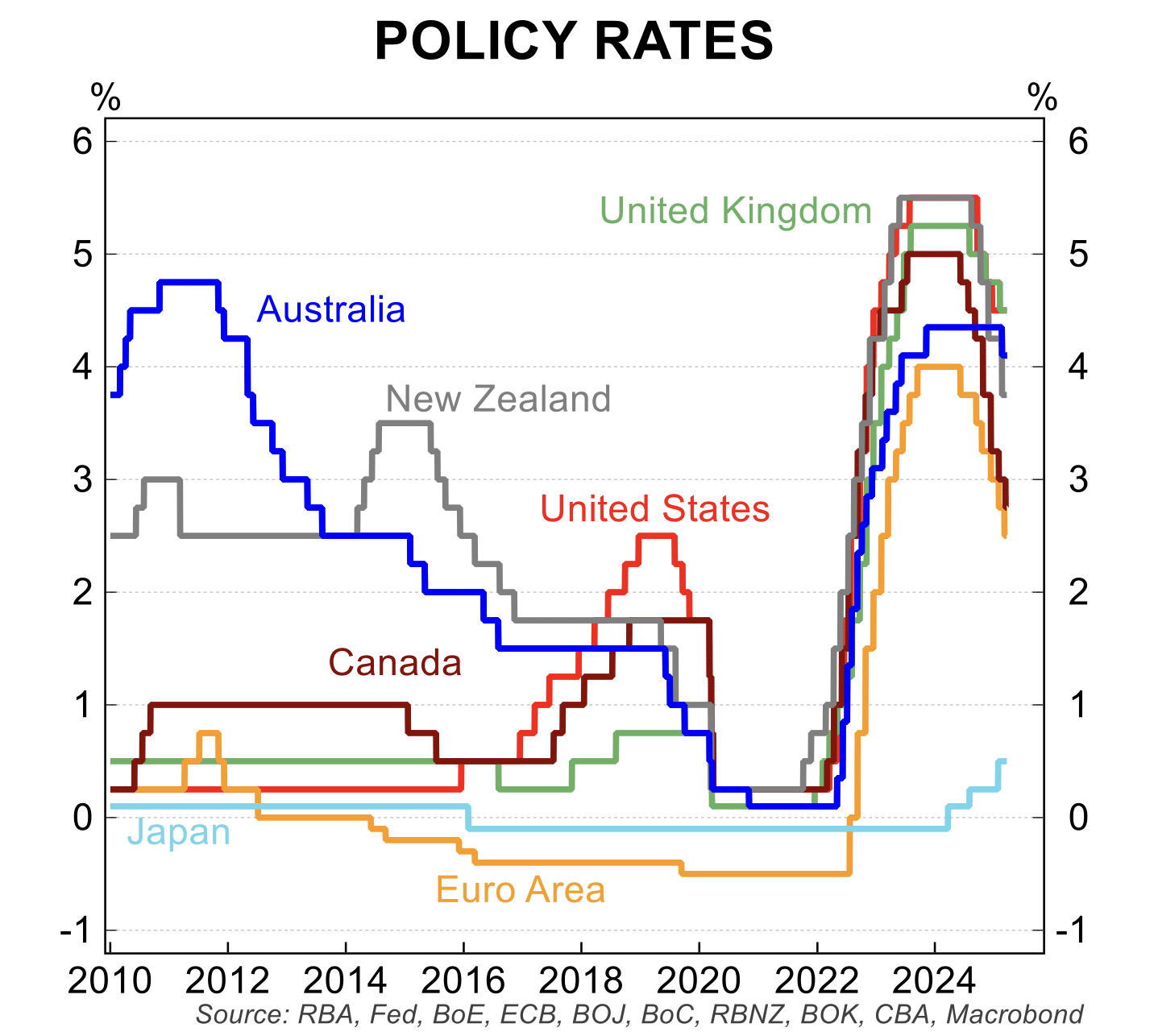

Private real estate debt (also known as private real estate credit) is a subset of the broader private debt asset class and is experiencing strong growth globally. An investment in private real estate debt is the provision of a loan to a borrower with the principal security being a mortgage over that borrower’s real estate asset. The interest payments made by borrowers through the life of the loan are passed on to the investors in the form of monthly distributions, offering a steady cash flow for the investors. This income predictability can make private real estate debt an attractive fixed-income style, alternative real estate investment option for investors seeking capital preservation and a hedge against inflation.

Commercial real estate debt (CRED), is a subset of private real estate debt and is essentially a form of financing property loans intended for commercial use, such as land acquisition, construction and development, as well as funding completed development property that has not yet fully sold.

Arguably the biggest advantage of commercial real estate debt over commercial real estate equity is security. In a CRED transaction, all underlying loans are secured by real property asset (for example, the development site, commercial building, residential apartment block or warehouse). This helps to manage risk.

Compared to commercial real estate equity (be it through Real Estate Investment Trusts, private equity funds or direct ownership), CRED ranks higher in the capital structure and is secured by the real property mortgage security. As such, debt investments sit lower on the risk-return scale than compared to equities. This is because debt investors take priority over equity investors in the event of the loan defaulting.

First-mortgage secured debt has first security ranking over property, meaning it gets repaid first from the sale of the asset. However, equity – meaning property ownership and the most traditional form of real estate investing – is repaid last after all debt investments.

Read more about private real estate debt and how it can be a powerful tool for income-focussed investors.

Some things to consider

1. Risk tolerance and investment horizon:

As with any investment, there is a level of risk. Investors must determine their risk appetite; generally, higher risk is associated with the potential for higher returns but also with a greater risk of capital loss, while lower risk typically corresponds to lower returns. Each investor should conduct their own risk-return analysis to decide which investment option, whether traditional or alternative, best suits their specific needs.

Investors must also carefully consider various aspects of alternative investments, including the level of risk in relation to the expected returns, the investment horizon, and the presence of security or recourse in the case of stressed or distressed situations. It’s crucial to ensure that these factors align with the investor’s requirements.

2. Balancing income generation with capital preservation:

As with ANY investment, there is ALWAYS downside risk.

Striking a balance between risk and return, and income and capital preservation is crucial. High-yield investments may promise attractive income, but they could also expose you to higher risks.

In this regard, private real estate debt – specifically commercial real estate debt – presents a compelling option for income-focussed investors given its unique characteristics. Its equities-like returns, coupled with debt-security can offer diversification benefits and compelling relative value. It can provide investors with a reliable income stream adjusted for inflation.

More importantly, private real estate debt also offers the opportunity for capital protection via secure lending structures attached to the underlying investment, often being a first-ranking mortgage over the security property.

3. Analysing historical performance and investment manager experience

Private real estate debt loans – especially in the commercial real estate sector – are idiosyncratic in nature and require thorough due diligence and structuring of risk management prior to investment. This specialist alternative asset class requires intensive asset management and risk management. Selection of a highly competent investment manager with proven track record is therefore of utmost importance when investors do their product due diligence.

Under the management of an experienced Investment Manager with multi-cycle experience, investors can more effectively mitigate the risk of loss of interest income – which can occur when the borrower is unable to pay loan interest and fees on the loan transaction, as well as loss of investment capital – which can occur when the sale proceeds (in the event of loan recovery or enforcement) are insufficient to cover the loan amount.

Zagga’s investment team leverages its extensive experience and local know-how to originate unique loan opportunities not available from other managers. Our experience and track record in investing through multiple cycles, and our proven expertise in managing through stressed and distressed situations has been the underlying factor underpinning our ‘$0-loss to investors’ since inception of our organisation.

By having a more thorough understanding of the diverse range of income-generating investments, considering your risk tolerance and investment horizon, and selecting only the most experienced and credible investment manager with a track record, investors can be better placed to consider including income-generating investment options in their portfolios.

Generally speaking, an investor wants to achieve capital preservation as a minimum; a return on their capital as a preference; and capital appreciation as the best case. In order to achieve this, an investor often needs to look to diversify beyond traditional asset classes.

So, depending on your own specific investment objectives, including non-traditional, or alternative assets, in your portfolio, may help you achieve those key objectives.

Speak to one of our team today to learn more about our commercial real estate debt opportunities.