In what could turn out to be an unwelcome tension in the economy, the weak economy continues to underpin a lift in the unemployment rate, while the pace at which the rate of inflation is falling is slower than the RBA would like.

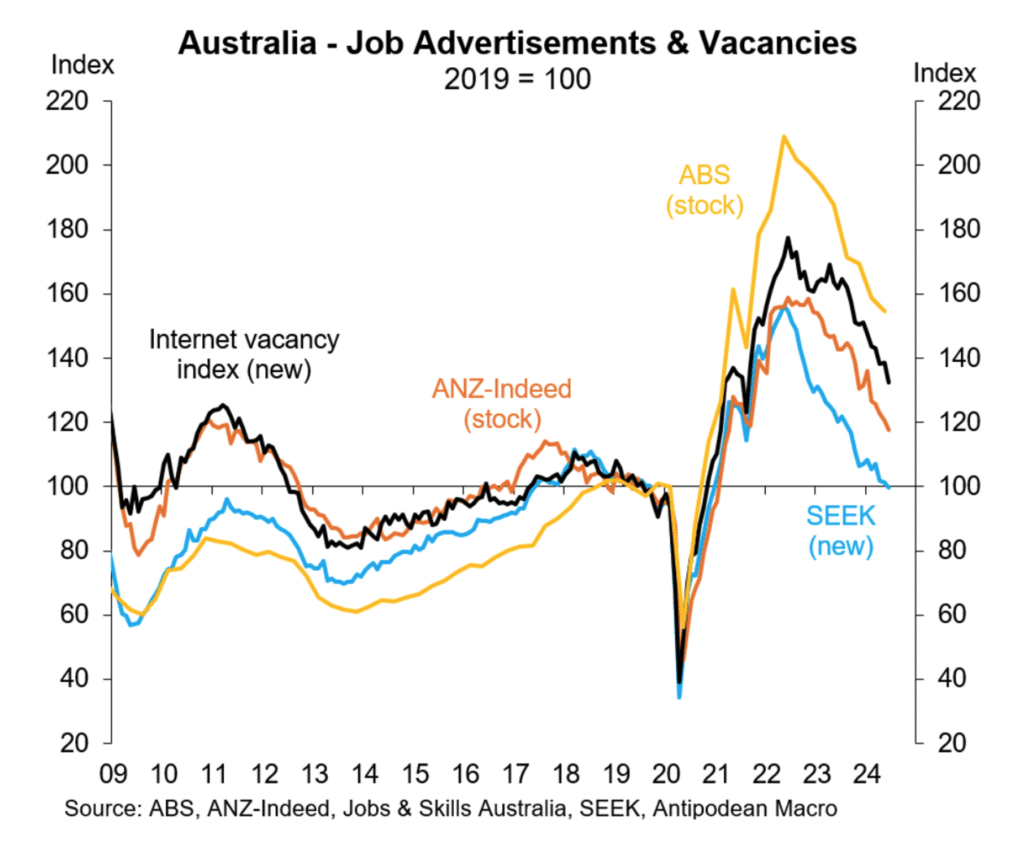

The unemployment rate rose to 4.2 per cent in July, up from the multi-decade low of 3.5 per cent in mid-2023. Based on the weakness of the job advertisements and vacancies data, further increases in unemployment are highly likely over the remainder of 2024.

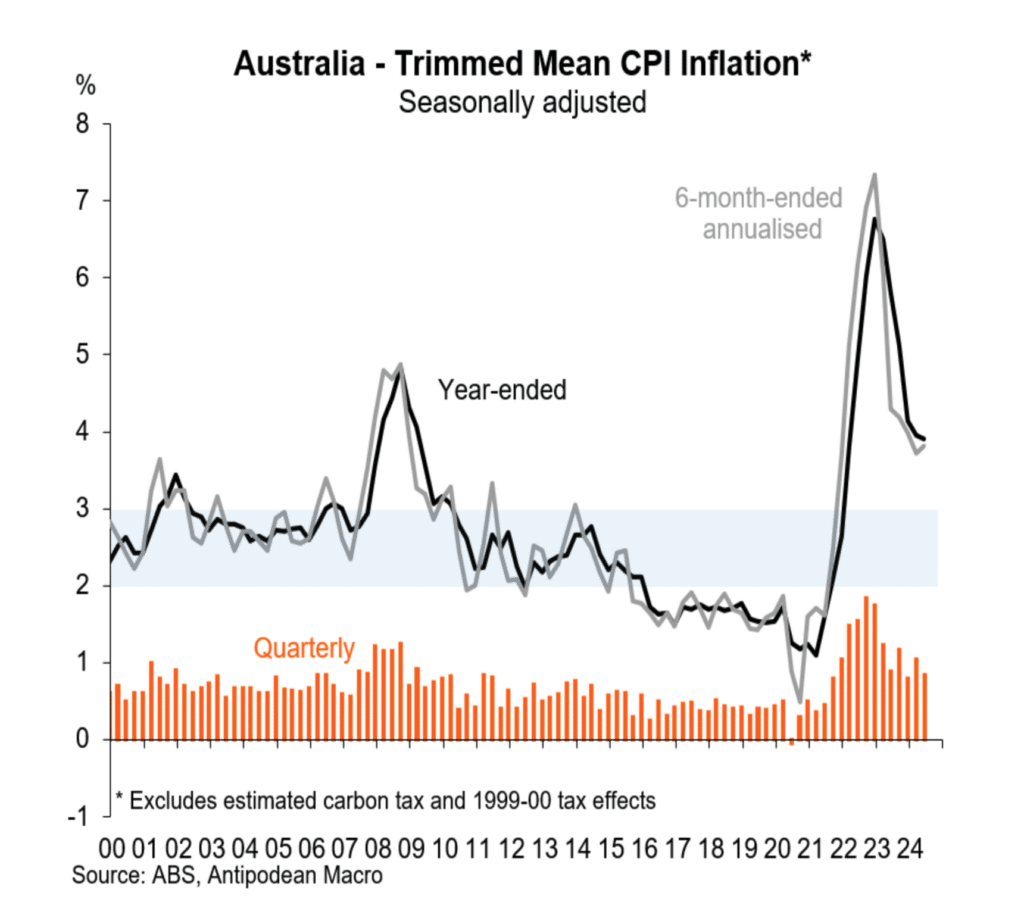

At the same time, inflation edged higher in the June quarter, rising 1.0 per cent and by 3.8 per cent through the year which was much as expected by the RBA. The trimmed mean or underlying inflation measure rose 0.8 per cent in the quarter which was below expectations and an encouraging sign that inflation pressures are easing.

That said, inflation is still too high for the RBA’s liking. RBA Governor Michele Bullock said that despite the weak economy, rising unemployment and the global trend among other central banks to cut interest rates, the RBA is not considering interest rate cuts and if anything, will hike interest rates further if future inflation data remain too high and as a result, slow to return to the 2 to 3 per cent target band. Money market investors largely ignored this guidance from the RBA and continue to price in a series of interest rate cuts over the next 18 months.

The broader economic weakness was confirmed in a range of other news.

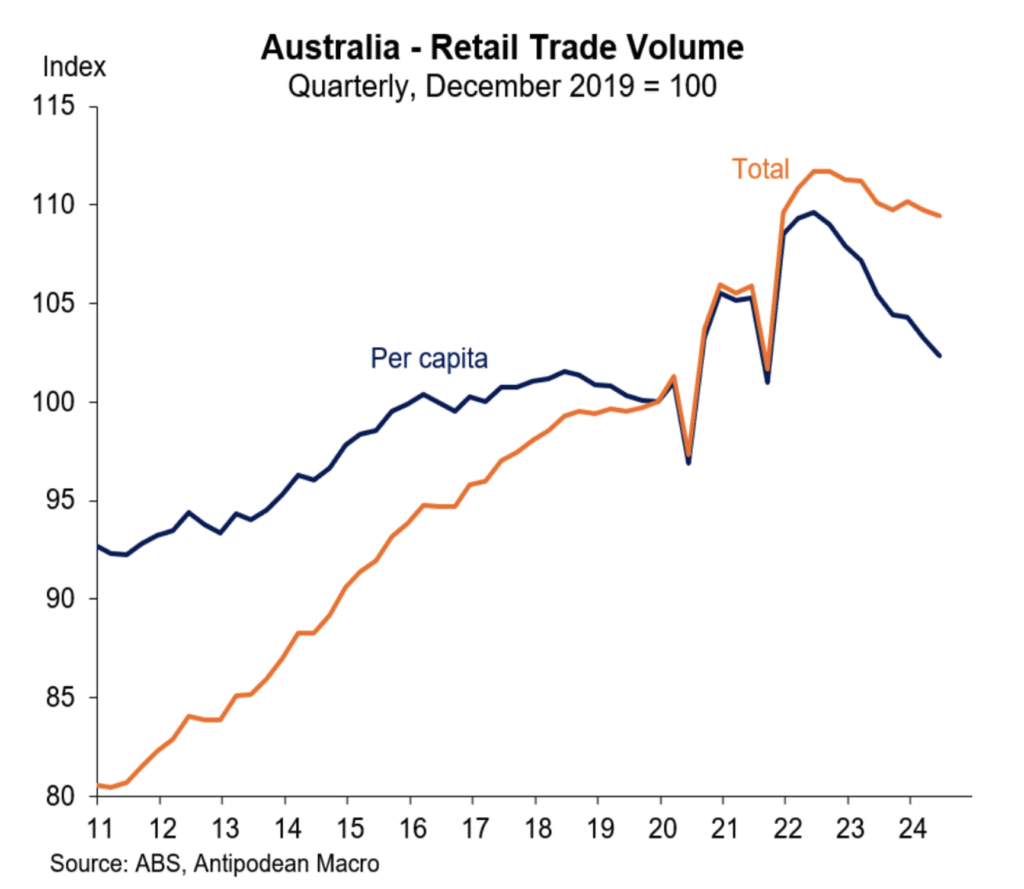

In real terms, retail sales fell 0.3 per cent in the June quarter to register five consecutive falls. This is unprecedented in the last 50 years. Consumers are hunkering down in reaction to cost of living and cash flow pressures sparked by the tight monetary conditions in place. The weakening in the labour market is also likely to impact consumer spending in the near term.

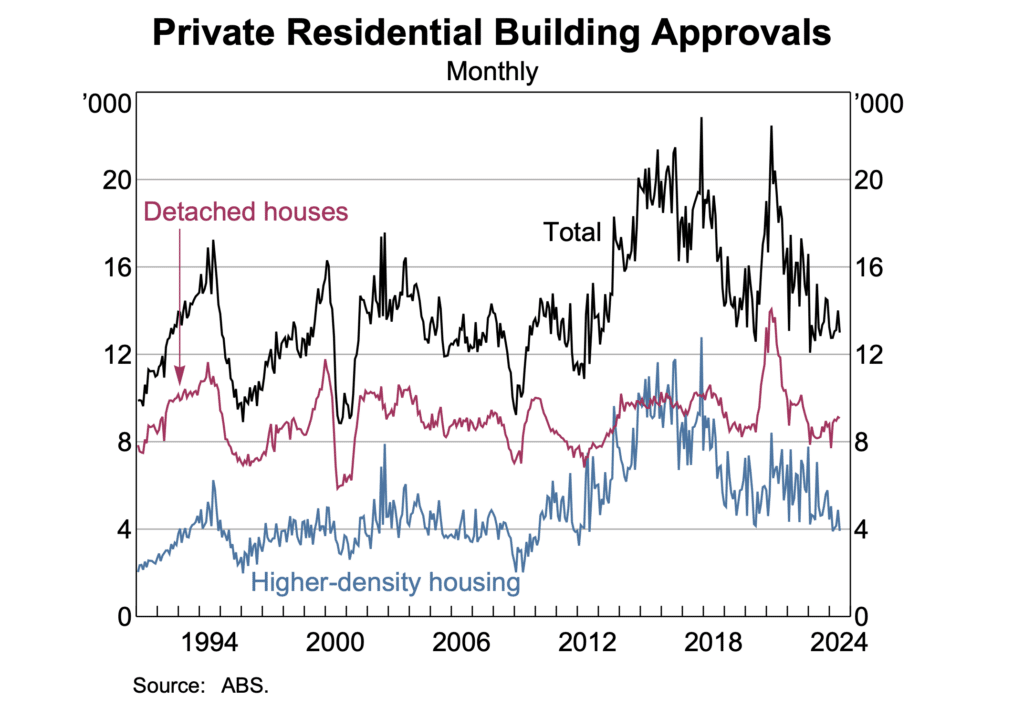

Residential building approvals dropped 6.5 per cent in June after a rise in May confirming that the number of approvals remains around an 11 year low. As has been the case for more than a year, the number of new dwellings coming on to the market remains well below the requirement being driven by population growth.

Consumer sentiment remains weak despite the payment of income tax cuts and the electricity subsidy which took effect on 1 July 2024. Weak sentiment is usually associated with low growth is household spending. Business confidence is fragile and risks undermining what is already a weak outlook for the economy.

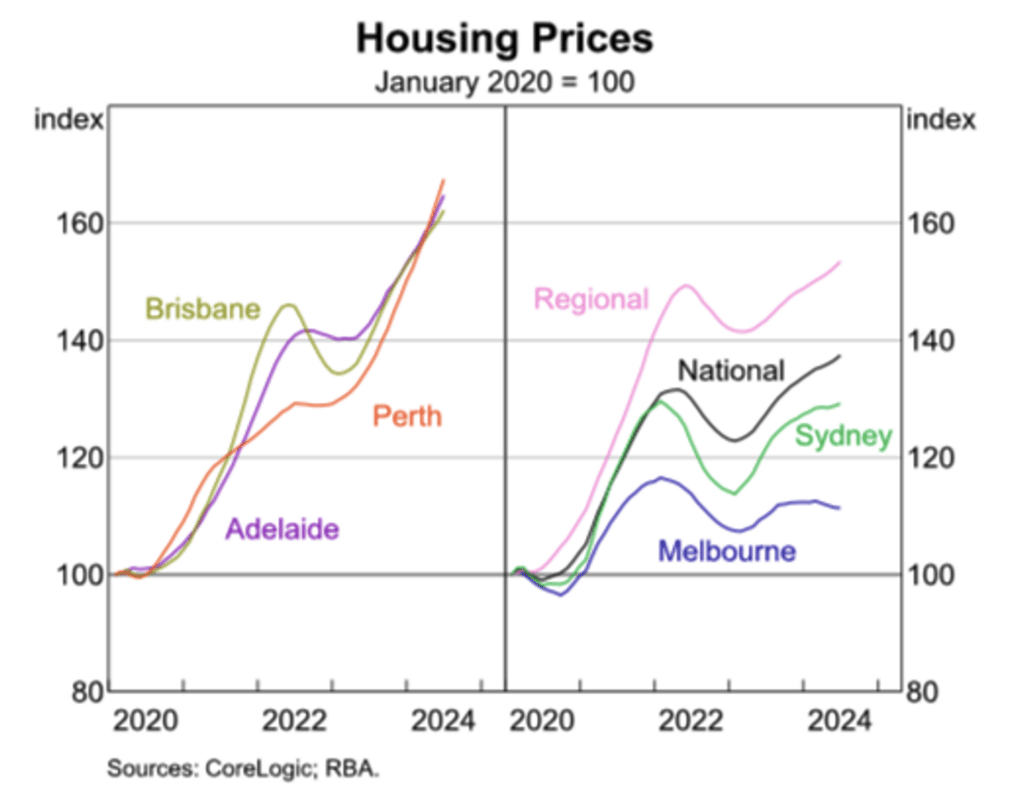

House price growth is continuing to slow, even though there is an extreme divergence between price trends from city to city.

Nationwide house prices continue to rise at around 0.5 per cent per month with annual growth easing to around 7.5 per cent.

Over the year to July 2024, Perth dwelling prices are up a boom-like 24.7 per cent, they are up 16.0 per cent in Brisbane, 15.5 per cent in Adelaide and have slowed to just 5.6 in Sydney. In contrast, prices in annual terms are up just 2.3 per cent in Darwin, 1.7 per cent in Canberra and 0.2 per cent in Melbourne while prices are down 1.2 per cent in Hobart.

Despite the hawkish rhetoric from the RBA, money markets are pricing in zero chance of an interest rate hike in the months ahead. Rather, there is about a 85 per cent chance of a 25 basis point cut by end 2024, with a further two to three 25 basis points of cuts during 2025. Investors are placing a greater weight on the slowdown being a trigger for inflation falling more rapidly than the RBA is forecasting.

The 3 year government bond yield, which is a good proxy for medium term interest rate expectations, is trading around 3.50 per cent, approximately 85 basis points below the official cash rate of 4.35 per cent.

The global interest rates cutting cycle is gathering more countries, with cuts delivered in the Eurozone, China, Canada, the UK and New Zealand with cuts priced into the US in the months ahead.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.