The past month was dominated by news of weaker economic growth, a still fragile labour market and an upward blip in inflation.

There was no surprise when RBA left interest rates steady at 4.35 per cent after its June meeting, meaning there has been no policy change since the last rate hike in November 2023.

In announcing the unchanged stance for monetary policy, RBA Governor Michele Bullock reiterated her current assessment that nothing could be ruled in or out when it came to the outlook for monetary policy – which means that the data flow on inflation, growth, the international economy and unemployment will determine the timing and direction of the next move in interest rates.

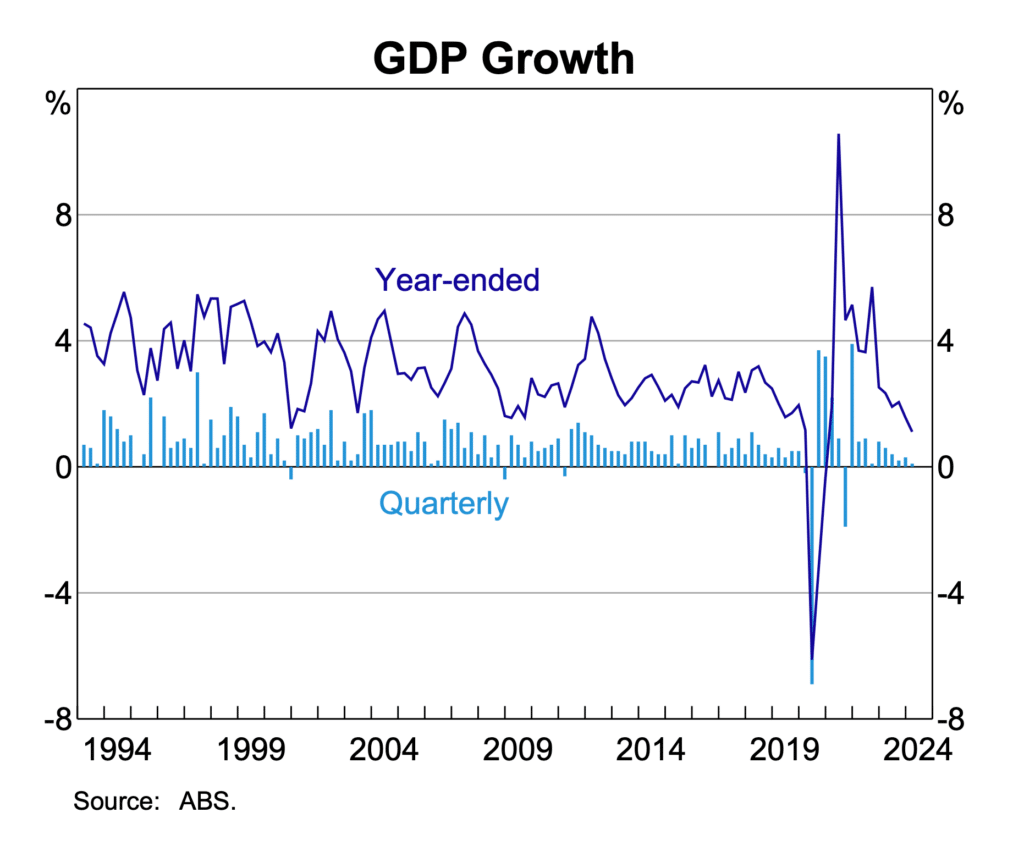

The March quarter national accounts confirmed GDP grew by a tepid 0.1 per cent following growth of just 0.3 and 0.2 per cent in the previous two quarters. Annual growth in GDP eased to 1.1 per cent, the weakest rate of growth in three decades outside the period of the 2020-2022 pandemic lockdowns. Growth is weaker than the RBA was forecasting in its May Statement on Monetary Policy and the composition of growth points to ongoing weakness for the next few quarters – at least.

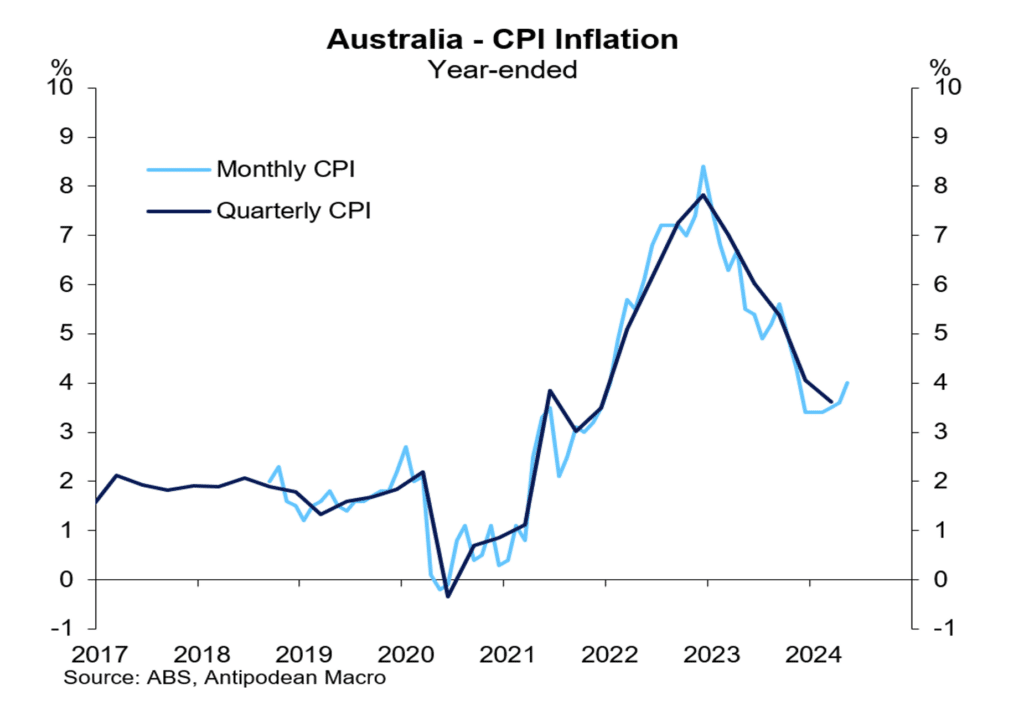

Annual inflation rate for May was higher than expected, at 4.0 per cent, driven by higher prices for tobacco, petrol, holiday travel, rent and insurance.

It has rekindled talk of an interest rate increase from the RBA. There are reasons to expect lower inflation in coming months – base effects of high inflation a year ago will soon drop out and it is inevitable that weaker GDP growth and a weaker labour market will drive inflation lower.

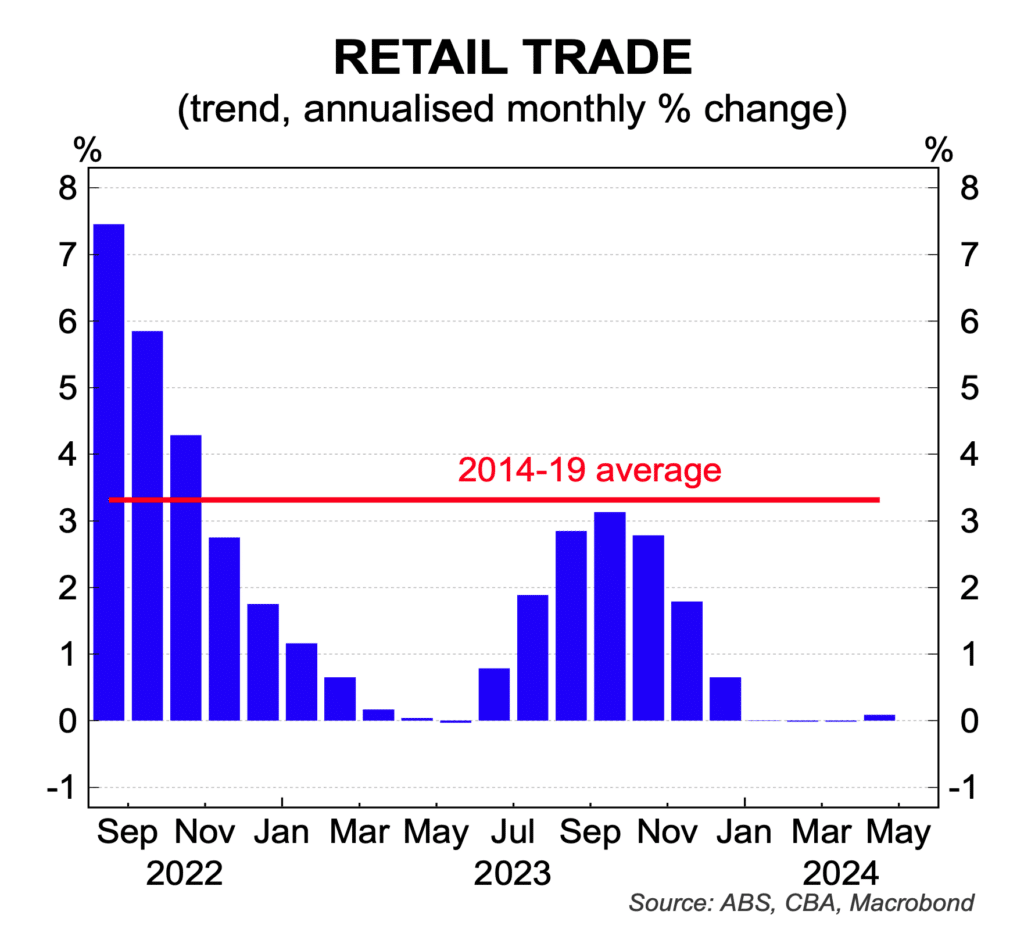

Other economic data were weak. Retail sales rose just 0.1 per cent in April and remain flat in trend nominal terms. In real per capita terms, retail spending is down a worrying 6 per cent over the past two years. Consumer sentiment remains very weak as cost of living pressures and higher mortgage interest rates impact spend. Card data from the major banks point to further weakness in spending through to June.

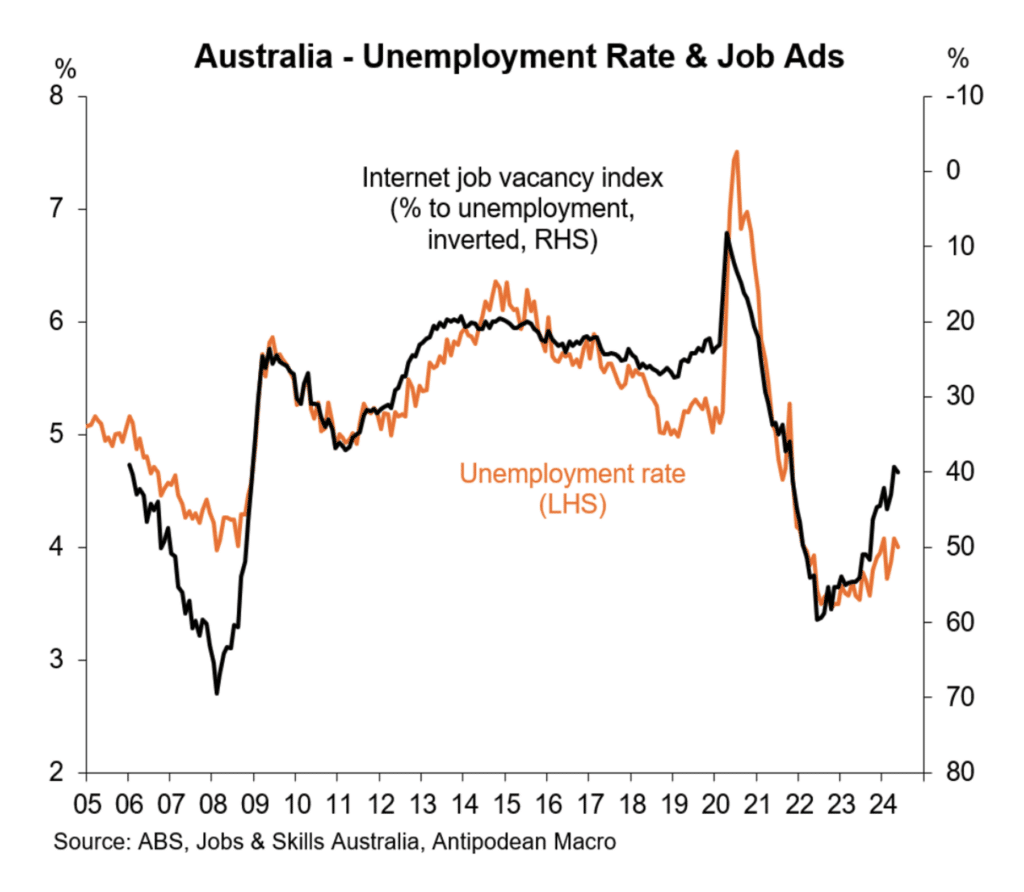

Labour market conditions continue to reflect the broader economic weakness with the rise in employment marginally below the pace of population growth. As a result, the unemployment rate is rising and in recent months it has hovered around 4 per cent compared with a recent low of 3.5 per cent in 2023. Labour demand indicators, job vacancies and advertisements continue to point to yet higher unemployment over the medium term. year. If the correlation between job advertisements and the unemployment rate remains in place, the unemployment rate will rise towards 5 per cent in the next 6 to 12 months.

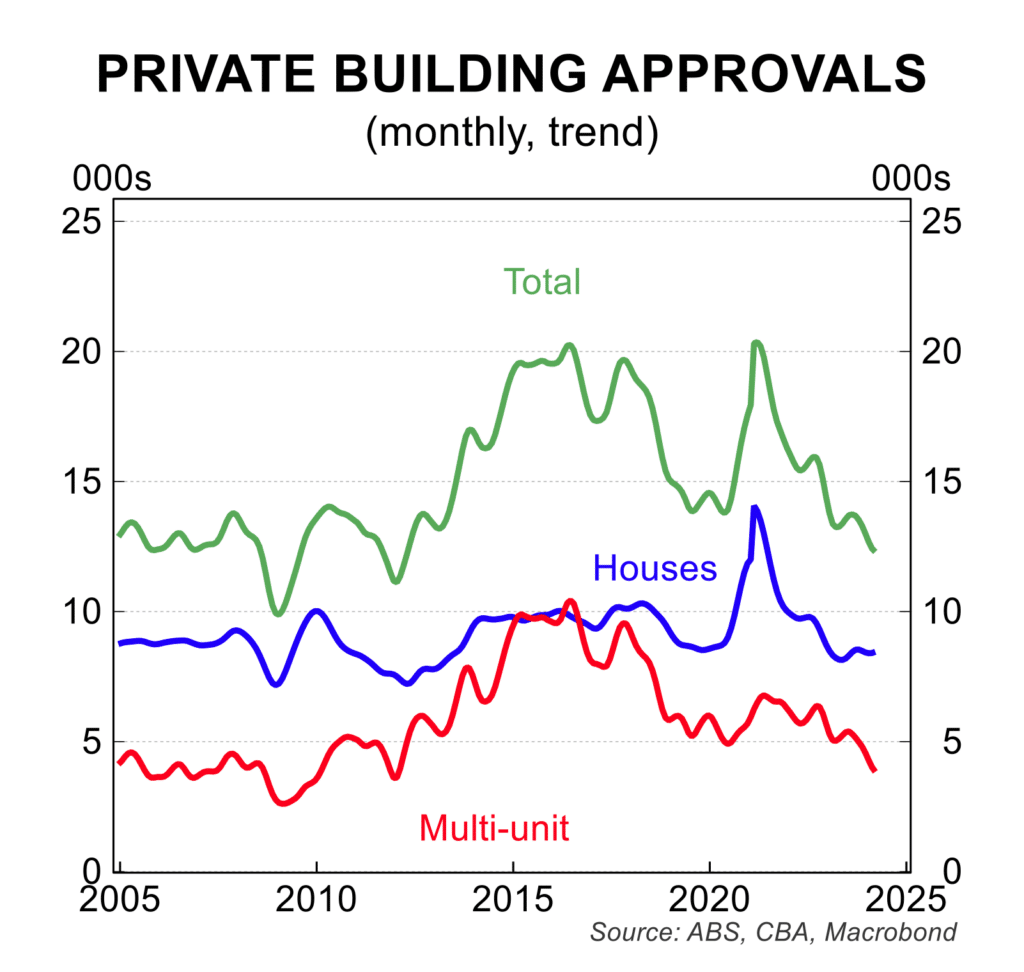

Dwelling approvals remain weak with the level of activity remaining near decade lows.

There are reports that a significant number of building companies are still grappling with cost pressures, including higher interest costs, and that this is holding back a genuine recovery in dwelling construction activity. The weakness in new dwelling construction is adding to concerns of a housing shortage which is one reason why house prices and rents are still strong.

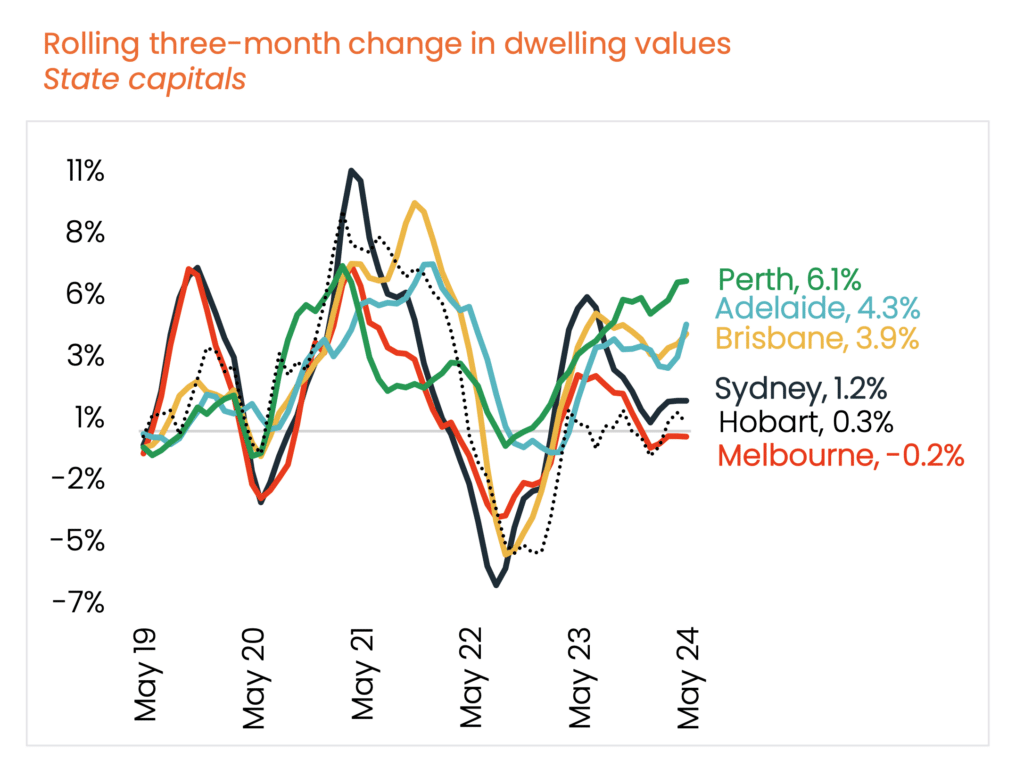

House price growth has picked up in recent months with nationwide prices up 0.8 per cent in May after a 0.6 per cent rise in April.

Based on data from Corelogic, house prices are likely to have risen by 0.7 per cent in June. The shortage of housing relative to demand remains the dominant issue driving prices, despite the early signs of weakness in the labour market. The sharp divergence in price growth from city-to-city remains a dominant issue – in the past year Perth prices are up 22.0 per cent, while prices in Hobart are down 0.1 per cent.

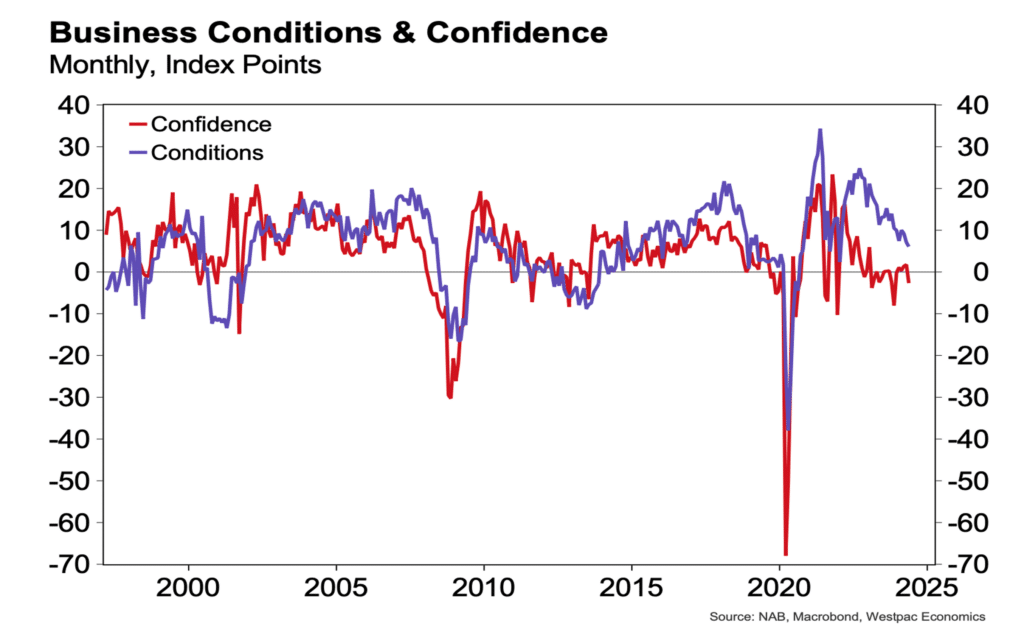

One emerging area of concern for the economy is the slide in business confidence and conditions.

In the middle of 2023, the business sector was resilient with a broadly positive outlook for activity. As the economy has slowed and the interest rate have bitten, the business sector’s optimism is fading. Any further slide in business activity will be a concern for the economic outlook over the second half of 2024.

Market pricing for interest rates remains fickle and volatile. After the May CPI data, the markets swung to price in the risk of an interest rate hike in coming months. Two weeks before that, rate cuts were being considered. Suffice to say, the run of data on unemployment, economic growth, inflation and from overseas will be vital in resolving the interest rate puzzle. It is noteworthy that a number of central banks, including the European Central Bank, Canada, Sweden, Switzerland and Brazil have cuts interest rates and lower interest rates are priced into the markets in the US, UK and New Zealand.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.