Invest Securely

Earn attractive, determinable returns through funding quality loans

– secured by Australian property

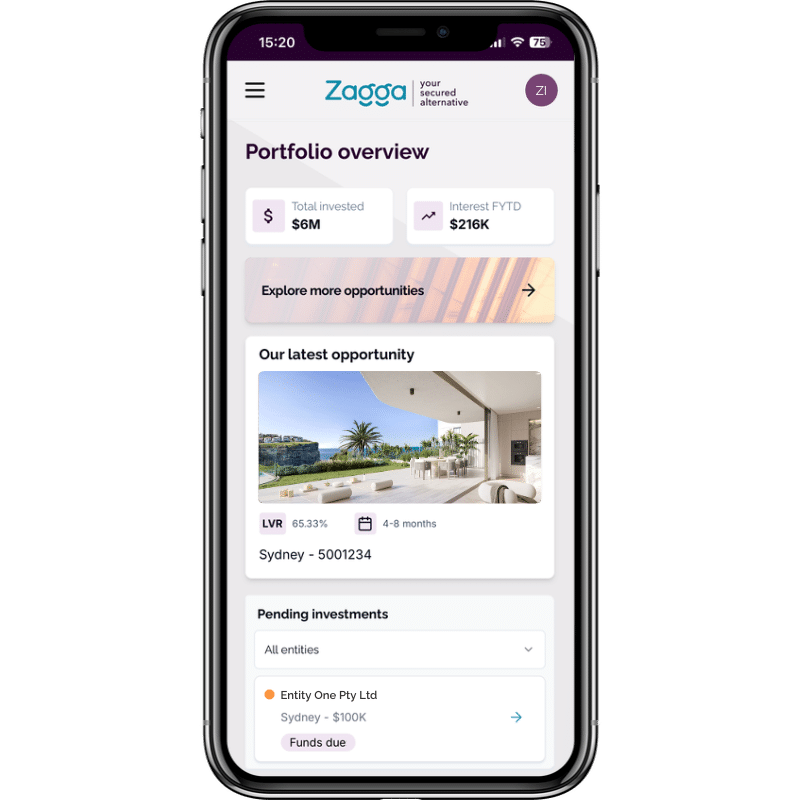

Invest in Commercial Real Estate Debt

Via our proprietary, purpose-built platform, wholesale investors can invest in Commercial Real Estate Debt, (CRED) which has traditionally been the preserve of the banks.

Every investment is 100% secured by a registered first mortgage over Australian real estate.

Investors select the loan term, yield and risk metrics that meet their investment objectives and appetite.

Portfolio diversification

Investing across different asset classes is the key to building a broadly diversified portfolio.

Capital preservation

First mortgage security and capped LVR provides repayment priority and ‘equity buffer’ to mitigate against loss of capital.

Determinable income

Receive regular cashflow for the duration of the loan term.

Attractive returns with your choice of risk level

Access this growing alternative asset class that can add that ‘middle ground’ to a well-diversified portfolio, helping you achieve attractive returns without a disproportionate increase in risk.

Explore our funding showcase.

Value vs Growth in uncertain times

This white paper looked at the impact of economic uncertainty on investor behaviour and how it acted as a catalyst to rethink risk and return.

Investing with Zagga

As a boutique alternative investment manager, we pride ourselves in our ability to present high-quality investment opportunities.

We are also highly disciplined in scrutinising every transaction, selecting only those that fit our rigorous risk underwriting models.

Who can invest?

Our investments are open to wholesale investors seeking portfolio diversification opportunities with risk-mitigated, regular and determinable income.

High net worth

individuals

SMSF

family

offices

Investment

managers

financial

institutions

Via a Fund

Directly

Create a more balanced investment portfolio and increase returns by investing in individual loans that meet your risk and return preferences.

Subscribe to our newsletter to learn more about Zagga

Direct or Fund?

Choosing the preferred option really comes down to:

How much time you wish to spend searching for, and looking at, the opportunities

Your investment strategy - do you prefer to target specific transactions, or invest across a diversified range?

Get started in just three easy steps:

Start investing with us

REGISTER

Confirm your investment entities and status as a wholesale investor

INVESTMENT STRATEGY

Choose between investing directly or via one of our Funds

INVEST

Earn regular income and be kept informed on your investment

Why Zagga?

PARTNERSHIP

We treat our borrowers, investors and service providers as business partners in our business.

Every loan transaction is aimed at delivering a commercial, flexible and responsive outcome.

TRUST

We operate with an ‘investor first’ approach and will not compromise credit quality over increased return.

We operate with integrity, transparency and honesty as our core behaviours.

RELATIONSHIP

We intrinsically understand that sustainable business requires long-term relationships.

We inculcate the value of relationships in our team members.