Invest via Fund

Earn attractive returns and portfolio diversification opportunities through investing via one of our discretionary funds.

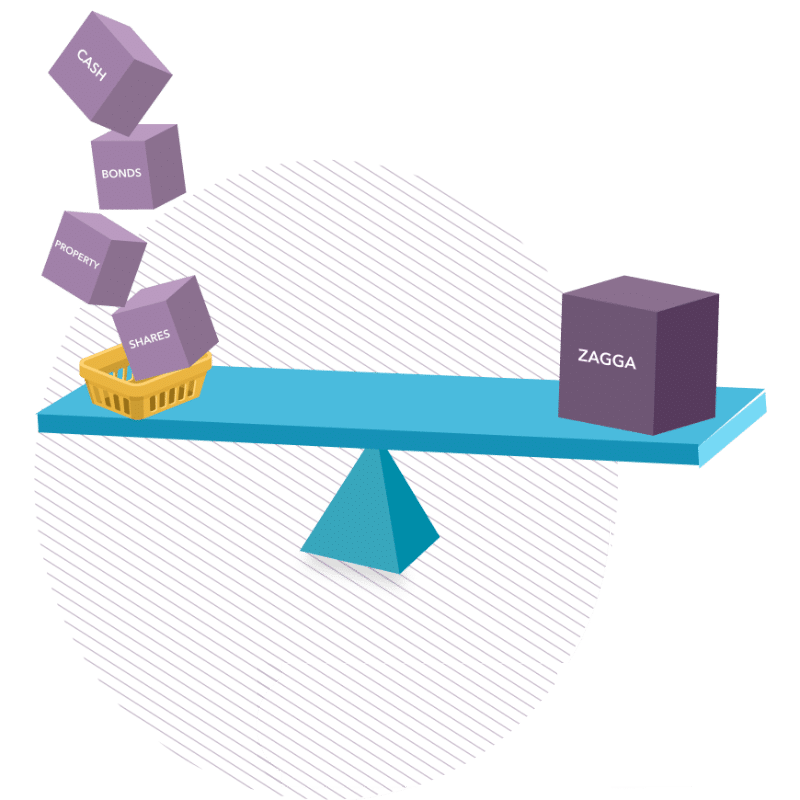

Offering Zagga's CRED property funds as a CREDible investment alternative

Cash and term deposits have always had strong appeal to self-managed super funds (SMSFs). However, to receive the highest return, you’re likely to have to lock up your cash for three to five years.

Via one of Zagga’s investment funds, investors have the option to include a credible investment alternative to their investment portfolio – one that offers a regular, risk-adjusted, fixed-income style of return, fully-secured by quality Australian property.

Introducing the Zagga Funds

Invest in property without buying the bricks and mortar

Investors in a Zagga Fund invest in quality loans to creditworthy borrowers, all first mortgage-secured by

high-quality, Australian property, without the need to personally scrutinise each and every individual loan.

Depending on an investor’s situation and objective, investors can select from one of two Fund types:

Pooled Funds

For investors looking to invest via the security of a lending trust, Zagga’s pooled funds offer investors a fractional ownership interest of the Fund’s interest in the Trust’s underlying assets, proportionate to the investor’s investment in the Fund.

Unitised Fund

For financial advisors looking to increase their clients’ allocation to private debt, the Zagga CRED Fund provides a compelling alternative to earn regular, determinable income.

Zagga launches the Zagga CRED Fund,

offering another CREDible alternative for advisors

The Zagga CRED Fund (ZCF) is a wholesale fund that aims to provide investors with an attractive rate of return and

regular, risk-adjusted income by investing in a specifically curated portfolio of credit-vetted, mortgage-secured loans.

Benefits of investing via a Fund

Simple investment

Invest without the need to personally scrutinise every loan

Portfolio diversification

Natural diversification from the specifically curated mix of loan types, purpose and location

Immediate returns

Your investment funds are generating a return from the day they are invested in a Fund

Highly experienced team

Our team possess deep expertise in credit, property and investment management. We operate with a highly disciplined, investor-first approach

Direct or Fund?

Choosing the preferred option really comes down to: