The RBA cut interest rates following its 18 February Board meeting, trimming official interest rates by 25 basis points to 4.10 per cent.

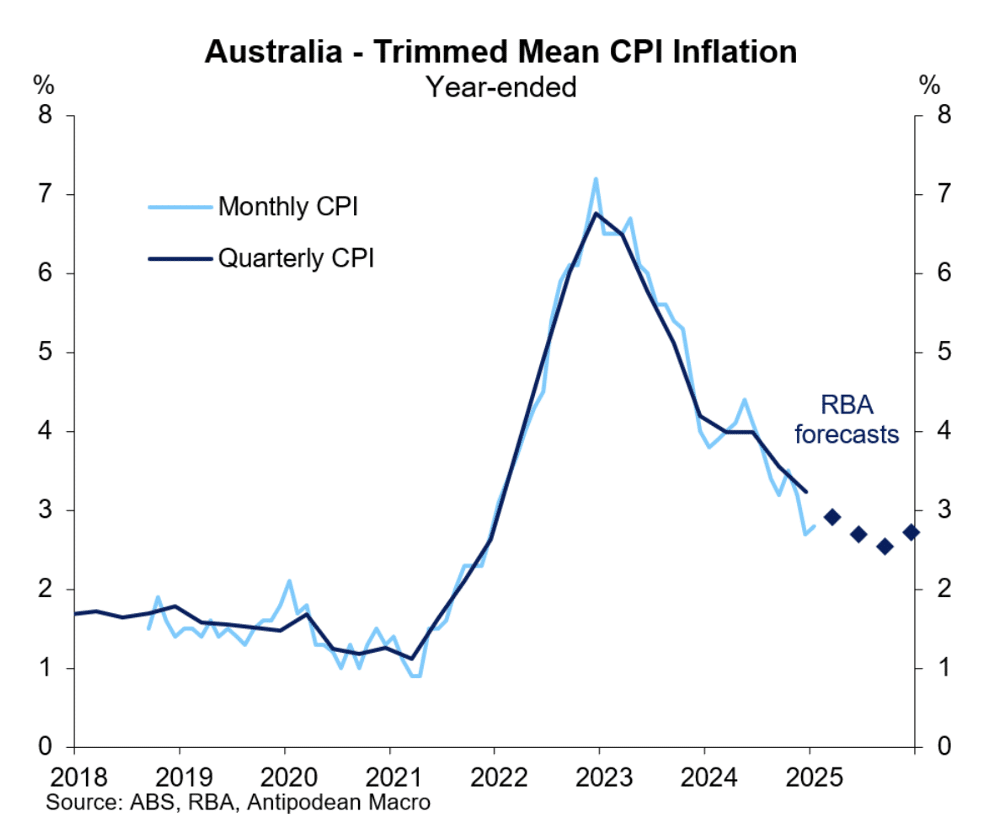

In announcing the rate reduction, the RBA noted progress on lowering inflation towards the 2 to 3 per cent target range as the key issue, adding to signs of ongoing subdued economic growth. The RBA was cautious about signalling further rate cuts, in part due to the on-going strength in the labour market and the possibility that the fall in global inflation so evident in 2024 may be stalling.

Despite the RBA commentary, financial markets are continuing to price in further interest rate cuts with a cash rate of approximately 3.40 per cent factored in by the first half of 2026. Softer economic data out of the US in recent weeks has helped reinforce the market pricing for lower interest rates.

Internationally, it is a rapidly moving feast on US economic and foreign policy changes. The overall effect of these is extremely uncertain, suffice to say it will take time to see the effects. In the mean time, financial markets remain volatile with sharp swings in stock and bond prices with each policy announcement from the Trump administration and responses from other governments.

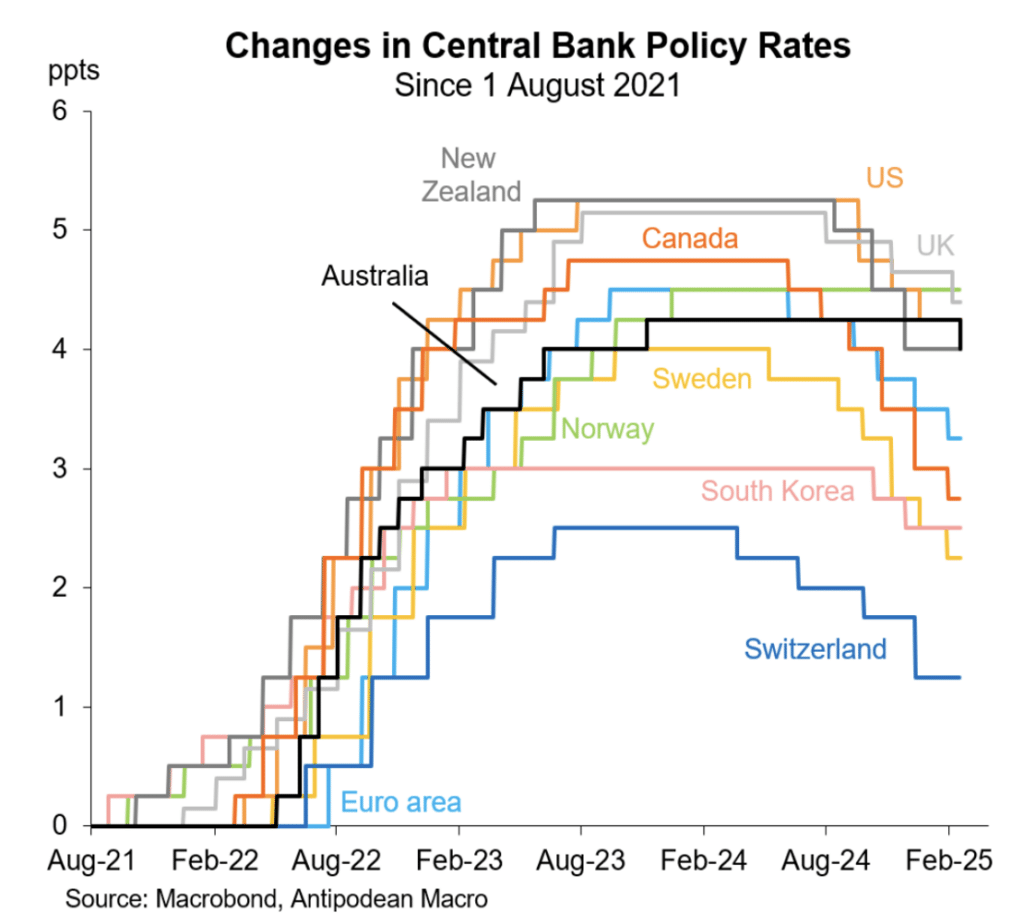

Economic growth is China is starting to respond positively to its policy stimulus while growth in the Eurozone, UK, Canada and New Zealand remains weak. Most major central banks are continuing to cut interest rates, although market pricing for future cuts has been scaled back as monetary policy is moving closer to a neutral stance.

Key data

Below is an update of key trends in the economy:

- There was further good news on inflation with the annual rate steady at 2.5 per cent in January, exactly the middle of the RBA target range. Indeed, annual inflation has been between 2 and 3 per cent for six consecutive months. The trimmed mean or underlying inflation rate was broadly steady at 2.8 per cent in annual terms in January from 2.7 per cent in December. Inflation is currently tracking below the latest RBA forecasts.

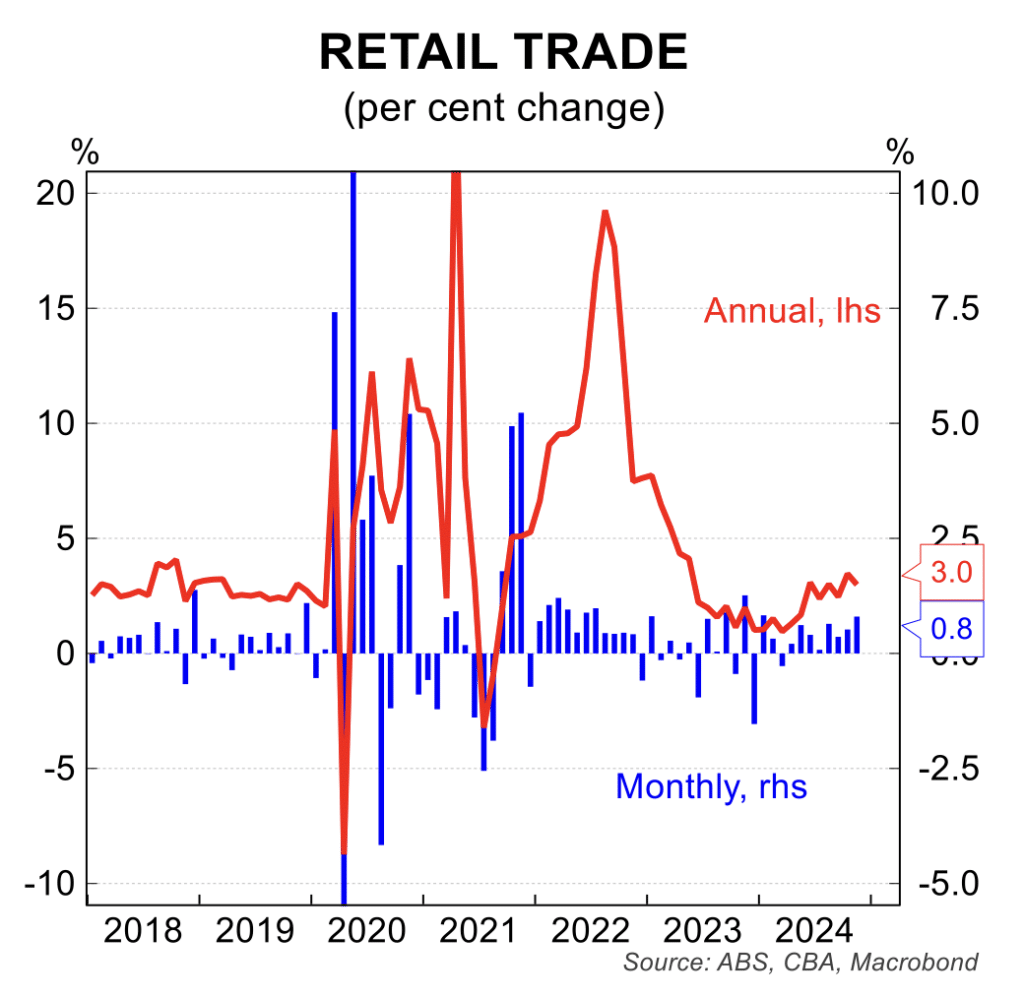

- Retail spending fell 0.1 per cent in December, after rising solidly in the previous two months. The monthly data have been impacted by changing spending patterns associated with Black Friday and Christmas. In real terms, retail sales rose 1.0 per cent in the December quarter, the strongest result in more than two years. Income tax cuts, rising consumer confidence and higher wealth are likely to have been behind the increase.

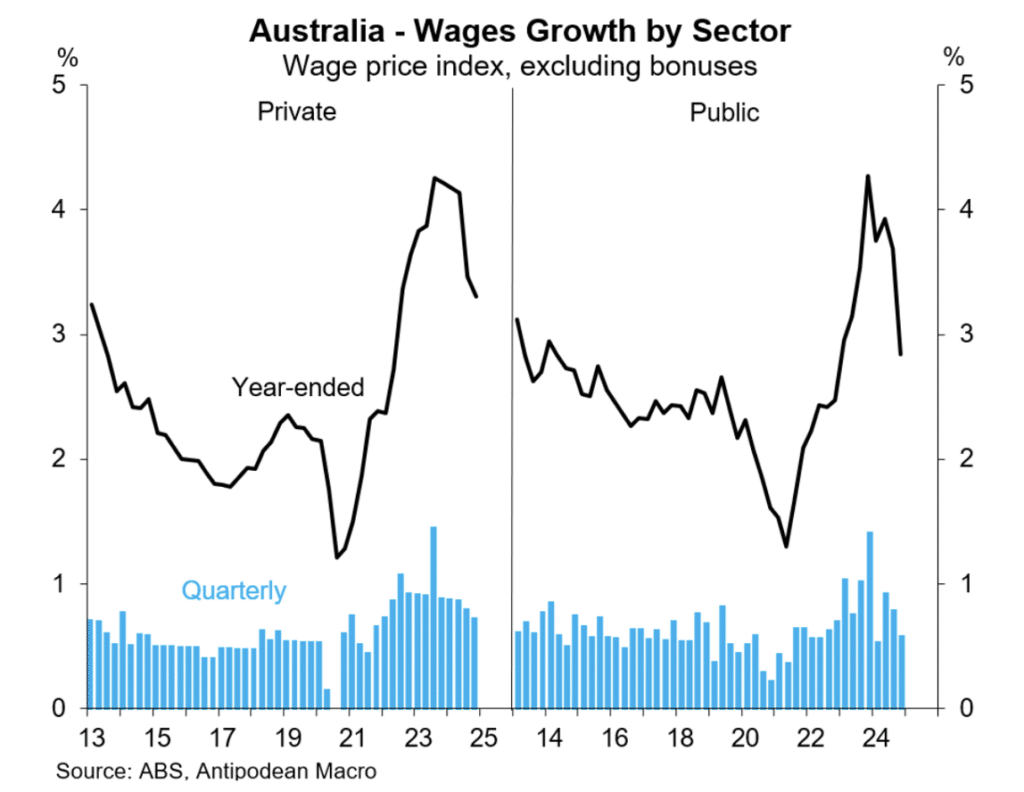

- Wages growth continues to ease with the annual rise in the wage price index cooling to 3.2 per cent in the December quarter 2024, down from 4.2 per cent at the end of 2023. Public sector wages registered a sharper slowing than private sector wages. As the unemployment rates edges higher and the Fair Work Commission scale back future award increases, wages and labour costs are forecast to remain around 3 per cent into 2026.

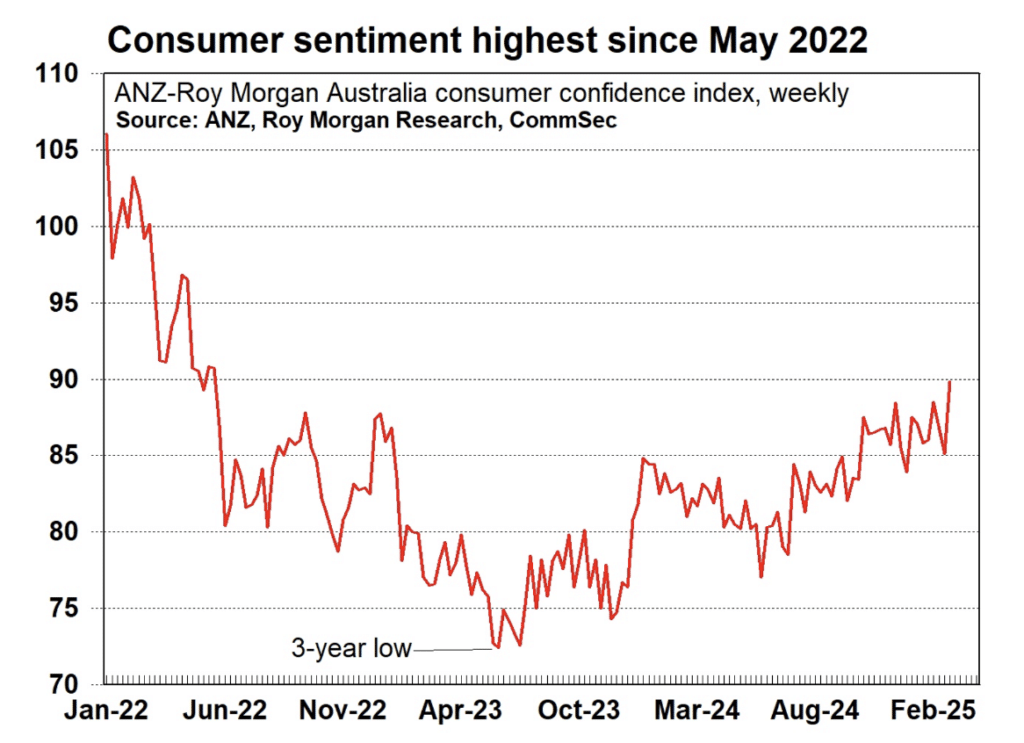

- Consumer sentiment rose 5 per cent in response to the 18 February interest rate cut, rising to a three year high. Consumers have been scaling back their pessimism from the low point in late 2023 which coincided with the last interest rate hike and was near the peak in inflation. Lower inflation and further interest rate cuts are likely to continue to support sentiment.

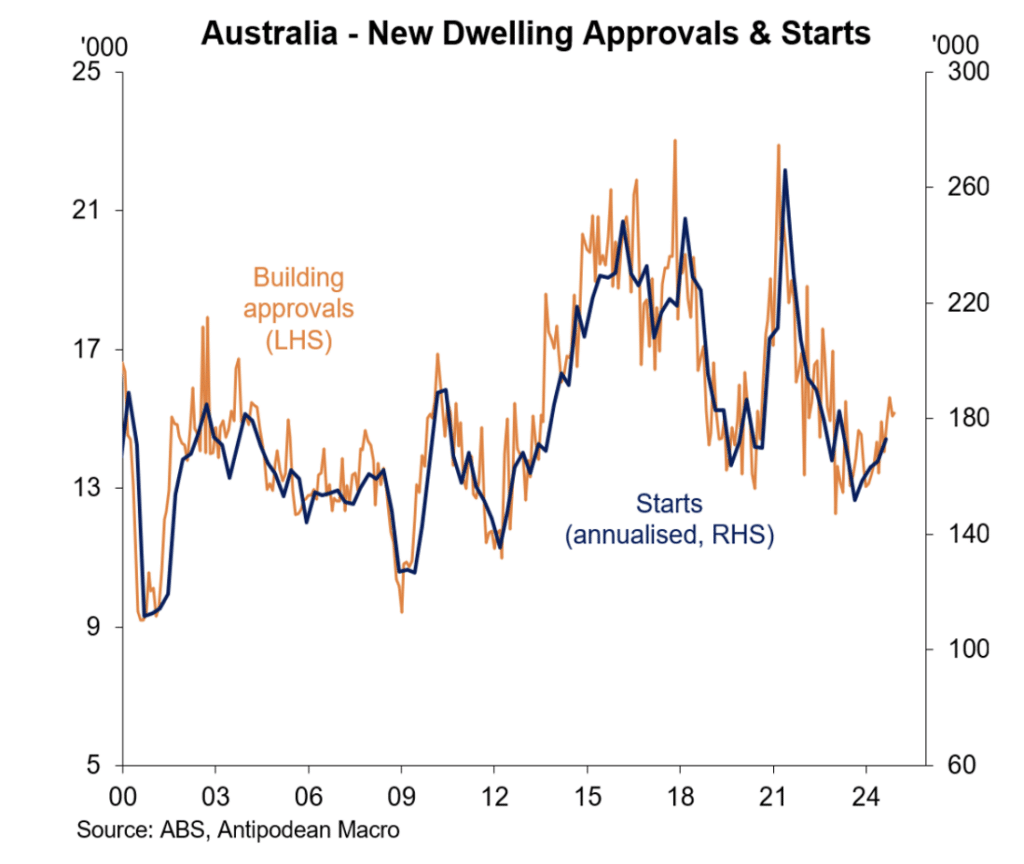

- The recovery in the number of new dwelling building approvals continues to develop, although the speed of the pick up is relatively subdued. To address the housing shortage, a strong and sustained increase in new dwelling construction is essential, with the interest rate cut and a moderation in cost pressures and labour shortages pointing to a further pick up through 2025.

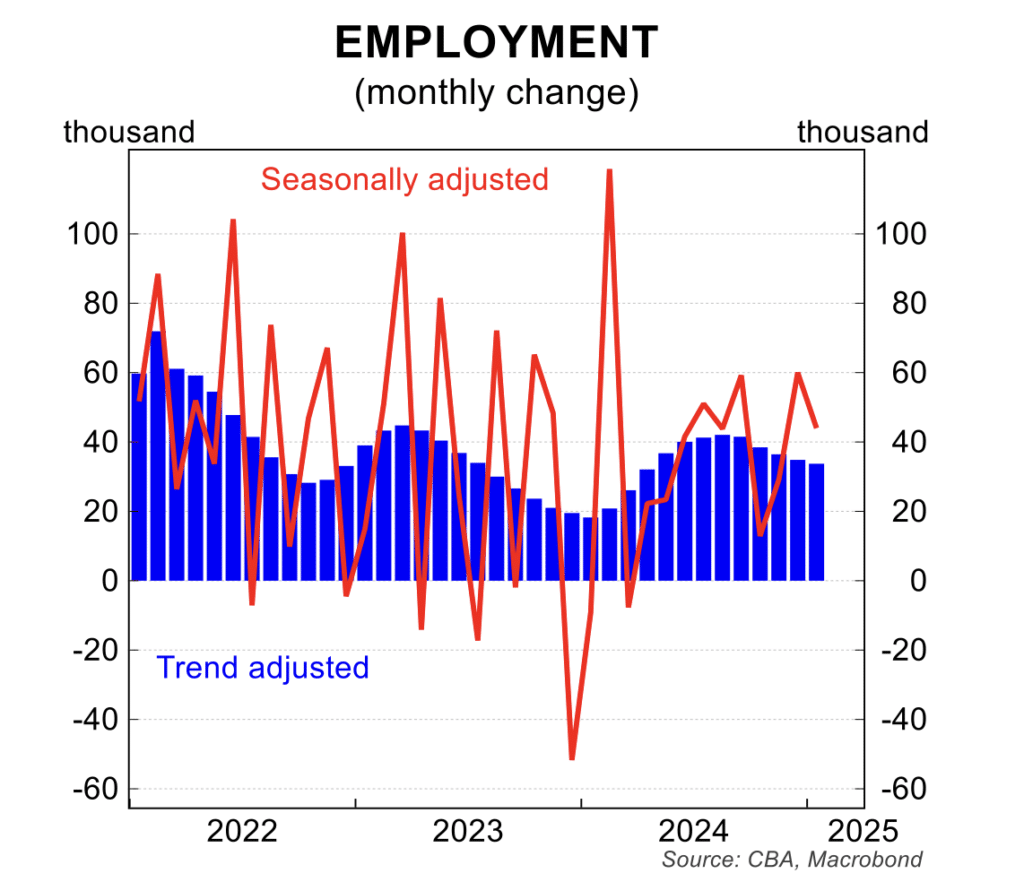

- Despite only moderate economic growth, labour market conditions remain solid with employment expanding and the unemployment rate up only marginally from a 50 year low. In January, employment rose 44,000 which was not enough to prevent the unemployment rate edging up to 4.1 per cent. In trend terms, the rate of employment growth is slowing. The unemployment rate is 0.7 percentage points above the October 2022 low of 3.4 per cent.

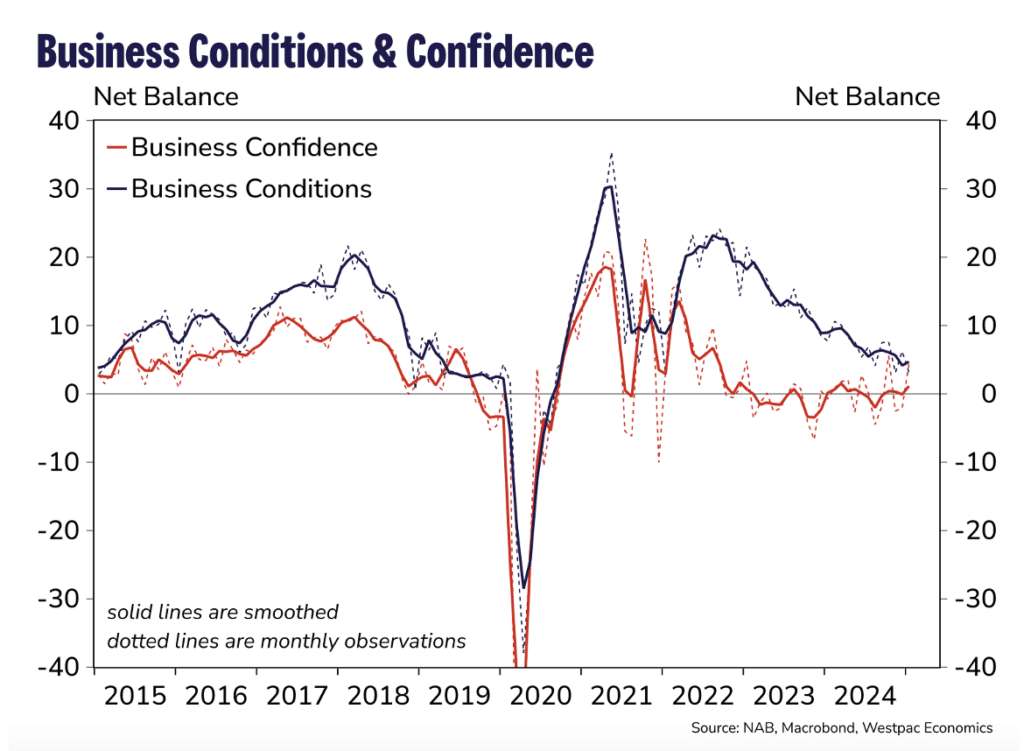

- The business sector continues to exhibit mixed signals with business conditions falling 3 points to +3 points in January. This is below the long run average of +7 points. Trading conditions and profitability fell in January to their lowest levels since 2020, signalling ongoing moderate growth in the business sector.

House prices

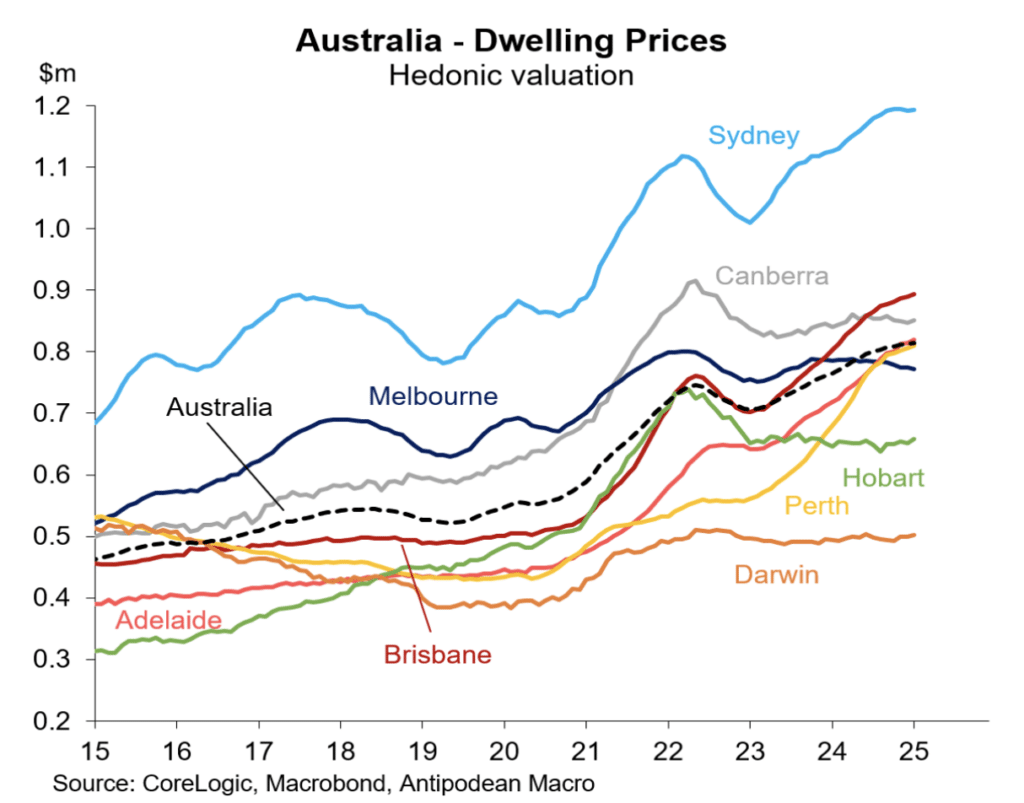

House prices at a national level remain weak. Nationwide prices were flat in January but were 0.3 per cent lower in the three months to January. The longer run structural issues that drive house prices remain at play. Growth in demand is tapering off as immigration inflows return to normal and supply is responding with new listings for sale continuing to rise.

The preliminary data from Corelogic for February is pointing to broadly flat prices.

That said, in the three months to January 2025, prices were weakest in:

- Melbourne -2.0 per cent.

- Sydney -1.4 per cent;

- Hobart -0.8 per cent; and

- Canberra -0.5 per cent.

The cities with resilient house prices in the three months to January 2025 were:

- Adelaide +1.8 per cent;

- Darwin +1.7 per cent;

- Brisbane +1.2%; and

- Perth +1.0 per cent.

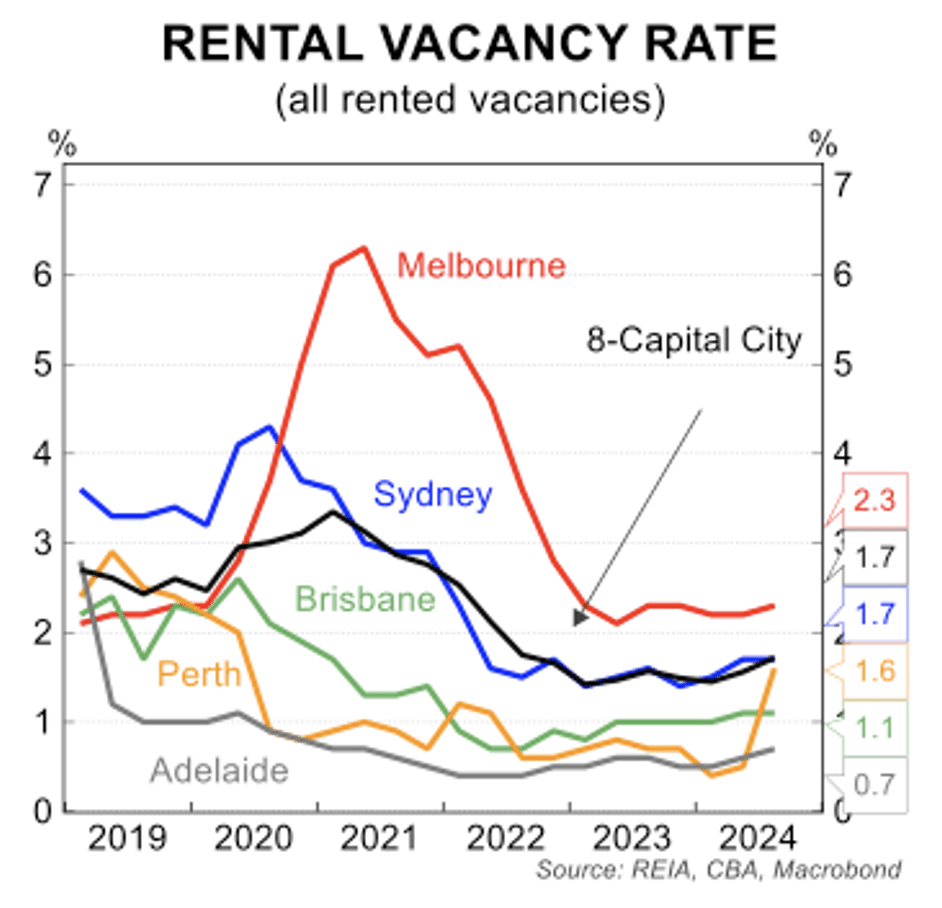

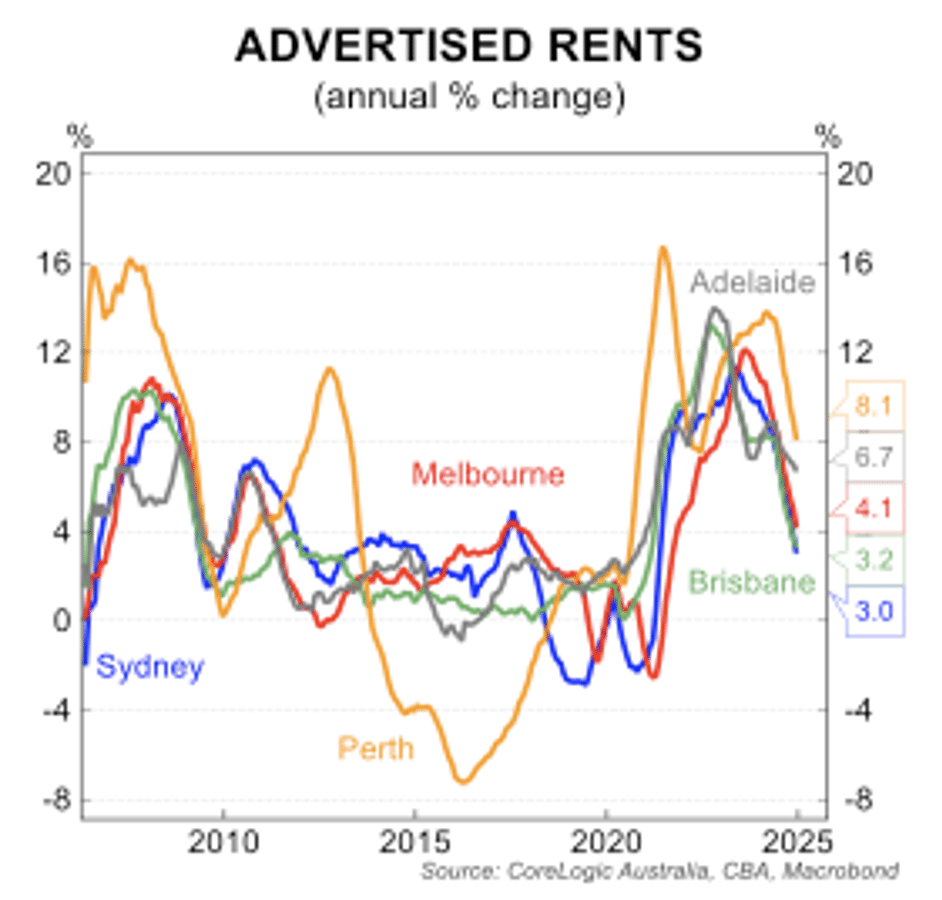

The rental market is also showing clear signs of softer conditions. The rental vacancy rate is trending higher in most cities which is feeding into a marked slowing in the growth of advertised rents. This trend is likely to continue through 2025 which is likely dampen investor demand.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.