RBA starts an interest rate cutting cycle as disruptive US policy changes are rolled out

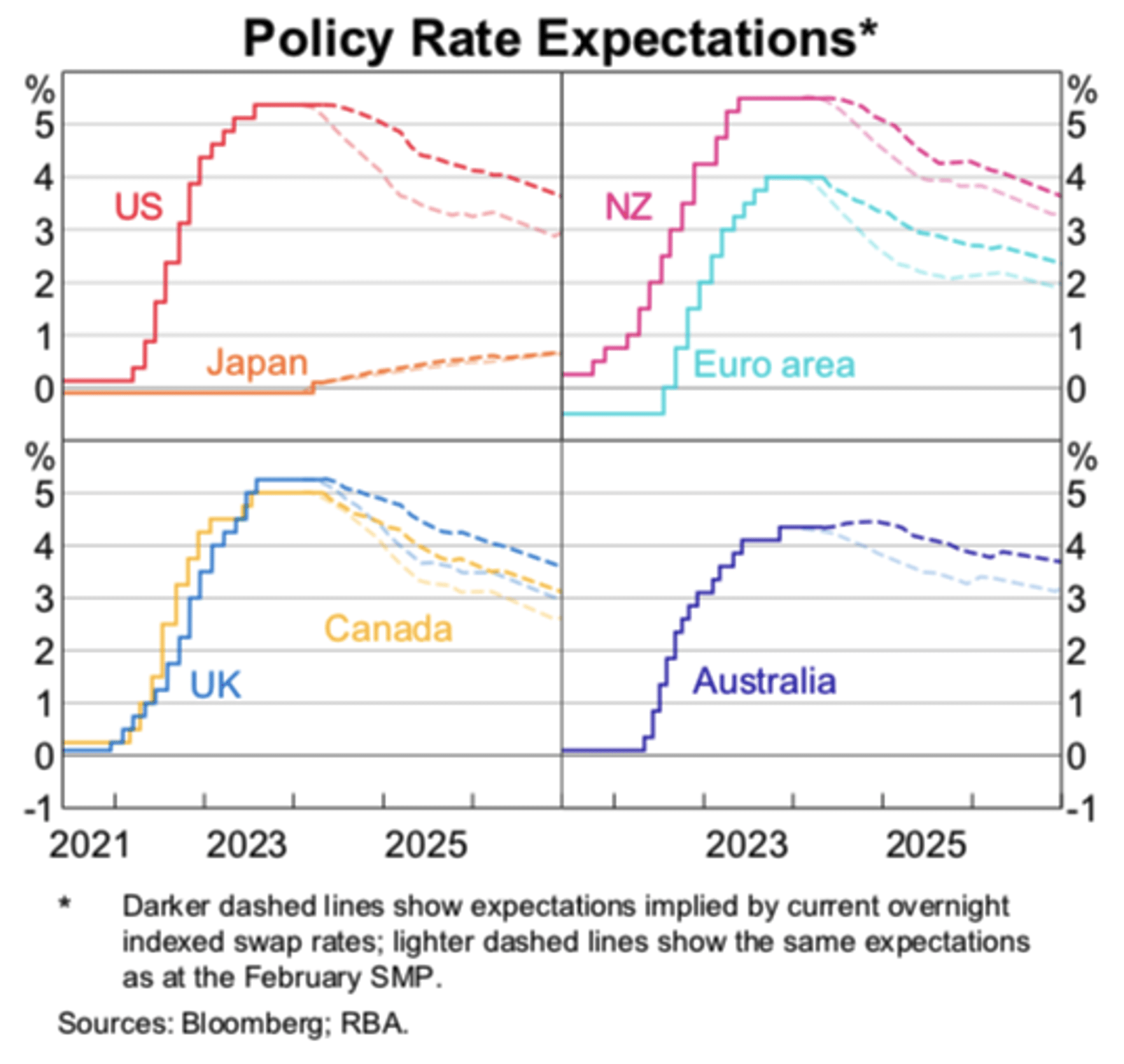

Despite the RBA commentary, financial markets are continuing to price in further interest rate cuts with a cash rate of approximately 3.40 per cent factored in by the first half of 2026. Softer economic data out of the US in recent weeks has helped reinforce the market pricing for lower interest rates.