The 2025–26 Federal Budget delivers clear intent: housing supply, affordability and construction workforce development are now front and centre of the national agenda.

With a $33Bn commitment and targeted initiatives, the incumbent Government is mobilising support for long-term structural improvement in a concerted effort to address both availability and affordability of residential accommodation.

These latest initiatives present opportunity for Australia’s ~$205Bn private credit sector, specifically the ~$87Bn real estate private credit segment, where capital is increasingly stepping in, as banks continue to pull back owing to regulatory and capital constraints, and NBLs fund the predicted 280,000 national dwelling residential accommodation shortage.

While private credit accounts for just ~17% of the total Australian Commercial Real Estate Debt Market (compared with ~50% in the US and ~40% in Europe), that share is growing—and with it, investor interest.

The fundamentals for providing capital remain compelling:

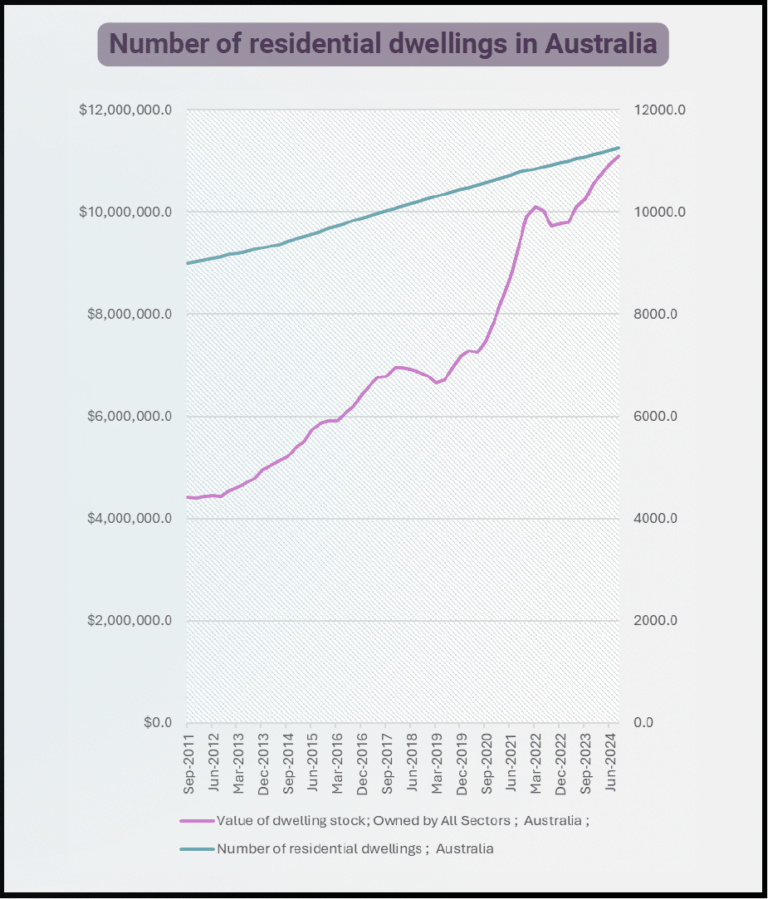

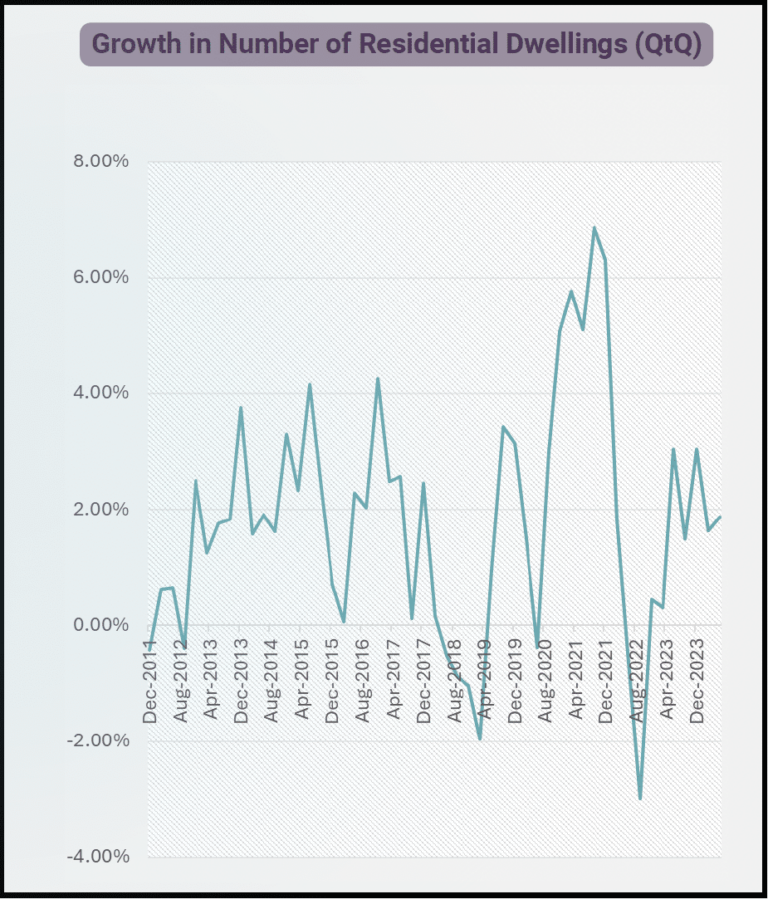

- house and unit prices continuing to increase

- demand outstrips supply and average rental vacancies remain at less than 1%

Source: ABS

Source: ABS

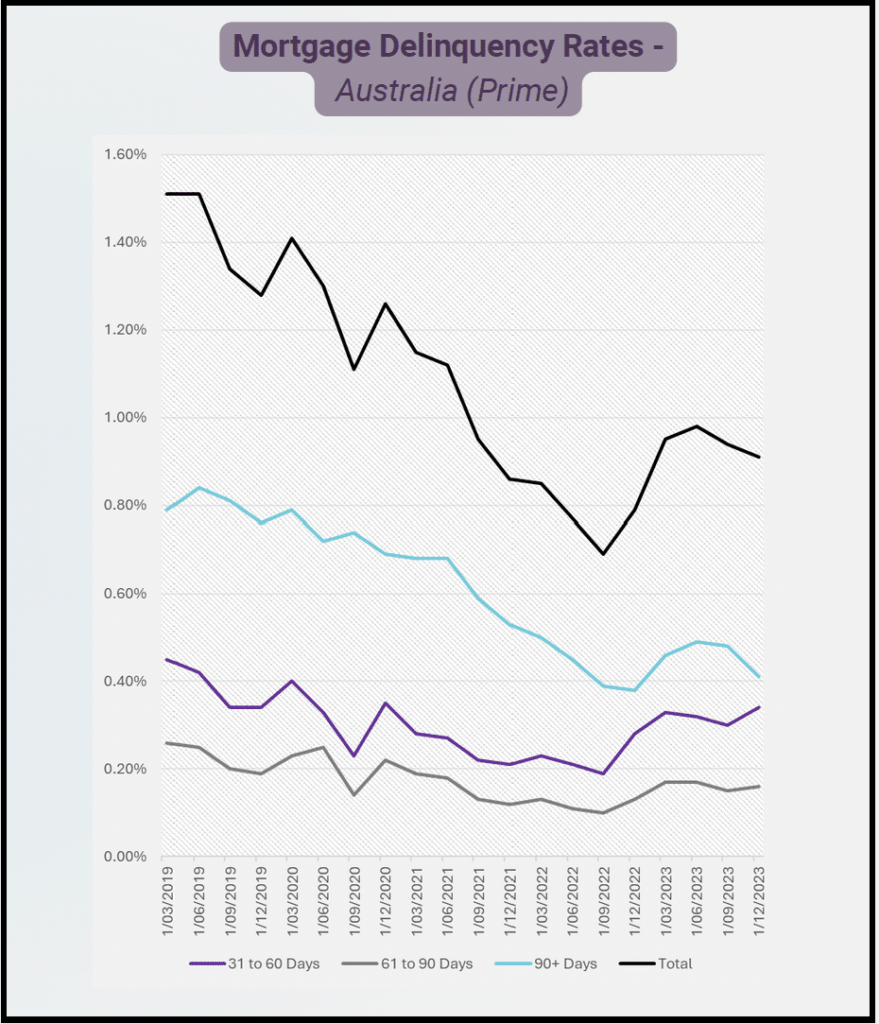

- bank total mortgage delinquencies is around 40% lower (0.91%) than six months ago (1.51%)

- 90+ day mortgage arrears at 0.41%, around half of their March 2019 figure

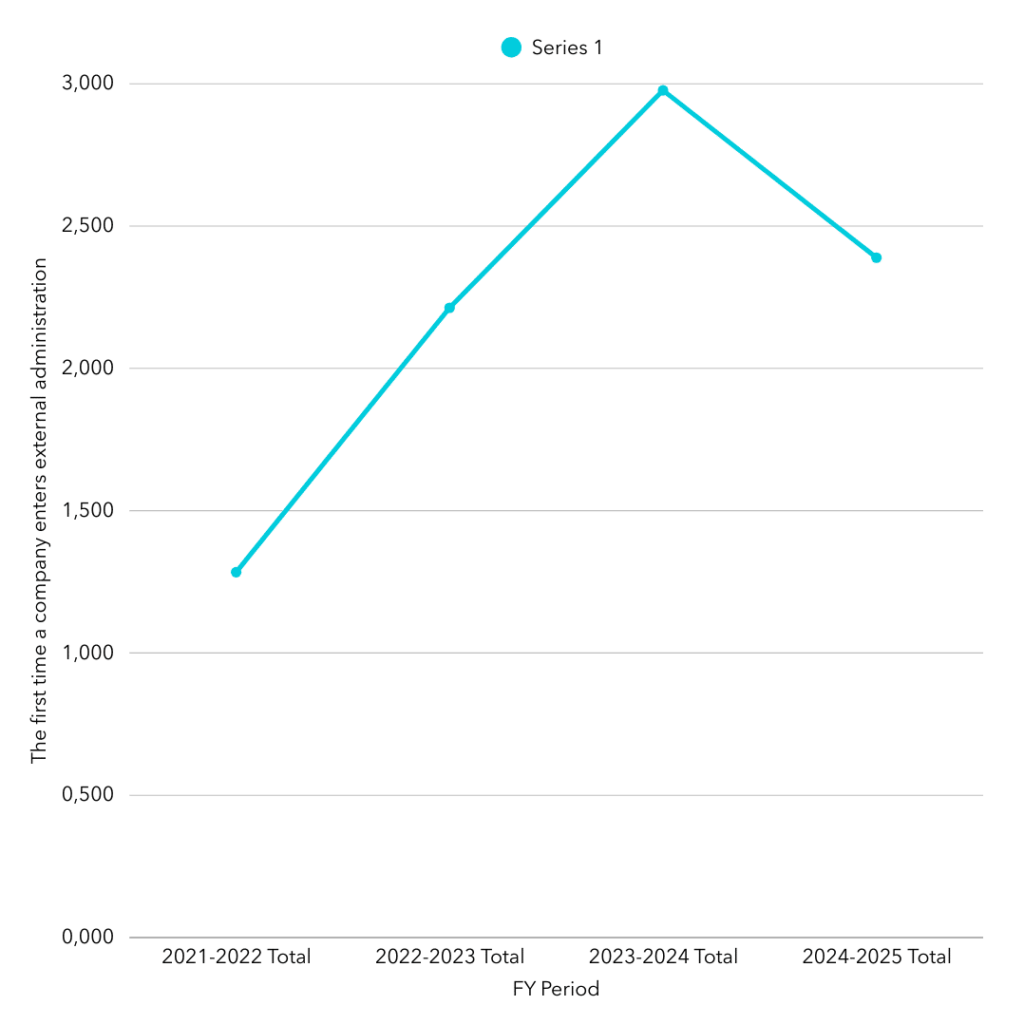

- ASIC stats to February 2025 reflect construction insolvencies trending down

Source: MPA

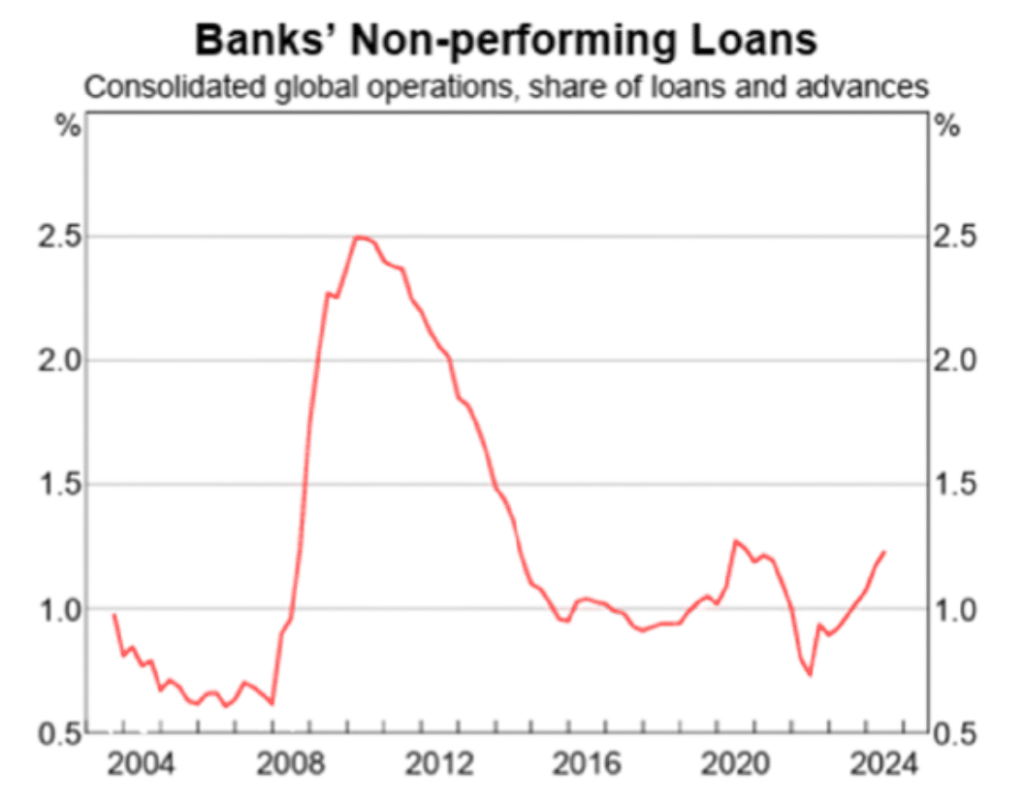

Source: APRA

Construction Insolvencies

Source: ASIC1

- ABS’s latest GDP data to December 2024 showing YoY economic growth of 1.6%2

- Real estate developers and investors may enjoy further reductions in interest rates over time.

At Zagga, we focus capital deployment in the most conservative parts of the real estate private credit universe:

We avoid speculative assets and seasonal or highly cyclical sectors—focusing instead on transactions where there is clear line-of-sight on delivery, exit, and return.

Having invested in excess of $2Bn and repaid over $1Bn, we at Zagga continue to believe that private credit anchored by high-quality real estate assets and strong counterparties, offers a credible, risk-adjusted income solution for sophisticated and wholesale investors.