While headlines may suggest the property market is falling, the bigger picture suggests that over time, the market is remarkably resilient.

The effects of a persistent undersupply of properties is already being felt by renters, who face soaring rental costs.

Regardless of short-term economic movements, Australia has a significant and persistent underlying housing gap. Population growth was averaging around 1.5% annually in the years leading up to COVID-19 and fell significantly as borders closed. However, the rate of overseas migration is recovering, and population growth along with it (now just under 1%, as at March 2022)1.

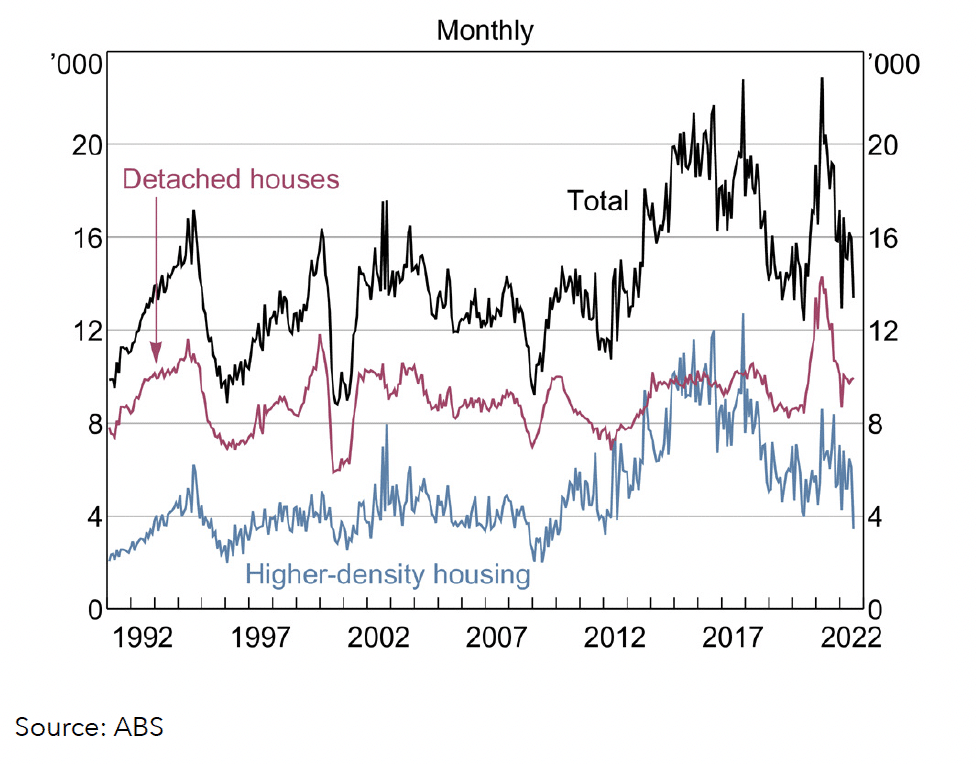

At the same time, dwelling investment, development starts and housing approvals are falling – suggesting a continued shortage in coming years. The chart below illustrates the decrease in the last two years.

Figure 1: Private Residential Building Approvals as at Sept 2022

And while the pandemic saw a short-term drop in the supply pipeline, its impact is likely to have a long-term effect. Research by Knight Frank showed there were just $4 billion worth of residential site sales in 2020, a 19.6 per cent fall from 2019 and well below the 2014 peak of $11.3 billion2.

The key point to bear in mind here is the length of the development cycle. The period from site purchase to building completion takes several years (especially for higher-density housing), so the impact of this reduced shortage will likely only emerge around 2024 and beyond.

Unfortunately, the effects of housing undersupply are also cumulative. A report into Sydney’s housing undersupply by the Property Council of Australia found that, “Each year that the dwelling targets are not met exacerbates this deficit. Crucially, the current targets do not incorporate the deficit into dwelling demand, meaning that there is an underlying deficit that can persist, even when dwelling targets are achieved3“.[1]

The outcome of this persistent shortage of housing and other property assets is that the long-term fundamentals make this sector attractive to investors. Regardless of short-term price movements, the market dynamics are strongly supportive of a robust property investment industry with decades of demand ahead of it.

Zagga’s latest white paper explains how commercial real estate debt can tap into the current market conditions.

[1] ABS, National State and Territory Population, March 2022

[2] Future apartments pipeline shrinks as site sales plunge, Australian Property Investor, April 2021

[3] New Housing Data Reveals Sydney Faces Undersupply, Property Council Australia, July 2022

Questions?

Look here.

The Federal Government has introduced several measures in an attempt to address the housing crisis including incentives for developers to build affordable housing units.

The National Cabinet has also agreed to a national planning reform blueprint with planning, zoning and land release measures to improve housing supply and affordability. These include promoting medium and high-density housing in well-located areas close to existing public transport connections and streamlining approval pathways.

More recently, the government has announced a policy aimed at building more dwellings with incentives for State and local governments to exceed the construction of 1 million new dwellings in the five years from July 2024. The new target of 1.2 million dwellings in that time frame is to address the on-going housing shortage which it expects to dampen growth in rents and prices by adding to housing supply.

Despite these, and other, measures being in place, their effectiveness to the housing crisis remains a subject of debate, and the situation continues to evolve.

Keep up to date here