In summary, economic growth in the Australian economy remains weak, the unemployment rate is rising, wages growth is slowing and inflation is falling back towards the RBA’s 2 to 3 per cent target. The interest rate hikes since May 2022 are working.

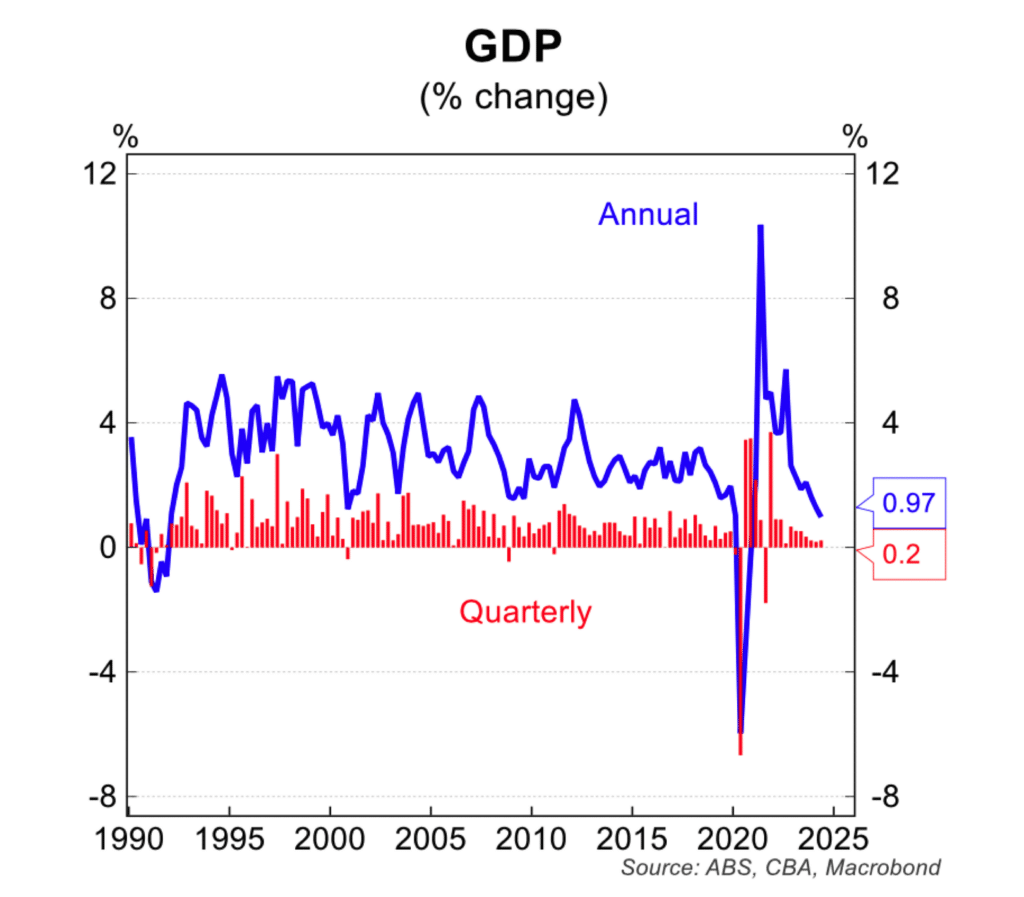

In terms of the specific data, GDP rose by just 0.2 per cent in the June quarter after a similar rise in the March quarter to be 1.0 per cent above the level of a year ago. Outside the Covid related recession, this is the weakest performance for the economy since the early 1990s recession. In per capita terms GDP fell 0.4 per cent in the June quarter and has been flat or down for the past six consecutive quarters.

Despite ongoing hawkish rhetoric from the RBA, which included comments that interest rate cuts before the end of 2024 are very unlikely, markets are pricing in a high probability of a 25 basis point cut before year end and a total of more than 100 basis points of interest rate cuts by the end of 2025. Investors are focussing on key fundamentals rather than the results of RBA inflation modelling when pricing in those cuts.

Partial economic indicators remain generally subdued.

Retail sales were flat in July despite the 1 July income tax cuts; the number of building approvals rose but this was from a decade low point; consumer sentiment is very weak and business conditions continue to deteriorate. The output for private sector business investment has weakened over the past quarter with Capex now expected to be broadly flat in FY2024-25.

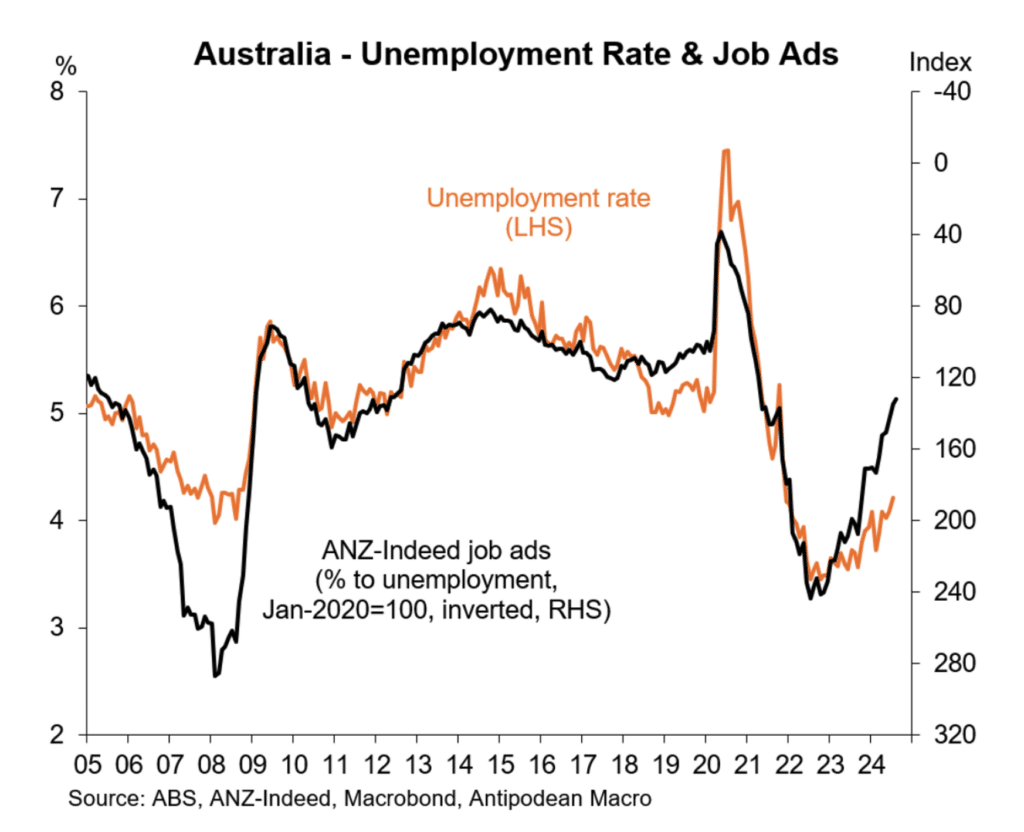

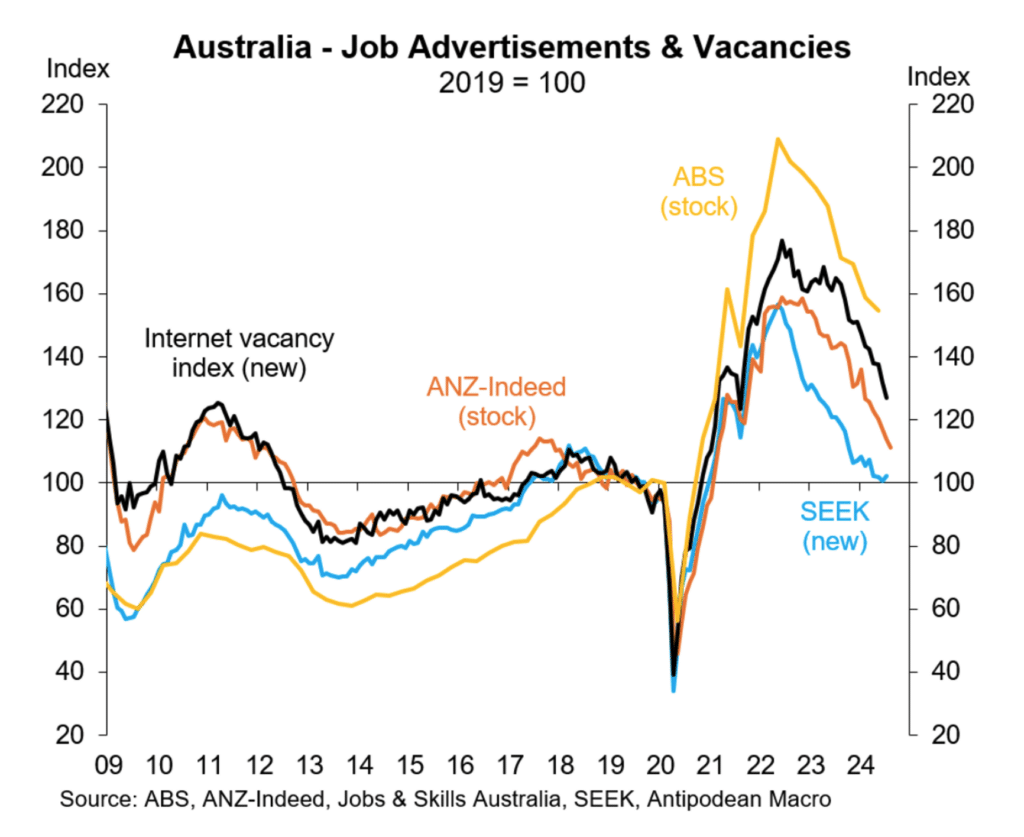

Conditions in the labour market continue to soften. As has been the case since the start of 2024, employment growth, in trend terms, is below the growth in the labour force and as a result the unemployment rate has risen from the cyclical low of 3.5 per cent in 2023 to 4.2 per cent in July 2024. With job vacancies confirming a slump in business demand for labour, further increases in the unemployment rate are certain (see charts below).

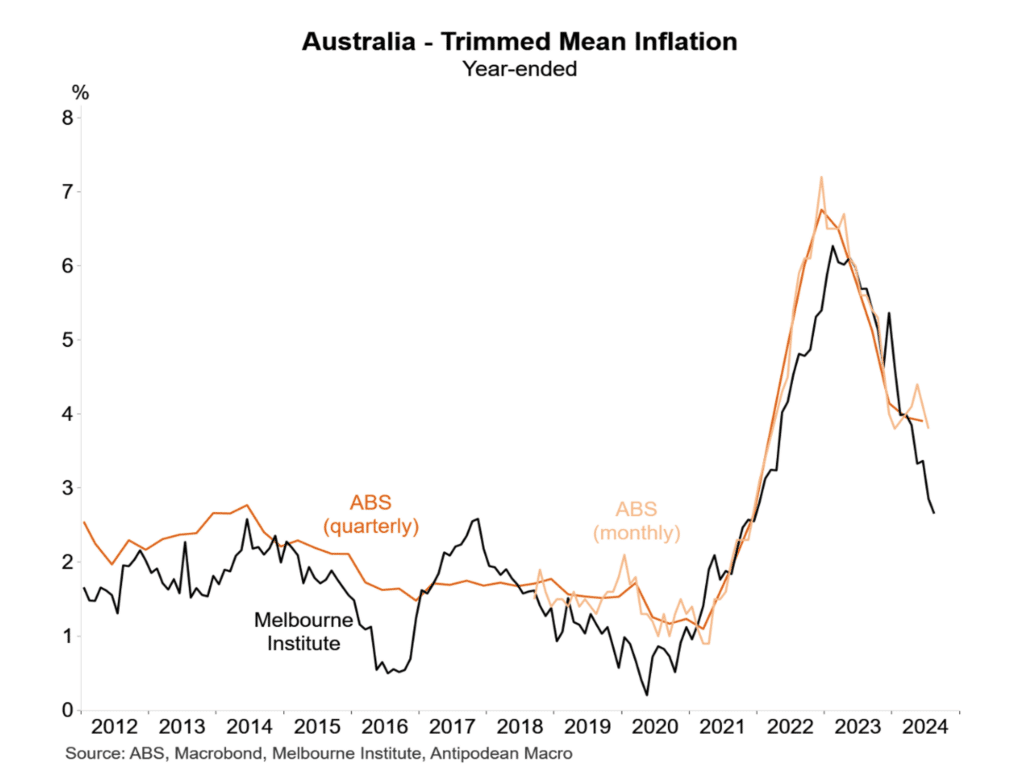

The monthly CPI rose 3.5 per cent in the year to July, easing from the peak of 8.4 per cent in December 2022 and 4.0 per cent in May 2024.

The weaker economy and moderate wage increases are impacting on the inflation deceleration.

Headline inflation is set to fall further as the effect of various government policies – electricity and rent subsidies in particular – dampen prices in those areas.

The Melbourne Institute Inflation Gauge rose by just 2.2 per cent in the year to August, and as the chart to the left shows, it has a solid correlation with the official inflation data from the ABS.

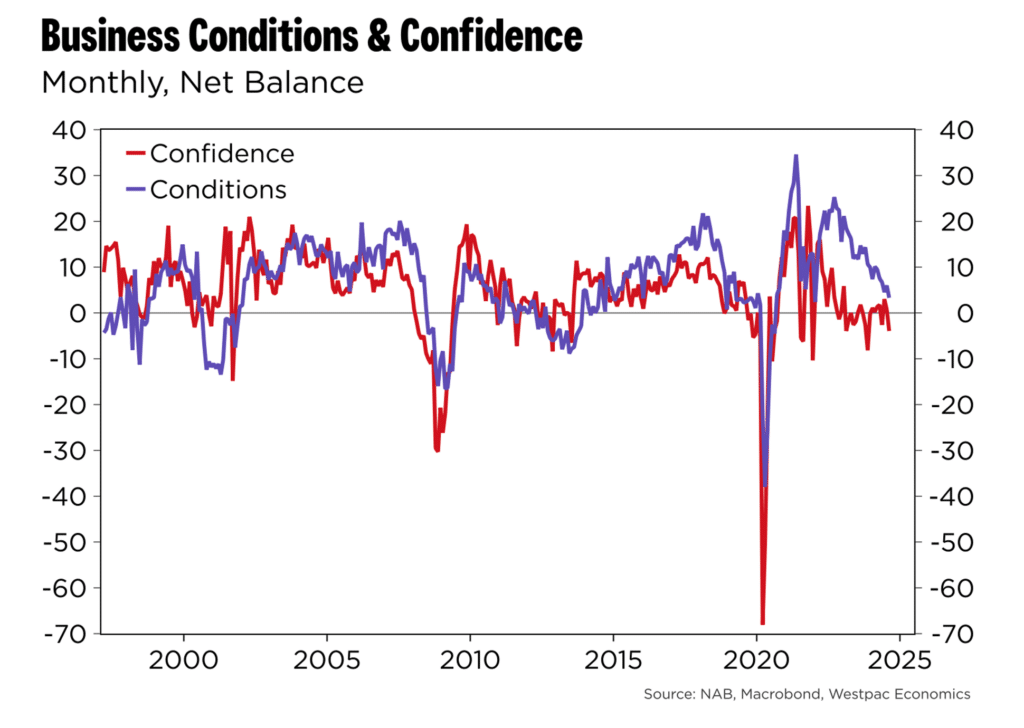

The NAB survey of business confidence and business conditions continue to weaken, reflecting the slump in economic growth. In August, the business confidence index fell to -4 points from +1, while conditions fell to a two and a half year low of +3 points.

Within the NAB survey, the inflation indicators confirmed a further easing of inflation pressures with final selling prices, wages and input costs all approaching pre-pandemic levels.

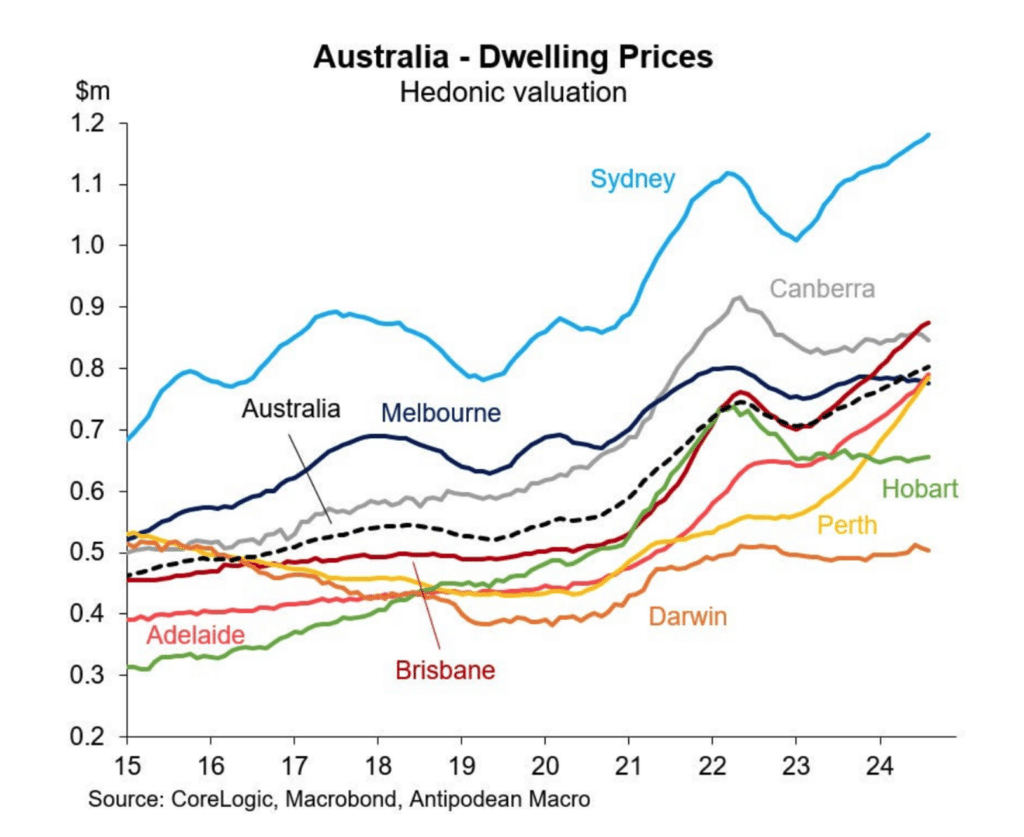

The growth in house prices continues to moderate with nation-wide prices up 0.5 per cent in August after a rise of just 0.3 per cent in July.

A moderation in demand from a step lower in net migration together with a lift in new listings for sale is dampening price growth.

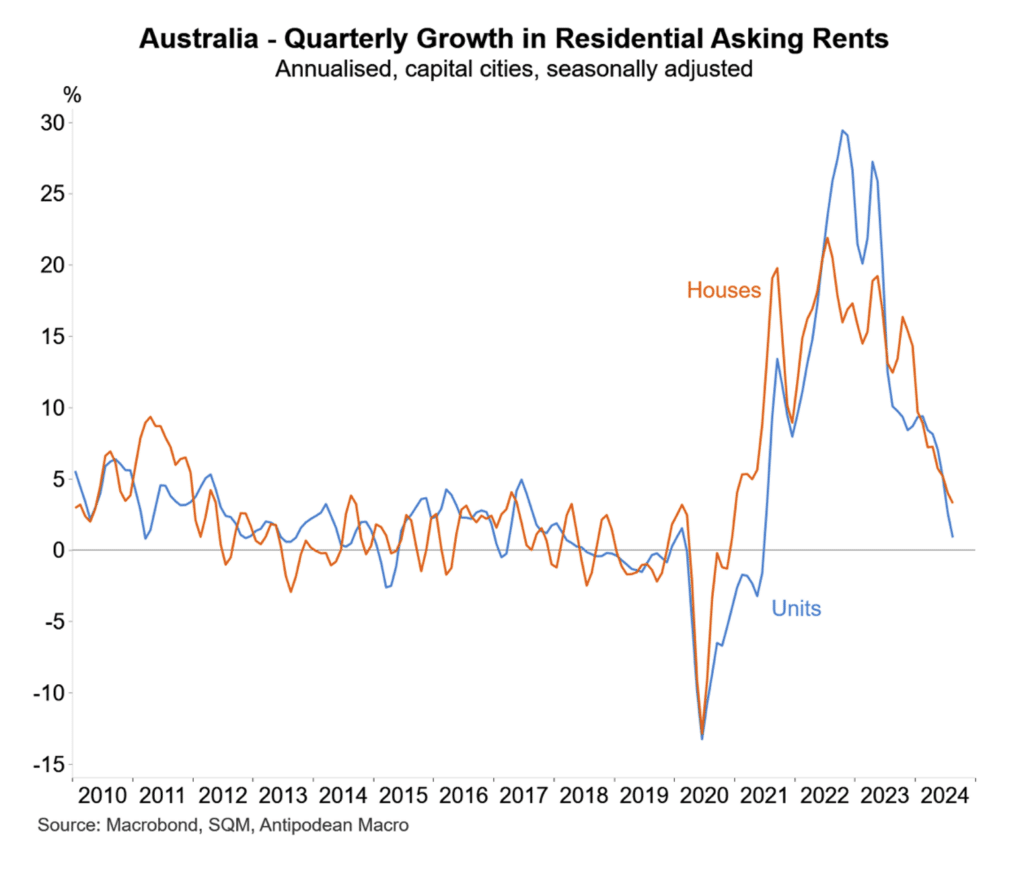

The rate of increase in dwelling rents is also moderating due to the demand / supply correction.

The interest rate cutting cycle around the world continues to deepen.

Interest rate cuts have been delivered in the Eurozone, Canada, the UK, China and New Zealand and later this month, the US is certain to join with the first rate cut in the coming cycle. A series of further interest rate reductions in all these countries is priced into these markets.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.