The economy remains in a fragile state as the impact of interest rate rises, a slower global economy and the lagged effects of the end of the COVID fiscal stimulus measures impact on domestic spending and job creation.

Importantly, inflation is falling. This will be a dominant factor in the outlook for interest rates which are set to the lowered by the Reserve Bank of Australia around the middle of the year as it deals with the slowing economy and rising unemployment.

One the key economic issues to emerge during 2023 was the weakening in labour market conditions. In December, employment fell 65,000 with full-time jobs down 107,000. Since the middle of 2023, full time employment has trended down as have the hours worked in the economy. Both of these indicators are consistent with a weakening in economic activity.

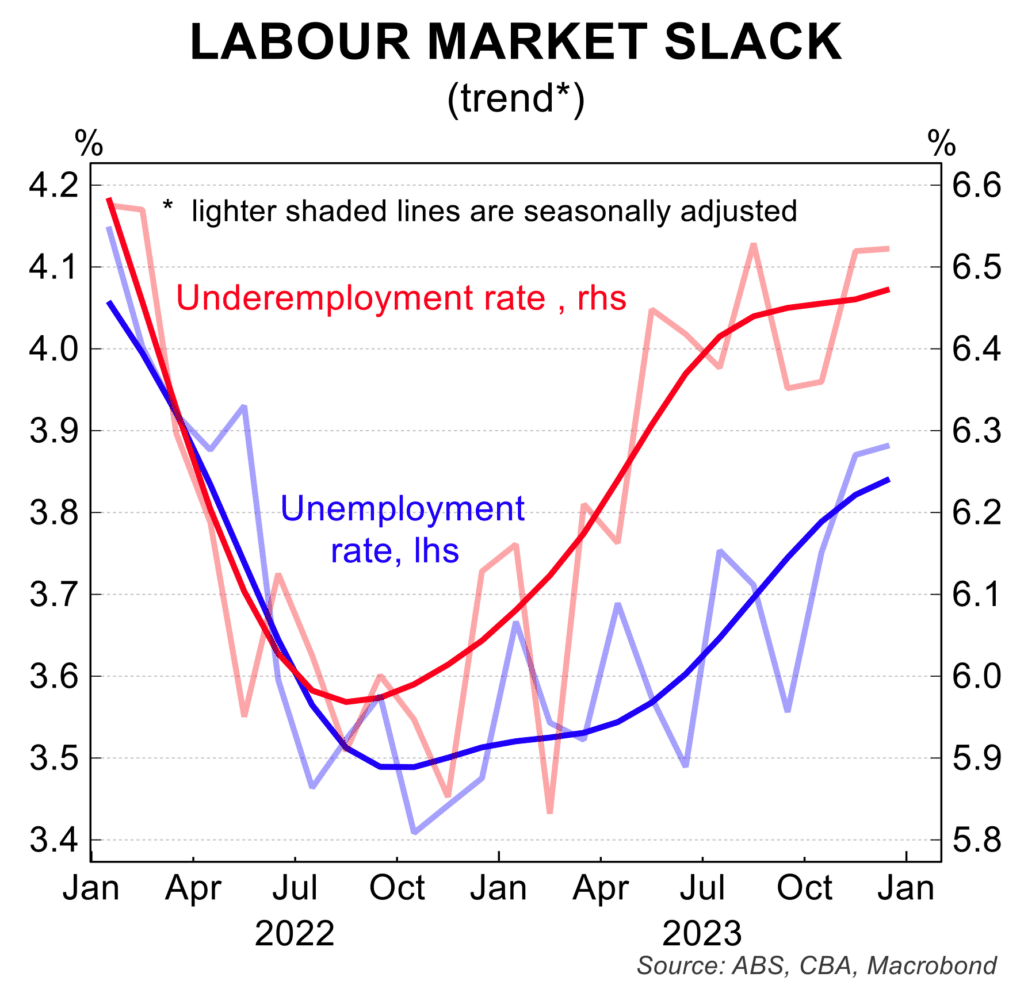

At the same time, the unemployment rate at 3.9 per cent is 0.5 percentage points up from the low of late 2022. Treasury and the RBA are forecasting the unemployment rate to keep rising through 2024 and into 2025 to peak around 4.25 to 4.5 per cent. At the same time, the underemployment rate, which measures people with a job who would prefer to work more hours, has increased from a low of 5.9 per cent to 6.5 per cent.

Also pointing to further weakness in labour market conditions is the decline in the number of job vacancies and job advertisements.

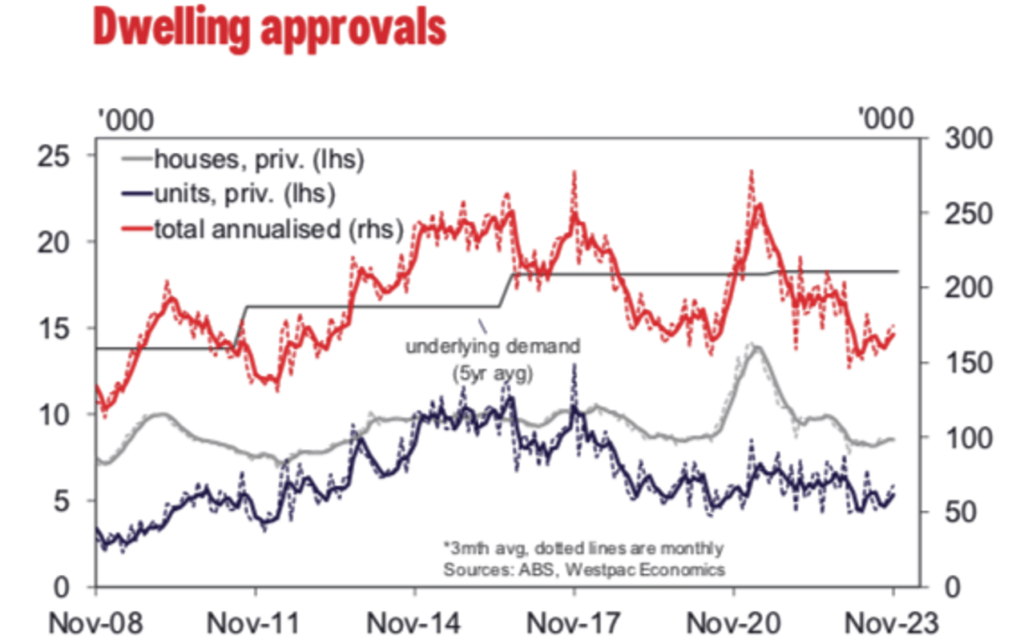

Dwelling construction is in the early stages of an upturn, although the month to month measure of new approvals is volatile.

The monthly number of building approvals reached a low of 12,500 early in 2023 but this has risen to 14,500 by year end. Despite the problems in the house building sector, this is a solid result. Cost pressures, labour costs and the interest rate hiking cycle have been headwinds to the sector in 2023.

For 2024, with cost pressures easing and the labour market problems abating, the sector is poised for a stronger 2024 and 2025. Interest rate cuts should assist. The government is aiming for building approvals to average 20,000 per month in the five years from the middle of 2024.

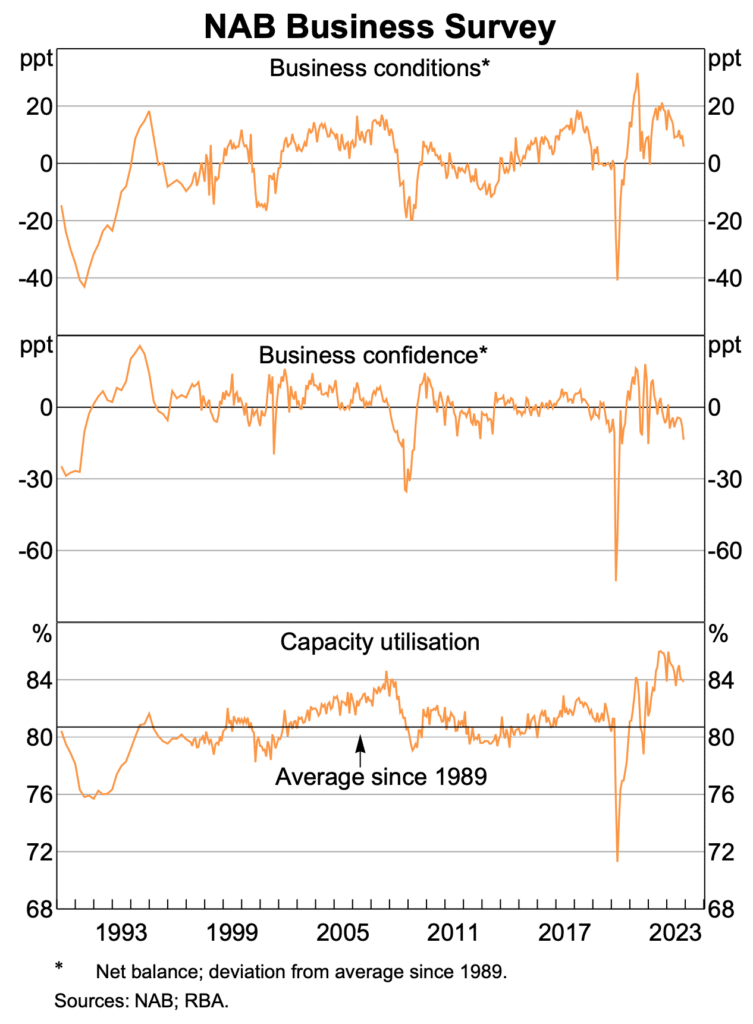

Having been resilient through most of 2023, business confidence and conditions are now both trending lower.

This is a potential concern for the economy in 2024 particularly when the consumer side of the economy has been weak. Business confidence, in particular, has fallen to a level not seen outside periods of extreme economic ructions – recession, the global financial crisis and the COVID pandemic. In good news for the inflation outlook, there has been an easing in the measure of capacity utilisation.

The outlook for monetary policy favours lower interest rates with money markets pricing in an approximate trajectory for 25 basis point cuts in August and December 2024 with a further rate cut in the first half of 2025.

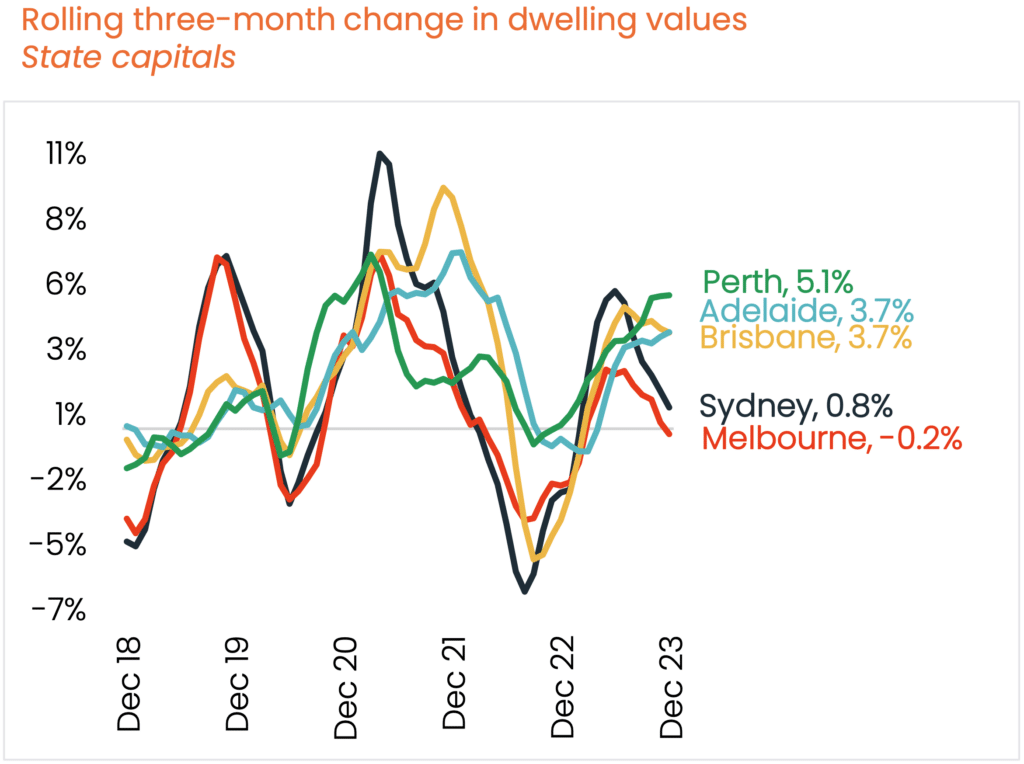

Growth in house prices is slowing, but there is a marked divergence in trends between cities.

For a macroeconomic policy perspective, it is the nationwide price measure that is most relevant and given that the wealth effect from rising prices through 2023 is abating, any price weakness will add to the case for lower interest rates over the medium term.

In the December quarter, house prices fell 0.2 per cent in Melbourne while in Sydney, Hobart, Darwin and Canberra, price growth was weak. Price momentum is squarely to the downside in all these cities. In sharp contrast, prices in the quarter rose by between 3.7 per cent and 5.1 per cent in Adelaide, Perth and Brisbane.

At a nationwide level, house prices rose 0.4 per cent in December, the smallest increase since early 2023. The broader slowing in house prices is linked to some rebalancing in supply – new listings – and demand – a slight cooling in the rapid immigration intake. Interest rate hikes are also having a cyclical impact on housing demand.

The period around Christmas / New Year is very quiet in terms of housing sales and changes in listings. Later in January, once the market activity returns there will be more reliable information on auction clearance rates, prices and general activity in the housing sector.

As the economy slows, the unemployment rate will trend higher and inflation lower. The speed and magnitude of these trends will determine the extent of the interest rate cutting cycle in 2024 and 2025.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.