The key economic themes for 2024 will be weak levels of activity, further falls in inflation, a rising unemployment rate and an intense discussion of the timing and extent of interest rate cuts.

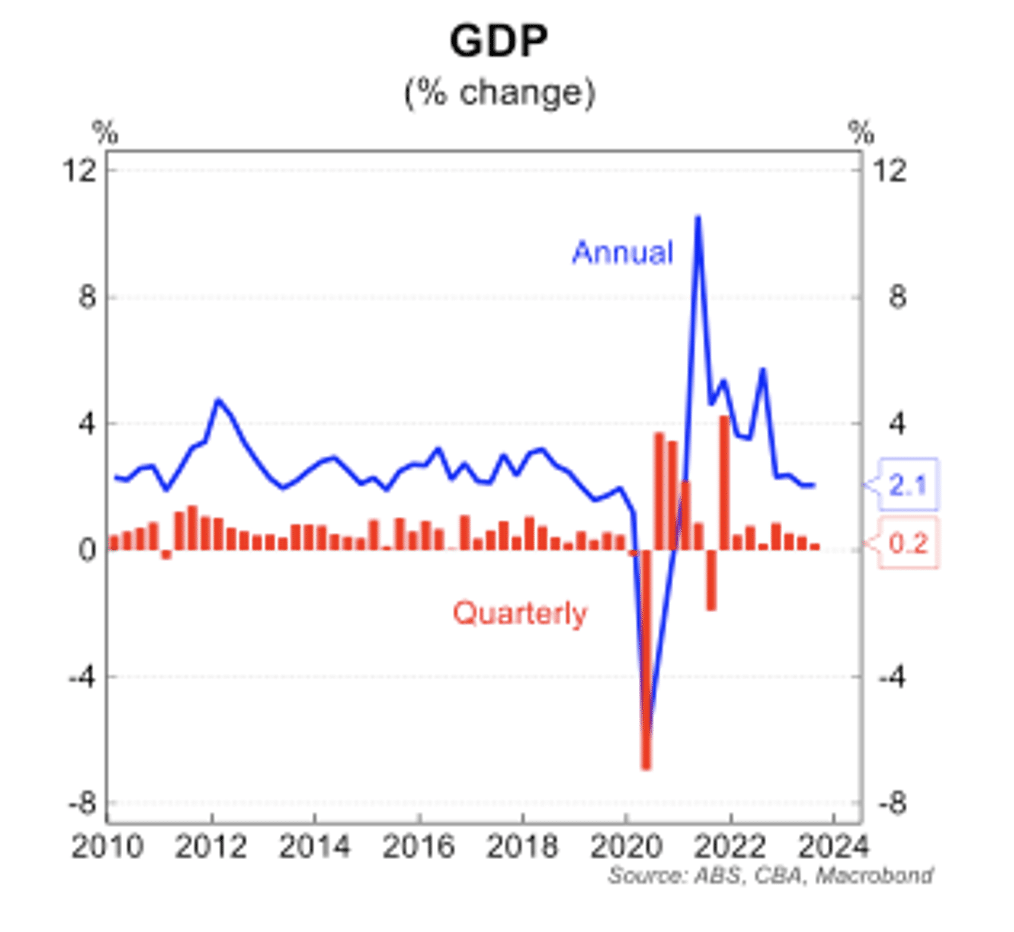

2023 ended with a clear and marked slowdown. GDP rose by just 0.2 per cent in the September quarter, following growth of 0.4 per cent in the June quarter, 0.5 per cent in the March quarter and 0.9 per cent in the December quarter 2022. The trend to slower growth is clear in this quarterly profile.

The economic weakening is showing up in the labour force data with growth in employment moderating and the unemployment rate rising to 3.9 per cent in November which is up 0.5 percentage points from the 3.4 per cent low in 2022.

Retail sales fell 0.2 per cent in October to be just 1.2 per cent higher than a year ago.

In real, per capita, terms real retail sales fell by around 5 per cent over the past year. This is close to a record fall. Consumers are responding to ongoing cost of living pressures, higher interest rates and the early stages of softening labour market conditions.

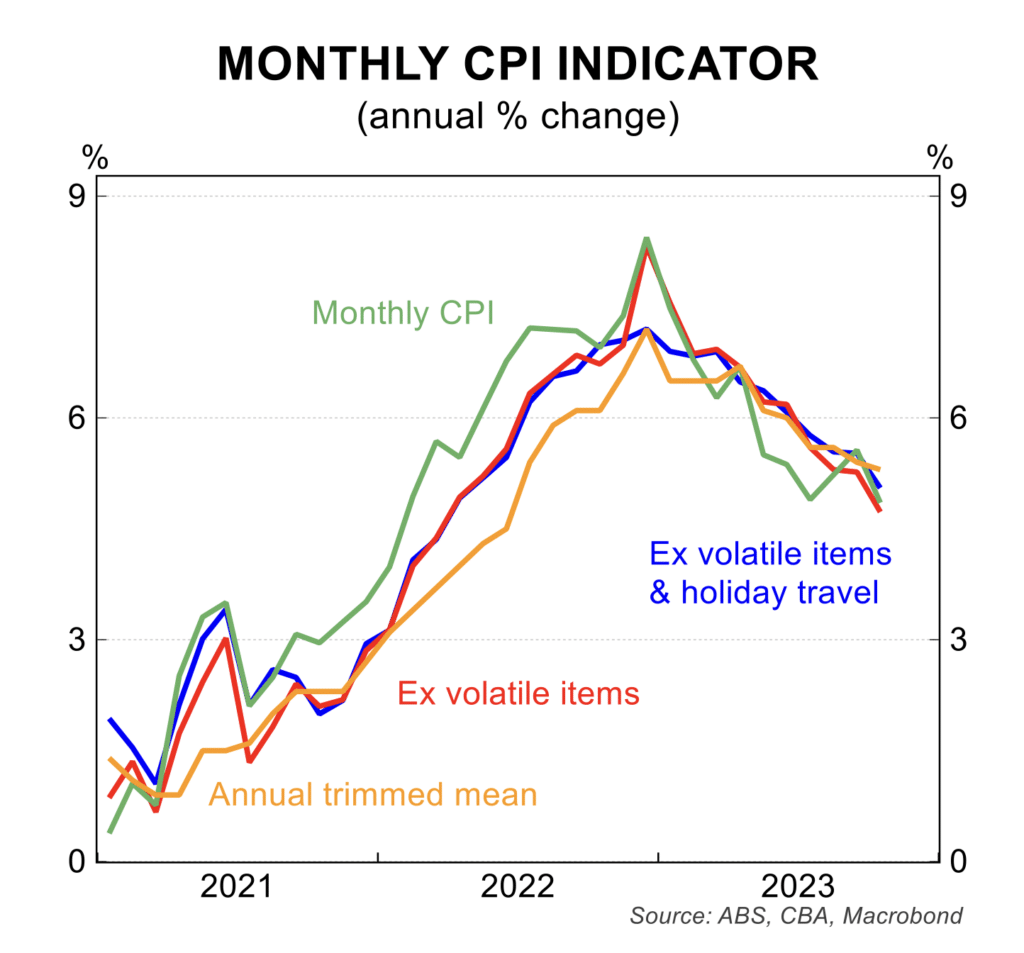

There was good news on inflation with the monthly indicator showing annual inflation in October easing to 4.9 per cent, well below the market and RBA expectations and locking in a deceleration in inflation from the peak of 8.4 per cent in December 2022.

While this is above the 2 to 3 per cent inflation target of the RBA, the next few months sees some large increases drop out of the annual run rate which means that annual inflation will fall towards 3.5 per cent when the monthly December data are released on 31 January.

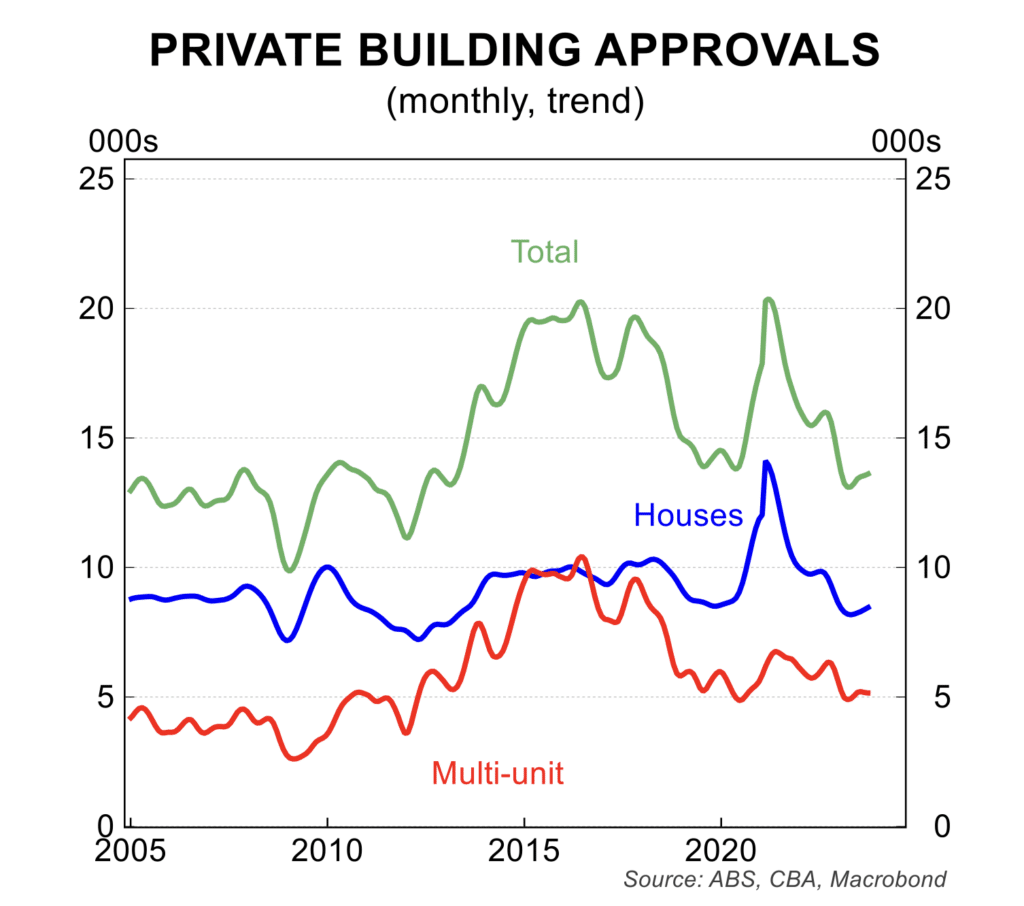

There is a turning point in housing construction.

While the number of building approvals are volatile on a monthly basis, approvals rose 7.5 per cent in October to be 16 per cent above the January 2022 low. An easing in cost pressures and labour shortages plus strong demand are set to drive a recovery in construction through 2024 and 2025. Strong growth is needed if the Federal Government’s target for 1.2 million dwellings to be constructed in the 5 years from the middle of 2024 is to be achieved.

After the 25 basis point interest rate hike in November, the RBA held rates steady at 4.35 per cent at its December meeting. It noted that the data and information flow over the prior month was broadly consistent with its forecasts.

Since the December meeting the run of data has been materially softer than the RBA forecasts which is why financial markets are pricing in no more interest rate hikes. Indeed, money markets are pricing in an interest rate cutting cycle from around the September quarter 2024 and for there to be 75 basis points of interest rate cuts by mid-2025.

The yield on the 3 year government bond, a proxy for the medium term interest rate outlook, has fallen from 4.40 per cent to 3.65 per cent.

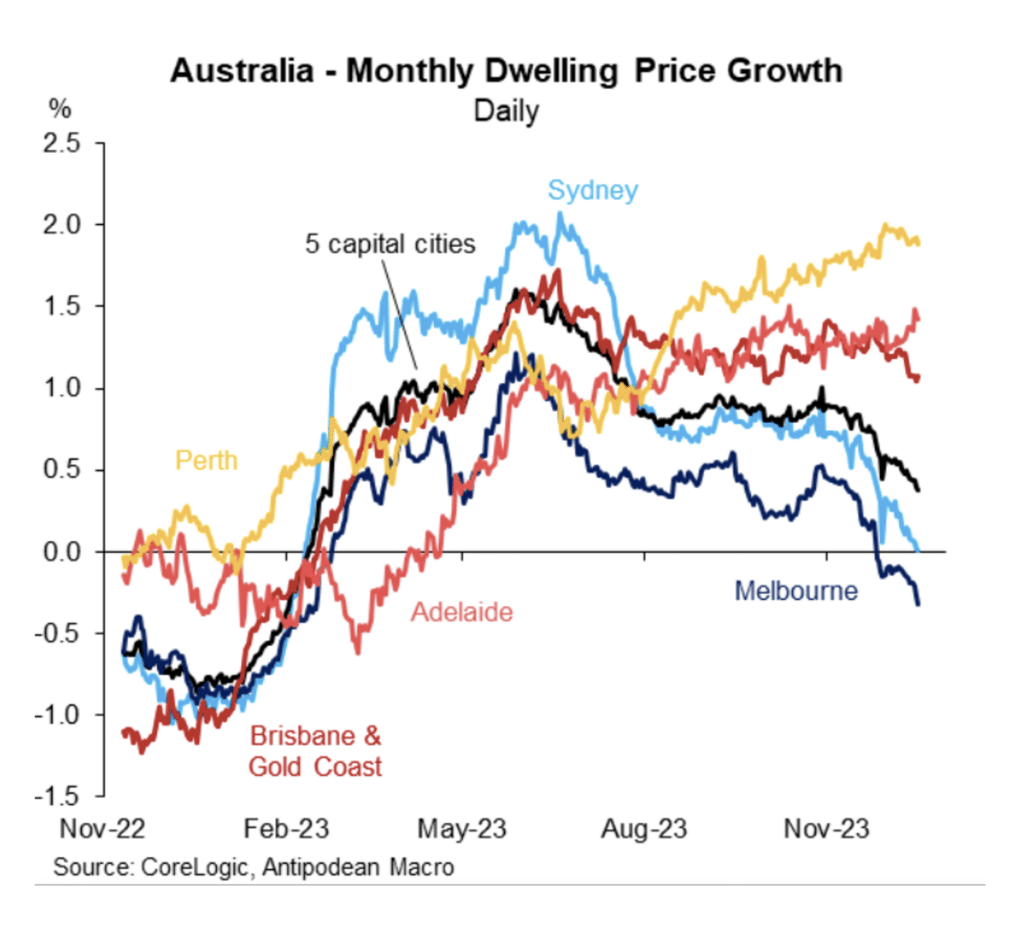

House prices is starting to ease, although the divergence between the strongest and weakest capital cities is wide.

In November, house prices rose 0.6 per cent to be 7.0 per cent higher than the level of a year earlier.

In the month, house prices edged lower in Darwin, Melbourne and Hobart while prices in Sydney rose by just 0.3 per cent. Prices growth remained strong in Perth, Brisbane and Adelaide.

In annual terms, house prices are down 3.0 per cent Hobart, down 1.5 per cent in Darwin and down 0.3 per cent in Canberra. Perth prices are up 13.5 per cent, 10.7 per cent in Brisbane and 10.2 per cent in Sydney.

The unevenness in prices reflect supply and demand dynamics – population growth for demand and listings for sale plus newly constructed dwellings for supply.

The preliminary house price data for December, including with a tepid level for auction clearance rates in Sydney and Melbourne, points to a further easing in prices in the short term.

The key issues early in 2024 will be the extent of the fall in inflation – if it falls earlier and more aggressively than the RBA is currently forecasting, the start of the interest rate cutting cycle will be brought forward to the first half of the year.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.