Why do private lending and non-bank lending exist?

Private and non-bank lending have been around for a long time but it is only in the last decade or so that it has gained traction as an alternative investment for a wider range of investors as well as providing an attractive, flexible and viable alternative source of capital for quality borrowers beyond traditional banking institutions. This dynamic sector has witnessed remarkable growth, presenting investors with a unique avenue to diversify their portfolios whilst earning regular, predictable and risk-adjusted income uncorrelated to market volatility.

In this blog, we will delve into the private and non-bank lending sector, offering insights from an investor’s perspective. We will analyse the merits, risks, and potential financial returns associated with this alternative investment option.

What are private lenders?

Private lending generally involves borrowing money from high-net-worth individuals, family offices or even businesses that utilise cash reserves to lend out to borrowers. Loans from private lenders tend to differ from traditional loans in that they typically have higher interest rates, and will generally be offered for only short to medium term loans. Private lenders are typically not bound by the same strict lending criteria as traditional banks and have the ability to assess loans on more flexible criteria.

Borrowers with requirements or situations that fall outside of conventional lenders’ strict lending policies may seek out this avenue of financing.

What are non-bank lenders?

Non-bank lenders are registered financial institutions that lend money through offering loans and credit facilities. They are not a bank in the traditional sense as non-bank lenders do not take deposits, and do not hold a banking licence. Non-bank lenders source funds – which they use to lend – from various channels, including wholesale markets, securitisation, and institutional investors.

Although non-bank lenders are not regulated by the Australian Prudential Regulation Authority (APRA) who is Australia’s prudential regulator of banks, insurance companies and most superannuation funds, non-bank lenders are still regulated and must hold an Australian Credit Licence and comply with Australian Securities and Investments Commission (ASIC) regulation, the Australian Consumer Laws, the Privacy Act and the National Consumer Credit Protection Laws.

Zagga is a fully-licensed non-bank lender, regulated by ASIC. Our objective is to generate high-yielding, alternative investment opportunities for wholesale/sophisticated investors. Zagga does this by sourcing and facilitating the funding of high-quality loan transactions in the Commercial Real Estate Debt (CRED) sector.

Why is there a market for private and non-bank lending?

The Tier 1 Australian banks hold majority share of the Commercial Real Estate Debt (CRED) market, yet a significant funding gap – valued at c. $70Bn per annum – still exists.

Prospective investors into this growing asset class often ask the question…

Why does a gap exist between bank and non-bank funding?

If these loans are creditworthy, why would the banks not fund them?

There has always been a gap in the lending market although perhaps, it has become more prevalent in the decade following the Global Financial Crisis due to the:

- introduction of Basel II

- APRA initiated proposals to implement Basel III

- higher capital requirements for ADIs resulting in tighter lending capabilities

- Banking Royal Commission

Taken together, this has resulted in much stricter capital requirements for the banks, thereby leading to a narrowing of their lending parameters and reduction in their risk appetite – especially for commercial lending – to ensure they meet Regulators’ capital requirements.

This does not mean that the transactions, or the borrowers, being turned away by the banks are not A-grade quality; it is simply a reflection of the banks being unable to meet the demand of all their borrowers.

Who is private lending and non-banking lending for?

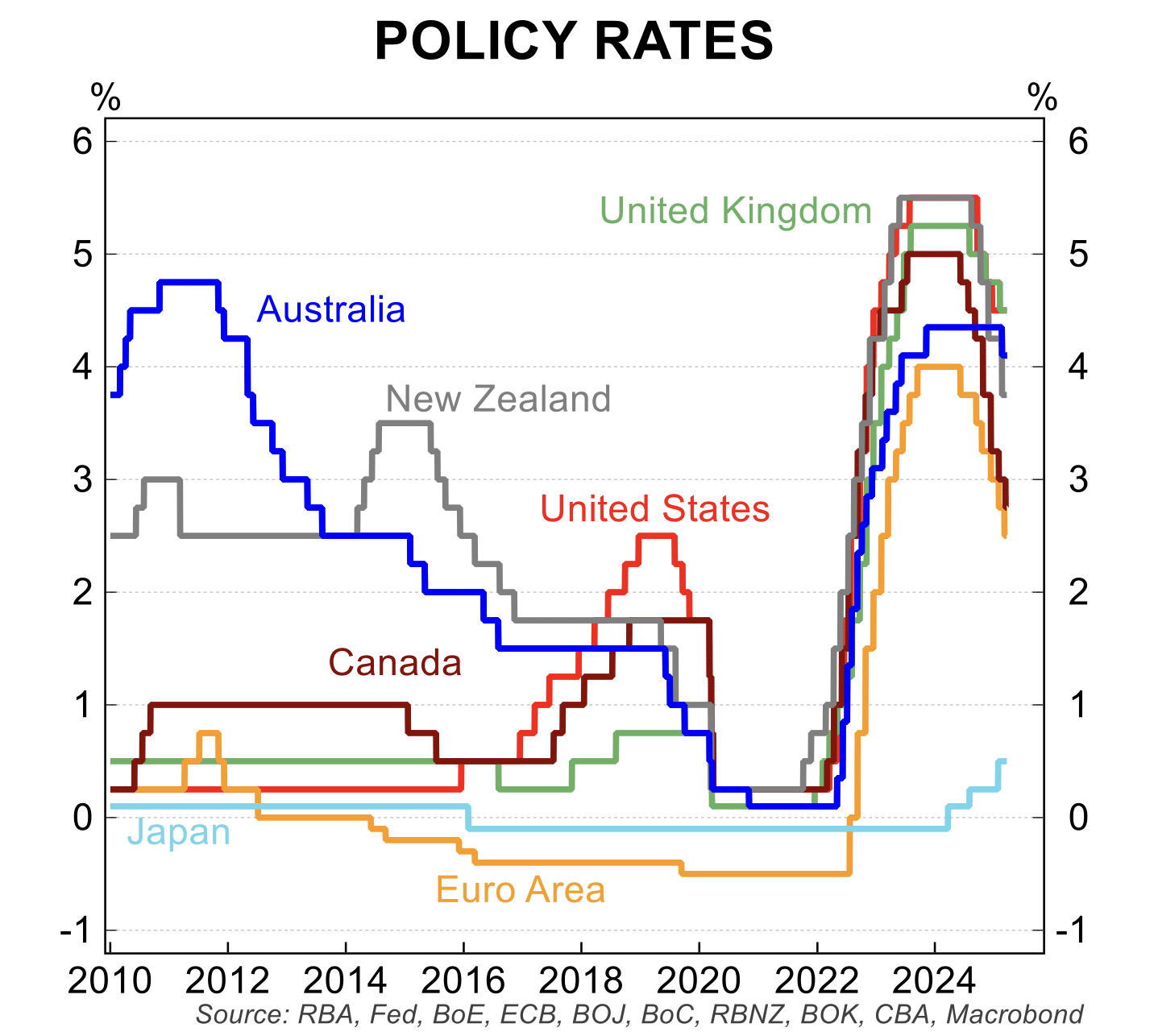

Private and non-bank lending has long been sought after for borrowers seeking an alternative source of capital outside of traditional bank funding but in the last ten years or so, particularly as interest rates in Australia reached record lows, many investors began looking for alternative sources of income-producing investments without taking on too much risk for the extra income.

With equity markets arguably overvalued and cash returns hovering close to zero, sophisticated investors began allocating their capital to alternative investments that fall broadly in the ‘fixed income’ space but provide more flexibility and higher returns than traditional bonds.

Such investments fall broadly within the private debt (also known as private credit) sector and can include non-bank lending.

Borrowers who typically seek non-bank and private lending are:

- ‘asset rich, cash poor’ businesses, who need short term finance for working capital requirements or to take advantage of business opportunities

- property developers and real estate investors who may be looking for more flexible criteria, and efficient turnaround times, than can be offered through traditional lenders.

What types of loans do private lenders and non-bank lenders offer?

Zagga’s objective is to generate stable, fixed income style, investment returns through funding high-quality, mortgage secured, loan transactions focussing primarily on the Commercial Real Estate Debt sector on the eastern seaboard of Australia.

Through the Zagga CRED Fund, investors are able to gain exposure to the private debt asset class to earn regular, risk-adjusted income, whilst also focussing on capital preservation.

The benefit that Zagga brings to investors is that they are able to add a ‘middle ground’ to their portfolios, providing regular, consistent income. Yet they benefit from greater capital protection than equities and higher returns than traditional bonds or fixed income products.

Zagga believes this type of income-producing investment will appeal to a growing class of wholesale / sophisticated investors who want transparency and returns from their investment products.

Whilst non-bank lenders in Australia can, and often do, offer 30-year residential home loans, private lenders do not, and instead, specialise in providing short to medium-term, ‘bridging’ style finance. The most common types of private lending loans are:

Development finance

Private finance to assist with the construction costs of a property development project.

Residual stock finance

Allows for the funding of completed but unsold development stock to allow the developer time to sell it.

Bridging

finance

A short term loan that ‘bridges’ the gap between the sale and purchase of two properties.

Land bank

finance

Private loan to purchase land usually intended for future, or impending, development.

Corporate

loans

Assists businesses with day-to-day operations, such as working capital requirements, or to reposition or restructure

for growth.

Speak to one of our team today

Benefits and risks of investing in private debt (includes private lending and non-bank lending): An investor's perspective

1. Diversification: investing in private debt can offer investors an opportunity to diversify their investment portfolios beyond traditional asset classes like stocks and bonds. Private debt has low correlation with other major asset classes, including growth assets such as equities and property, as well as other fixed income products such as bonds, providing excellent diversification opportunities.An investment in private debt can help to achieve attractive returns without a disproportionate increase in risk.

2. Potentially higher returns and predictable income: investing in private debt can yield higher returns than cash and near-cash alternatives, yet offer more security than equities whilst also being uncorrelated to market volatility making this alternative asset class an attractive option for income-focussed investors seeking defensive investments.

3. Risk mitigation: another key attraction of an investment in private debt is the asset class’s ability to offer superior capital protection because of its position in the capital stack. The capital stack is often depicted as a vertical stack with each layer representing a different type of capital or financing. These layers are typically arranged in order of seniority and defines who has the rights to the asset (and in what order) they are repaid. Equity takes the first loss or – put another way – is the last to be paid in the case of a borrower becoming insolvent. Senior debt – that is, loans that are secured by a first mortgage over the security – are repaid first.

Investing in private debt can be a great option to diversify your portfolio and earn regular and predictable income. However, all investments carry risks. Different investment strategies may carry different levels of risk, depending on the assets acquired under the strategy. Understanding the risks involved is critical before deciding whether an investment in private debt is right for you and your objectives. Below is a look at the typical risks associated with private debt investments:

Credit Risk: The risk of loss arising from the failure of a borrower to repay some or all of the money they owe.

Borrower Defaults: If a borrower defaults, there may be shortfalls where the sale proceeds of the security property are not sufficient to recover in full, the invested funds and costs incurred by the lender in enforcing or recovering the repayment of principal and interest under the relevant loan. There is a risk that an investor may not receive all of their monthly payments, could lose a portion or all of the principal amount they have invested to fund that particular loan and/or could potentially be required to contribute towards any shortfall.

Term of Investment and Liquidity Risk: Once you have agreed to invest funds in respect of a particular loan, you are committed to the investment for the full duration of the loan term, which can range from three months to two years, or more. Therefore, once exposed to a loan, your investment is essentially illiquid in nature. You may be unable to convert to cash, the portion of the principal component of a loan you agreed to fund. You must take this into consideration when deciding on what loan types will be suitable for you in light of your overall investment portfolio and needs.

It is crucial to consider the associated risks and perform due diligence before making any investment decision. You can read further in our Investment FAQs or if you’d like to schedule a call back please click here.

Conclusion

An investment in private debt including private lending and non-bank lending can represent a compelling investment opportunity, offering a distinct avenue for diversification, regular income and potentially higher returns. By comprehensively understanding its associated benefits and risks, investors can make informed decisions about integrating this alternative asset class into their investment portfolios.

Speak with one of our team today to explore the investment opportunities available through Zagga.