Environmental, Social and Governance (ESG) considerations have become increasingly important in the investment industry over the past few years. To try and better understand the significance of ESG on investment decisions, we held a Roundtable to gather views from our investors and industry participants.

It was acknowledged that ESG has become a mainstream topic in the investment industry, with more investors recognising the importance of sustainable and ethical investing. However, the industry still has a long way to go in terms of fully integrating ESG considerations into investment decision-making.

One key challenge highlighted is the lack of standardised ESG metrics and reporting. While there are many ESG frameworks and reporting standards, there is no one-size-fits-all approach, leading to confusion and inconsistency. The group emphasised the importance of companies being transparent and clear in their ESG disclosures, and the need for greater standardisation and harmonisation in ESG reporting.

Another challenge discussed is the risk of “greenwashing” – where companies present a false or misleading image of their environmental or social practices. The participants emphasised the importance of investors doing their due diligence and ensuring that companies are genuinely committed to ESG principles rather than just paying lip service to them.

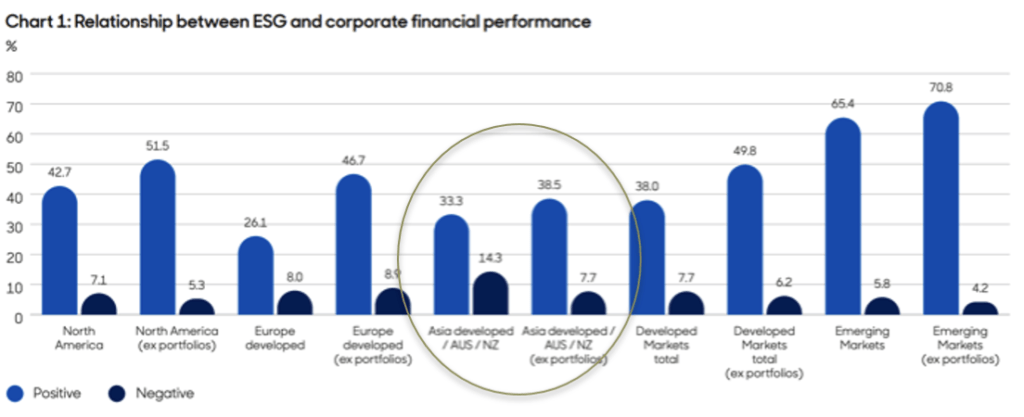

The potential impact of ESG on investment returns was also discussed, with the participants agreeing that while there may be short-term trade-offs, such as lower returns, taking an ESG approach to investing can result in better long-term returns. Based on data available reflecting the positive relationship between ESG and corporate financial performance, the participants agreed “…the business case for ESG investing is empirically very well founded”.

Source: Journal of Sustainable Finance & Investment, 2015

Source: Journal of Sustainable Finance & Investment, 2015

The discussion touched on the future of ESG investing. The participants agreed that ESG considerations will become increasingly important in the years ahead, with investors demanding greater transparency and accountability from companies. The group also noted that there is likely to be greater convergence in ESG reporting standards, which will make it easier for investors to compare companies on ESG metrics.

Overall, the discussion highlighted the importance of ESG considerations in the investment process and the need for greater standardisation and transparency in ESG reporting. As the industry continues to evolve, ESG investing will undoubtedly play a greater role in shaping the investment landscape, with investors increasingly looking to align their investments with their values and beliefs.

At Zagga, we are firm supporters of responsible and ethical investing, yet the lack of standardisation is currently one of the biggest obstacles for companies navigating the landscape of sustainability reporting. Via our ESG Advisory Committee, Zagga is preparing for the new standards which we believe will drive transparency and enable investors to make more informed decisions. By working together as an industry, we can help build a more sustainable and equitable future for all.